Changes in monetary policy operating procedures over the last decade: insights from a new database

We introduce a new interactive database that allows users to easily retrieve and customise detailed information on central banks' monetary policy operating procedures (MPOPs). These procedures govern the day-to-day implementation of monetary policy in markets. After a high-level conceptual overview of how MPOPs have evolved over the past decade, we showcase common trends and selected cross-country differences. We discuss, in particular, how the persistent environment of excess liquidity and the effective interest rate lower bound shaped MPOPs in the aftermath of the Great Financial Crisis of 2007–09.1

JEL classification: E42, E43, E52, E58.

Central banks' monetary policy operating procedures (MPOPs) govern how monetary policy is implemented on a day-to-day basis in markets, and in particular how central banks actually set interest rates. To enhance the transparency and general understanding of this core aspect of central banking, the Markets Committee (MC) has been issuing a compendium on MPOPs since 2007 (MC (2019a)).2 This special feature introduces a new interactive online tool based on the compendium which allows users to easily retrieve and customise detailed information.3

To set the stage, we start with a brief introduction of the main structure of the new online tool. We then turn to a bird's eye view of MPOPs. In this context, we provide a high-level conceptual overview of monetary policy implementation. We also highlight the profound changes in MPOPs due to the persistent environment of excess liquidity and the proximity to the effective interest rate lower bound (ELB) since the Great Financial Crisis (GFC) of 2007–09. We then distil some cross-country similarities and differences by drawing on the new database. Even though MPOPs share the same basic objective, there are notable differences across currency areas – for example, due to different market structures, players, practices and economic conditions.

Key takeaways

- A new interactive database allows users to easily retrieve and customise information on central banks' monetary policy operating procedures, covering the 15 largest currency areas.

- The database shows cross-country differences in the "nuts and bolts" of central banking since the Great Financial Crisis of 2007–09 and highlights several common trends.

- The expansion of central bank balance sheets and the effective lower bound led to the increased adoption of floor systems; increased use of multiple operating targets (beyond an overnight interbank rate); a lesser role for discretionary liquidity management; and more weight being placed on communication about monetary policy implementation.

The compendium on central bank operations in a nutshell

The MC Compendium, Monetary policy frameworks and central bank market operations, first published in 2007, captures the core features of the MPOPs of major advanced economy (AE) and emerging market economy (EME) central banks. At present, it covers the 15 currency areas around the globe whose currencies command the greatest international role. The information has been submitted by the respective central banks, all of which are represented on the Markets Committee (MC (2019a)). While the compendium reproduces or summarises information that is already publicly available,4 its value added mainly comes from providing a straightforward cross-country comparison of MPOPs. The latest instalment is from 2019.

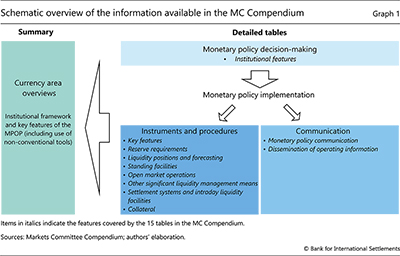

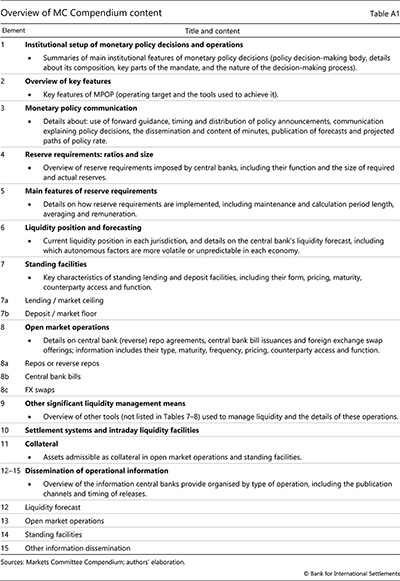

The information in the compendium is structured along two dimensions (see Graph 1 for a schematic overview). First, a concise summary of MPOPs and their role in monetary policy implementation for each currency area. This description also provides the broader context, including a succinct discussion of central bank mandates, key objectives and other institutional features. Second, 15 tables (or "elements") that cover specific features of the MPOPs, with several subcomponents for each currency area (see Annex for an overview).

