Buy now, pay later: a cross-country analysis

Buy now, pay later (BNPL) schemes let consumers spread their spending over a number of interest-free instalments, which are typically unreported to credit bureaus. BNPL is growing strongly, especially in countries with strong e-commerce, higher inflation, inefficient banking systems and less stringent regulations. Used to a greater extent by young adults, who are typically heavily indebted and have low credit scores, BNPL schemes suffer higher delinquency rates than traditional consumer credit. 1

JEL classification: D12, G40, G50, G51.

Buy now, pay later (BNPL) schemes have surged in popularity, allowing consumers to divide their spending into interest-free instalments. The cost of the platform-based BNPL service is borne primarily by merchants. Thus, consumers can manage their expenses while incurring only small fees or none. However, imprudent spending or a poor understanding of BNPL terms can lead to overindebtedness.

This special feature reviews BNPL payment schemes. First, it provides an overview of the BNPL business model, discussing the benefits and costs for each agent (merchant, user and platform). Second, it documents the global diffusion of BNPL services, mapping users' gender, age, education and risk profiles. Third, it asks why the adoption of BNPL services has varied widely across countries.2

The main findings are as follows. First, merchants pay high fees to transfer credit risk to the platforms and broaden the customer base. BNPL schemes are accessible even to consumers without a credit history or stable income and do not typically affect their credit scores. Relying primarily on fee revenues, platforms have faced profitability challenges due to high operating costs and rising credit losses.

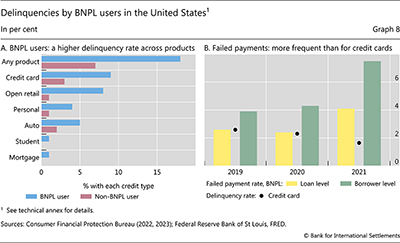

Second, BNPL users tend to have a riskier credit profile than those of traditional consumer credit products. BNPL users are typically younger, with less education, higher debt burdens and lower credit scores. Accordingly, late payments and losses for BNPL in the United States are higher than in the case of credit cards.

Key takeaways

- Buy now, pay later (BNPL) customers pay interest-free instalments, which are typically not reported to credit bureaus, while merchants pay fees to increase sales and shift credit risk to BNPL platforms.

- Compared with traditional consumer credit, BNPL users are typically younger, with less education, more debt, lower credit scores and higher delinquency rates.

- BNPL is more widespread in countries with greater e-commerce penetration, higher inflation, more inefficient banking systems, and looser financial and consumer protection regulation.

Third, BNPL uptake varies widely around the world. Adoption is stronger in countries with a robust e-commerce base, higher inflation and less stringent regulation. Our findings also reveal higher BNPL usage in countries with a higher level of household debt and banking inefficiencies.

The rest of the special feature is organised as follows. The first section discusses the characteristics of BNPL and how it differs from more traditional forms of consumer credit. The second section analyses users' characteristics and how BNPL use has evolved worldwide. The third section investigates the economic and institutional drivers of BNPL. The last section concludes.

BNPL: what it is and how it works

BNPL payment schemes let customers pay for their purchases with interest-free instalments rather than paying the full amount at checkout. They are widely used by consumers for online purchases on e-commerce platforms. BNPL is rapidly expanding in physical stores too, facilitated by the use of scannable barcodes and QR codes.

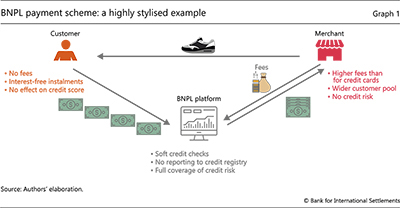

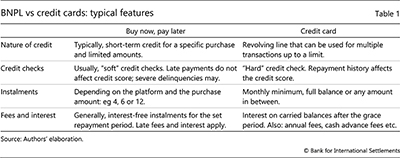

With some simplification, a BNPL transaction involves three agents: a merchant, a customer, and a BNPL platform (Graph 1).3 When customers decide on a purchase and select the BNPL option at checkout, the platform approves a credit line (see below). Upon approval, the platform pays the merchant the full amount of the goods purchased and takes on the customer's credit risk. Customers pay the first instalment upfront to the platform, while the residual amount is typically due in weekly instalments. The most common form of payment is "pay-in-four," ie repayment within four weeks, although options with longer repayment horizons are also available (Di Maggio et al (2023)). Popular BNPL services support borrowing up to $1,000 and are interest-free if instalments are paid on time. Otherwise, late fees or interest apply to missed payments, much as in the case of a credit card (see Table 1).

