The financial vulnerabilities driving firms to the exit

This special feature investigates the influence of financial vulnerabilities on the likelihood that firms will exit the market. We fill a gap in the literature by analysing comprehensive data on firm exits together with data on the financial accounts of firms, both aggregated at the sector level. We find that high short-term debt and low earnings relative to interest expenses are the two most significant financial predictors of firm exits. Moreover, there is a two-year lag from a rise in vulnerabilities to the peak in exits. We also find evidence that sector-level vulnerabilities magnify the likelihood that weaker sales or tighter lending conditions tip firms over the brink. The unprecedented Covid-19 shock notwithstanding, our analysis suggests that while exits may remain contained in the near term, pressures to exit are likely to build up over time.1

JEL classification: D22, E32, G32, G33.

The Covid-19 shock threatens the survival of many firms (Banerjee et al (2020b), Gourinchas et al (2020) and OECD (2020)). Whether firms will be able to maintain their operations or be forced to exit the market depends on many factors. Clearly, the length and depth of the shock are crucial. So too is the degree of policy support. Yet, unless policy support fully neutralises the shock, financial vulnerabilities could be the factor that determines which firms survive and which exit the market.

But which financial vulnerabilities are most relevant in pushing firms towards the exit? Surprisingly few studies look into the relationship between financial factors and economy-wide firm exits. A key limitation is data. Comprehensive data on firm exits do not typically include information on financial vulnerabilities. Conversely, analyses of firm vulnerabilities often focus on continuing firms; when they do consider exits, they cover only large publicly listed entities. Thus, the results of these analyses may be a poor guide for small- and medium-sized enterprises that constitute the majority of firms in the economy.

To study how financial vulnerabilities affect firm exits, we take a new approach by combining census data sets for seven European economies between 2008 and 2016. In particular, we merge sectoral data on gross entry and exits for the entire population of firms with harmonised company account data that provide key financial ratios evaluated at the median of each sector. In addition, we also include sales data at the sector level and lending standards at the country level to control for the business cycle as well as lending conditions. While the data do not cover the Covid-19 crisis, our broad findings are informative about the types of financial vulnerability that could determine firm exits in current conditions.

Key takeaways

- High short-term debt and low earnings relative to interest expenses are the two most significant financial predictors of firms exiting the market.

- There is a lag between rising financial vulnerabilities and exits, with the peak effect materialising after two years.

- Financially vulnerable firms are more likely to exit the market when financial conditions are tight or economic activity is weak.

Our empirical analysis produces three main findings:

First, financial vulnerabilities related to debt service have the strongest influence on firm exits. In particular, high short-term debt and low cash flow relative to interest payments are key drivers. By contrast, cash and holdings of liquid assets do not appear to provide much protection. Arguably, they may mitigate liquidity risks, but may be of little help in addressing solvency problems.

Second, the relationship between debt servicing vulnerabilities and firm exits is tighter during a period of relative calm than during the Great Financial Crisis (GFC) and the European sovereign debt crisis. The finding could reflect lags between the build-up of financial vulnerabilities during stressed periods and the realisation of firm exits once the stress has dissipated. Indeed, we find that it takes about two years before the full impact of higher financial vulnerabilities on exits is felt. Alternatively, loan evergreening by banks or very large aggregate shocks overwhelming even financially resilient firms would also be consistent with financial vulnerabilities being less of a driving factor in firm exits from 2008 to 2012.

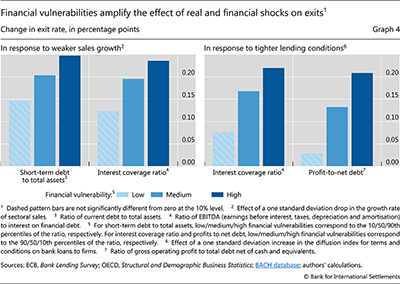

Finally, financial vulnerabilities amplify the effect of weak activity and tight lending conditions on firm exits. Conversely, when financial vulnerabilities are low, this effect is negligible.

