Tracing the footprint of cryptoisation in emerging market economies

Box extracted from Overview chapter "Markets jolted"

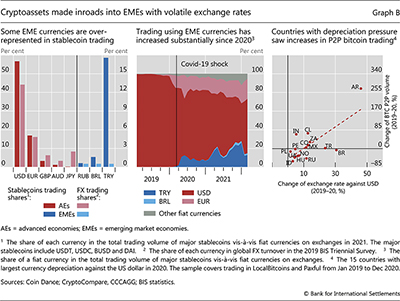

Cryptoassets have gained in popularity in emerging market economies (EMEs) in recent years. This development accelerated further after the Covid-19 crisis, especially in countries with volatile exchange rates. During periods of depreciation, holders of domestic fiat currencies have incentives to shift into claims denominated in more stable currencies. For residents in these countries, cryptoassets pegged to reserve currencies, such as US dollar-linked stablecoins, can be a convenient tool to do so, especially as they may help avoid capital controls and know-yourcustomer/ anti-money laundering (KYC/AML) requirements. In the extreme case of sharp declines in the purchasing power of local fiat currencies and stringent capital controls, some may even seek refuge in highly risky cryptoassets such as Bitcoin, which are not pegged to any reserve currency. As "cryptoisation" is akin to currency substitution (eg "dollarisation"), it may impinge on monetary sovereignty. While detailed information on crypto trading locations is typically very limited, the box relies on trading patterns involving EME currencies to provide novel empirical evidence on this phenomenon.

While detailed information on crypto trading locations is typically very limited, the box relies on trading patterns involving EME currencies to provide novel empirical evidence on this phenomenon.

Trading of US dollar-linked stablecoins vis-à-vis some EME currencies has soared since 2020. Although the US dollar remains the dominant fiat currency, the Turkish lira and the Brazilian real, for instance, accounted for much higher shares in stablecoin trading than in conventional FX trading, as captured by the BIS Triennial Survey (Graph B, left-hand panel). Tellingly, trading of stablecoins vis-a-vis these EME currencies gained momentum in early 2020, when the corresponding economies were hard hit by the Covid-19 shock (centre panel). In particular, the share of the Turkish lira increased from 0.3% in January to 11% in April 2020. As the lira further depreciated in 2021, its share picked up from 11% in July to 26% in December 2021. This dwarfs the lira's weight in global FX markets (0.5%).

Tellingly, trading of stablecoins vis-a-vis these EME currencies gained momentum in early 2020, when the corresponding economies were hard hit by the Covid-19 shock (centre panel). In particular, the share of the Turkish lira increased from 0.3% in January to 11% in April 2020. As the lira further depreciated in 2021, its share picked up from 11% in July to 26% in December 2021. This dwarfs the lira's weight in global FX markets (0.5%).

In addition, trading of risky cryptoassets, such as Bitcoin, also spiked in some EMEs facing depreciation pressure. For EME currencies that have small liquidity pools and are thus not suitable for trading in limit order books on centralised crypto exchanges, the spike surfaced on peer-to-peer (P2P) platforms that facilitate the matching of client trades (mostly involving Bitcoin). In a sign that residents may have tried to avoid losses of purchasing power, stronger depreciation pressure on such currencies went hand in hand with larger volumes of P2P trading in Bitcoin (Graph B, right-hand panel). By contrast, for EME countries whose currencies can be used in centralised exchanges (eg Turkey and Brazil), the P2P volume did not increase substantially, even though their exchange rates were highly volatile.

In a sign that residents may have tried to avoid losses of purchasing power, stronger depreciation pressure on such currencies went hand in hand with larger volumes of P2P trading in Bitcoin (Graph B, right-hand panel). By contrast, for EME countries whose currencies can be used in centralised exchanges (eg Turkey and Brazil), the P2P volume did not increase substantially, even though their exchange rates were highly volatile.

The increasing usage of cryptoassets in EMEs, especially during periods of elevated FX volatility, could – over time – contribute to economic instability. Although the degree of cryptoisation thus far remains limited, its growth could ultimately divert away some of the funding of local banking systems. As cryptoisation circumvents restrictions on exchange rates and capital controls, it can limit the effectiveness of domestic monetary policy transmission, in turn posing a threat to monetary sovereignty. In addition, if some cryptoassets were widely adopted as a means of payment, problems with these assets – such as disruptions to stablecoins or risky cryptoasset price crashes – could spill over to payment systems and adversely affect real economic activity. Such risks are further compounded by "unknown unknowns" – in particular due to the lack of transparency about ownership of cryptoassets.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS. The authors thank Claudio Borio, Stijn Claessens and Nikola Tarashev for helpful comments and discussions.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS. The authors thank Claudio Borio, Stijn Claessens and Nikola Tarashev for helpful comments and discussions.  IMF, "The crypto ecosystem and financial stability challenges", in "Global Financial Stability Report", 2021.

IMF, "The crypto ecosystem and financial stability challenges", in "Global Financial Stability Report", 2021.  The stablecoin and triennial trading shares refer to 2021 and 2019, respectively. That said, the triennial share has been stable over past decades.

The stablecoin and triennial trading shares refer to 2021 and 2019, respectively. That said, the triennial share has been stable over past decades.  Crypto trading can take place in both centralised exchanges (CEXs) or decentralised exchanges (DEXs). Transactions using fiat currencies mostly happen in CEXs. For international currencies, trades mostly take place in large exchanges such as Coinbase and Binance. For other currencies, trades take place mainly on P2P matching platforms such as LocalBitcoins and Paxful.

Crypto trading can take place in both centralised exchanges (CEXs) or decentralised exchanges (DEXs). Transactions using fiat currencies mostly happen in CEXs. For international currencies, trades mostly take place in large exchanges such as Coinbase and Binance. For other currencies, trades take place mainly on P2P matching platforms such as LocalBitcoins and Paxful.