Compared with traditional consumer credit, BNPL credit is extended on the basis of less information.4 "Soft" credit checks by BNPL platforms are less intrusive than the "hard" ones performed by credit card companies or banks. In contrast to traditional consumer credit, BNPL credit is typically not communicated to credit bureaus and, consequently, does not affect a consumer's credit score. While late payments are often not recorded on the credit file, severe delinquencies (missing multiple payments) are likely to be (Center for Responsible Lending (2022)).5

Credit that circumvents credit bureaus is nothing new. For instance, payday loans, a type of unsecured credit that is typically repaid by the borrower's subsequent pay cheque, also fall in this category. However, payday loans charge very high interest rates and may come with additional fees that generate substantial borrowing costs (Carrell and Zinman (2014); Gathergood et al (2018)). Thus, these loans tend to be for emergency financial needs rather than for the purchase of goods or services (Morse (2011); Zinman (2010)).

Merchants benefit from offering BNPL payment options in several ways. First, credit and fraud risks are transferred from the merchant to the platform. Second, offering BNPL options allows merchants to reach customers who lack immediate financial means. In some cases, merchants also benefit from non-payment services such as marketing and the data analytics provided by BNPL platforms. This results in a higher share of website visitors who finalise a purchase and an increase in both the number and value of sales (Lux and Epps (2022)).

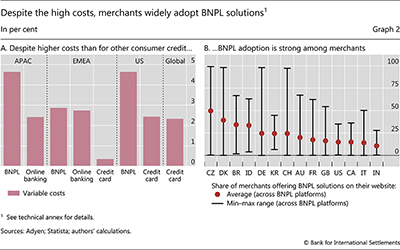

At the same time, merchants incur high costs when offering a BNPL option. Graph 2.A reports the percentage cost borne by the average merchant across selected platforms and jurisdictions. These variable costs are consistently – and several percentage points – higher for BNPL than for online banking credit or credit cards. In addition to these costs, merchants using BNPL also incur a fixed membership fee to join the platform's network and may also pay a fixed fee per transaction. Despite these costs, as of August 2023, a significant proportion of merchants in many jurisdictions offer BNPL payment options on their websites (Graph 2.B). According to Berg et al (2023), e-commerce merchants who offer BNPL as a payment option benefit from expanding sales, as some customers make purchases they might otherwise not have made, while others spend more than they had initially planned.

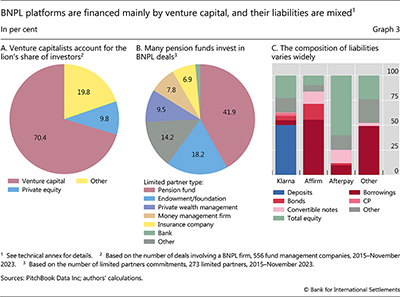

BNPL platforms are financed mainly through private markets. Exceptions to this pattern are Affirm and Sezzle, for example, which have tapped public equity markets. Among private investors, venture capital fund managers dominate (Graph 3.A). As is typical in private markets, BNPL firms are financed primarily through co-investment deals in which fund managers act as general partners and attract limited partners (LPs) (Aramonte and Avalos (2021)). Between January 2015 and November 2023, pension funds alone accounted for more than one third of these LPs, while financial companies accounted for an additional quarter (Graph 3.B).

The composition of non-equity liabilities varies considerably across BNPL providers (Graph 3.C). Klarna, which has a banking licence, is reliant mostly on deposits. By contrast, "borrowing" – represented mainly by bank credit lines – amounts to more than half of total assets for Affirm and Zip.

