Rotation from growth to value stocks and its implications

Box extracted from Overview chapter "Markets jolted"

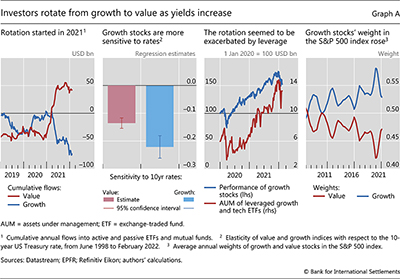

The prospects of tighter monetary policy seemed to spark a stock market rotation. From early 2021 to the third week of February 2022, investors reduced positions in so called "growth" stocks, which typically include sectors like technology and, more generally, younger firms. At the same time, investors added to their positions in "value" stocks, which typically include established firms with consistently positive cash flows (Graph A, first panel). The rotation reversed an earlier trend that had favoured growth stocks, which outperformed value stocks by nearly 40% in the course of 2020. In this box, we examine the drivers of this rotation and the potential implications for the broader market.

The shift from growth to value stocks is likely related to their different sensitivities to interest rates. This difference is related to the timing of the underlying cash flows. For growth companies, it is expected that a large fraction of their cash flow will accrue in the distant future, for instance when the underlying business model has reached maturity. By contrast, well established value firms – such as financial companies – have a track record of regularly generating positive cash flows. In this context, the prospect of higher rates would more greatly reduce the stock prices of growth firms, whose future-tilted cash flows would be more heavily discounted. Indeed, the sensitivity of growth stocks to interest rates is almost twice as large as that of value stocks (Graph A, second panel).

The recent rotation away from growth stocks could have been exacerbated by deleveraging. Earlier, in 2021, leveraged exchange-traded funds (ETFs) that focus on growth and technology stocks saw their assets under management (AUM) increase steadily, due mainly to capital gains (Graph A, third panel). Whenever the market prices of these ETFs' holdings increase, their leverage drops. Since the funds are contractually committed to lifting leverage back to target, they need to buy more stocks on margin. In other words, leveraged ETFs act like momentum traders, creating the potential for feedback loops. Indeed, as growth stocks' prices dropped in early 2022, the AUM of leveraged ETFs declined – and the attendant leverage rose above target – thus calling for sales into a falling market.

Indeed, as growth stocks' prices dropped in early 2022, the AUM of leveraged ETFs declined – and the attendant leverage rose above target – thus calling for sales into a falling market.

The heft of growth stocks suggests that their high sensitivity to interest rates could have significant market implications. As a result of their stellar performance since the pandemic's outbreak, the weight of growth stocks in the S&P 500 index rose to 57% before the latest index rebalancing in 2021 (Graph A, fourth panel). Taking the sensitivity estimates in the second panel at face value, this weight implies that a 1 percentage point increase in 10-year rates would go hand in hand with a repricing of growth stocks that translates into a roughly 12% drop in the whole index. In turn, the high sensitivity of the overall index to rates could spill over to other instruments linked to the performance of the benchmark, such as derivatives, or to investment funds whose performance mimics the index. More generally, outsized drops in the index could lead to large wealth losses for investors and might have macroeconomic implications if those losses were to weaken consumer spending and overall economic growth.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS. The authors thank Claudio Borio, Stijn Claessens, Andreas Schrimpf and Nikola Tarashev for helpful comments and discussions, and Alessandro Barbera and Pietro Patelli for excellent research assistance.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS. The authors thank Claudio Borio, Stijn Claessens, Andreas Schrimpf and Nikola Tarashev for helpful comments and discussions, and Alessandro Barbera and Pietro Patelli for excellent research assistance.  See K Todorov, "Passive funds affect prices: evidence from the most ETF-dominated markets", BIS Working Papers, no 952, July 2021.

See K Todorov, "Passive funds affect prices: evidence from the most ETF-dominated markets", BIS Working Papers, no 952, July 2021.