Despite the unprecedented Covid-19 shock, our analysis suggests that exits may remain contained in the short run, as pressure on firms may take time to build up. This is likely to be particularly true in the light of the unprecedented policy support in response to the pandemic, including highly accommodative monetary policy, public guarantees on loans, fiscal measures to bolster firms' cash flows, and moratoriums on certain credit obligations. Moreover, for the euro area economies in our study, financial vulnerabilities were lower at the onset of the Covid-19 recession compared with those before the GFC. Yet, to the extent that firms have borrowed to bridge the severe downturn, they may have become more vulnerable to future shocks, especially if they have built up high short-term debt and face low cash flows relative to interest expenses.

The remainder of this special feature is organised as follows. The first section documents trends in firm exits and financial vulnerabilities. The second compares how far different financial vulnerability metrics, on their own, help predict exit. The third analyses the time pattern of the impact of those vulnerabilities and how their relevance varies across sectors. The fourth evaluates how financial vulnerabilities interact with sales and lending conditions. Finally, we conclude with some broad implications for the current crisis.

Financial vulnerabilities and firm exits

Which financial vulnerabilities drive firms to exit the market? What matters more: is it overall indebtedness as a measure of insolvency risk, or is it short-term debt servicing needs, given that illiquidity can easily morph into solvency problems? Are liquid assets and cash balances sufficient to save an ailing firm? If not, does weak cash flow more clearly indicate difficulties in servicing debts and pressures to exit? The answers to these questions are critical if we are to identify the firms most at risk of failure in the Covid-19 crisis.

A vibrant literature studies the influence of financial vulnerabilities on firm defaults, following the seminal work of Altman (1968). But these analyses focus on the exit of large publicly listed firms. A literature examining firm exit (and entry) and its influence on firm productivity (eg Foster et al (2001)) is also well established. However, the business census data used in such studies do not include information from firm financial statements.2 In addition, a new and growing literature links financial vulnerabilities to firm performance, including those of small firms (eg Duval et al (2020)). Unfortunately, these sources, although rich with financial information, record firm entry and exits only poorly. Thus, surprisingly few studies examine the relationship between financial factors and firm exits using comprehensive data that avoid biases in coverage. As such, policymakers have been left with little guidance on navigating the Covid-19 fallout on firm exits across the entire economy.3

A consequence of these limitations is that studies seeking to estimate the impact of Covid-19 on firm exits have had to rely on somewhat ad hoc assumptions about the key underlying drivers. For example, Banerjee et al (2020b) and Gourinchas et al (2020) simulate the impact of Covid-19 by assuming that it is the firms unable to cover short-term debt with cash holdings and cash flow which have to exit. By contrast, our analysis identifies empirically the factors that have triggered firm exits, thereby shedding light on the validity of these ad hoc assumptions.

Trends in exit rates and financial vulnerabilities

Firms exit when they permanently shutter their operations. The exit can be voluntary if an enterprise pays off all remaining liabilities at closure, or involuntarily if the firm is liquidated after failing to meet its liabilities.4

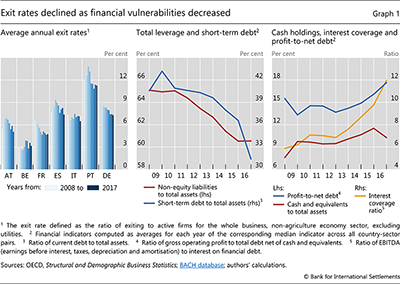

Looking at the data, we observe large differences in firm exit rates across the seven euro area economies in our sample, which covers the period 2008-16. In Portugal, the average annual exit rate stands at around 12% per year, while in Belgium it is as low as 3% (Graph 1, left-hand panel). The data also show that exits peaked around the European sovereign debt crisis in Austria, Italy, Spain and Portugal. By contrast in France and Germany, the average exit rate has fallen continuously since the GFC. As one would expect, exits rise in downturns and decline as economic conditions improve.