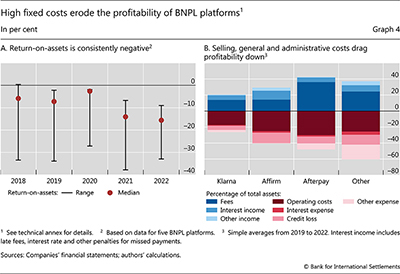

Major BNPL platforms, including Affirm, Afterpay and Klarna, face profitability challenges (Graph 4.A). High operating costs, for marketing, administrative and technology expenses among others (Graph 4.B), have prevented these platforms from breaking even since 2018 (Payments Dive (2022)). In addition, the return on assets for BNPL platforms was notably low in 2021–22 due to rising credit losses, and intensified competition from neo-banks and big techs entering the BNPL market (Fitch (2022)). In response, BNPL platforms are broadening their services to include interest-bearing loans in partnership with sponsor banks (Wang and Mason (2023)) and are leveraging advanced technologies, such as artificial intelligence (AI), to enhance customers' experience and reduce personnel costs.

The surge of BNPL: global trends and user characteristics

Data documenting BNPL activity are limited and come from different sources. We assemble a novel global data set comprising the following proxies for BNPL activity: (i) gross merchandise volume (GMV) processed through BNPL schemes; (ii) BNPL app downloads; and (iii) BNPL app use.6 The GMV measure represents the total value of transactions made using BNPL. App downloads indicate the popularity of BNPL platforms. Finally, app use – ie the number of individuals with at least one BNPL app session within a day – proxies for the actual engagement of users with BNPL services.

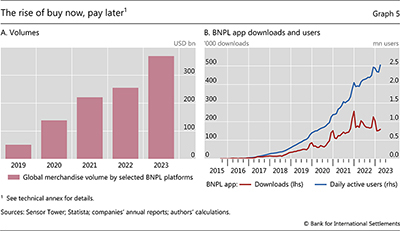

The growth of BNPL activity has been substantial in recent years. In terms of GMV, BNPL activity has increased globally more than sixfold from 2019 to 2023 (Graph 5.A). BNPL app use reveals a similar pattern, as it surged during the Covid-19 pandemic and has continued to grow since (Graph 5.B).

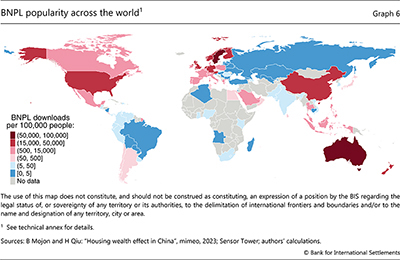

The popularity of BNPL varies widely around the globe (Graph 6). The countries with the highest adoption rates are Australia and Sweden. Other countries with significant BNPL uptake are China, Finland, Germany, the Netherlands, New Zealand, Norway, Singapore, the United Kingdom and the United States.

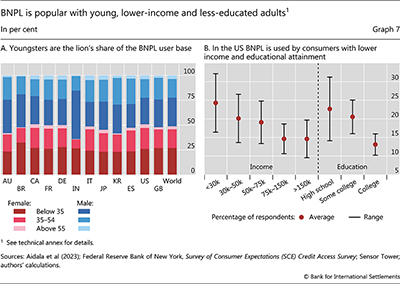

The typical profile of a BNPL user appears high-risk. The majority of BNPL app users across countries are under the age of 35 (Graph 7.A). Younger and tech-savvy individuals, including "Millennials" and "Generation Z", often do not possess credit cards (PYMTS (2023)) and are generally less financially literate than older generations (Lusardi and Mitchell (2023)). Consistent with this, a survey of US BNPL services reveals that they are more often used by individuals with low income levels and less educational attainment (Graph 7.B).

There is evidence from the United States that BNPL users are particularly risky. A recent report by the CFPB (2023) finds that, on average, BNPL users in the United States are more highly indebted and have lower credit scores than non-users. Notably, the report also finds that – across a wide range of consumer credit products – BNPL users have higher delinquency rates than non-users (Graph 8.A).7 Similar evidence comes from CFPB (2022), which reveals that – as government stimulus packages in response to the Covid-19 pandemic stopped in 2021 – the rate of failed BNPL loan payments spiked significantly, whereas credit card loan failures did not. As a result, the former became almost four times higher than the latter (Graph 8.B).8

Regulatory approaches to limiting consumer debt risks in the BNPL sector have been highly varied to date. They have ranged from self-regulation via industry codes to proposals for including BNPL under the umbrella of existing national credit laws (see Box A).

