The anatomy of bond ETF arbitrage

Exchange-traded funds (ETFs) allow a wide range of investors to gain exposure to a variety of asset classes. They rely on authorised participants (APs) to perform arbitrage, ie align ETFs' share prices with the value of the underlying asset holdings. For bond ETFs, prominent albeit understudied features of the arbitrage mechanism are systematic differences between the baskets of bonds used to create and redeem ETF shares, and a low overlap between these baskets and actual asset holdings. These features could reflect the illiquid nature of bond trading, ETFs' portfolio management and APs' incentives. The decoupling of baskets from holdings weakens arbitrage forces but allows ETFs to absorb shocks on the bond market. 1

JEL classification: G11, G12, G23.

Key takeaways

- Bond exchange-traded funds (ETFs) have grown to manage more than $1.2 trillion of assets globally.

- The arbitrage mechanism, which keeps bond ETF prices aligned with the value of the underlying investments, operates differently from that of equity ETFs.

- This difference potentially makes it harder for investors to exploit price gaps but allows bond ETFs to absorb shocks and withstand market stress.

Exchange-traded funds (ETFs) are investment vehicles that allow retail and institutional investors to obtain exposure to a wide range of assets or asset strategies. To perform this function, ETF sponsors – typically, large asset managers – minimise tracking error, or the difference between the return on the ETF and that on its respective benchmark index. The first ETF was introduced in 1993 and tracked the performance of S&P 500. As of 2020, ETFs managed about $7 trillion of assets globally and invested in equity, bonds, commodities, currencies and volatility.

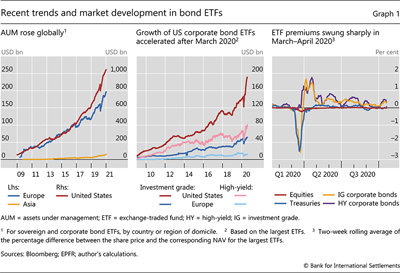

Recent trends and market developments call for a closer analysis of bond ETFs. First, bond ETFs have been growing steadily over the past few years and now manage more than $1.2 trillion of assets across the globe, compared with less than $10 billion in 2009. Second, the Federal Reserve's corporate bond purchase programme launched in 2020 involves interventions in the bond market through ETFs.2 Third, the difference between ETF share prices and the net asset value (NAV) of the underlying holdings (ie premium or discount) fluctuated more strongly for bond than for equity ETFs during March-April 2020. This highlighted that features specific to the bond market can have an impact on the pricing of bond ETFs.

In general, ETFs rely on an arbitrage mechanism to keep their share prices aligned with NAV. This mechanism relies on a special type of investors – usually, large market-makers and broker-dealers – collectively known as authorised participants (APs), which can create or redeem ETF shares. Whenever ETF prices rise above NAV, APs have an incentive to step in and exchange a subset of the asset holdings (a "creation" basket) for ETF shares. This helps close the arbitrage gap. Likewise, when ETF prices fall below NAV, APs exchange a "redemption" basket for ETF shares. In March and April 2020, however, bond ETF prices deviated strongly from their NAVs and the resulting gap was not arbitraged away by APs.

This article explains and analyses a crucial but understudied aspect of ETF arbitrage that distinguishes equity ETFs from bond ETFs: the nature of ETF baskets. Whereas for equity ETFs baskets are usually almost identical to holdings, for bond ETFs they are systematically different and include a small share of the bonds in the actual holdings, eg less than 3% for the largest bond ETF. For bond ETFs, baskets also change significantly from day to day and creation baskets tend to have longer duration and higher liquidity than redemption baskets.

Several factors are behind this contrast between equity and bond ETFs. First, the nature of the underlying assets is different. Compared with equities, bonds are generally less liquid and trade in a market with fewer potential buyers and sellers. In addition, bonds mature, whereas equities do not. Second, the minimum trading amount of bonds is much larger than that of equities, which constrains the feasible trades. Given these specificities of the bond market, ETF sponsors need flexibility as regards the composition of baskets. Sponsors choose strategically which bonds to include among the available ones, with an eye on continuously matching key characteristics of the benchmark index. Likewise, APs influence the composition of baskets and could use them to accommodate demand from their own clients rather than to close arbitrage gaps.

