CP and CDs markets: a primer

Commercial paper (CP) and certificates of deposits (CDs) are important short-term funding instruments for both financial and non-financial entities1. We describe the origins and evolution of these markets in major jurisdictions. We show that money market funds (MMFs) are still significant as investors in CP and CDs, although their footprint has shrunk in response to stricter regulation. Various players have filled the gap left by MMFs, with non-financial companies and banks being particularly important in Japan, and non-bank financial institutions in the United States. Historically, US MMFs' absorption of short-term paper has tended to fall during stress episodes, creating strains for issuers in search of dollar funding, such as European banks.

JEL classification: G15, G23, G28.

While the markets for commercial paper (CP) and certificates of deposit (CDs) stagnated in the aftermath of the Great Financial Crisis (GFC), they have recently resumed their upward trajectory. CP and CDs are the instruments most widely used by non-financial and financial companies for short-term funding on an unsecured basis.2 These markets have also been a locus of funding liquidity crises, notably in the GFC's early phases (Covitz et al (2013)) and more recently in March 2020 (Eren et al (2020), Boyarchenko et al (2021)). Thus, their structure and the evolution of their investor base have important implications for financial vulnerabilities and market functioning.

We study the evolution of the CP and CDs markets over the past decades and analyse the role of key investors. Focusing on major currency areas (euro area, Japan and the United States),3 we close some gaps in frequently used data on the identity of investors in these markets and document changes to the investor base. A key finding is that money market funds (MMFs) are still significant investors in CP and CDs although their footprint has shrunk in response to stricter regulation. However, MMFs tend to reduce their exposure to CP at times of money market stress. The investor types that tend to pick up the slack differ across jurisdictions: other non-bank financial intermediaries in the United States and non-financial corporates and banks in Japan.

Key takeaways

- CP and CDs markets have undergone significant structural changes: after a period of stagnation following the Great Financial Crisis, issuance volumes have been expanding again recently.

- MMFs remain key investors in CP and CDs, with US funds being an important source of short-term US dollar funding, especially for European banks.

- MMFs retrench during stress – leaving other non-bank financial intermediaries in the United States and banks in Japan to pick up the slack – and potentially propagating shocks across borders.

The markets for short-term paper are of systemic importance. We document significant interconnectedness across jurisdictions, which can intensify the cross-border spillovers of financial stress. Given the short maturities of these instruments, the potential for sharp pullbacks by core investors creates rollover risks for issuers. US investors, in particular, remain crucial in providing short-term US dollar financing to a number of foreign issuers, and especially to European banks.

The rest of this special feature is organised as follows. The first section reviews the main characteristics of CP and CDs and their historical origins. The second describes key trends in the investor base, with a focus on MMFs and other players that have become more relevant recently. The third section analyses the role played by different types of investor in absorbing CP and CDs issuance, in tranquil times and during crisis periods. The fourth section discusses policy considerations.

CP and CDs markets across jurisdictions

Main funding instruments and their characteristics

To legally qualify as CP, instruments must fulfil various requirements. They must finance "current assets" (eg cash, inventories or future receivables from customers), be sold to institutional investors and have short maturities at issuance. The maturity limit is crucial and varies across jurisdictions: 270 days in the United States and one year in Europe and Japan. In practice, the maturity of CP tends to be much shorter. In the US, the average maturity is around 30 days, while in Europe it is approximately four months. Issuers also have an incentive to have a credit line in place, as credit rating agencies usually require one to rate the CP.

Issued by non-financial corporations (NFCs), banks and other financial institutions, CP is a flexible way of funding short-term needs and managing working capital. It is usually issued at a discount to face value, ie there are no coupon payments. Placement occurs either directly (when the issuer is a large financial institution with a large client network) or through a dealer that intermediates between the borrower and the final investor (eg an MMF). From a regulatory standpoint, issuing CP is advantageous because it does not require the instruments to be registered, unlike other securities such as corporate bonds.