Drivers of BNPL payment schemes

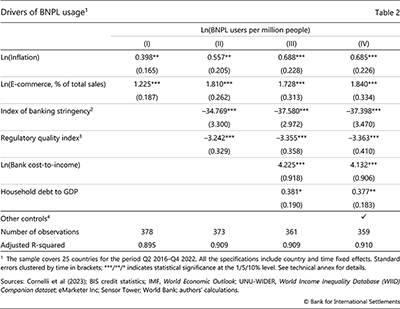

For potential explanations of cross-country differences in the use of BNPL payment schemes, we employ panel analysis. We examine both macroeconomic and financial characteristics of national economies as potential drivers. Given data availability, and for comparability across jurisdictions, we focus our empirical analysis on 25 countries for the period Q2 2016–Q4 2022 at the quarterly frequency.

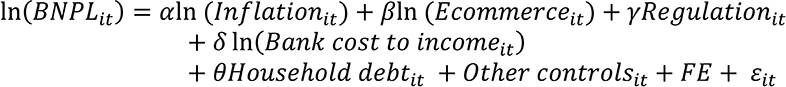

The panel regression is of the form:

where, BNPLit is the number of BNPL app users per capita in country i and quarter t.

On the right-hand side, Inflationit controls for changes in purchasing power. Inflation tends to erode the real value of savings and wages, thus tightening budgets. In addition, high inflation ushers in economic uncertainty. In either case, the option of payment deferrals raises the appeal of BNPL.9

In turn, Ecommerceit is equal to e-commerce sales as a percentage of total retail sales. This variable controls for how favourable the existing infrastructure is for the adoption of a BNPL online service.

As we do not have complete information on BNPL regulatory regimes, the vector Regulationit includes two indirect measures. The first is an index of regulatory stringency for the banking sector of economy i, as constructed by Barba Navaretti et al (2017) from World Bank data. We use it as a proxy for overall financial regulation. The second measure captures the government's ability to formulate and implement sound policies and regulations, including for consumer protection and starting a new business.10 The correlation of these measures and BNPL user activity is a priori unclear. A positive correlation could indicate the presence of regulatory arbitrage. Conversely, a negative correlation could signal that the launch of innovative lending products, such as BNPL, is easier in countries with relatively loose regulation. Limited consumer risk awareness and insufficient consumer protection measures could have the same effect.

Further reading

The bank cost-to-income ratio <emit proxies for the level of efficiency of the banking sector. Less efficient banks tend to charge higher prices for their financial services (Gambacorta (2008); Shamsur and Weill (2019)). This should increase the relative appeal of BNPL schemes.

The variable Household debtit is the ratio of aggregate debt in the household sector over GDP. It controls for potential access limitations to more traditional forms of credit. Households with higher levels of debt have typically lower credit scores and often report a credit application rejection (Aidala et al (2023)).11

All the specifications include country and time fixed effects (FE). Country fixed effects control for time invariant country characteristics, such as the rule of law and institutional quality (La Porta et al (2008); Demirgüç-Kunt and Levine (2018)). Time fixed effects control for global developments, especially during the Covid-19 pandemic.

Table 2 presents the results of the econometric analysis. Column (I) indicates a positive correlation of BNPL with inflation, suggesting a preference for such services when purchasing power is eroding. This interpretation is supported by a global survey conducted by Paysafe Group (2022), which indicates that BNPL usage was high among consumers who reported that the rising cost of living influenced their online payment methods in 2022. Moreover, another survey conducted by the Federal Reserve System (2023) on the economic well-being of US households in 2022 shows that 56% of BNPL users indicated BNPL payment scheme as being "the only way I could afford [the purchase]". BNPL use is also positively linked with e-commerce development, reflecting the fact that most of BNPL activity is done online.

Column (II) introduces the variables that account for countries' regulatory characteristics. The negative coefficients indicate that looser financial regulation and consumer protection are associated with more BNPL usage. This finding aligns with the results obtained by Barba Navaretti et al (2017), Claessens et al (2018) and Frost et al (2019) for fintech credit, and Cornelli et al (2023) for fintech and big tech credit.

