Funding for lending programmes during Covid-19

In response to the Covid crisis, central banks in various jurisdictions implemented "funding for lending" (FFL) programmes, which allow banks to access low-cost funding in order to lend to businesses in need. This type of measure had been introduced previously, such as by the Bank of England and the Magyar Nemzeti Bank in response to the euro area crisis in 2012. In 2020, several additional jurisdictions implemented similar programmes (including Australia, Mexico, New Zealand, Saudi Arabia, Sweden, Switzerland and Taiwan). Likewise, the European Central Bank (ECB) initiated the third phase of its Targeted Long-Term Refinancing Operations (TLTRO III), which aims to incentivise lending to households and corporations by providing low-cost financing to banks. To examine such programmes in detail, this box focuses on selected countries for which information is readily available.

FFL programmes typically have two main elements: the provision of low-cost funds; and conditions tied to the use of those funds and to additional access to funds. Such conditions differentiate FFL programmes from standard lending operations by central banks, such as standing or emergency lending facilities. The conditions usually require banks to use the funds to extend loans, often to SMEs or industries hard hit by Covid. In some cases, the funds are offered in tranches: banks can borrow a first tranche but need to extend new loans of a certain amount in order to access subsequent tranches of funds. For example, in Australia the amount of additional funding allowance is proportional to the increase in the bank's lending. In the United Kingdom, funds can be accessed if participating banks lend to the private non-financial sector in general, but total allowance increases are conditional on lending specifically to SMEs. Moreover, the cost of funding rises from 0.10% to 0.35% if the participating UK bank fails to increase its net lending.

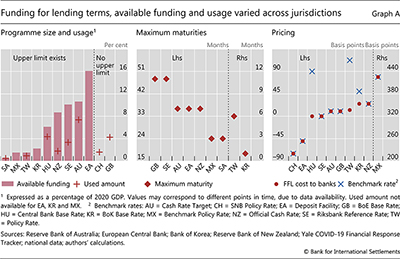

The size of these programmes varies considerably across countries (Graph A, left-hand panel). The largest programme in terms of total funding committed is the ECB's, at over 16% of the euro area's 2020 GDP. By contrast, Saudi Arabia has the smallest programme, amounting to 0.5% of its GDP. In the United Kingdom and Switzerland, there is no upper limit on available funding, hence resources channelled through the programme depend entirely on the demand from banks and the extent to which they satisfy the underlying conditions.

FFL programmes also vary in terms of loan maturities and pricing (Graph A, centre and right-hand panels). For example, the ECB's TLTRO III programme provides funding with a maturity of three years, while the repayment period is limited to six months in Chinese Taipei and just one month in South Korea. In most countries, interest charged on the funding to banks is set at a benchmark rate, such as the overnight interbank rate or the policy rate. In Hungary, Chinese Taipei and South Korea, the rate is actually set below the relevant benchmark to further encourage use.

The use of the FFL programme was also quite disparate. Among countries for which usage data are available, Australia had the highest take-up, reaching 7% of its 2020 GDP as of Q2 2021. Banks in the United Kingdom, Hungary and Sweden also utilised a sizeable amount of funds, at over 3% of the respective country's GDP.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.