Activity in CP markets is confined mainly to the primary market, with sparse trading in secondary markets, depending on dealers' balance sheet capacity. Given its short maturity and reliance on programmes that facilitate rolling over issuance and investment, CP rarely trades in secondary markets except in crisis periods.4 If a sale does occur prior to maturity, it almost always involves a dealer agreeing to buy back previously placed paper, typically to maintain a client relationship.5 Dealers' willingness to intermediate trades declines during stress times (Blackrock (2020)).

Another key short-term funding instrument, CDs, can be issued only by deposit-taking institutions. The CDs we focus on are known as "negotiable" because their ownership can be transferred in a secondary market.6 Indeed, while negotiable CDs fulfil similar economic functions as time deposits, their design is similar to that of securities. In practice, CDs rarely trade on secondary markets and investors tend to hold CDs to maturity – a feature shared with CP. For banks with a solid credit standing, CDs are a flexible way of raising wholesale funding quickly.

Historical evolution and main inflection points

Markets for unsecured short-term negotiable debt originally developed in the US. As Alworth and Borio (1993) point out, the US CP market was already flourishing in the late 19th century, with non-financial entities dominating issuance at the time. In the years after World War I, the balance shifted. Banks became the main issuers, as they turned increasingly to this market to finance their credit expansion in a booming economy. The growth in CP issuance ground to a halt during the Great Depression but picked up steam again after World War II (Anderson and Gascon (2009)). It was especially strong from the 1970s to the early 1990s, with outstanding CP volumes increasing more than 16-fold to $500 billion. A key catalyst was the advent of MMFs, which broadened the investor base.7

CDs are a more recent innovation but have also been spurred on since the 1970s by the rise of MMFs. The first such instrument was issued by First National City Bank of New York in 1961, in response to US regulations that introduced ceilings on banks' deposit rates. CDs grew quickly over the following decade, and by 1975 there was more than $90 billion in CDs outstanding (OCC (2023)).

Outside the US, CP and CD markets started developing in the 1960s and 1970s, particularly in Europe and Japan. The zeitgeist of liberalisation and deregulation was a key factor, leading to private sector calls to emulate US developments and allow financial intermediaries to flexibly expand their balance sheets. The nucleus of the market in Europe was the issuance of a Eurodollar CD by the London office of First National City Bank of New York in 1966 – five years after the first issuance in the US (Morris and Walter (1998)).8 In Japan, the first CD was issued in May 1979, with CP following somewhat later, in the 1980s.

European markets for short-term paper have been fragmented. Such markets developed notably in France, Germany, Spain and Sweden in the 1980s to cater mostly to domestic issuers and investors. That said, a Europe-wide CP market established at the same time in London has served for raising US dollar funding outside the United States. The ongoing fragmentation of European CP and CD markets is a key reason for some of the data gaps that limit our analysis below.

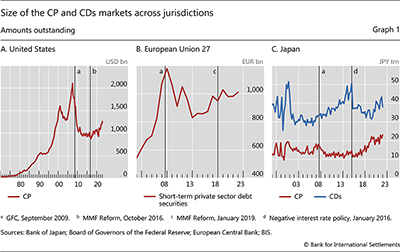

While the CP and CD markets shrunk substantially in the GFC and its aftermath, they have staged a comeback in recent years. For instance, at the outset of the GFC, there was more than $2.2 trillion in CP outstanding in the US (Graph 1A.). After contracting and fluctuating around the $1 trillion mark post GFC, the CP market resumed its growth in 2016, reaching $1.3 trillion in outstanding amounts in 2022. The pattern is similar in Europe, with the market contracting by a third post-GFC and then recovering after 2013 (Graph 1.B). In Japan, the post-GFC decline was mainly in CDs (Graph 1.C).9