BNPL thrives where the banking sector is less efficient (Table 2, column (III)). In such contexts, consumers might seek alternative financial solutions that are more convenient and cost-effective. Furthermore, BNPL is more prevalent in countries where households have a higher level of debt and potentially more limited access to traditional forms of credit. Column (IV) confirms the consistency of the results when adding additional controls.

Conclusions

BNPL payment schemes are growing rapidly in popularity across the globe, especially among young adults with less educational attainment. While consumers enjoy the advantage of immediate purchases with deferred payments at no added cost, merchants expand sales and their customer base. However, despite earning revenue from merchant fees, BNPL platforms face profitability challenges due to high fixed costs, increasing funding expenses and elevated delinquency rates.

The rapid ascent of BNPL could be of concern to public authorities for two reasons: consumer protection issues and the accumulation of credit risk (FCA (2022a,b)). It is thus important to establish whether BNPL schemes take advantage of financially constrained individuals through misleading promotions and inadequate information. In turn, since BNPL platforms suffer from high delinquency rates, a sustained growth of these platforms would warrant monitoring of their direct and indirect links with the rest of the financial system.

References

Aidala, F, D Mangrum and W van der Klaauw (2023): "Who uses "buy now, pay later?", Federal Reserve Bank of New York, Liberty Street Economics, September.

Aramonte, S and F Avalos (2021): "The rise of private markets", BIS Quarterly Review, December, pp 69–82.

Australian Government (2022): Regulating Buy Now, Pay Later in Australia, Options Paper, November.

Barba Navaretti, G, G Calzolari, J Mansilla-Fernandez and A Pozzolo (2017): "FinTech and banks: friends or foes?", European economy: banks, regulation, and the real sector, no 2, December.

Berg, T, V Burg, J Keil and M Puri (2023): "The economics of 'buy now, pay later': a merchant's perspective", SSRN, June.

Berg, T, A Fuster and M Puri (2021): "Fintech lending", NBER Working Papers, no 29421, October.

Bian, W, L Cong and Y Ji (2023): "The rise of e-wallets and buy-now-pay-later: payment competition, credit expansion, and consumer behavior", NBER Working Papers, no 31202, May.

Board of the Federal Reserve System (2023): Economic Well-Being of U.S. Households in 2022, May.

Carrell, S and J Zinman (2014): "In harm's way? Payday loan access and military personnel performance", The Review of Financial Studies, vol 27, no 9, pp 2805–40.

Center for Responsible Lending (2022): Comment Regarding the CFPB's Inquiry into Buy-Now-Pay-Later, March.

Claessens, S, J Frost, G Turner and F Zhu (2018): "Fintech credit markets around the world: size, drivers and policy issues", BIS Quarterly Review, September, pp 29–49.

Consumer Financial Protection Bureau (2021): Will a Buy Now, Pay Later (BNPL) loan impact my credit scores?, www.consumerfinance.gov/ask-cfpb/will-a-buy-now-pay-later-bnpl-loan-impact-my-credit-scores-en-2117/.

----- (2022): Buy Now, Pay Later: Market trends and consumer impacts, September.

----- (2023): Consumer use of buy now, pay later insights from the CFPB making ends meet survey, March.

Cornelli, G, J Frost, L Gambacorta, R Rau, R Wardrop and T Ziegler (2023): "Fintech and big tech credit: drivers of the growth of digital lending", Journal of Banking and Finance, vol 148, March.

deHaan, E, J Kim, B Lourie and C Zhu (2022): "Buy now pay (pain?) later", SSRN, October.

Demirgüç-Kunt, A and R Levine (2018): Finance and growth, Edward Elgar Publishing Limited.

Di Maggio, M, J Katz, and E Williams (2022): "Buy now, pay later credit: User characteristics and effects on spending patterns", NBER Working Papers, no 30508.

European Council (2023): Asking for a loan will be safer in the EU after the Council's final approval of the Consumer Credit Directive, October.

Financial Conduct Authority (FCA) (2022a): Making Buy Now Pay Later terms clearer and fairer, www.fca.org.uk/about/case-study/bnpl-terms-clearer.

