US branches and subsidiaries of non-US banks and the Covid-19 shock

US affiliates play an important role in the management of non-US banks' US dollar operations. This box uses call report data to document how such affiliates responded to the Covid-19 shock.

This box uses call report data to document how such affiliates responded to the Covid-19 shock.

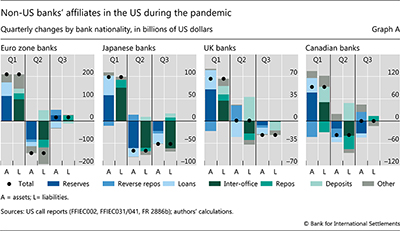

The balance sheets of the US affiliates of non-US banks expanded in the first quarter and reverted only partly afterwards (Graph A). On the asset side, reserves at the Federal Reserve increased overall but loans declined in Q2 and Q3, reflecting net credit repayment. The Senior Financial Officer Survey conducted by the Federal Reserve suggests a precautionary motive behind increased reserves during the first half of the year. Nearly all of the foreign banks surveyed said that "preparing for potential drawdowns of committed credit lines" was the most important reason behind reserve build-up (FRB (2020)). On the liability side, deposits account for most of the increase during 2020 – as foreshadowed by Graph 1 and the left-hand panel of Graph 3. Most of these deposits were vis-à-vis non-banks, including non-bank financial institutions. The increase in deposits was particularly large for Canadian banks (+$88 billion), which reduced their repos (–$53 billion). Euro zone, Japanese and Swiss banks, in turn, increased their repos (+48 billion combined).

Indeed, the drawdowns of contingent credit lines dominated balance sheet changes in the midst of the Covid-19 dollar funding crisis and its immediate aftermath. These drawdowns by non-banks lead to simultaneous increases in loans and deposits (Glancy et al (2020)). In the first quarter of 2020, they amounted to $101 billion, out of a total of $189 billion in loans by non-US banks' US affiliates. For some of the largest banking systems a significant share of the change in loans during Q1 2020 can be accounted for by drawdowns: for euro zone, UK and Canadian banks, this share stood at 63.5%, 62.7% and 72.4%, respectively. The footprint of central bank swap line use was, in turn, visible in the changes in inter-office liabilities and reserves during the first two quarters of 2020 (Aldasoro, Cabanilla, Disyatat, Ehlers, McGuire and von Peter (2020)).

out of a total of $189 billion in loans by non-US banks' US affiliates. For some of the largest banking systems a significant share of the change in loans during Q1 2020 can be accounted for by drawdowns: for euro zone, UK and Canadian banks, this share stood at 63.5%, 62.7% and 72.4%, respectively. The footprint of central bank swap line use was, in turn, visible in the changes in inter-office liabilities and reserves during the first two quarters of 2020 (Aldasoro, Cabanilla, Disyatat, Ehlers, McGuire and von Peter (2020)).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  Previous stress episodes left a visible trail in these balance sheets. Examples are the large shifts in inter-office claims and liabilities observed during the euro area sovereign crisis and the FDIC assessment of banks' managed liabilities in 2011, as well as when the branches and agencies of foreign banks in the US ran down their holdings of excess reserves at the Federal Reserve in the aftermath of the US MMF reform of 2016.

Previous stress episodes left a visible trail in these balance sheets. Examples are the large shifts in inter-office claims and liabilities observed during the euro area sovereign crisis and the FDIC assessment of banks' managed liabilities in 2011, as well as when the branches and agencies of foreign banks in the US ran down their holdings of excess reserves at the Federal Reserve in the aftermath of the US MMF reform of 2016.  This reflects net drawdowns, or the change in unused commitments to provide liquidity. It combines information on drawdowns with changes in committed amounts.

This reflects net drawdowns, or the change in unused commitments to provide liquidity. It combines information on drawdowns with changes in committed amounts.