Money market fund lending to Federal Home Loan Banks

Box extracted from special feature "Who borrows from money market funds?"

Federal Home Loan Banks (FHLBs) are large borrowers from money market funds (MMFs) through short-term debt instruments. Their borrowing increases markedly when funding conditions tighten (Anadu and Baklanova (2017)). This box documents how such borrowing supports relatively long-term lending by FHLBs to their member banks.

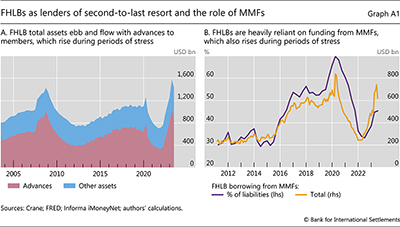

The FHLBs are a system of regional banks in the United States. They were created in 1932 to support the housing finance and community lending needs of their member financial institutions (thrifts, insurance companies and banks). They enjoy relatively low funding costs as they are perceived to have an implicit government guarantee. Members, in turn, obtain over-collateralised wholesale funding from FHLBs for their mortgages and mortgage-related investments (so-called advances). Advances are a substantial component of total FHLB assets, and tend to grow when member banks' funding conditions are tighter (Graph A1.A). Due to their role as providers of liquidity during funding stress episodes, FHLBs are sometimes referred to as lenders of second-to-last resort (Ashcraft et al (2010)).

Advances are a substantial component of total FHLB assets, and tend to grow when member banks' funding conditions are tighter (Graph A1.A). Due to their role as providers of liquidity during funding stress episodes, FHLBs are sometimes referred to as lenders of second-to-last resort (Ashcraft et al (2010)).

MMFs are instrumental to FHLBs' role as lenders of second-to-last resort, sparking concerns that MMFs are again "underwriting the US housing market". FHLB borrowing from MMFs grows considerably during episodes of funding stress (Graph A1.B). It jumped around the September 2019 repo market stress and spiked to over $800 billion with the global Covid-19 outbreak in March 2020 (a 32% monthly increase). Another sharp increase began with the start of the recent US interest rate hiking cycle, peaking with the bank stresses in March and April 2023. For example, the failed Silicon Valley Bank (SVB) had outstanding advances with the FHLB of San Francisco of $15 billion as of end-2022 (just before its collapse), up from zero one year before.

FHLB borrowing from MMFs grows considerably during episodes of funding stress (Graph A1.B). It jumped around the September 2019 repo market stress and spiked to over $800 billion with the global Covid-19 outbreak in March 2020 (a 32% monthly increase). Another sharp increase began with the start of the recent US interest rate hiking cycle, peaking with the bank stresses in March and April 2023. For example, the failed Silicon Valley Bank (SVB) had outstanding advances with the FHLB of San Francisco of $15 billion as of end-2022 (just before its collapse), up from zero one year before.

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements  For background on FHLBs and related financial stability risks, see Gissler and Narajabad (2017) and Gissler et al (2023).

For background on FHLBs and related financial stability risks, see Gissler and Narajabad (2017) and Gissler et al (2023).  See Dunbar (2023).

See Dunbar (2023).  See the financial reports of SVB and FHLBs for 2021 and 2022.

See the financial reports of SVB and FHLBs for 2021 and 2022.