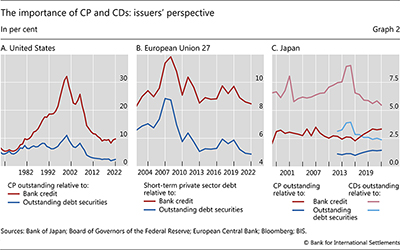

The importance of CP and CDs as a source of financing has generally been on the decline over the past 15 years but remains material in many jurisdictions.10 Focusing first on the US (Graph 2.A), CP issuance grew faster than other types of financing (such as bank credit or longer-term debt issuance) until the late 1990s. The subsequent relative decline – to 10% of bank credit and to less than 5% of debt securities at end-2022 – is an indication that issuers were seeking to reduce rollover risk. A similar decline resulted in short-term private-sector debt amounting to 8.5% of bank credit in Europe (Graph 2.B). An exception in this respect is Japan, where CP and CD markets are much smaller in relative terms (Graph 2.C).

Issuer types

To gain a complete picture of short-term markets, it is important to identify the typical issuers of CP and CDs and document their funding structure. The available data allow for this in the case of CP markets in the US, the short-term funding markets (ie CP and CDs combined) in Europe and the CP and CD markets separately in Japan.11

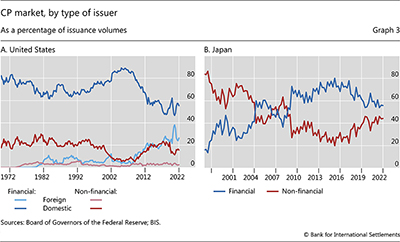

We observe notable differences in the main issuer types over time and across jurisdictions. In the United States, financial institutions remain the largest issuers (approximately 80% of total issuance), with NFCs representing the rest. Among the former, foreign banks have grown in importance since the mid-2000s, accounting for slightly less than half of the overall issuance by financial institutions at end-2022 (Graph 3.A). A key reason is the dollar funding needs of these entities (Aldasoro, Ehlers and Eren (2022), CGFS (2020)). Based on granular MMF portfolio holdings data, we estimate that the largest bank issuers are from the European Union, followed by Canada, Japan, the United Kingdom, Australia and Switzerland. In Japan, NFCs represented 80% of total CP issuance at the beginning of the 2000s but then the share of financial entities rose steadily till 2015 and, despite a subsequent decline, remained above 50% at end-2022 (Graph 3.B)

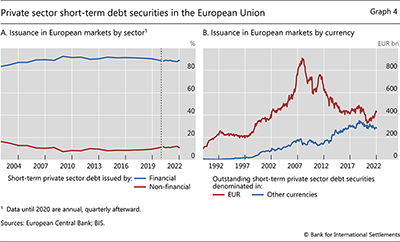

Financial institutions are by far the largest issuers of short-term debt in Europe. At end-2022, these entities accounted for 90% of total issuance of CP and CDs. While most of this funding is raised in euros, issuance in other currencies amounted to around 40% at the end of 2022 (Graph 4.A and 4.B).

CP markets can propagate funding stress across borders and currencies. Some key evidence in this respect stems from the reliance of foreign entities on dollar funding through CP issuance in US markets (Graph 3.A). If they freeze up, these markets could generate significant spillovers should borrowers need to make large repayments in a currency that they cannot source elsewhere. Historically, the most acute shortages have involved the US dollar, given its status as the world's dominant funding currency. In times of funding stress, central banks have averted adverse financial stability consequences by engaging in large liquidity interventions, drawing on the Federal Reserve's swap lines to obtain US dollars (Eren et al (2020)).

Investors in short-term funding markets

The diminishing role of MMFs

Since their origin in the 1970s, MMFs have been a key investor in CP and CD markets. They were at the root of the markets' buoyant growth in the run-up to the GFC and they have helped to reduce issuance costs (Klingler et al (2023)). But they have also been at the epicentre of episodes of turmoil. Over the past 15 years, their heft has dwindled in all major jurisdictions.