Firms' financial vulnerabilities are a natural driver of exits. These include insolvency cases, when firms' debts exceed their assets, as well as cases of illiquidity when debt servicing difficulties force firms into bankruptcy. In our sample, firms' financial vulnerabilities rather eased in the aggregate, particularly after 2013. Leverage, measured by the median non-equity liabilities-to-total asset ratio, declined by about 5 percentage points, from 65 to 60% between 2008 and 2016 (Graph 1, centre panel, red line). Similarly, the median ratio of short-term debt (ie debt maturing within one year) to total assets declined from around 40% to just above 30% over the same period (blue line). On the asset side, the median ratio of cash to total assets increased by around 2 percentage points between 2008 and 2016 (right-hand panel, red line). Over the same period, the median interest coverage ratio (ICR) - measured by the ratio of earnings before interest taxes and depreciation (EBITDA) to interest expenses - doubled as euro area economic activity recovered without a concomitant rise in interest rates (yellow line). Funding costs declined over this period for many firms. Last, consistent with the drop in leverage and the increase in the ICR, the median ratio of profits to net debt improved after 2013 (blue line), the order of magnitude being approximately the same as the increase in cash holdings.

Box A

A new data set to uncover the financial determinants of firm exits

To overcome the data limitations in existing studies described in this article, we take a sector-level approach. We merge three data sets at the sector level. The first, the OECD's Structural and Demographic Business Statistics database, provides annual information on firm entries and exits at the sector level based on business census data. Thus, it avoids bias in coverage, for example towards large firms. In these data, firm exit is defined as the dissolution of a combination of production factors with the restriction that no other enterprises are involved in the event. Mergers, takeovers, breakups or restructuring of a set of enterprises are not classified as exits. Neither are changes in activity nor firms that restart activity within two calendar years. Under this definition, it is important to highlight that exits may be voluntary, ie the enterprise paid off all remaining liabilities at closure, or involuntary, ie the firm was liquidated after failing to meet its liabilities eg in a bankruptcy.

The second data set is the Bank for the Accounts of Companies Harmonised (BACH) database from the European Committee of Central Balance Sheet Data Offices (ECCBSO). This database provides harmonised balance sheets and income statement information aggregated at the sector level. Importantly, this data set provides median financial ratios in each sector. In contrast to using the mean, the median helps to prevent unrepresentative balance sheets, such as those of large firms, from distorting the sector-level measures of financial vulnerabilities. Third, we use the OECD Structural Analysis database of sectoral activity, which provides sector-level information on sales. We use this to control for the business cycle, which has been shown to have a strong influence on firm exits. Finally, we merge these three sector-level data sets with data from the ECB Bank Lending Survey to control for country-level lending conditions.

In contrast to using the mean, the median helps to prevent unrepresentative balance sheets, such as those of large firms, from distorting the sector-level measures of financial vulnerabilities. Third, we use the OECD Structural Analysis database of sectoral activity, which provides sector-level information on sales. We use this to control for the business cycle, which has been shown to have a strong influence on firm exits. Finally, we merge these three sector-level data sets with data from the ECB Bank Lending Survey to control for country-level lending conditions.

Sector-level data come with advantages and drawbacks. The census equivalent coverage of our data set is representative of all business activity within each sector and across the whole economy. However, the sectoral nature of the data comes at the cost of losing within-sector granularity. After merging the three underlying data sources, our data set covers seven euro area economies (Austria, Belgium, France, Germany, Italy, Portugal and Spain) and 34 underlying sectors from 2008 to 2016. On average, each economy has around 270 sector-year observations.

To compute the median level of each financial indicator, firm-level observations are first sorted in ascending order. The middle value that cuts the data in half is the value for the median financial indicator. Thus, the median firm can differ across indicators. In addition, the BACH database provides other quantiles of financial ratios for each sector (in addition to weighted averages). Empirically, results using other quantiles are quantitatively similar.

To compute the median level of each financial indicator, firm-level observations are first sorted in ascending order. The middle value that cuts the data in half is the value for the median financial indicator. Thus, the median firm can differ across indicators. In addition, the BACH database provides other quantiles of financial ratios for each sector (in addition to weighted averages). Empirically, results using other quantiles are quantitatively similar.