The main innovation of the online database is an interactive "Comparison" tool. It allows users to easily customise their queries to obtain a cross-country and/or a cross-table perspective on particular MPOP elements.

A bird's eye view of monetary policy operating procedures

The implementation of monetary policy has two core elements (eg Borio and Nelson (2008)).5

The first comprises mechanisms to signal the desired policy stance, eg is the central bank easing or tightening? These mechanisms involve variables that are fully under the central bank's control. Such variables can be policy interest rates, such as a lending rate or announced ranges for an overnight rate, or balance sheet quantities, such as announced large-scale purchases of government securities.

Further reading

The second comprises market operations to implement the stance. In line with the type of signal, the operations may seek to influence a market interest rate, such as an overnight rate in the interbank market, or simply execute the announced adjustments in the central bank's balance sheet, such as the purchases noted above. If the central bank seeks to influence a market rate rather precisely, this is typically referred to as an "operational target".

The GFC has resulted in profound changes in operating procedures in many currency areas, especially in major AEs.

Pre-GFC, most central banks defined the policy stance and operational targets exclusively in terms of a short-term interest rate, most often an overnight interbank rate. In and of themselves, the transactions in the market to implement that stance carried no signal. Indeed, central banks went a long way to avoid any such impression so as not to confuse markets. The transactions were of a purely technical nature and were designed not to influence market prices beyond the operational target. They were carried out purely to adjust the amount of bank deposits with the central bank in order to control the overnight rate (see below). This "decoupling principle" ruled supreme.

Post-GFC, as the policy rate neared the ELB in many currency areas, the respective central banks expanded their toolkit and followed a more multifaceted approach. Signals have included balance sheet quantities too. And they have not been limited to announcing some policy rate(s) or an adjustment in the central bank balance sheet today; they have sometimes also provided guidance about the future path of those variables ("forward guidance"). Moreover, operational targets have also gone beyond overnight or short-term rates and included long-term rates, such as benchmark 10-year bond yields. Put differently, the active use of adjustments in the size and composition of the balance sheet to change the policy stance ("balance sheet policies") has done away with the decoupling principle.

Despite these fundamental changes, the overnight interbank rate still plays a key role in day-to-day policy implementation. This is because it is the rate that the central bank controls most closely and, partly as a result, is the linchpin of the term structure of interest rates. This rate represents the marginal cost of funds for immediate liquidity purposes and is determined by the supply of, and demand for, bank deposits with the central bank, ie "bank reserves". It can be controlled most closely because the central bank is, by construction, the monopoly supplier of bank reserves. It changes the supply by lending/borrowing in the market (eg through repos and reverse repos) and by buying/selling assets.6 Moreover, the central bank can also influence directly the demand for reserves through reserve requirements, which require banks to hold a minimum amount of deposits with the central bank.

While not affecting the significance of the interbank overnight rate, the growing reliance on balance sheet policies has had profound implications for how the central bank influences this rate. In general, there are two types of arrangement.

The first arrangement, which was the most common pre-GFC, is to adjust the amount of bank reserves rather precisely to meet banks' required demand. This precision is important, because the demand, which is ultimately determined by interbank settlement needs, is very interest-inelastic: failing to meet it would result in a very volatile overnight rate.7 The central bank controls the supply of reserves through a combination of discretionary open market operations and standing (lending and borrowing) facilities that banks can tap on demand – together, so-called "liquidity management operations", which "drain" or add liquidity. In such a system, reserve requirements are a common tool that can allow banks to smooth their demand for reserves over given periods (ie requirements that have to be met only on average). This reduces the need for the central bank to forecast the demand for reserves precisely and/or to frequently fine-tune the supply of reserves.

Two terms are often used to describe this first arrangement. One, a "corridor" system, as the central bank steers the overnight rate within a range defined by the borrowing and lending rates on the standing facilities. Two, a "scarce reserves" system, because the central bank does not supply reserves over and above what is needed to meet day-to-day settlement needs.

The second arrangement, which has become common post-crisis, is often referred to as an "abundant reserves" or "floor" system. Here, the central bank tends not to offset the increase in the amount of reserves generated by its large-scale asset purchases.8 In essence, the central bank floods the market by supplying banks with more reserves than needed for their settlement or liquidity management purposes more generally.9 As a result, it pushes the overnight rate to that at which banks can deposit excess funds with the central bank – the deposit facility rate, which thus acts as a floor.