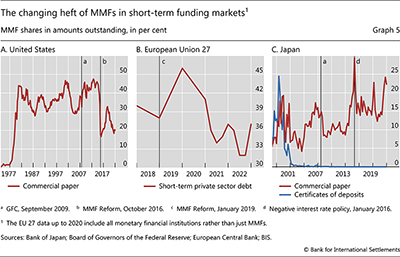

In the US, the role of MMFs shrank after post-GFC financial reforms. At their zenith, just prior to the GFC, MMFs held around 40% of the outstanding CP in the US. However, their share dropped to a mere 20% in late 2022 (Graph 5.A). This reflected various rounds of reforms that imposed constraints on prime MMFs – ie the type of MMFs that invest in CP and CDs and whose liquidity mismatches and exposure to run risk had come to the surface during the GFC.12 Notably, the reform in 2016 led to a contraction in the assets under management of the prime MMF sector – both through the exit of existing players and through the reallocation of assets to MMFs investing in public sector debt (eg Treasury bills).13

The role of MMFs in Europe has also shrunk in recent years. They held around a third of the short-term debt securities issued by European entities in 2022, down from 40% before the 2019 European MMF reform (Graph 5.B).

In Japan, the retrenchment of MMFs affected mainly the CD segment. The launch of the Bank of Japan's zero interest rate policy in 1999 marked the start of Japanese MMFs' withdrawal from the CD market. To some degree, the higheryielding CP market picked up the slack. While MMFs held around 12% of Japanese CP in the early 2000s, their share grew to 22% by end-2022 (Graph 5.C). That said, since the introduction of negative policy rates in 2016, only so-called money reserve funds have remained active as CP investors. Unlike standard MMFs, investors use these funds not necessarily to earn interest but to temporarily store cash in a brokerage account ahead of adjustments to portfolio positions.

Other types of investor

Over the past 15 years, a diverse group of investors have come in to fill the gap left by MMFs in short-term funding markets. In the US, various financial institutions and NFCs have ramped up holdings of CPs, whereas foreign investors have increased their share in Europe. In Japan, banks, NFCs and the central bank have assumed a dominant role as investors in CP markets.

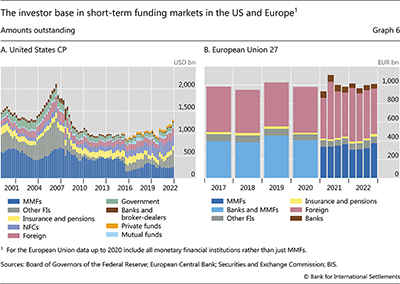

In the US, investors referred to as "other financial institutions" (OFIs) in the flow of funds accounts, have recently displaced MMFs as the dominant investor type in the CP segment (Graph 6.A). The OFIs sector includes non-bank financial intermediaries such as subsidiaries of foreign financial firms, financial holding companies, clearing houses, and segregated custodial accounts that hold cash collateral. This sector was important up to the mid-2000s but shrank during the GFC and then rebounded steadily in its aftermath, whereas the MMF reform reduced MMFs' role as CP investors. At end-2022, the share of OFIs in CP holdings stood at 28%, exceeding that of MMFs by 8 percentage points.

Further reading:

Non-financial corporates (NFCs) are another group of investors that have significantly ramped up their holdings of US short-term paper. This group includes cash-rich corporates that invest directly in CP and CDs, thus revealing a preference to manage their liquid asset portfolios in-house, rather than outsource them to MMFs. While NFCs held less than 4% of CP outstanding ($57 billion) at the outset of the GFC in 2008, they represented 17% of the total ($210 billion) at end-2022.

Foreign investors in US paper have also seen their role increase gradually from the early 2000s, stabilising at around 15% after 2015. In December 2022, they held $183 billion of CP (Graph 6.A).

While the investor base is broadly similar in Europe, there are some important differences. The heft of non-euro area investors in the EU 27 is much larger than that of foreign investors in the United States, accounting for nearly 50% of all short-term debt instruments after 2017 (Graph 6.B). US-based investors are especially important for European issuers. We estimate that US MMFs and mutual funds account for nearly a quarter of all EU short-term debt securities held by foreigners (or about 13% of the total). This is consistent with the large share of European banks as issuers in the US markets. Overall, we have evidence of a strong dependence of European issuers on US investors for short-term funding needs.