The financial drivers of firm exits

Turning now to our empirical analysis, we investigate the financial determinants of firm exits, covering both voluntary and involuntary ones at the sector level. Following the existing literature, we link exits to three types of financial indicator. First, stock variables pertaining to the liability side of firms' balance sheets, eg total leverage or short-term debt. Second, stock variables from the asset side of the balance sheet, eg liquid assets and cash and equivalents. Last, we consider indicators of firms' cash flow vulnerability, eg the ICR or the ratio of profits to net debt.5

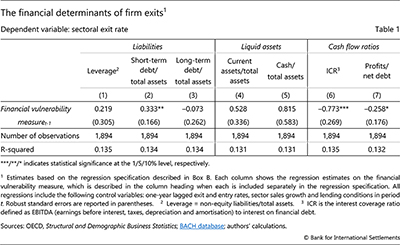

Our empirical evidence indicates that the two most significant financial predictors of sectoral firm exit rates are high levels of short-term debt and low earnings relative to interest expenses. Firms are more likely to exit when the median leverage ratio in the sector goes up (Table 1, first column).6 However, this result is largely driven by firms' short-term debt. Once we split a firm's liabilities into those falling due within one year (second column), and longer-term debt (third column), only the coefficient on short-term debt is significant in predicting higher firm exits within the next year. This suggests that difficulty in rolling over short-term debt is a crucial factor pushing firms towards an exit.

Further reading

Somewhat surprisingly, liquid assets do not appear to offer firms much protection from an exit. The insignificant (and positive) coefficients in the fourth and fifth columns of Table 1 indicate that neither high levels of current assets7 nor high levels of cash holdings significantly affect the probability of an exit.

Several factors could account for this, at first sight, surprising result. For one, cash buffers may only determine how - and not necessarily if - a firm exits. For example, Balcaen et al (2012) find that firms with high cash buffers are more likely to exit voluntarily, while those with limited buffers tend to exit involuntarily through bankruptcies. A firm's decision to hold cash could also be driven by the riskiness of the firm. Hence, firms in riskier sectors could hold more cash and have a higher risk of exiting. Indeed, Opler et al (1999) show that firms with riskier cash flows tend to hold larger cash buffers as self-insurance. Our finding suggests that such precautionary cash buffers may be insufficient to fully offset higher exit risk. Indeed, Acharya et al (2012) document that, among large firms, those with higher cash holdings have higher bond spreads, also supporting the notion that cash holdings and risk are positively correlated. The limited impact could also reflect the fact that cash and liquid assets are held to hedge liquidity risks, but may be insufficient to address solvency problems. Finally, cash balances funded through credit lines and overdrafts do not improve a firm's net liquidity position.

By contrast, the fragility of cash flows plays a significant role in shaping firm exits. The ICR features strongly in credit rating models, which predict defaults in listed firms (eg Damodaran (2020)). Indeed, weaker ICRs are significantly correlated with higher firm exits in the following year (Table 1, sixth column). Over long horizons, profits relative to debt can also be viewed as an indicator of firm solvency.8 Indeed, firms are more likely to exit when profits are low relative to net debt. That said, this effect is only marginally significant (seventh column).9

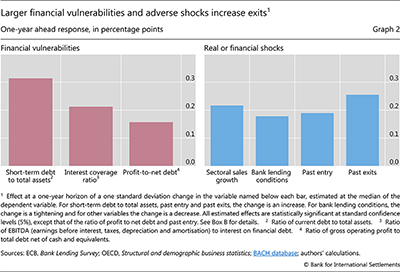

Shifting from statistical to economic significance, the short-term debt ratio has the greatest economic significance among our financial vulnerability metrics, followed by the ICR (Graph 2, left-hand panel). In particular, a one standard deviation10 increase in the short-term debt ratio is associated with a 0.3 percentage point increase in the exit probability, amounting to a 4% increase over the mean exit rate. Somewhat smaller is the impact of a one standard deviation drop in the ICR, which is associated with a 0.2 percentage point increase in the exit rate. An equivalent drop in profits relative to net debt is associated with a 0.15 percent increase in the exit probability.11

Box B

Assessing the financial determinants of firm exits

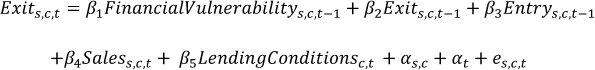

To assess the financial determinants of exits, we estimate the following empirical specification:

The dependent variable Exits,c,t is the exit rate defined as the ratio of exiting to active firms in sector s in country c in year t. The first set of explanatory variables, FinancialVulnerabilitys,c,t-1, are measures of financial vulnerabilities for the median firm directly computed in the European Committee of Central Balance Sheet Data Offices (ECCBSO) Bank for the Accounts of Companies Harmonised (BACH) database: firm liabilities (leverage and short-term debt to assets), liquid assets (liquid asset holdings to assets and cash to assets) and cash flow (EBITDA to interest expenses and profits-to-net debt), considering each time the median value of each indicator in sector s in year t-1.

