The global picture of non-bank financial intermediation from FSB data

Non-bank financial intermediation provides additional sources of financing for households and corporates. But it can also contribute to systemic risks through links with the banking system. In the wake of the Great Financial Crisis, G20 leaders requested that the Financial Stability Board (FSB) develop recommendations to strengthen the oversight and regulation of "shadow banking".

The framework developed in response includes the monitoring of non-bank financial intermediation. Findings are reported annually to provide a global picture of the size and growth of non-bank financial institutions (NBFIs), as well as their links with other parts of the financial system.

The framework developed in response includes the monitoring of non-bank financial intermediation. Findings are reported annually to provide a global picture of the size and growth of non-bank financial institutions (NBFIs), as well as their links with other parts of the financial system. Compared with the BIS international banking statistics, FSB data have a broader coverage of NBFIs' domestic and cross-border counterparties - including non-banks - but cover fewer jurisdictions and have no counterparty country breakdown.

Compared with the BIS international banking statistics, FSB data have a broader coverage of NBFIs' domestic and cross-border counterparties - including non-banks - but cover fewer jurisdictions and have no counterparty country breakdown.

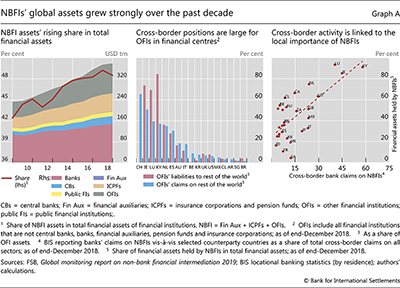

The growth of NBFI assets exceeded that of bank assets over the past decade, reaching 48% of total financial assets at end-2018, from 42% at end-2008 (Graph A, left-hand panel). As of end-2018, the combined assets of NBFIs - consisting mostly of insurance companies, pension funds and other financial intermediaries (OFIs) - stood at $184 trillion, versus $148 trillion for banks.

- stood at $184 trillion, versus $148 trillion for banks.

The importance of OFIs' cross-border positions relative to local positions varies across jurisdictions. Although financial centres have larger cross-border links, OFIs in most jurisdictions report cross-border links representing less than 20% of their assets (Graph A, centre panel).

The bigger the role of NBFIs in the financial system of a given jurisdiction, the bigger their share in banks' cross-border claims on that jurisdiction. The right-hand panel of Graph A illustrates this point by measuring the NBFIs' role with the ratio of their financial assets under management to total financial assets within a jurisdiction. Financial centres stand out, with relatively large NBFI sectors that have strong cross-border links with banks (upper right-hand corner).

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  FSB (2011). In October 2018, the FSB replaced the term "shadow banking" with "non-bank financial intermediation".

FSB (2011). In October 2018, the FSB replaced the term "shadow banking" with "non-bank financial intermediation".  The 2019 report covers data up to end-2018 from 29 jurisdictions, which together represent over 80% of global GDP; see FSB (2020).

The 2019 report covers data up to end-2018 from 29 jurisdictions, which together represent over 80% of global GDP; see FSB (2020).  OFIs include central counterparties, finance companies, hedge funds, money market funds and other investment funds.

OFIs include central counterparties, finance companies, hedge funds, money market funds and other investment funds.