The heft of domestic investors has remained roughly constant in Europe since 2017. More specifically, the share of non-bank and non-MMF financial investors has hovered at around 10% (Graph 6.B). The role of corporates, on the other hand, has not been material: NFCs held less than 2% of European shortterm paper at end-2022. A potential reason could be the lower appetite for cash management in euros as opposed to the US dollar, which would be yet another manifestation of the special role of the dollar in investors' liquidity preferences.

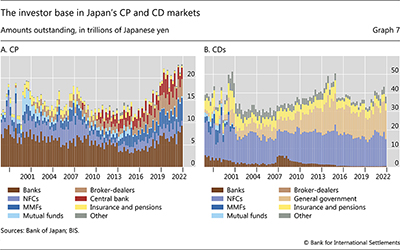

The investor base for Japanese short-term paper has evolved quite differently. Unlike in the US and Europe, the role of OFIs and foreign investors has remained minor. By contrast, banks play a major role, holding almost half of the Japanese CP outstanding (Graph 7.A).14 Furthermore, through its asset purchases, the central bank now holds approximately 10% of CP outstanding.15 NFCs also play a significant role in Japan, notably in the CDs segment, where they account for 50% of the holdings (Graph 7.B).16 Almost all of the remaining CDs are in the hands of government entities, especially local ones.

The emergence of new players

Two new classes of investors in short-term markets have emerged in recent years: private liquidity funds (PLFs) and stablecoin issuers. So far, their role has been confined mostly to US markets. The risks they pose are not as well understood as those posed by less opaque investors, such as MMFs.

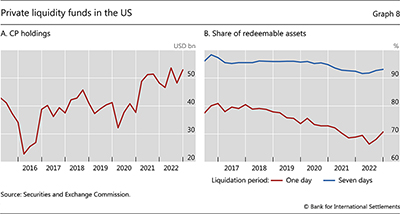

PLFs emulate the role of MMFs but are managed privately for big clients and not via open-ended mutual fund structures. They have gradually expanded their presence in US markets in recent years. The holdings of US CP by PLFs more than doubled between 2016 and 2022, from approximately $23 billion to $53 billion (Graph 8.A) – or 5% of all CP outstanding, roughly a fifth of MMF holdings. This expansion took place when prime MMFs – which have similar portfolios (Hiltgen (2017)) – faced pressure to shrink, suggesting that some ultimate beneficiaries saw private liquidity funds as a viable alternative.

While PLFs seem less exposed than MMFs to the risk of redemptions, their unfettered rise could still cause financial stability concerns. PLFs typically have a stable NAV but, unlike MMFs, do not offer daily liquidity to their investors. At the end of 2022, two thirds of PLFs' assets at most could be redeemed in a single day (Graph 8.B), compared with 100% for MMFs. This implies much weaker first-mover incentives17 for PLF investors. Yet, these funds might be still exposed to runs in the case of mounting fears about the value of CP. However, much less information is available for monitoring PLFs than for MMFs.

Stablecoin issuers are another new class of investors in the CP and CD markets. Based on the limited public disclosures, we estimate that stablecoin issuers could have been material holders of short-term paper in 2021, when crypto markets boomed. At their peak, individual stablecoin issuers' holdings of CP and CDs were likely to have been of similar magnitude as those of large MMFs – ie an estimated $65 billion (around 6% of total CP outstanding). After 2021, however, when various high-profile collapses rocked crypto markets, and as yields on safer government bills increased, the importance of stablecoin issuers as CP and CD investors declined substantially. If the crypto market rebounds and new players enter, eg as the August 2023 announcement by PayPal indicates,18 a proper analysis of the attendant risks would require better data than are currently available.19

The role of investors in tranquil and stress times

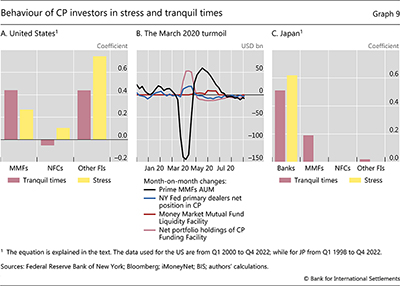

From a financial stability perspective, it is important to assess how far key investor groups could be expected to absorb issuance in times of stress. Some investors may act procyclically and exacerbate stress by not rolling over investments, while others could step in and thus stabilise prices. In assessing such differences in investor behaviour, we use data that let us study only the US and Japanese CP markets.

