The broad dollar exchange rate as an EME risk factor

US dollar appreciation is associated with a darkening of the economic outlook for emerging market economies (EMEs). Using data from 21 EMEs, we find that a 1 percentage point (ppt) appreciation shock to the dollar against a broad basket of currencies dampens the growth outlook by over 0.3 ppt and growth-at-risk (the lowest 5% of growth outcomes) by 0.6 ppt. Dollar appreciation adversely affects investment growth-at-risk in particular and even export growth-at-risk, indicating that global financial conditions play a key role. Indeed, the negative impact is significantly larger in countries with high dollar debt or high foreign presence in local currency bond markets.1

JEL classification: F31, F34, F36, F41, F44.

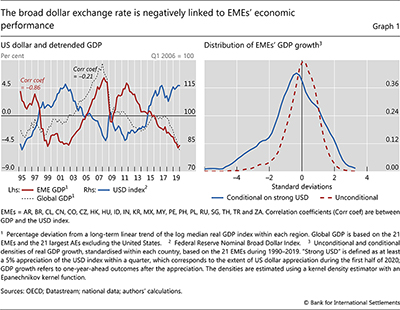

The gyrations of the broad US dollar exchange rate over the past few decades have been linked to marked shifts in global economic activity. In particular, dollar strength has been systematically associated with worse economic performance in EMEs (Graph 1). There is a strong negative correlation between the value of the dollar and detrended EME output over time (left-hand panel). A stronger dollar is also associated with a larger frequency of particularly poor growth outcomes (blue distribution for strong dollar states versus overall red distribution, right-hand panel).

Against this background, this article aims to explore the link between the dollar and EME cyclical growth more systematically, abstracting from long-term trends. The literature on "growth-at-risk" (GaR) has established that tighter financial conditions and sustained high credit growth are key drivers of adverse real economy outcomes (eg Adrian et al (2018), Aikman et al (2019)). So far, this literature has not considered the dollar as a risk factor. At the same time, recent studies have found that the broad dollar exchange rate influences economic activity and financial conditions, in particular in EMEs (eg Avdjiev et al (2019a,b), Erik et al (2020), Shousha (2019)). These studies have focused on average outcomes. We bridge the gap between these two strands of the literature by analysing the impact of the dollar on both the average growth outlook and on GaR using data covering 21 EMEs from Q1 1990 to Q4 2019.

We focus on the link between EME cyclical growth and the broad dollar nominal effective exchange rate (as shown in Graph 1), not the bilateral exchange rates of EME currencies against the dollar. This is for two main reasons. First, reflecting the dollar's role as a global risk factor, the effects of the broad dollar exchange rate on EME financial conditions have tended to outweigh those of the bilateral dollar exchange rates (Avdjiev et al (2019a), Shin (2019)). Second, the effects of the bilateral dollar exchange rate on growth are empirically more difficult to disentangle from causal effects in the other direction. Namely, a bilateral exchange rate could reflect perceptions of a country's current and future growth. This reverse causality is less of a concern in the case of the broad dollar index, which measures the value of the dollar against all major trading partners of the United States.

Key takeaways

- A stronger dollar is followed by weaker growth in EMEs and a higher risk of deeper economic downturns.

- Dollar appreciation dampens in particular investment growth and even export growth.

- These negative effects are significantly larger in countries more exposed to changes in global credit conditions, because of high foreign investment in local currency bond markets or high dollar debt.

Our results suggest that broad dollar appreciation dampens real GDP growth on average and, in particular, lowers GaR, defined as the lowest 5% of real GDP growth realisations. We find that a stronger dollar has negative effects especially on real investment GaR and also dampens real export GaR. Moreover, we find that the dollar affects EMEs more strongly than small advanced economies (AEs) and that appreciations of other safe haven currencies do not have similar adverse effects on EME growth. These findings are consistent with the notion that the dollar influences global financial conditions, impacting EMEs in particular. This interpretation is supported by further empirical results, suggesting that dollar appreciation has a significantly larger effect on GaR in EMEs with high dollar debt and high foreign investor presence in local currency bond markets.

