Banks through Covid-19

The Covid-19 crisis raised significant challenges for both banks and prudential authorities. There was high uncertainty about how economic activity would be affected and whether banks could weather the potential losses as businesses closed, either temporarily or permanently. Banks have so far proved to be a source of stability, remaining resilient while supporting the economy. Nevertheless, equity valuations remain depressed, credit rating outlooks are largely negative, and pockets of weakness and risk exist.

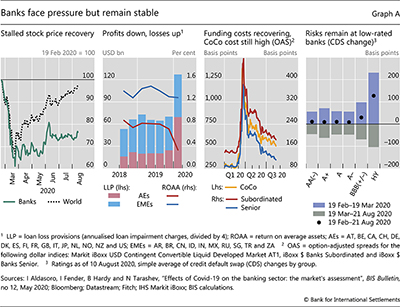

Bank stock prices plummeted along with those of other industries as the crisis unfolded. Thereafter, they largely moved sideways, remaining well below global stock prices and below their own pre-crisis levels (Graph A, first panel). Similarly, price-to-book ratios fell, stabilising around 1 on average for banks outside Europe. Less profitable banks in Europe and Japan had ratios below 1 pre-crisis and saw them deteriorate further thereafter.

Thereafter, they largely moved sideways, remaining well below global stock prices and below their own pre-crisis levels (Graph A, first panel). Similarly, price-to-book ratios fell, stabilising around 1 on average for banks outside Europe. Less profitable banks in Europe and Japan had ratios below 1 pre-crisis and saw them deteriorate further thereafter.

Why have equity investors responded so negatively to banks? The sector has seen losses accumulate, with loan loss provisions for advanced economy banks increasing by $45 billion (182%) between Q4 2019 and Q1 2020 (Graph A, second panel). Consequently, their profits in Q1 2020 fell considerably, adding to the woes of many that were already suffering from low profitability. These trends are likely to have continued in Q2, in part owing to strong monetary policy accommodation that compressed net interest margins. Restrictions on capital payouts have further dampened investors' appetite for bank equity. Global banks have seen a recent spike in so-called level 3 assets, whose opaqueness is likely to be weighing down on valuations.

Consequently, their profits in Q1 2020 fell considerably, adding to the woes of many that were already suffering from low profitability. These trends are likely to have continued in Q2, in part owing to strong monetary policy accommodation that compressed net interest margins. Restrictions on capital payouts have further dampened investors' appetite for bank equity. Global banks have seen a recent spike in so-called level 3 assets, whose opaqueness is likely to be weighing down on valuations.

Despite these stresses, banks have remained resilient so far. Basel regulations implemented since the 2008 crisis obliged banks to increase their capital considerably, with the average Common Equity Tier 1 ratio rising from 10% in Q4 2010 to 14% in Q4 2019. Banks thus entered the current crisis well positioned to absorb losses. Because of this strength, authorities turned to them as part of the solution to the economic downturn rather than as part of the problem. They reduced regulatory buffer requirements in some jurisdictions and, more generally, encouraged the use of liquidity and capital buffers to support the flow of credit. Efforts to preserve bank capital during the pandemic, eg capital distribution restrictions, while not welcomed by equity investors, were valued by debt investors for the safety provided. On the back of robust monetary policy support and a generally positive sentiment in debt markets, bank funding costs have largely recovered since late March, in contrast to the flagging stock price (Graph A, third panel). Spreads for Additional Tier 1 instruments, such as contingent convertible bonds (CoCos) used mainly by European banks, were an exception. They are still nearly double their pre-Covid levels, reflecting concerns over possible coupon cancellations from payout restrictions.

Efforts to preserve bank capital during the pandemic, eg capital distribution restrictions, while not welcomed by equity investors, were valued by debt investors for the safety provided. On the back of robust monetary policy support and a generally positive sentiment in debt markets, bank funding costs have largely recovered since late March, in contrast to the flagging stock price (Graph A, third panel). Spreads for Additional Tier 1 instruments, such as contingent convertible bonds (CoCos) used mainly by European banks, were an exception. They are still nearly double their pre-Covid levels, reflecting concerns over possible coupon cancellations from payout restrictions.

That said, vulnerabilities remain. Credit rating outlooks for banks are still generally negative. Credit default swap (CDS) spreads for BBB-rated and high-yield banks in particular have remained elevated, on average 30 and 127 basis points above their pre-Covid positions, respectively (Graph A, fourth panel). The concern in CDS markets over lower-rated banks underscores the value of a cautious approach to bank capital amid uncertainty about the evolution of the pandemic and the underlying quality of banks' assets. The full extent of economic damage from the pandemic will play out in the longer term, and losses may take time to fully materialise. These losses could be larger for more opaque assets, whose true value and risk are more uncertain.

Credit default swap (CDS) spreads for BBB-rated and high-yield banks in particular have remained elevated, on average 30 and 127 basis points above their pre-Covid positions, respectively (Graph A, fourth panel). The concern in CDS markets over lower-rated banks underscores the value of a cautious approach to bank capital amid uncertainty about the evolution of the pandemic and the underlying quality of banks' assets. The full extent of economic damage from the pandemic will play out in the longer term, and losses may take time to fully materialise. These losses could be larger for more opaque assets, whose true value and risk are more uncertain.

The views expressed are those of the author and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the author and do not necessarily reflect the views of the Bank for International Settlements.  See I Aldasoro, I Fender, B Hardy and N Tarashev, "Effects of Covid-19 on the banking sector: the market's assessment", BIS Bulletin, no 12, May 2020.

See I Aldasoro, I Fender, B Hardy and N Tarashev, "Effects of Covid-19 on the banking sector: the market's assessment", BIS Bulletin, no 12, May 2020.  This is despite regulators encouraging banks to take a longer view when accounting for losses from the immediate stress.

This is despite regulators encouraging banks to take a longer view when accounting for losses from the immediate stress.  Level 3 assets are banks' most illiquid holdings, resulting in little market/external data to guide valuations and leaving banks to value them based on their own internal experience and methodology. See D Griffin and Y Onaran, "Big banks sit on $250 billion of murkiest trades after Covid", Bloomberg, 19 August 2020.

Level 3 assets are banks' most illiquid holdings, resulting in little market/external data to guide valuations and leaving banks to value them based on their own internal experience and methodology. See D Griffin and Y Onaran, "Big banks sit on $250 billion of murkiest trades after Covid", Bloomberg, 19 August 2020.  See C Borio, "The prudential response to the Covid-19 crisis", speech on the occasion of the BIS Annual General Meeting, 30 June 2020.

See C Borio, "The prudential response to the Covid-19 crisis", speech on the occasion of the BIS Annual General Meeting, 30 June 2020.