How does the rise in interest rates affect debt rollover across non-financial firms?

Box extracted from Overview chapter "Markets adjust to 'higher for longer'"

Non-financial firms took advantage of ample cheap credit in the low rate environment. Amid extraordinary policy stimulus, flat yield curves and low corporate spreads incentivised firms to lengthen the maturity of their debt and borrow at fixed interest rates. However, the rapid rise in interest rates over the past 18 months has tightened financial conditions. This will adversely affect firms' ability to roll over maturing debt.

However, the rapid rise in interest rates over the past 18 months has tightened financial conditions. This will adversely affect firms' ability to roll over maturing debt.

To assess debt rollover needs, we examine over 83,000 debt instruments that were outstanding as of 2023 and were issued by over 18,000 non-financial firms in 53 countries. Our sample extends to firms without credit ratings, thus broadening the canvas relative to that underpinning many other analyses. It also contains relatively small firms. For example, the smallest 5% of the firms in our sample have annual revenues of around $2 million – the threshold below which firms are commonly regarded as micro-sized in the United States and European Union. Nevertheless, our sample is tilted towards larger firms, which are more likely to disclose detailed information on debt liabilities.

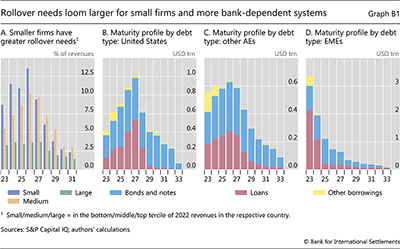

Differences in debt refinancing needs by firm size suggest that the current tightening episode will have highly uneven effects across firms. Smaller firms are likely to be subject to significantly larger refinancing pressures than larger ones. In each of the next four years, the bottom tercile of firms – as measured by revenues – has debt coming due in excess of 10% of total annual revenues (Graph B1.A) and over four times annual earnings before interest, taxes, depreciation and amortisation (EBITDA). Although the refinancing needs of medium-sized firms are relatively contained in the near term, they too will rise to around 10% of annual revenues and 40% of annual EBITDA by 2026. The refinancing needs of large firms are lower, at around 3% of annual revenues and only 20% of annual EBITDA. Relative to 2019, the debts coming due over the next two years are around 1 percentage point higher as a share of revenues for large firms but 2 percentage points higher for small and medium-sized firms.

The relative importance of bank and bond finance for non-financial corporates creates important cross-country differences. This is because bank loans tend to be of shorter maturity. In the United States, the greater use of corporate bonds suggests that immediate debt refinancing needs may be muted and will only grow gradually, peaking in around five years (Graph B1.B). By contrast, greater dependence on bank loans and other types of short-term borrowing will front-load the refinancing needs of firms in other advanced economies and especially in EMEs (Graphs B1.C and B1.D). The refinancing wave has already started for firms in these jurisdictions.

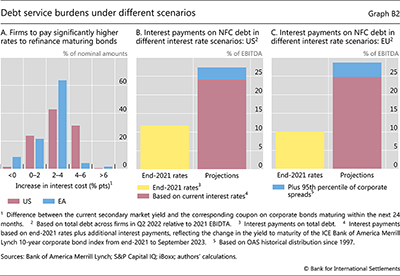

Graph B2

Finally, the extent of monetary tightening in specific jurisdictions could make a difference across firms. As the United States has experienced the largest increase in interest rates among the major advanced economies, the extra cost of rolling over maturing US dollar-denominated debt is likely to be higher than debt denominated in other major currencies. To give a sense of the potential upward pressure on refinancing costs, we compare current yields on corporate bonds in secondary markets with those prevailing at the time of issuance. This suggests that over 30% of the total amount of US dollar bonds maturing in 2024/25, if they are to be refinanced, will have interest rates that are 4 or more percentage points higher than what firms were paying in late 2021 (Graph B2.A). By contrast, the corresponding share for euro-denominated bonds is only 6%. Nevertheless, secondary market yields suggest that at least 60% of maturing euro-denominated corporate bonds will face interest rates that are between 2 and 4 percentage points higher than in late 2021 if they are refinanced (Graph B2.B).

Servicing existing debt at current interest rate levels could be challenging for many firms. Simulations suggest that debt servicing costs relative to earnings could more than double if yields remain at current levels and firms refinance the totality of their debt (Graphs B2.B and C, yellow and red bars). Moreover, should the currently compressed credit spreads widen, firms' debt servicing challenges would worsen. For instance, if credit spreads were to increase to the 95th percentile of the historical distribution, this could increase debt service-to-EBITDA ratios by an additional 3.5 percentage points, in both the United States and the European Union (Graph B2.C and D, blue bars).

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  See M Ampudia, E Eren and M Lombardi, "Non-financial corporates' balance sheets and monetary policy tightening, BIS Quarterly Review, September 2023, pp 9–10.

See M Ampudia, E Eren and M Lombardi, "Non-financial corporates' balance sheets and monetary policy tightening, BIS Quarterly Review, September 2023, pp 9–10.