The flexibility inherent in baskets' composition may allow ETFs to withstand episodes of market stress. In the face of panic selling (runs), which generates redemption pressure, ETF sponsors could tilt redemption baskets towards riskier or less liquid securities. This would decrease prices of ETF shares since shares are exchanged for a lower-quality subset of ETF holdings. Meanwhile, non-running investors would be better off given that the average quality of the bonds in the ETF portfolio has improved. This mechanism could reduce incentives to redeem, thus nipping runs in the bud.

The remainder of this special feature is organised as follows. The first section describes recent trends in bond ETFs. The second analyses the ETF arbitrage mechanism, paying particular attention to key differences between bond and equity ETFs, and the incentives of ETF sponsors and APs. The third section reviews salient features of bond ETF baskets. The fourth considers the attendant implications for market functioning and financial stability.

Recent developments in bond ETFs

Assets under management (AUM) of bond ETFs have risen spectacularly over the past decade. They increased from less than $10 billion in 2009 to more than $1.2 trillion in 2020 (Graph 1, left-hand panel), compared with the $5 trillion of equity ETFs' AUM. Among bond ETFs, US funds are the largest, with more than $1 trillion of AUM, followed by European funds, which manage around $200 billion. Asian ETFs are much smaller in size and manage less than $15 billion.

ETFs invest in a variety of bond types, and those specialising in corporate bonds have grown strongly in the past decade. The AUM of US corporate bond ETFs increased more than 13 times over the past 10 years and reached $260 billion in 2020 (Graph 1, centre panel), or more than a quarter of the total size of all US bond ETFs. The increase accelerated most recently after the announcement of the Federal Reserve's bond ETF purchase programme in March 2020. The trends have been similar outside the United States. European corporate bond ETFs' AUM increased tenfold following the Great Financial Crisis of 2007–09, reaching $62 billion of AUM in 2020. In both the United States and Europe, the growth in investment grade (IG) bond ETFs exceeded that of high-yield (HY) ones.

Bond ETFs were not spared by the market turmoil during the Covid-19 crisis in March-April 2020. Within days, steep discounts of share prices relative to NAV transformed into large premiums (Graph 1, right-hand panel).3 This set them apart from other funds, such as equity ETFs. In addition, the tracking error of bond ETFs increased to above 200 basis points for some funds in March–April 2020, much higher than the historical average of 0.7 bp in the sector. These facts indicated impediments to the functioning of the arbitrage mechanism for bond ETFs.4

The concept of ETF arbitrage

The ETF ecosystem

For ETFs in general, a crucial aspect of the arbitrage mechanism is the interplay between primary and secondary markets for ETF shares. The primary market activity involves in-kind transfers between ETF sponsors and APs, which are the outcome of a negotiation between these two parties on the portfolio of assets that ETF shares are exchanged for.5 The secondary market activity takes place on an exchange, where all investors – including APs – trade ETF shares among each other (Ramaswamy (2011)). The trading volume in the secondary market dwarfs that of the primary market, as it includes 90% of the overall daily activity in ETF shares (ICI (2015)).

Each ETF sponsor signs special agreements with a set of APs that can then create or redeem shares. Usually, there are three to five active APs for each ETF. APs have the incentive to engage in creation-redemption activity whenever there is an arbitrage opportunity: a gap between the ETF price and the value of the underlying basket. However, given that APs are also usually major bond dealers, they could create or redeem ETF shares also in order to manage their own inventory (Pan and Zeng (2019)).

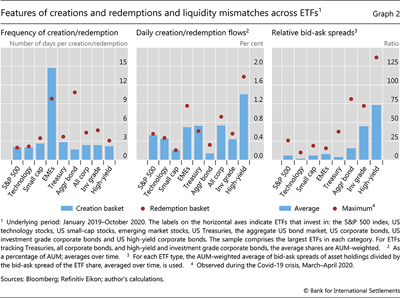

ETF creations or redemptions take place through baskets, ie sets of specific bonds or stocks6 that are exchanged with the ETF sponsor for shares. Such a set is published by the ETF sponsor at the end of each trading day for reference on the next day and is publicly known. APs of bond ETFs could also propose bonds that are not in the published basket but facilitate their role as dealers. The ETF sponsors make the ultimate decision whether to accept such proposals or not. Actual creations and redemptions happen once every two to four days on average (Graph 2, left-hand panel).7 The average size of creations and redemptions is typically small, ie below 1% of AUM for most ETFs (centre panel).

