Korea's policy response to the March 2020 market turmoil

This box reviews the Korean experience with US dollar shortages during the March 2020 episode and the changes it triggered to the country's regulatory framework.

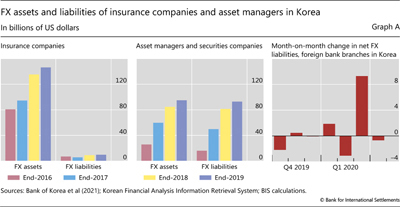

Strong demand for dollar funding in Korea originated from at least three sources. First, insurance companies were required to continue to roll over foreign currency (FX) hedges for their sizeable mismatches between FX assets and liabilities (Graph A, left-hand panel). Second, despite their smaller size, demand for dollars by asset managers and securities companies (centre panel) spiked during the market stress, as these investors struggled to meet margin calls on the roughly $11 billion in equity-linked securities (ELS) they had sold to Korean investors. Third, non-resident investors sold local currency assets, resulting in the conversion of roughly $4.5 billion Korean won into US dollars in the spot market (Bank of Korea et al (2021)).

Third, non-resident investors sold local currency assets, resulting in the conversion of roughly $4.5 billion Korean won into US dollars in the spot market (Bank of Korea et al (2021)).

Banks managed to continue to supply dollars via FX derivatives, albeit at a premium since they too needed to secure dollar funding. Domestic banks' FX borrowing grew by $4.5 billion in March 2020 and that of the branches of foreign banks by almost $10 billion, mostly via borrowing from their headquarters (Graph A, right-hand panel).

The experience highlighted two key vulnerabilities involving asset managers and institutional investors in Korea. First, their investment practices tended to exhibit herd behaviour and lacked diversity, thus amplifying systemic risk. In particular, the exposures in ELS issued by securities companies – which contributed to dollar shortages in March 2020 – were highly concentrated in only a few stock indices (eg the KOSPI 500, S&P 500, EURO STOXX 50 and the Hang Seng index). Second, these asset managers did not maintain sufficient dollar credit lines with banks before March 2020 and thus had to scramble for dollars exactly when banks became reluctant to lend to them.

In January 2021, the authorities announced a plan to address these weaknesses. It aims to enhance FX risk management capabilities of institutional investors and asset managers, strengthen monitoring of FX liquidity, close loopholes in FX prudential regulations, improve the FX macroprudential policy framework, and build a multi-layered supply chain to backstop FX liquidity for non-bank investors (Bank of Korea et al (2021)). By end-July 2021, indicators were in place to monitor the FX risks of insurance and asset management companies, and FX liquidity stress tests were conducted on a quarterly basis. In addition, the cap on insurance companies' open FX positions had been raised from 20% to 30% of solvency capital, so that they can hedge more flexibly. Finally, the FX Macroprudential Council was set up to enhance coordination among financial authorities. Additional measures are to be implemented by end-2021.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.  Since their introduction in 2003, ELS and derivatives-linked securities have become the main indirect investment products in Korea. Their combined outstanding amount at end-2016 reached KRW 100 trillion, from KRW 18 trillion at end-2007 (Lee (2017)). ELS are classified as hybrid debt securities since they have domestic bonds as the underlying assets but also derivatives exposure to foreign equity indices.

Since their introduction in 2003, ELS and derivatives-linked securities have become the main indirect investment products in Korea. Their combined outstanding amount at end-2016 reached KRW 100 trillion, from KRW 18 trillion at end-2007 (Lee (2017)). ELS are classified as hybrid debt securities since they have domestic bonds as the underlying assets but also derivatives exposure to foreign equity indices.