Market turbulence and soaring margins: lessons from two recent episodes

Box extracted from Overview "Perceptions of risk and policy outlook drive markets"

An increasing share of derivatives transactions is subject to margin requirements, with those for centrally cleared instruments set by central counterparties (CCPs) and those for uncleared ones set by regulatory standards.

These requirements have been effective in meeting their primary objective – reducing counterparty credit risk. However, in recent periods of large shocks and bouts of market turbulence, margin surges boosted counterparties' demand for liquidity exactly when the supply was short, in some cases exacerbating the turbulence.

These requirements have been effective in meeting their primary objective – reducing counterparty credit risk. However, in recent periods of large shocks and bouts of market turbulence, margin surges boosted counterparties' demand for liquidity exactly when the supply was short, in some cases exacerbating the turbulence.

This box analyses how swings in liquidity demand reflect central clearing margin requirements, paying particular attention to aspects of the underlying model. We draw on a unique data set that estimates margin requirements on hypothetical trades of interest rate swaps (IRS) at LCH SwapClear, a prominent CCP for such derivatives. We focus on two episodes: the Covid–19 shock of March 2020 and the UK "mini" budget turmoil in September 2022. We show that a large component of the calibration of margin requirements – namely one reflecting market developments observed immediately before the time of calibration – is at the root of destabilising dynamics. A stronger precautionary component in the underlying model would dampen these dynamics but may reduce centrally cleared activity.

Margin arrangements normally include two components: variation margin (VM), which reflects current market conditions, and initial margin (IM), which seeks to anticipate future market conditions. When the value of a derivative changes and the losing side makes a payment to the winning side, there is an exchange of VM (usually daily). In addition, each CCP participant has to post an IM to cover potential future VM payments that it may fail to deliver, eg in case of default. Realised VMs in excess of the IM represent a potential "margin breach" that signals a risk for the CCP; if losing counterparties were to fail, IM would not be sufficient to cover the VM payments that these counterparties owe the CCP. The magnitudes of IM and VM depend on the size of the underlying positions and hence trading volumes. In addition, IM may change because of a recalibration of the underlying model that estimates extreme shocks down the road.

Required margin amounts underwent exceptional swings during the stress episodes we consider. In February/March 2020, when the Covid–19 epidemic spread worldwide, market volatility rose dramatically, resulting in sharp increases in both the overall amounts of the VMs exchanged between counterparties and the required IM. The largest daily VM paid to SwapClear reached $26 billion in Q1 2020, and IM increased by $28 billion over the same period.

The largest daily VM paid to SwapClear reached $26 billion in Q1 2020, and IM increased by $28 billion over the same period. Both of these values were 40% higher than the previous records. SwapClear witnessed a potential margin breach as high as £558 million in Q1 2020, which was roughly equal to three times the largest value that had yet been recorded (in Q3 2015). IM again rose sharply during the bout of turbulence that followed the UK "mini" budget announcement in September 2022, and potential margin breaches peaked at £698 million, even higher than in March 2020.

Both of these values were 40% higher than the previous records. SwapClear witnessed a potential margin breach as high as £558 million in Q1 2020, which was roughly equal to three times the largest value that had yet been recorded (in Q3 2015). IM again rose sharply during the bout of turbulence that followed the UK "mini" budget announcement in September 2022, and potential margin breaches peaked at £698 million, even higher than in March 2020.

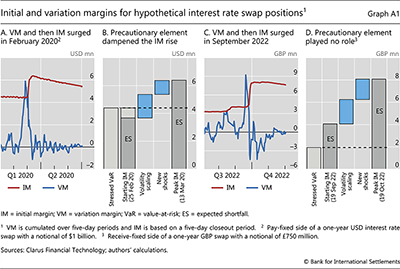

To understand the role of the underlying model in such IM developments, we consider two hypothetical positions, for which we can derive margin requirements while fixing the trading volume. The positions are: the pay–fixed side of a US dollar one–year swap in February/March 2020 (Graph A1.A); and the receive–fixed side of a GBP one–year swap for September 2022 (Graph A1.C). In their respective periods of stress, both positions incurred market losses that necessitated substantial VM payments. In each case, our simulations indicate that the VM level was higher than the concurrent IM, ie there was a potential margin breach. Subsequently, the required amount of IM surged, suggesting that the shocks underpinning the VM payments materially affected the implications of the IM model, even if with a lag of a few days. This surge reinforced the liquidity needs of entities holding the positions we consider, as it came on the heels of VM payments. Such needs generate destabilising dynamics when they arise during market stress, ie when they are procyclical. We thus investigate what aspects of the IM model generate procyclicality.