The ETF arbitrage mechanism

A key role of APs is to ensure that the ETF price (determined in the secondary market) is aligned with the NAV of ETF holdings (based on the prices of the underlying assets). While APs are not legally obliged to play this role, they have an incentive to do so, as eliminating deviations between ETF share prices and NAV generates profits.8 The following example illustrates the ETF arbitrage mechanism in its simplest form, as well as its relationship with tracking error.

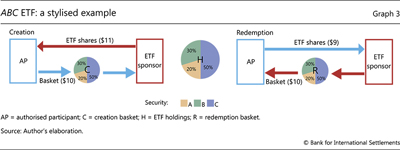

Suppose that a hypothetical ETF called ABC tracks a benchmark of three securities: A, B, and C worth $2, $3 and $5, respectively (Graph 3). The benchmark weights are: 20% (A), 30% (B) and 50% (C). The ETF has one unit of each security, implying that NAV is equal to: $10 = $2 + $3 + $5. Assume that the ETF is trading at a premium: concretely, the ETF share price is $11 > $10. This premium creates an arbitrage opportunity but also reflects a tracking error – the ETF return is higher than that on the benchmark index.

An AP profits from the arbitrage opportunity as follows. It buys a creation basket consisting of one unit of each security for $10 on the secondary market, creates one ETF share by transferring the basket to the ETF sponsor in the primary market (Graph 3, left-hand panel) and sells that share for $11 on the secondary market. This generates an arbitrage profit of $11 – $10 = $1.9 These transactions put downward pressure on the ETF price and upward pressure on the NAV. For future reference, suppose that closing the gap between the two requires the creation of 10 shares, ie a flow of $100. This flow would also eliminate the tracking error since, in the current stylised example, the creation basket is identical to ETF holdings.

The implications would be symmetric, if the ETF was trading at a discount at $9 < $10. In this case, the AP would buy one ETF share, redeem it for the basket of securities worth $10 in total (Graph 3, right-hand panel) and make a profit of $10 – $9 = $1. This would eliminate the discount by putting upward pressure on the ETF price and downward pressure on NAV.

Further reading

ETF arbitrage can also be performed without transacting in the primary market. Investors such as hedge funds and high-frequency traders could exploit ETF mispricing by trading ETF shares and underlying assets in the secondary market. These investors can simply sell the expensive asset (an ETF share or a set of the underlying assets), buy the cheap one, and wait for the two prices to converge as the ETF premium becomes zero. Importantly, this type of activity is profitable only if the arbitrage mechanism works smoothly in the primary market and eliminates ETF premiums or discounts over the investment horizon of secondary-market investors.

Unique aspects of bond ETF arbitrage

While the above discussion captures well the nature of the arbitrage mechanism in the case of equity ETFs, it misses key features of bond ETFs. These features stem from the specifics of the underlying assets. First, bond ETFs need to transact in a less liquid and more concentrated market, with fewer potential buyers and sellers than in the equity market. Second, the minimum trading size of bonds is much larger than that of equities. Third, bonds have a finite maturity, whereas equities do not.

The illiquid nature of the asset class implies that, compared with equity ETFs, there is a more severe liquidity mismatch between the assets and liabilities (shares) of bond ETFs. The bid-ask spreads of the asset holdings of bond ETFs are 17 times greater than those of ETF shares. The corresponding number for equity ETFs is five (Graph 2, right-hand panel). To a large extent, bonds are illiquid because they usually trade over the counter (OTC) in a dealer-intermediated market, where not all desired securities are readily available (Hendershott and Madhavan (2015), CGFS (2014), CGFS (2016)). This is not an issue for equities, as they are predominantly traded on exchanges, which are open directly to a wide range of investors.