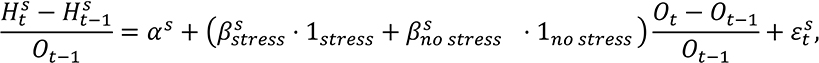

We seek to estimate how far different groups of investors will absorb CP and CDs issuance. Building on Fang et al (2023), we regress the relative change in the volume of securities held by a given sector on the percentage change in total securities outstanding (as a proxy for net issuance):

where  is the amount of CP held by sector s at time t, and 0t is the total amount of CP outstanding. The coefficient

is the amount of CP held by sector s at time t, and 0t is the total amount of CP outstanding. The coefficient  captures the fraction of CP issuance absorbed by sector s in stress times, and

captures the fraction of CP issuance absorbed by sector s in stress times, and  gives the corresponding share in tranquil times. We use quarterly data and identify periods of money markets stress using the relevant indicator proposed by Aldasoro, Hördahl and Zhu (2022). We define stress periods as the ones where that indicator is above the 90th percentile.

gives the corresponding share in tranquil times. We use quarterly data and identify periods of money markets stress using the relevant indicator proposed by Aldasoro, Hördahl and Zhu (2022). We define stress periods as the ones where that indicator is above the 90th percentile.

We find procyclical behaviour by US MMFs and NFCs, with OFIs picking up the slack in times of stress. MMFs absorb 44 cents of every CP dollar issued in normal times but only 27 cents in times of stress (Graph 9.A). The gap left by MMFs is filled by the OFI sector, which absorbs 74% of all CP issued in stress compared with 44% in tranquil periods.

We confirm these findings by zooming in on the March 2020 market turmoil, for which we use data on MMFs flows, dealer inventories and the take-up of central bank facilities. We find again that US MMFs significantly scaled down their CP holdings (Graph 9.B), amid massive redemptions in this particular episode. This added to the upward pressure on inventories that dealers were experiencing at the time. MMFs ramped up their CP positions only after the central bank intervened with targeted liquidity support.

MMFs in Japan absorb virtually no CP issuance during stress, with banks stepping in instead. Banks absorb 62% of new CP issued during stress relative to slightly more than half in normal times (Graph 9.C). This finding suggests that the Japanese system depends on bank intermediaries to play a stabilising role.20

Policy considerations

CP and CDs markets are growing again after several years of post-GFC stagnation. In this article, we document the genesis and development of these markets, the changes in the investor base, and the role of different investors in times of stress. Our analysis has policy implications in two broad areas.

First, the interconnectedness of short-term funding markets has important financial stability implications. Non-US banks – notably European ones – crucially rely on the US CP market, and on MMFs in particular, for short-term borrowing. Major redemption shocks to US-based MMFs may thus impair the funding of these foreign entities, leading to international spillovers. Most recently, these mechanisms were at play during the "dash for cash" in March 2020 (Aldasoro et al (2021), Eren et al (2020)).

Second, further work on filling data gaps is warranted, not least to assess the potential build-up of hidden risks in the system. Such work would involve information on the CD market segment in the US. Similarly, there would be great value in separate data on CP and CD markets in Europe, over a period that is longer than that for the current data on the region's short-term funding markets. Given the role that other financial intermediaries have played so far in the US CP market, there is also a case for more granular information on the sector's composition.

References

Aldasoro, I, E Eren and W Huang (2021): "Dollar funding of non-US banks through Covid-19", BIS Quarterly Review, March, pp 31–40.