The specific details of MPOPs differ across currency areas, reflecting in part differences in market structures and institutions. With the expanded use of central bank balance sheets, these differences have grown further. The MC Compendium provides a window into many of these contrasting features, although it focuses primarily on the determination of the overnight rate. As the last instalment from the compendium is from 2019, the changes during the Covid-19 crisis are not covered. But these do not change the overarching narrative discussed next.

A cross-country perspective on monetary policy operations

The switch from "corridor" to "floor" systems

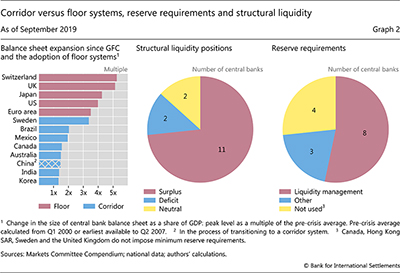

Many central banks, in particular in advanced economies, have shifted from a corridor to a floor system since the GFC. The AE central banks that have expanded their balance sheet most since the GFC currently use floor systems (Graph 2, left-hand panel).10 This contrasts with the pre-GFC environment, when corridor systems were the norm, just like they still are among EME central banks. The general reluctance to operate a floor system at the time reflected concerns that interbank trading activity and market functioning might suffer in a regime of abundant reserves.

Virtually all of the central banks operating a floor system today have short-term interest rates that are close to zero, at zero or even negative. This reflects the fact that the adoption of the floor system has largely been a by-product of the ELB and the related use of central bank balance sheets as a policy tool and its subsequent expansion (MC (2019a)). Central banks have regarded the side effects of reduced interbank money market activity as largely second-order compared with the benefits of leveraging on central bank balance sheets to provide additional policy accommodation (MC (2019b)).

Large balance sheets per se are not a new phenomenon. In particular, many EMEs have had large balance sheets for quite some time, as they had built up precautionary buffers against potential currency crises. To that end, they have bought foreign currency (mostly dollars) financed with domestic currency in the form of bank reserves. As in a floor system, these central banks operate in an environment of a "structural liquidity surplus" (Graph 2, centre panel). A "structural liquidity surplus" means that the banking system in aggregate, and absent offsetting central bank operations, has more bank reserves than strictly needed for reserve requirement and/or settlement purposes. But in contrast to many of their AE peers, EME central banks reabsorb the excess reserves through a variety of tools – for instance, by issuing their own debt securities or offering time deposits. In so doing, they "sterilise" the FX interventions.

Reserve requirements

Reserve requirements have traditionally been an important part of MPOPs in scarce reserves regimes, but their role has dwindled with the adoption of floor systems. By construction, for reserves to be abundant, they must exceed reserve requirements by a sufficient margin. Several central banks do not impose such requirements at all at present (Graph 2, right-hand panel). This includes the Bank of Canada, Sveriges Riksbank and the Bank of England.

The majority of the central banks that have binding reserve requirements in place rely on them primarily for liquidity management purposes. A few also employ them for financial stability purposes – as a kind of "macroprudential tool" – and/or to affect bank credit for monetary policy purposes. In these two cases, the requirements simply act as a tax. Several EME central banks use them for such purposes, such as the Central Bank of Brazil and the People's Bank of China.11

Liquidity management operations

Standing facilities

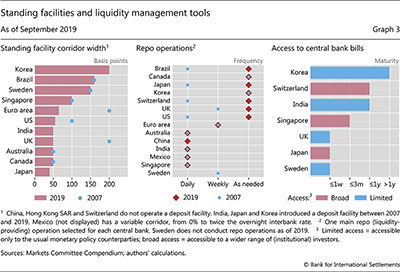

All central banks operate standing facilities. In an abundant reserves regime, the deposit facility is particularly important as it determines the interest rate floor. Almost all central banks offer a deposit facility, or reverse repos fulfilling a similar function. India, Japan and Korea adopted deposit facilities in 2007. The Federal Reserve started paying interest on reserves during the GFC in October 2008 to achieve the same objective.12 Similarly, the Swiss National Bank moved away from non-interest-paying deposit accounts in 2015 so that it could implement negative interest rates.