The remainder of the special feature is organised as follows. The first section reviews from a conceptual perspective the channels through which movements of the dollar can affect GDP growth (henceforth, "channels of dollar transmission"). The second estimates the effect of dollar fluctuations on GDP growth and on GaR in EMEs. The third section explores the nature of the dollar as a risk factor in EMEs, estimating GaR effects at the level of individual GDP components, juxtaposing the dollar impact on EMEs with that on small AEs and comparing its effect on EMEs with that of other safe haven currencies. The fourth section directly tests some of the channels of dollar transmission, assessing the role of foreign ownership, dollar debt and dollar trade invoicing in the transmission of dollar movements to EME GaR. The last section concludes.

Channels of dollar transmission

A negative correlation between broad-based dollar strength and global growth, as displayed in Graph 1, may arise through various channels.

First, the broad dollar exchange rate has attributes of a barometer of global investor risk appetite, over and above other gauges such as the VIX (Shin (2016)). When investor risk appetite dives, flight to safety may both push up the dollar and weaken global economic activity through capital outflows and tighter financial conditions as investors and lenders retrench from risky investments and borrowers.

Second, and relatedly, the broad dollar exchange rate could affect the global supply of dollar credit (Bruno and Shin (2015), Shin (2019)). When there is the potential for valuation mismatches on borrowers' balance sheets arising from exchange rate fluctuations, a stronger dollar weakens the balance sheets of those dollar borrowers whose liabilities rise relative to assets. From the standpoint of creditors with a diversified portfolio of borrowers, the weaker credit position of some borrowers increases tail risk in the overall credit portfolio, reducing the capacity for additional credit extension even with a fixed exposure limit as given by a value-at-risk (VaR) constraint or an economic capital constraint. The result would be a general tightening of global dollar credit supply, including for trade credit (Bruno et al (2018)). This aggregate credit supply channel would be in addition to a decline in dollar borrowing by entities with currency mismatches.

Third, similar dynamics may play out in local currency government bond markets if the tighter dollar credit conditions mentioned above are correlated with tighter risk constraints for global investors holding a diversified portfolio of local currency bonds. This can in turn lead to a general tightening of credit conditions in EME local currency bond markets as investors retrench across the board, including from countries whose bilateral exchange rates have not depreciated. Indeed, Hofmann et al (2020) find that broad dollar appreciation has larger adverse effects on bond flows and bond spreads in EME local currency sovereign bond markets than a depreciation of EME bilateral exchange rates against the dollar.

Fourth, the dollar can affect trade activity. A broad-based appreciation of the dollar could improve international price competitiveness of those countries whose bilateral exchange rate depreciated against the dollar, boosting net exports and ultimately output. The conventional trade channel, however, rests on the assumption that export and import prices adjust in response to a change in the country's exchange rate. Over short horizons, this may not be the case if trade is invoiced in a foreign currency (Gopinath (2015), Gopinath et al (2020)). Such foreign currency invoicing weakens the link between exchange rates and price competitiveness, and hence the conventional trade channel. In particular, it means that a broad-based appreciation of the dollar may push up prices from the perspective of the importer and thus lead to a drop in trade.

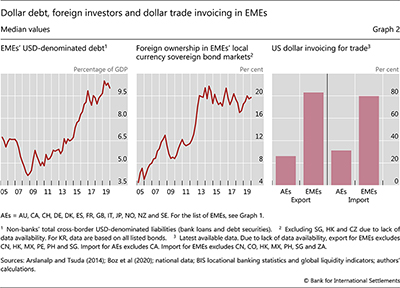

EMEs are particularly vulnerable to changes in the value of the dollar through these channels, making the broad dollar exchange rate an EME-specific risk factor. While EMEs' financial deepening has progressed significantly over the past decades, in particular through the development of local currency bond markets, their financial systems still remain shallower than those of AEs. As a result, EMEs remain more dependent on foreign funding (CGFS (2019)). This is reflected in high dollar debt (Graph 2, left-hand panel) and large foreign investor holdings of EME local currency bonds (centre panel). On the back of thin hedging markets, these FX exposures of EME dollar borrowers and of foreign lenders in EME currencies are largely unhedged.2 At the same time, US dollar invoicing is more widespread in EMEs than in AEs (right-hand panel).

The impact of the dollar on EME growth and growth-at-risk

If dollar transmission takes place through the financial channels described above, the effects would be larger for GaR than for average growth outcomes. This is because financial constraints and frictions are usually more binding in bad states of the world.