Moreover, the liquidity mismatch differs across market segments and can change materially over time. For instance, this mismatch is particularly pronounced for high-yield corporate bonds, with the measure of relative illiquidity equal to 75 on average. This measure reached 130 during the Covid-19 crisis (Graph 2, red dot).

The minimum trading amount of bonds is several orders of magnitude larger than that of equities. Typically, bonds trade in minimum amounts above $100,000. By contrast, for equities, these amounts can be as small as a fraction of a share, ie less than $5. Thus, bond ETF sponsors would need a much larger basket size than equity ETF sponsors in order to transact in the same number of instruments.10

Lastly, bonds' finite maturity also necessitates portfolio rebalancing. In practice, most bond ETFs have a target maturity defined by their benchmark index.11 Thus, bonds falling below the target maturity need to be replaced by bonds with longer maturity. Such rebalancing is irrelevant for equity ETFs.

Stylised example, revisited

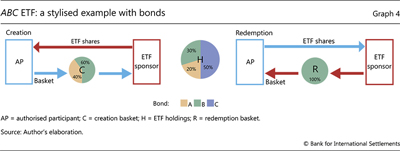

These three specificities of the bond market call for modifications to the above stylised example of the ABC ETF when A, B and C stand for bonds. First, in line with the illiquidity of the market, let bond A be hard to locate. Second, to capture the large minimum trade size, let A, B and C be traded in 20 units or more. Third, to incorporate maturity considerations, assume that bond B is maturing soon.

These modifications weaken the arbitrage mechanism for the ABC ETF. The first modification implies that the ETF may choose to exclude bond A from the creation basket. The second modification means that, even though an inflow of $100 is needed to close the price gap (see above), such an inflow does not allow the ETF to buy all the underlying bonds. One feasible option is to buy 20 units of bond A, 20 units of bond B and none of bond C ($100 = 20 * 2 + 20 * 3; Graph 4, left-hand panel). The third modification suggests that the ETF could overweight bond B in a redemption basket in anticipation of its imminent maturity (right-hand panel). In each case, the difference between baskets and the underlying holdings prevents APs from putting adequate buying or selling pressure on bonds A, B and C. This weakens APs' capacity to close the ETF premium or discount.12

Incentives of ETFs and APs

The specifics of the bond market shape ETF sponsors' and APs' incentives in a way that also contributes to the unique aspects of bond ETF arbitrage.

ETF sponsors' portfolio optimisation and their incentives to maintain a long-term relationship with APs can lead to differences between baskets and holdings and to changes in baskets over time. Sponsors would adapt the composition of baskets based on the availability of bonds and would choose a subset of bonds that minimises tracking error. In turn, when an AP cannot deliver a bond, such as A in the above example,13 it could propose some similar new bond D that is easier to locate for the transaction and could even allow the AP to absorb a supply shock from its clients. While this bond is not part of the ETF holdings, a sponsor might accept the proposal if the new bond keeps the tracking error in check and helps maintain the relationship with the AP, whose market-making function provides valuable services to the sponsor. As the availability of bonds changes over time, similar transactions will translate into changes of ETF baskets.

ETF sponsors could use creations and redemptions to adjust their holdings according to certain liquidity or rating targets. These would be in addition to the maturity target affecting bond B in the ABC ETF example. For a sponsor, it is often more cost-effective to attain all these targets by transacting with APs on the primary market than by trading on the more illiquid bond market.

The actions of APs in their role as bond dealers can drive a wedge between creation and redemption baskets. APs could accommodate extraordinary supply of bonds from their bond clients by creating an ETF share. Symmetrically, they could accommodate demand by redeeming a share. In either case, APs' creations and redemptions do not target to reduce the size of an ETF premium or discount.

Empirical evidence

The three specificities of the bond market illustrated in the stylised example, combined with ETFs' and APs' incentives, translate into three aspects of the arbitrage process that are unique to bond ETFs. First, creation and redemption baskets would differ from actual holdings. Second, as the relative liquidity and availability of various bonds change over time, so will the composition of baskets. Third, creation baskets would differ from redemption baskets in terms of liquidity and maturity. The three unique aspects of the arbitrage process of bond ETFs surface clearly in the data.