All central banks have a lending facility, even though it is rarely used in currency areas that have moved to a floor system. In general, lending facilities perform a backup function, allowing banks in need to obtain reserves. When reserves are abundant, these facilities are essentially a safety valve to avoid excessive volatility at times of tensions in the market. Lending facilities most often take the form of an overnight repo or collateralised loan. The People's Bank of China is an exception, as it also offers loans with longer maturities of one week and one month.13

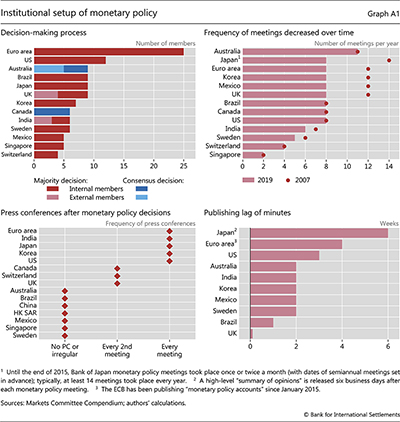

Depending on the design of their MPOPs, there are some notable differences across countries in terms of the width of the corridor – ie the difference between the interest rate charged on the lending facility and that paid on the deposit facility (Graph 3, left-hand panel). It ranges from 200 basis points for Korea to 40 bp for Japan. For most central banks, it has changed little since 2007. That said, with short-term rates approaching the ELB and with the move to an abundant reserves regime, the ECB and the Bank of England narrowed it significantly, from 200 bp to a mere 65 and 50 bp, respectively.

Open market operations and other liquidity management tools

Beyond standing facilities, central banks utilise open market operations (OMOs) to adjust bank reserves as needed. Discretionary OMOs remain a core part of the MPOP toolkit, even though the need to rely on them frequently is greatly reduced in a floor system. While the MC Compendium covers all OMO tools, the three most commonly used ones are repos and reverse repos, central bank bills and FX swaps. But some central banks have also engaged in longer-term lending operations stretching out to several years' maturity.14

Nearly all central banks use repos and reverse repos with eligible counterparties as the main tool. That said, instead of regular operations, many central banks now provide liquidity depending on market conditions. In particular, the central banks of five major AEs and the Central Bank of Brazil shifted from daily or weekly operations to operations that depend on market liquidity conditions (Graph 3, centre panel).

About two thirds of central banks can also issue debt securities – or central bank bills – in order to withdraw bank reserves from the system (or technically "drain liquidity"). But not all of them make use of that instrument. When employed, central bank bills come with a wide range of maturities (up to two years in the case of Korea). Another differentiating factor across central banks is the accessibility and marketability of such instruments. Some central banks (Japan, Singapore and Switzerland) allow a wide range of institutional investors to hold bills, rather than only the usual monetary policy counterparties (Graph 3, right-hand panel).

A single operating target no longer embodies the policy stance

As discussed, many central banks are no longer able to express the policy stance exclusively via short-term interest rates as their operational target. Short-term rates still continue to be one such target, not least because of their role in anchoring the yield curve. However, a richer set of tools are used to adjust the stance as rates have approached, or reached, the effective lower bound.

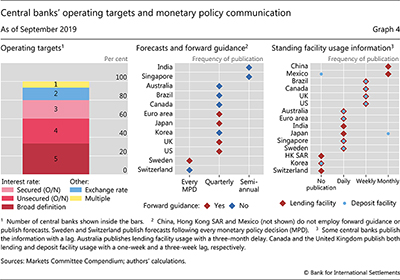

The most common operating target continues to be an interest rate with an overnight maturity.15 Given its controllability, central banks most commonly target an unsecured overnight interbank rate (Graph 4, left-hand panel). A prominent example is the Federal Reserve, which defines a target range for the effective federal funds rate. That said, some central banks also target overnight secured (ie repo) rates (eg Brazil, Canada and Mexico).