The first set of explanatory variables, FinancialVulnerabilitys,c,t-1, are measures of financial vulnerabilities for the median firm directly computed in the European Committee of Central Balance Sheet Data Offices (ECCBSO) Bank for the Accounts of Companies Harmonised (BACH) database: firm liabilities (leverage and short-term debt to assets), liquid assets (liquid asset holdings to assets and cash to assets) and cash flow (EBITDA to interest expenses and profits-to-net debt), considering each time the median value of each indicator in sector s in year t-1. Our selection of financial vulnerability metrics is limited to those computed in the BACH database, which includes some of the most commonly used metrics of firm financial vulnerabilities found in other studies.

Our selection of financial vulnerability metrics is limited to those computed in the BACH database, which includes some of the most commonly used metrics of firm financial vulnerabilities found in other studies.

The additional regressors are as follows. We include the lagged dependent variable Exits,c,t-1 and the entry rate Entrys,c,t-1, defined as the ratio of new entrants to active firms. The lagged dependent variable captures the staggered nature of exits, while the lagged entry variable captures creative destruction or churn, by which new entrants tend to displace some of the existing firms. The variable Saless,c,t measures the growth rate of sales at the sector level to capture business cycle and sectoral demand fluctuations. We also include a measure of bank lending conditions at the country level LendingConditionsc,t, ie the change in the terms and conditions that banks apply on loans to firms. These data are taken from the ECB Bank Lending Survey. All our regressions include sector-country fixed effects αs,c, and time fixed effects αt.

We also include a measure of bank lending conditions at the country level LendingConditionsc,t, ie the change in the terms and conditions that banks apply on loans to firms. These data are taken from the ECB Bank Lending Survey. All our regressions include sector-country fixed effects αs,c, and time fixed effects αt.

We examine four extensions to our baseline model. In the first, we estimate a local projection version of our baseline model by changing our dependent variable to Exits,c,t+h, where h=0,1,2,3 years as it may take several years before the full impact of financial vulnerabilities on firm exits is revealed. In the second extension, we interact our financial vulnerability measures with a time dummy variable that takes the value of one from 2013 onwards to measure if there has been a change in the sensitivity of exits over time. In the third, we allow financial vulnerabilities to have heterogeneous effects across sectors. In the fourth, we include interaction terms between our financial vulnerability metrics, on the one hand, and sector sales and aggregate lending conditions, on the other. This allows us to test whether depressed sales in a given sector or tighter lending conditions in the economy raise firm exits more strongly when firms' financial vulnerabilities are larger.

As exit and entry rates are bounded between 0 and 1, we use a logistic transformation for these variables, ie log(y/1-y) where y is the exit or the entry rate.

As exit and entry rates are bounded between 0 and 1, we use a logistic transformation for these variables, ie log(y/1-y) where y is the exit or the entry rate.  The BACH database provides the mean, median and the quartiles of financial ratios of firms for each sector, country-year triple. We use the median ratio, as opposed to the mean, to reduce the influence of outliers or of a specific group of firms. Our results are robust to using the quartiles of the distribution.

The BACH database provides the mean, median and the quartiles of financial ratios of firms for each sector, country-year triple. We use the median ratio, as opposed to the mean, to reduce the influence of outliers or of a specific group of firms. Our results are robust to using the quartiles of the distribution.  This specification implicitly assumes that changes to sales growth affect firm exits. However, the opposite could also be true because higher firm exits could also reduce production and hence sales growth. As a robustness test, in alternative regressions not reported we instead use aggregate sales growth instead of sectoral sales growth, which is less likely to suffer from this reverse causality. The results are very similar, both qualitatively and quantitatively, to those presented here.

This specification implicitly assumes that changes to sales growth affect firm exits. However, the opposite could also be true because higher firm exits could also reduce production and hence sales growth. As a robustness test, in alternative regressions not reported we instead use aggregate sales growth instead of sectoral sales growth, which is less likely to suffer from this reverse causality. The results are very similar, both qualitatively and quantitatively, to those presented here.