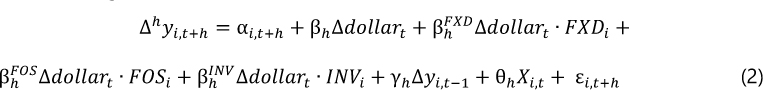

In order to test this hypothesis, we estimate the dynamic impact of movements in the dollar on average growth and on GaR. Our estimates are from panel regressions, based on quarterly data for 21 EMEs over the period Q1 1990-Q4 2019.3 The regression equations take the following form:4

for horizons h={0, 1, ..., 16} quarters, where ∆hyi,t+h stands for cumulative real GDP growth over horizon h and ∆dollart for the quarterly change in the Federal Reserve's broad dollar index. As we are aiming to identify the independent impact of the dollar on EME economic activity, the regressions further include a large set of variables Xi,t, which control for US factors that could affect both the dollar and EME growth: the VIX, quarterly real GDP growth, the purchasing managers' index (PMI) and quarterly CPI inflation as well as the change in one- and 10-year Treasury bond yields. To account for the historical negative correlation between the dollar and global commodity prices - which affect EME growth prospects - we also include the quarterly change in a global (dollar-based) commodity price index in Xi,t. Finally, we include a number of additional country-specific drivers of cyclical growth outcomes, as identified in the previous literature: stock market volatility as a measure of financial conditions, three-year non-financial private credit growth (relative to GDP), the current account balance (relative to GDP), the quarterly inflation rate and the change in the policy rate.5

Since we want to estimate the impact of the dollar on both average GDP growth and GaR, we estimate equation (1) in two ways. We first estimate a standard linear model. Then, we estimate a quantile regression for GaR, defined as the lowest 5% of growth outcomes over each regression horizon h.

Further reading

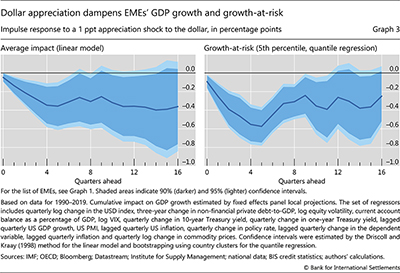

The results suggest that an appreciation of the dollar has a quantitatively and statistically significant negative effect on GDP growth in EMEs, both for the average outcome and for GaR (Graph 3). In line with the conjecture derived from the conceptual considerations, the impact on GaR is quantitatively larger. Concretely, a 1 percentage point (ppt) appreciation shock to the broad dollar index is followed by a statistically significant cumulative decline of EME GDP growth by over 0.3 ppt after one year.6 At about 0.6 ppt, the impact on GaR is almost twice as large, and is estimated with higher confidence in statistical terms. The effects of dollar appreciation on growth and on GaR are persistent, but start to fade and to become statistically insignificant after about six quarters.

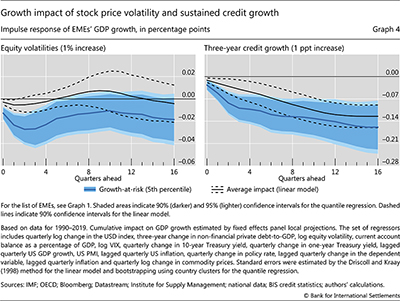

As a validation of the empirical model in equation (1), it is useful to consider the estimated impact of other prominent drivers of cyclical output growth, such as stock market volatility and three-year credit growth (relative to GDP), which were highlighted in the previous literature on GaR. In line with the existing literature, our estimates suggest that tighter financial conditions - captured by an increase in stock price volatility - dampen growth temporarily (Graph 4, left-hand panel), while higher indebtedness - captured by three-year credit growth - has a more persistent effect (right-hand panel). In either case, the effect on GaR is larger than that on average growth.

The above results indicate that the effect of the dollar on GaR is quite similar to that of stock market volatility and credit growth. A one standard deviation change of the broad dollar exchange rate over one quarter is 2.5 ppt. The corresponding numbers for stock price volatility and the three-year growth of private debt over GDP are 53% and 13.9 ppt, respectively. According to our empirical estimates, this would translate into respective cumulative impacts on GaR of -1.4, -1.2 and -1.4 ppt over a horizon of about one year.