The number of central banks with multiple operating targets has risen. In 2007, only the ECB considered an array of money market rates (even though EONIA was de facto the most relevant one). Now, the Riksbank and the Swiss National Bank also define their operational target more broadly. Most explicit about multiple operating targets is the Bank of Japan, which states that it targets the overnight rate as well as the yield on 10-year government bonds under its yield curve control framework.16

The rising communication challenge

Given that the first element of monetary policy implementation is signals to express the desired policy stance, communication frameworks play a central role in MPOPs.17 And communication has become increasingly important for ensuring the effectiveness of monetary policy implementation in recent years. At the same time, it has become more challenging, as the stance cannot be summarised by a single operating target once central banks also make active use of their balance sheets. The information in the MC Compendium reflects this evolution.

Guidance on the future path of operating interest rate targets and/or balance sheet operations – or forward guidance – has become a standard tool for shaping expectations, particularly for major AE central banks.18 As of 2019, one third of central banks used forward guidance (Graph 4, centre panel).

The expansion of the toolkit and a more multifaceted approach to signal the stance have created communication challenges.19 For example, consider the asset purchases by the Federal Reserve in three recent episodes, which were driven by different considerations: (i) in September 2019, to inject reserves to curb the upward spike in repo rates; (ii) in March 2020, to address market dysfunction in the Treasury market; and (iii) the subsequent continuation of asset purchases to ease financial conditions once the market stress had subsided (as recognised in the November 2020 Federal Open Market Committee statement). As this experience indicates, it has become harder to distinguish those operations that are done for purely technical reasons from those that are intended to implement the stance.

Also in response to the communication challenge, central banks have started to frequently inform market participants about operational results and facility usage. For instance, all central banks that employ open market operations publish the resulting volumes and prices, in most cases immediately after each operation. And, all but three publish information on the usage of their lending and deposit facilities, though some of them with a lag (Graph 4, right-hand panel).

References

Bank for International Settlements (BIS) (2018): Annual Economic Report 2018, June.

Bindseil, U (2004): Monetary policy implementation: theory, past, and present, Oxford University Press.

----- (2014): Monetary policy operations and the financial system, Oxford University Press.

----- (2016): "Evaluating monetary policy operational frameworks", paper prepared for the Federal Reserve Bank of Kansas City's Jackson Hole Symposium, August.

Blinder, A, M Ehrmann, M Fratzscher, J de Haan and D-J Jansen (2008): "Central bank communication and monetary policy: a survey of theory and evidence", Journal of Economic Literature, vol 46, no 4, December.

Borio, C (1997): "The implementation of monetary policy in industrial countries: a survey", BIS Economic Papers, no 47, July.

Borio, C and P Disyatat (2009): "Unconventional monetary policies: an appraisal", BIS Working Papers, no 292, November.

Borio, C and W Nelson (2008): "Monetary operations and the financial turmoil", BIS Quarterly Review, March, pp 31–46.

Committee on the Global Financial System (CGFS) (2019): "Unconventional monetary policy tools: a cross-country analysis", CGFS Papers, no 63, October.

Corradin, S, J Eisenschmidt, M Hoerova, T Linzert, G Schepens and J-D Sigaux (2020): "Money markets, central bank balance sheet and regulation", ECB Working Paper Series, no 2483, October.

Disyatat, P (2008): "Monetary policy implementation: misconceptions and their consequences", BIS Working Papers, no 269, December.

Filardo, A and B Hofmann (2014): "Forward guidance at the zero lower bound", BIS Quarterly Review, March, pp 37–53.

Kim, K, A Martin and E Nosal (2018): "Can the US interbank market be revived?", Board of Governors of the Federal Reserve System, Finance and Economic Discussions Series, December.

Markets Committee (MC) (2019a): MC Compendium: Monetary policy frameworks and central bank market operations, October.

----- (2019b): Large central bank balance sheets and market functioning, October.

Reiss, R (2013): "Central bank design", Journal of Economic Perspectives, vol 27, no 4.

Annex

1 The authors are grateful to Ulrich Bindseil, Claudio Borio, Paolo Cavallino, Stijn Claessens, Piti Disyatat, Benoît Mojon, Maik Schmeling, Hyun Song Shin, Olav Syrstad, and Nikola Tarashev for helpful comments. The views in this article are those of the authors and do not reflect those of the Bank for International Settlements.

2 The Markets Committee is a central bank forum comprising senior officials with expertise in central bank operations and their interactions with financial markets. For further information on the MC, its current membership and work.