Baskets versus actual holdings for bond ETFs

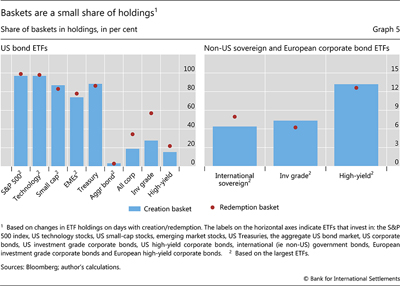

Creation/redemption baskets differ materially from holdings for bond ETFs but not for equity ETFs. This is illustrated by an alignment measure equal to the number of securities common to a basket and holdings, expressed as a share of the holdings.14 For the largest equity ETFs, the alignment is almost 100% (Graph 5, left-hand panel). By contrast, bond ETFs' baskets are less aligned with holdings. For the largest bond ETF, which tracks the aggregate bond market, baskets represent on average only 3% of holdings.

There is also a significant heterogeneity across bond market segments, reflecting the liquidity of the underlying assets. For US Treasuries, baskets are well aligned with holdings, similarly to equity ETFs. For US corporate bonds, creation baskets only cover about 20% of holdings, and redemption baskets 35%. The alignment is even smaller for bond ETFs that invest in non-US securities (Graph 5, right-hand panel). Both in the United States and in Europe, baskets of investment grade corporate bond ETFs are more aligned with holdings than those of high-yield ETFs.

The variability of bond ETF baskets

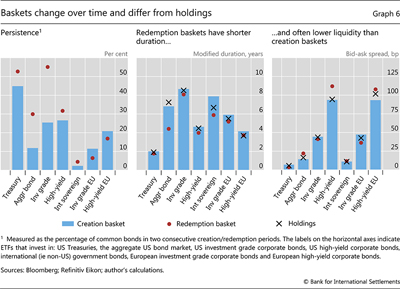

The composition of bond ETF baskets changes frequently over time. The persistence of creation baskets – that is, the fraction of bonds that are in a basket in two consecutive periods – is 45% for ETFs that track Treasuries but only 12% for the largest bond ETF (Graph 6, left-hand panel). Baskets of European bond ETFs and international bond ETFs are even less persistent than those of US ETFs.

Creation baskets change more often than redemption baskets for most ETFs. This is particularly pronounced for ETFs tracking investment grade bonds and the aggregate bond market: these ETFs' creation baskets are more than twice less persistent than redemption baskets. The composition of creation baskets often depends on the availability of bonds in the underlying market, which can vary substantially. In contrast, redemption baskets always draw on bonds that are already part of ETF holdings and are thus less dependent on broad market conditions.

Redemption baskets are different from creation baskets

In line with ETFs' portfolio management, bonds in the redemption baskets tend to have shorter duration and slightly lower liquidity than holdings and creation baskets (Graph 6, centre and right-hand panels). In terms of duration, the differences are most pronounced for ETFs investing in the aggregate bond index and non-US sovereign debt. Liquidity differences – as measured by the average bid-ask spread – are largest for ETFs investing in the least liquid instruments: high-yield bonds.

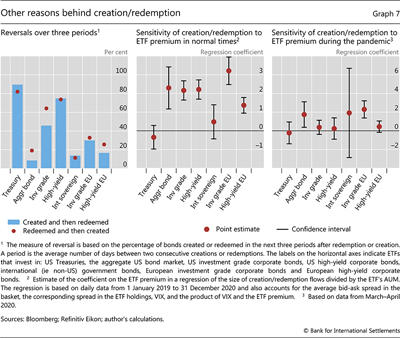

There is evidence of additional drivers of baskets' composition. If ETFs' portfolio management was the sole driver of the composition of baskets, then redeeming a bond from the pool of holdings would tend to be irreversible, not least because bond maturity always declines.15 The data reveal, however, that bonds often re-enter the pool of holdings shortly after their redemption (Graph 7, left-hand panel). Likewise, if closing arbitrage gaps was the main driving force of APs' actions, then creation and redemption activity would be consistently sensitive to the size of such gaps. This is the case for only some asset classes in normal times (centre panel) and even fewer asset classes in times of market stress (right-hand panel). This fact indicates the important role of APs' arbitrage-independent incentives.