----- (2022b): "FCA warns Buy Now Pay Later firms about misleading adverts", press release, 19 August, www.fca.org.uk/news/press-releases/fca-warns-buy-now-pay-later-firms-about-misleading-adverts.

Financial Consumer Agency of Canada (FCAC) (2021): Pilot Study: Buy Now Pay Later Services in Canada, November.

Financial Counselling Australia (2023): Small Loans, Big Problems – Insights on Buy Now Pay Later From More Than 500 Financial Counsellors On The Frontline, July.

Fitch (2022): U.S. Buy Now Pay Later Challenged by Rising Credit and Funding Costs, July.

Frost, J, L Gambacorta, Y Huang, H S Shin and P Zbinden (2019): "BigTech and the changing structure of financial intermediation", Economic Policy, vol 34, pp 761–99.

Gambacorta, L (2008): "How do banks set interest rates?", European Economic Review, vol 52, pp 792–819.

Gathergood, J, B Guttman-Kenney and S Hunt (2018): "How do payday loans affect borrowers? Evidence from the U.K. market", The Review of Financial Studies, vol 32, no 2, pp 496–523.

HM Treasury (2023): Regulation of Buy-Now Pay-Later. Consultation on draft legislation, February.

La Porta, R, F Lopez-de-Silanes and A Shleifer (2008): "The economic consequences of legal origins", Journal of Economic Literature, vol 46, no 2, pp 285–332.

Lusardi, M and O Mitchell (2023): "The importance of financial literacy: opening a new field", NBER Working Papers, no 31145, April.

Lux, M and B Epps (2022): "Grow now, regulate later? Regulation urgently needed to support transparency and sustainable growth for buy-now, pay-later", Harvard Kennedy School M-RCBG Associate Working Paper Series, no 182, April.

Mason, M, G Zamparo, A Marini and N Ameen (2022): "Glued to your phone? Generation Z's smartphone addiction and online compulsive buying", Computers in Human Behavior, vol 136, no 107404.

Monetary Authority of Singapore (2022): Reply to Parliamentary Question on "Buy Now Pay Later" Schemes, April.

Morse, A (2011): "Payday lenders: Heroes or villains?", Journal of Financial Economics, vol 102, no 1, pp 28–44.

Payments Dive (2022): BNPL players' losses grow as costs soar, May.

Paysafe Group (2022): Lost in Transaction: Consumer payment trends 2022.

Reserve Bank of India (2022): Guidelines on Digital Lending, September.

Shamsur, A and L Weill (2023): "Does bank efficiency influence the cost of credit?", Journal of Banking and Finance, vol 105, pp 62–73.

Wang, Y and T Mason (2023): "Buy-now, pay-later platforms turn to interest-bearing lending via bank partners", S&P Global, March.

Sveriges Riksbank (2023): "Buy now, pay later – a threat to financial stability?", Staff Memo, September.

Zinman, J (2010): "Restricting consumer credit access: Household survey evidence on effects around the Oregon rate cap", Journal of Banking & Finance, vol 34, no 3, pp 546–56.

Technical annex

APAC = Asia-Pacific; CP = commercial papers; EMEA = Europe, Middle East and Africa.

Graph 2.A: Variable costs as a percentage of transaction value. Total costs can be higher in the presence of fixed costs per transaction. Values are calculated based on a selected sample of payment service providers.

Graph 2.B: Based on survey data for a selected number of countries on the share in a representative sample of merchants offering BNPL payment solutions on their websites through the most prominent providers. The sample of BNPL providers corresponds to Affirm, Afterpay, Klarna, Pay in 4, Sezzle and Zip. Data as of August 2023.

Graph 3.A: Other includes asset managers, governments, holding companies, secondary buyers and sovereign wealth funds.

Graph 3.B: Other corresponds to corporations, direct investments, economic development agencies, government agencies and sovereign wealth funds.

Graph 3.C: For other, simple average of Sezzle and Zip. The graph shows simple averages over the period 2019–22. For Affirm, simple average over the period, 2019–21. Category other includes accounts payables, deferred tax liabilities, operating leases liabilities, provisions and subordinated liabilities.

