Foreign currency funding of real investors in Asia-Pacific commercial real estate

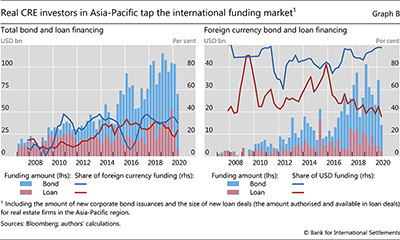

Financial investors in commercial real estate (CRE) markets play a greater role than suggested by their share in cross-border or domestic deals. This is because even domestic real investors, eg property developers, fund a large share of their transactions in international financial markets. FX bank and bond financing by real CRE investors in Asia-Pacific rose to a third of their total funding in 2019, equivalent to $30 billion per quarter (Graph B, left-hand panel).

Real CRE investors in the Asia-Pacific region obtain most of their FX funding by issuing US dollar-denominated bonds (Graph B, right-hand panel). In particular, regional property developers have found it cheaper to borrow in US dollars in offshore bond markets. However, foreign currency funding can be fragile, as it is frequently of short duration, Indeed, the total amount of offshore US dollar bond issuances by Chinese property developers fell by 8.2% to $25.8 billion in Q1 2020, as compared with Q1 2019, and further dropped to $5.5 billion in Q2 2020, representing a year-on-year decrease of 74.8%. The number of new bond issuances also fell by 60.7% in Q2 2020 compared with Q2 2019. Finally, in the first half of 2020, Chinese property developers tended to issue offshore bonds with shorter tenors, suggesting that the drop in issuance was at least partly supply-driven due to tighter international funding conditions.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.