Two findings related to other drivers of exits are also worth noting. First, our estimation results confirm the important impact of the business cycle and lending conditions on firm exits documented in previous studies (eg Dunne et al (1988)). Notably, declines in sectoral sales or tightening lending conditions at the country level are associated with higher exit probabilities (Graph 2, right-hand panel). Second, an increase in firm entry raises firm exits. This is suggestive of a creative destruction or churn channel whereby new entrants compete with incumbent firms, potentially driving out the most inefficient. Finally, we find that exit dynamics are persistent.

Financial vulnerabilities, persistence and sectoral differences in exits

It could arguably take several years before the full impact of financial vulnerabilities on firm exits is revealed. For instance, in the case of involuntary exits, there could be a long period between the point at which a firm defaults on its first debt payment and its final liquidation. For firms that levered up with long-term debt, pressures to exit may only materialise once large repayments start coming due. Moreover, for an entrepreneur deciding whether to wind down a firm voluntarily, it may take repeated evidence of poor performance before the firm finally exits.

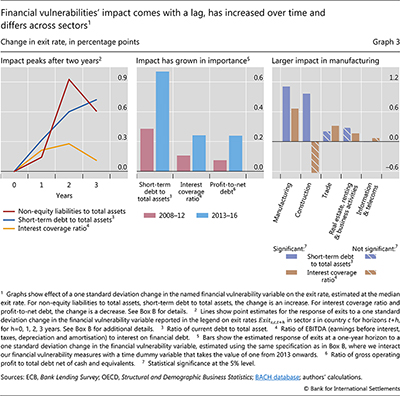

Indeed, the effect of the financial vulnerabilities identified above takes about two years to peak (Graph 3, left-hand panel). The peak of the delayed effect is particularly noticeable for firm leverage (red line). For short-term debt, the effect does not peak before three years have elapsed (blue line). In this case, the steadily rising impact suggests that, while firms may be able to initially roll over their short-term debts, this may only delay the inevitable exit. Last, similar to the case of leverage, the full effect of a decline in the ICR takes two years to realise.12

While financial vulnerabilities trended downwards between 2008 and 2016 (Graph 1, centre and right-hand panels), their impact on exits appears to have increased during the latter part of our sample (Graph 3, centre panel). Estimates show that the coefficient on short-term debt, ICR and the profit-to-net debt ratio were all approximately twice as large during the period 2013-16 compared with that estimated during the more turbulent 2008-12 period. Importantly, both the ICR and the profit-to-net debt ratio were statistically insignificant in the pre-2013 period.

Thus, during periods of large aggregate shocks - ie the GFC and the European sovereign debt crisis - firm financial vulnerabilities appear less informative about the types of firm that exit. The finding could reflect loan evergreening by banks or higher uncertainty, raising the option value of delaying an exit during financial turmoil. Such factors would contribute to lags between the build-up of financial vulnerabilities and the realisation of firm exits. It is also possible that very large aggregate shocks can overwhelm even financially resilient firms, weakening the relationship between financial vulnerabilities and firm exits.

Moreover, the effect of financial vulnerabilities varies across sectors. In particular, the exits of firms in the capital-intensive manufacturing sector are more sensitive to financial vulnerabilities than those in the services sector (Graph 3, right-hand panel). There are also significant differences within the service sector, as financial vulnerabilities appear to be irrelevant for firms in information technology and communications. By contrast, in other types of service (eg trade, real estate, renting, business activities), some of which have been hit particularly hard by the Covid-19 shock, exits appear to be sensitive to the ICR.

The amplification effect of financial vulnerabilities

One would expect that financial vulnerabilities will amplify the impact of weaker economic activity or tightening lending conditions on firm exits. For instance, profits tend to move in tandem with sales. Therefore, downturns lead to a deterioration in firms' ability to cover interest payments. When firms already have weak ICRs, this can lead many of them to exit as they enter bankruptcy. A similar mechanism operates during periods of tight lending conditions. For instance, firms with low profits need to refinance more of their maturing debt than do more profitable firms. Thus, weaker firms with larger refinancing needs are more likely to be pushed over the brink when lending conditions tighten.