Exploring the nature of the link

In this section, we further explore the broad dollar exchange rate as a risk factor for EME growth by considering a number of testable hypotheses. First, if dollar transmission occurs via financial channels, we would expect to see larger negative effects on investment than on other components of GDP as it is more sensitive to changes in financial conditions. Second, because of tighter trade-credit conditions and sticky export prices due to dollar invoicing, dollar appreciation need not be associated with higher export growth in EMEs. Third, on the basis of relative financial depth, we would expect to find that the dollar's impact on AEs is less pronounced than that on EMEs. Fourth, if the effects of the dollar reflect financial effects beyond the flight to safety, we would not see similar adverse effects on EMEs from appreciations of other safe haven currencies.

To test these hypotheses, in this section we explore variations of the previous empirical model. Specifically, we estimate the dollar's effect on the GaR for specific components of GDP, assess the impact of the dollar on small AEs - which resemble EMEs as regards exposure to global financial shocks - and compare the effects of the dollar with those of alternative safe haven currencies.

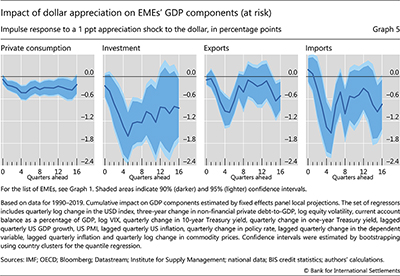

In order to assess the impact of the dollar on the GaR for different components of GDP, we re-estimate equation (1) for GaR using, sequentially, the cumulative growth rates of real consumption and real investment as well as real exports and real imports as the dependent variable. We find that dollar appreciation negatively affects all private components of GDP. Nevertheless, there are notable quantitative differences in the estimated effects (Graph 5).

The effect of the dollar is strongest for investment, consistent with the notion of financial channels driving the effects of the dollar. Investment GaR declines in cumulative terms by as much as 1.6 ppt after five quarters after a 1 ppt appreciation shock to the dollar (second panel). This compares with a negative cumulative effect on consumption GaR of 0.4 ppt over the same horizon (first panel).

An appreciation of the dollar also has a negative impact on export GaR, triggering a cumulative contraction of up to 1 ppt after four and five quarters (Graph 5, third panel). This finding points to the relevance of financial channels through trade credit and dollar invoicing, counteracting the traditional expansionary effects on exports that would emanate from EME bilateral exchange rate depreciation.

In parallel, import GaR is negatively affected by a stronger dollar. The cumulative effect of a 1 ppt dollar appreciation shock reaches 1.5 ppt after five quarters, a result that is more in line with traditional trade channel effects. Since the impact of dollar appreciation on imports is larger than that on exports, the overall effect of the dollar on net export GaR is positive.

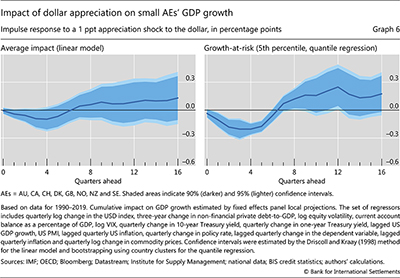

The effect of dollar appreciation on EMEs seems to be considerably stronger than that on small AEs, in line with the notion that EMEs are more vulnerable because of shallower financial systems. This result rests on data from Australia, Canada, Denmark, New Zealand, Norway, Sweden, Switzerland and the United Kingdom over the same sample period (Q1 1990-Q4 2019). In qualitative terms, the results are similar to those for EMEs: the dollar affects AEs' growth prospects and the negative effect of its appreciation on GaR is larger than that on average growth (Graph 6). Quantitatively, however, these effects are much smaller than in the case of EMEs. A 1 ppt appreciation shock to the dollar dampens GaR in AEs by 0.2 ppt over one year (right-hand panel), which is one third of the impact we have estimated for EMEs. After about seven quarters, the effect even becomes positive, possibly reflecting the traditional trade channel.