In setting IM for IRS, SwapClear computes two tail risk measures from two historical loss distributions and uses the maximum of the two. One of the measures (expected shortfall (ES)) is based on a history of shocks from the previous 10 years. This risk measure is recalibrated every day to include the latest observation in the set of historical shocks (the "new shocks" effect) and to scale these historical shocks so that their standard deviation reflects the most recent volatility (the "volatility scaling" effect). Both the new shocks and the volatility scaling effects raise ES in times of market stress. The second tail risk measure (stressed value–at–risk (SVaR)) is calibrated on specific historical stress episodes (eg the Great Financial Crisis or the European sovereign debt crisis). Since adjustments to this set of events are rare, SVaR is stable over time and acts as a floor for IM, surfacing when ES is low during periods of calm. Conversely, a transition from calm to heightened volatility brings ES to the fore by raising it above the SVaR floor. Importantly, the higher the SVaR, the smaller the portion of the ES rise that translates into an IM increase. Overall, while the new shocks and volatility scaling effects introduce procyclicality in IM, an SVaR effect dampens this procyclicality.

The stress episodes we focus on highlight the three model–based effects behind IM rises, and in particular the scope for SVaR to dampen IM swings. In both episodes, the volatility scaling effect and, to a lesser extent, the new shocks effect drove the spike in IM for the hypothetical positions (Graphs A1.B and A1.D). The SVaR floor dampened the procyclicality of these two effects during the 2020 episode: only 74% of their combined impact on ES translated into an IM increase for the US dollar interest rate swap. By contrast, a low SVaR did not bind and thus did not play a dampening role in the 2022 episode, during which the IM for the GBP interest rate swap doubled.

The message of our stylised exercise is clear: if policymakers wish to mitigate the perverse effects of sharp adjustments to IM in times of market stress, they need to beef up its precautionary component, ie the SVaR floor, in tranquil times. Of course, raising this component means that the evolution of IM would reflect the current market environment less accurately. And the generally higher IM would increase the cost of entering derivatives positions. This may push activity to the less transparent bilateral markets or have participants shun derivatives, leaving some risks unhedged. From a financial stability perspective, the trade–offs between reducing margin procyclicality and reducing activity in centrally cleared derivatives call for a careful assessment and require a system–wide regulatory approach.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  Basel Committee on Banking Supervision (BCBS) and International Organization of Securities Commissions (IOSCO), Margin requirements for non–centrally cleared derivatives, July 2019.

Basel Committee on Banking Supervision (BCBS) and International Organization of Securities Commissions (IOSCO), Margin requirements for non–centrally cleared derivatives, July 2019.  A Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid–19 crisis", BIS Bulletin, no 2, April 2020; M Brunnermeier and L Pedersen, "Market liquidity and funding liquidity", Review of Financial Studies vol 22, February 2009, pp 2201–38.

A Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid–19 crisis", BIS Bulletin, no 2, April 2020; M Brunnermeier and L Pedersen, "Market liquidity and funding liquidity", Review of Financial Studies vol 22, February 2009, pp 2201–38.  BCBS, Committee on Payments and Market Infrastructures (CPMI) and IOSCO, Review of margining practices, September 2022, and W Huang and E Takats, "The CCP–bank nexus in the time of Covid–19", BIS Bulletin, no 13, May 2020.

BCBS, Committee on Payments and Market Infrastructures (CPMI) and IOSCO, Review of margining practices, September 2022, and W Huang and E Takats, "The CCP–bank nexus in the time of Covid–19", BIS Bulletin, no 13, May 2020.  According to SwapClear's CPMI–IOSCO quantitative disclosures and Clarus Financial Technology.

According to SwapClear's CPMI–IOSCO quantitative disclosures and Clarus Financial Technology.  S Aramonte and P Rungcharoenkitkul, "Leverage and liquidity backstops: cues from pension funds and gilt market disruptions", BIS Quarterly Review, December 2022, Box B.

S Aramonte and P Rungcharoenkitkul, "Leverage and liquidity backstops: cues from pension funds and gilt market disruptions", BIS Quarterly Review, December 2022, Box B.