To assess the size of these effects, we extend our regression specification to include the interaction between sectoral sales and lending conditions on the one hand and financial vulnerabilities on the other. We then compare the effect of a contraction in sales or a tightening in lending conditions across three stylised cases. In one of these cases, the financial vulnerabilities are at a low level (Graph 4, left-hand panel, light blue bars). In the other two, it is at the median level (blue bars) or a high level (dark blue bars).13

We find that the degree of financial vulnerabilities can sizeably change the impact of sectoral sales or lending condition shocks. Specifically, our estimates show that, for a given downturn in economic activity, a sector with a high level of short-term debt experiences an increase in firm exits that is some two thirds larger than is the case for a sector with low short-term debt (Graph 4, left-hand panel). Looking at the case of the ICR, the difference is even larger: in a sector where firms have low ICRs, a given drop in economic activity raises the exit rate twice as much as in a sector with high ICR firms.

A tightening of lending conditions also has a larger impact on sectors where firms are more financially vulnerable. These effects are particularly pronounced for cash flow vulnerabilities (Graph 4, right-hand panel). For example, in a sector where firms have low ICRs, a financial tightening delivers an increase in exits about three times higher than in a sector where firms have high ICRs. A similar difference holds for the profit-to-net debt ratio.

Conversely, low financial vulnerabilities can insulate firms from the fallout of weaker sales or tightening lending conditions. Indeed, our results indicate that, with low financial vulnerabilities, neither a drop in sectoral demand nor a tightening in lending conditions has a statistically significant effect on firm exits.

Conclusion

Systematic and comprehensive studies on the financial determinants of economy-wide firm exits have been a blind spot in the literature. We try to fill this gap by mobilising comprehensive data on firm demographics and harmonised company account data at the sector level. We find that high short-term debt relative to total assets and low earnings relative to interest expenses predict a significantly larger number of subsequent firm exits.

What do these results potentially imply for firm exits during the current Covid-19 crisis?

First, corporate earnings have collapsed for many firms, severely impairing their interest coverage ratios. Our results suggest that this will threaten the survival of many firms if earnings remain depressed for an extended period. Moreover, cash buffers may provide only limited protection. Second, the extent to which firms have been able to raise funding to cover losses and roll over existing short-term debt will be a decisive factor in preventing firm exits in the short run. However, as our results show, pressures to exit after a rise in indebtedness build up over time. Thus, firms' survival in the short term does not preclude a wave of exits later. Third, because of its sheer size, the Covid-19 shock may dwarf the impact of financial vulnerabilities on firm exits, as occurred during the GFC and the European sovereign debt crisis. That said, financial vulnerabilities may still matter because of their role as shock amplifiers. Finally, once the Covid-19 shock dissipates, it is likely that many sectors will be more financially vulnerable. Going forward, this greater fragility could keep exits high for some time.

Initial emergency measures have certainly been successful in containing the pandemic's fallout. Jobs and wages have been protected, while there have been fewer corporate bankruptcies in the first half of 2020 than in the previous five years (Banerjee et al (2020a)). Yet at least two major challenges loom (Carstens (2020)). First, businesses that can succeed in this new economy but are financially vulnerable may still need help as they undergo debt restructuring, repair their balance sheets and reduce their financial vulnerabilities. Second, there is a need to encourage and enable stakeholders of businesses involved in the most severely damaged sectors to reallocate their resources toward sectors that are more likely to thrive in the post-pandemic economy.

References

Acharya, V, A Davydenko and I Stebulaev (2012): "Cash holdings and credit risk", Review of Financial Studies, vol 25, no 12, pp 3572-609.

Altman, E (1968): "Financial ratios, discriminant analysis and the prediction of corporate bankruptcy", Journal of Finance, vol 23, no 4, pp 589-609.

Balcaen, S, S Manigart, J Buyze and H Ooghe (2012): "Firm exit after distress: differentiating between bankruptcy, voluntary liquidation and M&A", Small Business Economics, vol 39, no 4, pp 949-75.

Banerjee, R, G Cornelli and E Zakrajšek (2020a): "The outlook for business bankruptcies", BIS Bulletin, no 30, 12 October.