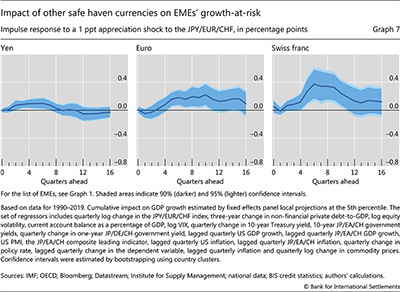

The negative effect of dollar appreciation on EMEs does not merely reflect flight to safety effects. This is suggested by analyses in which we re-estimate equation (1) after replacing the dollar with other safe haven currencies: the yen, the euro and the Swiss franc.7 The link between these alternative safe haven currencies and EME GaR is quite different from that of the dollar (Graph 7). A yen, euro and Swiss franc appreciation is not followed by lower EME GaR. Moreover, the effect is even significantly positive over medium-term horizons, possibly reflecting traditional trade channel effects.

Exploring the channels of dollar transmission

In this section, we aim to directly explore some of the channels through which the broad dollar exchange rate may affect GaR. To this end, we exploit cross-country variation in financial and economic structure. Specifically, we estimate equations of the following form:

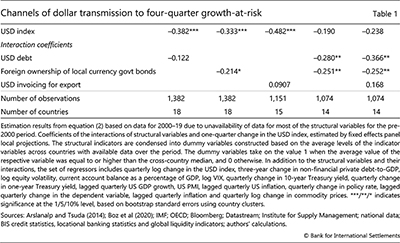

This is an augmented version of equation (1) that includes indicators of foreign ownership, dollar debt and dollar invoicing and their interactions with the change in the broad dollar exchange rate. Concretely, FXD refers to gross cross-border dollar debt as a percentage of GDP, FOS to the share of foreign ownership in local currency sovereign bond markets, and INV to the share of dollar invoicing in exports.8 Each structural indicator is measured in qualitative terms, separating the countries into two groups, with above- or below-average shares.9

Higher dollar debt and higher foreign ownership should increase the sensitivity of EMEs' GDP to global credit conditions and hence to the dollar, while greater dollar invoicing should weaken the trade channel. To the extent that these mechanisms are at play, the three indicators would strengthen the negative effect of dollar appreciation on GaR, implying that the coefficients on each interaction term would be negative. To test this hypothesis, we estimate equation (2) by first including the indicators separately and then jointly. For the sake of brevity and presentability, we report results only for GaR over four quarters (Table 1).

The estimation results underscore the importance of financial channels of dollar transmission. High foreign ownership is consistently associated with a significantly higher negative effect of dollar appreciation on GaR (second, fourth and fifth columns). Likewise, once the effect of foreign ownership is accounted for, high dollar debt is associated with a significantly higher negative impact of dollar appreciation on EME growth (fourth and fifth columns). By contrast, the extent of dollar invoicing does not appear to have a statistically significant effect (third and fifth columns), thus indicating that the role of the invoicing channel is small.

Conclusions

Our analysis suggests that the broad dollar exchange rate is an important risk factor for EMEs' growth. Dollar strength is followed by significantly weaker EME growth on average and lower GaR. Our findings further suggest that the dollar affects EMEs through financial channels. This is linked to the shallowness of EME financial markets, as reflected in high dollar debt and high foreign ownership in local currency bond markets.

The role of the dollar as an EME risk factor has also been on display since the outbreak of the Covid-19 pandemic. In the wake of the first wave of the pandemic, the US dollar initially appreciated on a broad basis by almost 10% in the first three months of the year, accompanied by record bond portfolio outflows from EMEs and sharply widening EME bond spreads. Subsequently, when the pandemic situation eased in the summer, the dollar depreciated and bond portfolio flows and spreads normalised.

Going forward, the outlook of prolonged low interest rates across all major AEs implies an environment of ample global liquidity amid high economic uncertainty. This combination could also be associated with wide swings in the broad dollar exchange rate, with the potential to affect EMEs' GaR.

References

Adrian, T, F Grinberg, N Liang and S Malik (2018): "The term structure of growth-at-risk", IMF Working Papers, no 18/180, August.

Aikman, D, J Bridges, S Hoke, C O'Neill and A Raja (2019): "Credit, capital and crises: a GDP-at-risk approach", Bank of England, Staff Working Papers, no 824, September.

Arslanalp, S and T Tsuda (2014): "Tracking global demand for emerging market sovereign debt", IMF Working Papers, no 14/39, March.

Avdjiev, S, V Bruno, C Koch and H S Shin (2019a): "The dollar exchange rate as a global risk factor: evidence from investment", BIS Working Papers, no 695, January.

Avdjiev, S, W Du, C Koch and H S Shin (2019b): "The dollar, bank leverage, and deviations from covered interest parity", American Economic Review: Insights, vol 1, no 2, September, pp 193-208.