Aldasoro, I, T Ehlers and E Eren (2022): "Global banks, dollar funding, and regulation", Journal of International Economics, vol 137(C), July.

Aldasoro, I, P Hördahl and S Zhu (2022): "Under pressure: market conditions and stress", BIS Quarterly Review, September, pp 31–45.

Alworth, J and C Borio (1993): "Commercial paper markets: a survey", BIS Economic Papers, no 37, April.

Anderson, R and C Gascon (2009): "The commercial paper market, the Fed, and the 2007–2009 financial crisis", Federal Reserve Bank of St Louis Review, November/December.

Bank of France (2023): Monthly statistical review, May.

Barthélemy, J, P Gardin and B Nguyen (2021): "Stablecoins and short-term funding markets", Bank of France Working Papers, no 908.

Blackrock (2020): Lessons from COVID-19: U.S. Short-Term Money Markets.

Boyarchenko, N, R Crump, A Kovner and D Leonard (2021): "The commercial paper funding facility", Federal Reserve Bank of New York, Staff Reports, no 982, September.

Buchholtz, A (2020): "Japan's outright purchases of commercial paper", Journal of Financial Crises, vol 2, no 3.

Chen, Q, I Goldstein and W Jiang (2010): "Payoff complementarities and financial fragility: Evidence from mutual fund outflows", Journal of Financial Economics, vol 97, no 2.

Committee on the Global Financial System (CGFS) (2020): "US dollar funding: an international perspective", CGFS Papers, no 65, June.

Covitz, D, N Liang and G Suarez (2013): "The evolution of a financial crisis: collapse of the asset-backed commercial paper market", The Journal of Finance, vol 68, no 3, January.

Darpeix, P-E (2022): "The market for short-term debt securities in Europe: what we know and what we do not know", European Systemic Risk Board, ESRB Occasional Paper Series, no 21.

Eren, E, A Schrimpf and V Sushko (2020): "US dollar funding markets during the Covid-19 crisis – the international dimension", BIS Bulletin, no 15, May.

Fang, X, B Hardy and K Lewis (2023): "Who holds sovereign debt and why it matters", BIS Working Papers, no 1099.

Kacperczyk, M and P Schnabl (2010): "When safe proved risky: commercial paper during the financial crisis of 2007–2009", Journal of Economic Perspectives, vol 24, no 1.

Klingler, S and O Syrstad (2022): "Disclosing the undisclosed: commercial paper as hidden liquidity buffers", working paper.

Klingler, S, A Rzeznik and O Syrstad (2023): "Issuer certification in money markets", mimeo.

Hiltgen, D (2017): "Private liquidity funds: characteristics and risk indicators", SEC White Papers, January.

International Capital Market Association (ICMA) (2021): The European commercial paper and certificates of deposit market.

Morris, M and J Walter (1998): "Large negotiable certificates of deposits", in T Cook and R Laroche (eds), Instruments of the Money Market, Federal Reserve Bank of Richmond, monograph.

Office of the Comptroller of the Currency (OCC) (2023): 160 Years of Safeguarding Trust in Banking: 1863–2023, webpage.

Schenk, C (1998): "The origins of the Eurodollar market in London: 1955–1963", Explorations in economic history, vol 35, no 2.

Totan Research Corporation (2009): Introduction to the Tokyo money market.

1 The authors thank Iñaki Aldasoro, Claudio Borio, Stijn Claessens, Marco Graziano, Wenqian Huang, Sven Klingler, Benoît Mojon, Maria Perozek, Hyun Song Shin and Nikola Tarashev for valuable comments, and Alberto Americo and Pietro Patelli for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the BIS.

2 CP and CDs are a subset of short-term funding markets (STFMs). Other segments of STFMs include government bills, medium-term notes, foreign exchange swaps, repurchase agreements, securities lending and lines of credit.

3 While there are CP markets in other jurisdictions – notably, China, where they have grown considerably over the past decade – the quality of the related data is not sufficient for our study.