Banerjee, R, A Illes, E Kharroubi and J Serena (2020b): "Covid-19 and corporate sector liquidity", BIS Bulletin, no 10, 28 April.

Banerjee, R, E Kharroubi and U Lewrick (2020c): "Bankruptcies, unemployment and reallocation from Covid-19", BIS Bulletin, no 31, 13 October.

Carstens, A (2020): "The Great Reallocation", op-ed, Project Syndicate, 12 October.

Damodaran, A (2020): "Ratings, interest coverage ratios and default spread".

Davis, S and J Haltiwanger (2019): "Dynamism diminished: The role of housing markets and credit conditions", NBER Working Papers, no 25466.

Dunne, T, M Roberts and L Samuelson (1988): "Patterns of firm entry and exit in US manufacturing industries", RAND Journal of Economics, vol 19, no 4, pp 495-515.

Duval, R, G Hong and Y Timmer (2020): "Financial frictions and the great productivity slowdown", Review of Financial Studies, vol 33, no 2, pp 475-503.

Foster, L, J Haltiwanger and C Krizan (2001): "Aggregate productivity growth: Lessons from microeconomic evidence" in "New developments in productivity analysis", NBER Chapters, pp 303-72.

Fort, T, J Haltiwanger, R Jarmin and J Miranda (2013): "How firms respond to business cycles: The role of firm age and firm size", IMF Economic Review, vol 61, no 3, pp 520-59.

Gourinchas, P, S Kalemli-Özcan, V Penciakova and N Sander (2020): "Covid-19 and SME failures", NBER Working Papers, no 27877.

OECD (2020): "Corporate sector vulnerabilities during the Covid-19 outbreak: assessment and policy responses", Tackling Coronavirus.

Opler, T, L Pinkowitz, R Stulz and R Williamson (1999): "The determinants and implications of corporate cash holdings", Journal of Financial Economics, vol 52, no 1, pp 3-49.

1 We thank Claudio Borio, Stijn Claessens, Krista Hughes, Marco Lombardi, Benoît Mojon, Hyun Shin, Nikola Tarashev, Christian Upper, Philip Wooldridge and Egon Zakrajšek for helpful comments and suggestions. We are grateful to Anamaria Illes for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 This has limited such studies to the analysis of broad financial conditions on firm entry and exit (eg Fort et al (2013) and Davis and Haltiwanger (2019)).

3 One exception is Balcaen et al (2012), who study the influence of financial factors on economy-wide firm exits in Belgium using firm-level data. Contrasting different types of exit, they find that voluntary exits, as opposed to involuntary ones such as bankruptcies, are more likely in firms with lower leverage and higher levels of cash holdings.

4 See Box A for more details on the data and definitions. Note that mergers and acquisitions are not classified as exits. The OECD's Structural Development and Business Statistics database does not distinguish between voluntary and involuntary exits. However, firm bankruptcies range from around 10 to 50% of firm exits at the country level.

5 In addition to the financial vulnerabilities, our regression specification also controls for sectoral sales growth, sector entry and country-level lending conditions. See Box B for details on our empirical methodology.

6 Median levels of financial indicators are computed by sorting firm-level observations in ascending order, dividing the sample into two halves and taking the middle value.

7 Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities and other liquid assets.

8 A variant of this metrics featured in the US Interagency guidance on leveraged lending issued in 2013.

9 Unfortunately, the European Committee of Central Balance Sheet Data Offices (ECCBSO) Bank for the Accounts of Companies Harmonised (BACH) database does not compute the ratio of profits to total debt. Such a metric would facilitate a more systematic analysis of cash buffers in preventing firm exits.

10 Standard deviations are computed by stacking all country, sector and year observations.

11 A simple horse race between the four statistically significant financial vulnerability measures identified in Table 1 shows that, while the ratio of short-term debt to assets remains significant once the ICR is included in the same regression, the leverage and ratio of operating profits to debt do not.

12 Interestingly, these results follow a similar pattern to the dynamic effects of GDP contractions on aggregate business bankruptcies (Banerjee et al (2020c)).

13 Low (high) values for the metric correspond to the 10th percentile (90th percentile) of the distribution of the variable considered.