Boz, E, C Casas, G Georgiadis, G Gopinath, H Le Mezo, A Mehl and T Nguyen (2020): "Patterns in invoicing currency in global trade", IMF Working Papers, no 20/126, July.

Bruno, V, S-J Kim and H S Shin (2018): "Exchange rates and the working capital channel of trade fluctuations", American Economic Review, Papers and Proceedings, vol 108, May, pp 531-6.

Bruno, V and H S Shin (2015): "Cross-border banking and global liquidity", Review of Economic Studies, vol 82, no 2, April, pp 535-64.

Committee on the Global Financial System (2014): "Trade finance: developments and issues", CGFS Papers, no 50, January.

----- (2019): "Establishing viable capital markets", CGFS Papers, no 62, January.

Driscoll, J and A Kraay (1998): "Consistent covariance matrix estimation with spatially dependent panel data", Review of Economics and Statistics, vol 80, no 4, November, pp 549-60.

Erik, B, M Lombardi, D Mihaljek and H S Shin (2020): "The dollar, bank leverage and real economic activity: an evolving relationship", BIS Working Papers, no 847, March.

Gopinath, G (2015): "The international price system", in proceedings of the Federal Reserve Bank of Kansas City Jackson Hole Symposium, August.

Gopinath, G, E Boz, C Casas, F Diez, P-O Gourinchas and M Plagborg-Møller (2020): "Dominant currency paradigm", American Economic Review, vol 110, no 3, March,pp 677-719.

Hofmann, B, I Shim and H S Shin (2020): "EME bond markets and the dollar", Bank for International Settlements, mimeo.

Jordà, Ò (2005): "Estimation and inference of impulse responses by local projections", American Economic Review, vol 95, no 1, March, pp 161-82.

Shin, H S (2016): "The bank/capital markets nexus goes global", speech at the London School of Economics and Political Science, 15 November.

----- (2019): "In search of a global risk factor: case of the dollar index", speech at the ECB colloquium in honour of Benoît Cœuré, Frankfurt am Main, 18 December.

Shousha, S (2019): "The dollar and emerging market economies: financial vulnerabilities meet the international trade system", Board of Governors of the Federal Reserve System, International Finance Discussion Papers, no 1258, October.

Upper, C and M Valli (2016): "Emerging derivatives markets?", BIS Quarterly Review, December, pp 67-80.

1 The authors would like to thank Claudio Borio, Stijn Claessens, Catherine Koch, Aaron Mehrotra, Benoît Mojon, José María Serena, Hyun Song Shin, Vlad Sushko, Nikola Tarashev and Agustín Villar for helpful comments. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 The scope for hedging exchange rate risk through financial derivatives is much more limited in EMEs as FX derivatives markets in EME currencies are much smaller than those for AE currencies (Upper and Valli (2016), CGFS (2019)).

3 For the full list of EMEs, see Graph 1.

4 The regressions are set up as local linear projections following Jordà (2005).

5 Following Aikman et al (2019), we calculated stock market volatility as the quarterly average of the realised daily stock price volatility and three-year credit growth as the three-year change in the non-financial private sector debt-to-GDP ratio.

6 The effects obtained for the linear model are similar to those found by Shousha (2019) based on a vector autoregression.

7 In order to control for macro-financial developments in the respective safe haven currency economy, we add the respective real GDP growth, inflation, business cycle indicator and changes in short- and long-term bond yields.

8 FXD is measured as non-banks' total cross-border US dollar-denominated liabilities (bank loans and debt securities) as a percentage of GDP taken from the BIS locational banking statistics and global liquidity indicators. FOS is the share of central government debt securities denominated in local currency held by foreign investors, estimated by Arslanalp and Tsuda (2014). INV is the percentage of exports invoiced in the US dollar (Boz et al (2020)). The variables that are interacting with the dollar in equation (2) are also included directly in the regressions in the set of control variables, so as to avoid the interaction terms picking up any direct effects of the variables.

9 More precisely, each structural indicator is condensed into a dummy variable, reflecting the average levels of the indicator variables across countries with available data over the period. The dummy variables take on the value 1 when the average level over the sample period of the respective share in a country was equal to or higher than the cross-country median, and 0 otherwise.