Implications for market functioning and financial stability

The salient features of bond ETFs' creation and redemption baskets have implications for market functioning. While these features may weaken arbitrage forces, they also enhance the shock-absorbing capacity of ETFs and can help stabilise markets.

Arbitrage versus prevention of runs

Features of bond ETF baskets may weaken arbitrage forces not only directly (as discussed earlier) but also indirectly, by influencing the risk borne by APs and other traders. Until the negotiation with ETF sponsors is complete, APs are uncertain about the basket of bonds that they would be able to exchange for an ETF share. They are also unsure how this basket would compare with the one underpinning transactions on the following day. Likewise, investors performing an arbitrage on the secondary market (eg hedge funds) are uncertain about how the composition of the basket behind an ETF share would change between their entry into and exit from a trade. As this uncertainty reduces the risk-adjusted profits that could be extracted from a premium or discount, it weakens arbitrage forces.

That said, the uncertainty's flip side is flexibility for ETF sponsors to absorb shocks. By selecting the composition of baskets, ETF sponsors could discourage runs by influencing the desirability of redemptions (Shim and Todorov (2021b)). If there is excessive selling of ETF shares in the secondary market, which puts redemption pressure on APs, the ETF sponsor can include only the riskier or less liquid securities from the pool of holdings in the redemption basket. The lower-quality bonds that APs obtain after redeeming ETF shares would in turn reassure non-running investors that their shares are now backed with holdings of higher average quality. This would discourage further runs and lead to ETF discounts during run episodes. In fact, such a stabilisation mechanism was arguably in place during the March–April 2020 episode (Graph 1, right-hand panel) when some ETFs traded at a discount while redeeming baskets that were more illiquid than the holdings.

Such a strategy can backfire in the long run, however, as it can hurt ETFs' reputation. If investors perceive an ETF as redeeming only low-quality bonds in stress times, they may withdraw from the ETF altogether. This, in turn, could lead to lower inflows to the ETF and, as a result, decrease ETF profits from management fees, which are based on the size of AUM.

Basket flexibility and bond market liquidity

The flexible composition of baskets allows for a more efficient primary market activity and may improve the liquidity of the bond market. Since baskets can differ across APs even on the same day, a large number of diverse APs – with different bond inventories and different client relationships – can participate in creating or redeeming ETF shares. Thus, even when there is a shortage of a particular bond for creation, the bond is still likely to be sourced from the inventory of one of the participating APs. And if the bond is impossible to find, it could be excluded from the basket altogether. Similarly, when there is demand from APs' clients for a particular bond, APs can add that bond to their inventory by redeeming shares. In effect, APs can use the creation/redemption mechanism to enhance their market-making activities (Shim and Todorov (2021a)).

Conclusion

This special feature reveals three novel facts about the arbitrage mechanism for bond ETFs. First, creation/redemption baskets are only a small subset of bond ETF holdings and have different characteristics than these holdings. Second, baskets' composition varies over time. Third, there are systematic differences between creation and redemption baskets in terms of the maturity and liquidity of the constituent bonds. These findings stem from the specifics of the bond market, ETFs' portfolio management and APs' own incentives. The differences between baskets and holdings could impact ETF premium and tracking error in stress times, but does not prevent ETF sponsors from tracking closely their benchmarks during normal times.

The decoupling of baskets from holdings can also be a shock absorber during volatile times. The partial convertibility that stems from the decoupling means that ETFs could be a stabilising force during runs and prevent fire sales. This mechanism is possible because of the predominantly in-kind nature of ETF redemptions, whereby shares are exchanged for securities. It is not available to other investment vehicles with cash redemptions such as mutual funds.

References

Aramonte, S and F Avalos (2020): "The recent distress in corporate bond markets: cues from ETFs", BIS Bulletin, no 6, April.

BlackRock (2020): "Lessons from COVID-19: ETFs as a source of stability", ViewPoints.

Committee on the Global Financial System (CGFS) (2014): "Market-making and proprietary trading: industry trends, drivers and policy implications", CGFS Papers, no 52, November.

