The news sensitivity of high equity prices when long-term rates are low

While low interest rates may help explain high equity prices, they also change the relative importance of alternative drivers of stock returns. In this box, we first document that the current low rates, rather than corporate earnings, assuage concerns about froth in the equity markets. We then argue that, in such an environment, equity valuations are particularly sensitive to monetary policy news, much more so than to macroeconomic news. Besides increasing the present value of future cash flows, accommodative monetary policy can help to boost economic activity and can also, to some extent, limit downside risks. Overall, the findings underscore the pivotal role that central banks are playing in influencing stock prices at the current juncture.

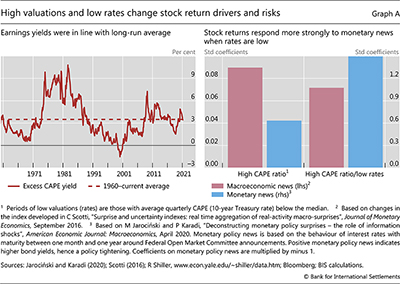

Equity valuations reflect both corporate profitability and the level of interest rates. In an asset-pricing model, the price of a stock is the discounted present value of future profits, with the discounting factor dependent on the profile of interest rates at short and long horizons. Measures that abstract from interest rates and compare equity prices only with corporate profitability conclude that stocks are at present trading at a substantial premium. One of the most common such measures, the cyclically adjusted price/earnings ratio (CAPE) of the S&P 500, is at its highest apart from a brief period in the late 1990s. Once interest rates are taken into account, however, stocks appear more reasonably priced. The excess CAPE yield, which takes the inverse of the S&P 500 CAPE ratio and subtracts real (inflation-adjusted) interest rates, is currently not far from its long-term average (Graph A, left-hand panel).

An environment of low interest rates is conducive to particularly high sensitivity of stock returns to monetary policy news. When interest rates are below their median, monetary policy news, measured with changes in short-term interest rates around Federal Open Market Committee announcements, has a stronger effect on S&P 500 returns than when interest rates are above their median. In contrast, the corresponding impact of macroeconomic news, proxied by deviations of scheduled macroeconomic releases from consensus forecasts, is actually lower at low interest rates.

In principle, there could be a mechanical effect at play. Monetary policy news that induces changes to interest rates at low levels has a substantially larger impact on the discount factor, which translates into a similarly large impact on stock returns. For the results we report in Graph A (right-hand panel), we seek to strip out these effects. Likewise, all else the same, macroeconomic news could have mechanically a stronger impact on returns when the discount factor is lower. Our findings indicate that this effect does not drive outcomes. Namely, the reported sensitivities to macroeconomic news (red bars) are actually lower at low interest rates.

Likewise, all else the same, macroeconomic news could have mechanically a stronger impact on returns when the discount factor is lower. Our findings indicate that this effect does not drive outcomes. Namely, the reported sensitivities to macroeconomic news (red bars) are actually lower at low interest rates.

Through what channels – other than that of the discount factor – do low interest rates strengthen the responsiveness of stock returns to monetary policy news? Such interest rates reduce corporates' debt servicing costs and encourage economic activity, thus leading to higher expected profits and ultimately higher equity valuations. Moreover, if low interest rates are the symptom of accommodative monetary policy that seeks to reduce the likelihood of steep losses on the equity market, then they would go hand in hand with low risk premia and, thus, high valuations. Overall, to the extent that corporate profitability and investors' attitude to risk are predicated on monetary policy, stock valuations would respond strongly to news about this policy.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  We observe similar patterns in the corporate bond market. The effect of monetary policy on exchange rates is also higher when interest rates are low. See M Ferrari, J Kearns and A Schrimpf, "Monetary policy's rising FX impact in the era of ultra-low rates", BIS Working Papers, no 626, April 2017.

We observe similar patterns in the corporate bond market. The effect of monetary policy on exchange rates is also higher when interest rates are low. See M Ferrari, J Kearns and A Schrimpf, "Monetary policy's rising FX impact in the era of ultra-low rates", BIS Working Papers, no 626, April 2017.  Concretely, in our empirical analysis, we estimate separately the effect of news on stock returns that depends on the interest rate level and the effect that does not. In Graph A (right-hand panel), we report only the latter effect.

Concretely, in our empirical analysis, we estimate separately the effect of news on stock returns that depends on the interest rate level and the effect that does not. In Graph A (right-hand panel), we report only the latter effect.