The flight home effect among non-bank lenders

Box extracted from special feature "Non-bank lenders in the syndicated loan market"

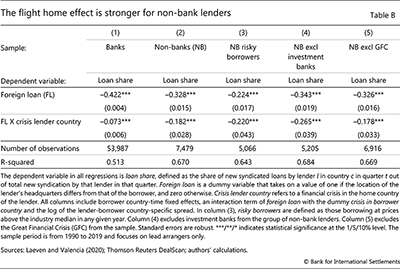

In this box, we investigate the flight home effect (FHE) among non-banks. The FHE refers to the finding in Giannetti and Laeven (2012) that, during financial crises in their home country, lead arranger banks cut lending to foreign borrowers by more than they did to domestic borrowers. Giannetti and Laeven also find that the effect is driven by banks that are more exposed to riskier borrowers and with more volatile funding.

Following the methodology in Giannetti and Laeven, we estimate regressions at the lender parent-borrower country-quarter level. We do so separately for bank and non-bank lead arrangers:

The dependent variable captures the share of new loans by lender l in country c in quarter t out of total new syndication by that lender in that quarter. Using the share as a dependent variable has the benefit that it is unaffected by shocks changing the lender's overall supply of loans. Instead, it captures the allocation of a lender's new loans to domestic and foreign markets in response to changes in economic conditions. Foreign loan is a dummy variable that equals one if the location of the arranger's headquarters differs from the borrower's, and zero otherwise. Crisis lender country captures financial crises in the arranger's home country, obtained from Laeven and Valencia (2020).

The interpretation of the key coefficients is as follows. The coefficient  indicates whether lenders systematically issue a higher or lower share of their new loans to the average foreign country, relative to their home country. The coefficient

indicates whether lenders systematically issue a higher or lower share of their new loans to the average foreign country, relative to their home country. The coefficient  captures the FHE. A negative estimate suggests that lenders reduce lending to foreign borrowers relative to domestic borrowers when their home country experiences a crisis. A higher absolute value of

captures the FHE. A negative estimate suggests that lenders reduce lending to foreign borrowers relative to domestic borrowers when their home country experiences a crisis. A higher absolute value of  indicates a more pronounced FHE.

indicates a more pronounced FHE.

The allocation of new loans could also be affected by crises in borrower countries, and more broadly by changes in demand. We control for the differential effect of borrower country crises on foreign loans directly by interacting foreign loan with a dummy for crisis years in borrower countries, which implies that the coefficient  reflects relative changes in lending to foreign countries after accounting for the effects of crises there. To account for demand shocks and borrower risk, regressions include time-varying borrower country fixed effects, and control for the (logarithm of) the median lender country-specific loan spread. However, we cannot fully account for (unobservable) changes in borrowers' loan demand, which could also be affected by crises outside the borrower country. Estimated coefficients hence reflect lender characteristics, but also differences in the pool of borrowers within a country. That said, a domestic financial crisis is likely to have a stronger effect on the performance – and hence loan demand – of domestic borrowers compared with foreign borrower countries, implying an attenuation bias in the estimates.

reflects relative changes in lending to foreign countries after accounting for the effects of crises there. To account for demand shocks and borrower risk, regressions include time-varying borrower country fixed effects, and control for the (logarithm of) the median lender country-specific loan spread. However, we cannot fully account for (unobservable) changes in borrowers' loan demand, which could also be affected by crises outside the borrower country. Estimated coefficients hence reflect lender characteristics, but also differences in the pool of borrowers within a country. That said, a domestic financial crisis is likely to have a stronger effect on the performance – and hence loan demand – of domestic borrowers compared with foreign borrower countries, implying an attenuation bias in the estimates.

Results in Table B show that the FHE is stronger for non-bank arrangers. Column (1) first shows a FHE among lead arrangers that are banks, with estimates quantitatively similar to those in Giannetti and Laeven. In column (2) we estimate the same specification for non-bank arrangers. As indicated by the point estimate of  , the average difference in the shares of new loans between foreign and domestic countries is larger for banks than non-banks (42.2 percentage points vs 32.8 percentage points). More importantly, the FHE is stronger for non-bank arrangers (

, the average difference in the shares of new loans between foreign and domestic countries is larger for banks than non-banks (42.2 percentage points vs 32.8 percentage points). More importantly, the FHE is stronger for non-bank arrangers ( of 18.2 percentage points vs 7.3 percentage points for banks). In column (3) we show that the FHE becomes more pronounced when considering only the subset of riskier borrowers, defined as those obtaining loans with a spread above the yearly industry median. Column (4) shows that results strengthen further when excluding investment banks, which could have more stable funding than other non-banks. Finally, the results are also robust to excluding the Great Financial Crisis in column (5).

of 18.2 percentage points vs 7.3 percentage points for banks). In column (3) we show that the FHE becomes more pronounced when considering only the subset of riskier borrowers, defined as those obtaining loans with a spread above the yearly industry median. Column (4) shows that results strengthen further when excluding investment banks, which could have more stable funding than other non-banks. Finally, the results are also robust to excluding the Great Financial Crisis in column (5).

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.  In unreported regressions, we find that the existence of a stronger flight home effect for non-banks is also robust to the exclusion of the euro zone crisis, as well as the exclusion of different regions and countries that are home to a significant number of non-bank lenders (eg Japan, the United Kingdom and the United States).

In unreported regressions, we find that the existence of a stronger flight home effect for non-banks is also robust to the exclusion of the euro zone crisis, as well as the exclusion of different regions and countries that are home to a significant number of non-bank lenders (eg Japan, the United Kingdom and the United States).