----- (2016): "Fixed income market liquidity", CGFS Papers, no 55, January.

Haddad, V, A Moreira and T Muir (2020): "When selling becomes viral: disruptions in debt markets in the COVID-19 crisis and the Fed's response", NBER Working Papers, no 27168.

Hendershott, T and A Madhavan (2015): "Click or call? Auction versus search in the over-the-counter market", Journal of Finance, vol 70.

Investment Company Institute (ICI) (2015): "The role and activities of authorized participants of exchange-traded funds", ICI Publications, March.

Laipply, S and A Madhavan (2020): "Pricing and liquidity of fixed-income ETFs in the COVID-19 virus crisis of 2020", Journal of Index Investing, Winter.

Pan, K and Y Zeng (2019): "ETF arbitrage under liquidity mismatch", working paper, Goldman Sachs and University of Washington.

Ramaswamy, S (2011): "Market structures and systemic risks of exchange-traded funds", BIS Working Papers, no 343, April.

Securities and Exchange Commission, Division of Economic and Risk Analysis (SEC) (2020): US credit markets: interconnectedness and the effects of the COVID-19 economic shock, October.

Shim, J and K Todorov (2021a): "Bond ETFs are different: evidence from baskets", working paper, University of Notre Dame and BIS.

Shim, J and K Todorov (2021b): "Runs on ETFs", working paper, University of Notre Dame and BIS.

Todorov, K (2019): "Passive funds actively affect prices: evidence from the largest ETF markets", working paper, BIS.

1 The author thanks Claudio Borio, Stijn Claessens, Andreas Schrimpf, Hyun Song Shin, Vladyslav Sushko and Nikola Tarashev for valuable comments, and Cornelius Nicolay for excellent research assistance. The views expressed are those of the author and do not necessarily reflect those of the BIS.

2 The Secondary Market Corporate Credit Facility (SMCCF) was announced by the Federal Reserve on 23 March 2020 and was expanded on 9 April 2020 to include high-yield bond ETFs.

3 The extraordinary dysfunction of the market for US Treasuries resulted in deep discounts for ETFs investing in these securities. These discounts subsided with the Federal Reserve's intervention on 23 March (Haddad et al (2020)).

4 In March–April 2020, ETF prices may have incorporated information in a timelier manner than NAV (SEC (2020), BlackRock (2020), Avalos and Aramonte (2020)). Using intraday NAV calculations could give better estimates of the true ETF premium (Laipply and Madhavan (2020)) since NAV calculations can at times be based on stale quotes.

5 Admittedly, for some ETFs, primary market creations and redemptions are in-cash and baskets are not negotiated. However, in-kind transfers and customised baskets are key characteristics of bond ETFs, which are the main object of analysis in this feature.

6 Sometimes, also cash.

7 Each transaction is usually done in units of 50,000 shares and incurs a small fee: typically, $250–1,000, or less than 1 basis point of the creation/redemption size.

8 ETF arbitrage can also be performed by other investors. For instance, APs can rent out their creation/redemption facilities to hedge funds (Laipply and Madhavan (2020)). These agents create/redeem ETF shares by submitting orders to APs to act on their behalf.

9 In reality, APs often first short-sell the ETF share in the secondary market and then deliver the newly created share to cover that short position in the event of creations. In the case of redemptions, APs would first short-sell the basket and then deliver the redeemed assets to cover the short position.

10 Often bond ETF benchmarks constitute hundreds or thousands of bonds. The average size of creation/redemption for the largest 300 US ETFs is approximately $20 million.

11 This is similar to calendar rebalancing for commodity ETFs in Todorov (2019). Such rebalancing arises because the funds target a specific future's maturity and replace expiring short-term futures contracts with longer-term ones over time.

12 The ETF premium calculated using NAV of the basket is often less severe compared with the usually measured ETF premium based on NAV of holdings (Shim and Todorov (2021a)).

13 APs usually do not hold the full set of bonds in ETF baskets in their inventory.

14 Redemption baskets will be mechanically more aligned with holdings because ETFs can only redeem assets that are already in the holdings.

15 Bond ratings, another criterion for portfolio management, are extremely persistent and rarely exhibit reversals over a few days.