4 An important variant of CP is asset-backed commercial paper (ABCP), typically issued by the off-balance sheet conduits of financial institutions. These institutions maintain control of the underlying assets (Kacperczyk and Schnabl (2010)).

5 Henceforth, when we refer to CP or CD markets, we mean the primary market unless stated otherwise.

6 Banks also issue non-negotiable CDs, primarily to retail investors. However, this type of CD is not used for raising large amounts of financing in a flexible manner.

7 The first MMF, the Reserve Primary Fund, was created in 1970. It was famously liquidated after the GFC as it broke the buck, ie its net asset value dropped below $1 per share.

8 The Eurodollar market, ie the market for dollar deposits in banks outside the US started to develop in London in the 1950s and grew substantially in the following decades (Schenk (1998)).

9 The GFC significantly scarred the asset-backed commercial paper (ABCP) market. At its peak in 2007, ABCP represented more than 50% of US paper outstanding. Currently only around 20% of CP is asset-backed in the US and less than 5% in France (Boyarchenko et al (2021), Bank of France, (2023)).

10 According to Klingler and Syrstad (2022), CP debt on average accounted for roughly 8% of US non-financial corporates' total debt between 2015 and 2019.

11 In the United States, data on CDs are simply not available. In Europe, there is only aggregate information on short-term debt securities, which does not distinguish between CP and CDs, and there are also coverage inconsistencies over time. Detailed quarterly information on holdings of European CP starts only in 2021. In addition, while data on total amounts of securities outstanding are disclosed for EU 27 residents, data on securities held are only available for euro area residents.

12 US MMFs are of two main types: (i) government MMFs that primarily invest in short-term Treasury securities and reverse repos backed by Treasuries; and (ii) prime MMFs that can invest in CP and CDs.

13 The 2016 MMF reforms increased liquidity requirements for prime funds, required them to have liquidity fees and suspension gates, and forced them to move from a fixed $1 share price to a floating net asset value (NAV). Additional reforms – in response to the events of March 2020 – have been agreed by the SEC in 2023 and will enter into force in 2024.

14 Post-GFC, Japanese banks have come to play a minor role as investors in CDs issued by other banks, in line with the global shrinkage of interbank unsecured funding markets.

15 In response to the failure of Lehman Brothers in September 2008, the Bank of Japan put in place a number of facilities, including in the CP market. It started buying CP and ABCP in the secondary market in January 2009. Purchases were limited to CP with a residual maturity of less than three months and of high credit quality (Buchholtz (2020)). While the emergency programme ended in December 2009, the BoJ continued buying CP as part of its monetary policy operations.

16 For Japanese corporates, CDs serve as a substitute for time deposits, and they frequently buy newly issued CDs to foster a good relationship with their bank (Totan (2009)).

17 First-mover advantage occurs when investors who redeem their shares first do so on more favourable terms than investors in the same fund who redeem late (Chen et al (2010)). In an open-ended fund, this can happen as redeeming investors do not pay the transaction costs of their redemptions, or because asset managers sell more liquid assets first.

18 On 7 August 2023, PayPal announced the launch of its own stablecoin to facilitate payments between merchants and buyers on their platform. The stablecoin will be backed by "dollar deposits, US treasuries and cash equivalents" (see PayPal Stablecoin).

19 First, in their disclosures, stablecoin issuers generically refer to CP without specifying the currency denomination or the issuer's country of origin. While it is likely that they invest in dollar-denominated paper, uncertainty remains (Barthélemy et al (2022)). Second, it is not clear from voluntary disclosures that the definition of CP and CDs used by stablecoin issuers matches the commonly used one. Finally, in some cases, the holdings of CP and CDs are disclosed only jointly.

20 We run a similar analysis for the Japanese CDs market and find that NFCs also play an important role as stabilisers in stress periods. Hence, it is possible that banks issue new CDs that are bought by NFCs, and then use the proceeds to stabilise the CP market.