3 The institutional details captured in the compendium are useful for practitioners and researchers interested in, for instance, optimal central bank design (eg Reiss (2013)), central bank communication (eg Blinder et al (2008)) and monetary policy operations (Borio (1997), Bindseil (2004, 2014)).

4 The original central bank publications remain the ultimate reference.

5 For a detailed discussion on the analytical underpinnings of MPOPs, see Borio (1997) for an early review and Bindseil (2016) for a more recent and comprehensive assessment. See also Borio and Disyatat (2010) for an analysis of how balance sheet policies have profoundly influenced operating procedures. Disyatat (2008) discusses how misconceptions of MPOPs can compromise the understanding of the monetary transmission mechanism and other policy issues.

6 For instance, "quantitative easing" (QE) is nothing but a purchase of government securities financed with bank reserves that are not subsequently withdrawn ("sterilised").

7 In these approaches, excess reserves are remunerated, if at all, at a rate below the policy rate. Hence banks would typically be unwilling to hold more reserves than strictly needed. Conversely, being short of reserves would be very costly, as it would potentially lead to settlement problems.

8 More generally, of any increases in its balance sheet that would add to bank reserves, such as foreign exchange intervention (purchases of foreign currency assets) or large-scale lending to banks.

9 Depending on their precise structure, prudential requirements can also influence the demand for bank reserves. This has been a factor complicating the identification of the demand for reserves post-GFC. See eg Kim et al (2018) and Corradin et al (2020).

10 The main exception among AE central banks are Australia and Canada – two economies for which the effective ELB became a constraint only lately during the Covid-19 crisis. Another exception is Sveriges Riksbank, which, despite abundant reserves on the back of large-scale asset purchases, chose to absorb the excess liquidity daily via fine-tuning operations. The Central Bank of Norway (not covered in the compendium) abandoned its floor system in 2011 in favour of a novel quota-based system that incentivises banks to economise on their reserve holdings.

11 The advantage of reserve requirements (RRs) over changes in interest rates is their impact on capital flows. For example, an interest rate hike would tend to encourage inflows, as domestic interest rates rise relative to those on other currencies. But a tightening of RRs, because they are a tax, would make it less attractive for banks to encourage inflows and could reduce the interest rates on their liabilities.

12 Since 2014, the Federal Reserve has also had an overnight reverse repo facility (O/N RRP) as a supplementary tool, which is available to a different set of counterparties. In addition, the rate of remuneration on the deposit facility may not always act as a firm floor (as cash-rich government-sponsored entities are not entitled to earn interest on reserves). The O/N RRP facility, which is accessible to a broader set of institutions, ensures that the floor for market rates such as the effective federal funds rate and repo rates is not "leaky".

13 There can be significant differences across currency areas regarding the extent to which banks actually tap lending facilities. A key consideration is stigma, which depends, inter alia, on how the facility is designed. See Borio (1997) for a cross-country analysis of this issue.

14 Some of these long-term lending operations have embedded conditionality to foster lending to the real economy, also known as "funding for lending schemes".

15 Among currency areas in the compendium, Hong Kong SAR and Singapore are the major exception, as they explicitly target the exchange rate.

16 Since March 2020, the Reserve Bank of Australia has also set an operating target for the yield on three-year Australian government bonds, in addition to setting the target "cash rate".

17 Just as in other areas, central banks have become more transparent. For example, until 1994 the Federal Reserve did not announce the fed funds rate. Rather, the stance was conveyed through subtle changes in its liquidity operations, which only a relatively small set of market participants could easily understand. See Borio (1997) for a cross-country analysis of the evolution of communication practice in this context.

18 Forward guidance has been commonly viewed as an effective tool to provide monetary stimulus in a situation where policy rates are at the ELB (eg CGFS (2019); see also eg Filardo and Hofmann (2014)).

19 The balance sheet unwinding implemented by the Federal Reserve between September 2017 and September 2019 illustrates such challenges. Communication by Fed officials at the time sought to emphasise that the fed funds rate target range was the key signal regarding the monetary policy stance. To facilitate this signalling, the Fed decided to put the balance sheet reduction "on autopilot", so as to minimise the risk that market participants could see it as a relevant factor in (co-)determining the monetary policy stance.