Graph 4.A: For Affirm, data for the period 2019–22; for Afterpay, data for the period 2018–21; for Klarna, Sezzle and Zip, data for the period 2018–22.

Graph 4.B: For other, simple average of Sezzle and Zip. For Affirm, simple average over the period, 2019–21. Operating costs include selling, general, administrative, technology and data costs. Credit loss includes realised losses and provisions.

Graph 5.A: Based on a sample of selected BNPL platforms including Affirm, Afterpay, Beforepay, humm, Klarna, Laybuy, Openpay, Sezzle, Zebit and Zip. In the case of missing data, volumes are proxied by receivables from customers. For 2023, estimate based on data on forecasted GMV for online BNPL.

Graph 5.B: Monthly average of total number of daily downloads and of daily active users for BNPL apps. The sample is selected following Sensor Tower app classification.

Graph 6: The map shows the total number of downloads for the period Aug 2015–Jun 2023 per 100,000 people, based on population data for 2022. Data for mainland China are estimated based on the downloads of daily active users of Alipay app, and the share of Alipay users purchasing goods with the BNPL solution in a randomly selected sample.

Graph 7.A: Based on averages for the period Q3 2015–Q4 2022.

Graph 7.B: The graph shows the percentage of respondents (average and range) by income and education group.

Graph 8.A: "Any product" refers to delinquency in at least one of the products.

Graph 8.B: For credit cards, simple average of quarterly values.

Table 2: Data are winsorised at the third and 97th percentiles. The dependent variable in all underlying regressions is the natural logarithm of the quarterly average number of total daily active users of BNPL apps per million people. The index is normalised between 0 (no regulation) and 1 (most stringent regulation). See Cornelli et al (2023) for further details. The measure of regulatory quality captures the perception of the government's ability to implement policies capable of promoting the development of the private sector. It ranges from –2.5 to 2.5. Real interest rate and the natural logarithm of real GDP per capita, of the country-specific residential property price index, and of the percentage of the total country income of the first income decile.

1 We thank Douglas Araujo, Claudio Borio, Johannes Ehrentraud, Jon Frost, Gaston Gelos, Jan Keil, Benoît Mojon, Han Qiu, Andreas Schrimpf, Hyun Song Shin, Nikola Tarashev, Karamfil Todorov, Raihan Zamil and Sonya Zhu for comments. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 Our empirical analysis focuses on firms whose core business is BNPL, thus excluding firms that offer BNPL solutions as part of their diverse payment options (eg PayPal). Thus, the data reported below are likely to understate actual BNPL uptake and volumes.

3 The example describes the typical features of a BNPL transaction within a "merchant partner acquisition model". An alternative strategy is the "app-driven acquisition model" where BNPL providers pre-approve consumers' credit applications within their proprietary apps (Consumer Financial Protection Bureau (CFPB) (2022)).

4 While soft checks refer to income and recent payment history, a hard check is a thorough examination of the full credit history, financial behaviour and outstanding debts (Di Maggio et al (2023)).

5 The reporting of severe delinquencies for BNPL to credit registries varies by jurisdiction and is also influenced by the specific terms and conditions of the BNPL service user agreement.

6 The GMV indicator is available at the yearly frequency for a selected number of platforms that represent the majority of the BNPL market. Data on BNPL app downloads and use are obtained from Sensor Tower for a sample of 29 apps available in 34 countries, at a monthly frequency.

7 Similar results are obtained by the Financial Counselling Australia's 2023 survey.

8 The allure of cost-free borrowing can push households towards overborrowing (Berg et al (2021)), a trend amplified by the growing smartphone reliance of newer generations (Mason et al (2022)).

9 In other specifications, not reported for the sake of brevity, we included the nominal interest rate, to control for consumers' opportunity in terms of other interest-bearing forms of credit. This variable turned out to be insignificant, suggesting that other forms of credit may be simply unavailable to many BNPL users (Bian et al (2023)).

10 See www.govindicators.org/documentation

11 The other control vector variables are the natural logarithm of the real GDP per capita; the real interest rate; the natural logarithm of the country-specific residential property price index, and the natural logarithm of the share of the top income decile in total country income.