Covid-19 and SARS: what do stock markets tell us?

The rapid spread of Covid-19 since mid-January invariably brings up a comparison with the early 2003 outbreak of severe acute respiratory syndrome (SARS). In this box, we provide a preliminary assessment of the relative impact of the Covid-19 and SARS epidemics on various economies through the lens of equity investors. An advantage of looking at the stock markets of different countries is that equity valuations should encompass both the local and global risk factors that the investors view as important. Fluctuations in the global risk factor - gauged, for instance, through the returns on the MSCI Global index - may be driven by investors' concerns about the global economic fallout of a virus outbreak. Such fluctuations are likely to have a differential effect on each country's stock market performance; moreover, the magnitude of these effects is likely to have changed in the nearly two decades between the two epidemics.

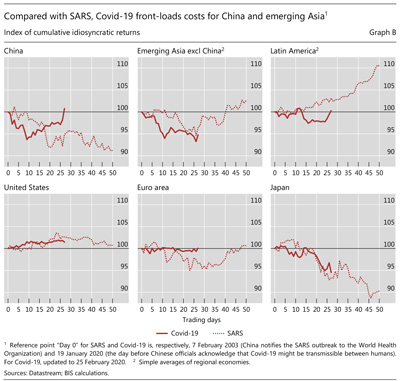

Nevertheless, we can calculate "idiosyncratic" stock returns, the portion of a country-specific stock return that is not explained by fluctuations in the global risk factor, as the residual from a regression of the country's returns on the returns on the MSCI Global index.

Nevertheless, we can calculate "idiosyncratic" stock returns, the portion of a country-specific stock return that is not explained by fluctuations in the global risk factor, as the residual from a regression of the country's returns on the returns on the MSCI Global index. The comparison of the idiosyncratic country-specific returns during periods in which the Covid-19 and SARS epidemics unfolded can thus provide a cleaner assessment of the relative fallouts from the two outbreaks across countries and time, at least as perceived by equity investors.

The comparison of the idiosyncratic country-specific returns during periods in which the Covid-19 and SARS epidemics unfolded can thus provide a cleaner assessment of the relative fallouts from the two outbreaks across countries and time, at least as perceived by equity investors.

According to this metric, the Covid-19 outbreak appears to have had an appreciably more front-loaded adverse effect on the Chinese stock market than the 2003 SARS epidemic (Graph B, first panel). Abstracting from the Chinese stock market's co-movement with the global market, Chinese equity valuations were down more than 5% after the 10th trading day following the news of the outbreak. In contrast, it took about 20 trading days for the Chinese market to incur such a loss during the SARS epidemic, as the very early phase of the outbreak saw a performance quite in line with the global MSCI. Part of this difference may be explained by the more forceful reaction of the Chinese authorities to the Covid-19 outbreak, which may have cued investors about the seriousness of the problem, whereas in the past this realisation took longer to be priced in. After the 10th trading day, Chinese stocks began to recoup their losses vis-à-vis the global market, while during the SARS epidemic losses continued to cumulate for a considerably longer period.

Emerging Asian stock markets outside China also suffered greater losses initially than during the SARS outbreak (second panel). This result is likely to reflect the increase in China's global economic imprint, and its greater integration in the world economy since the first epidemic, as well as the proximity of Asian economies to the epicentre of the Covid-19 outbreak. By the 20th trading day, however, the cumulative losses in those markets had roughly converged to those registered during the SARS epidemic. The average initial impact of the Covid-19 outbreak on the stock markets of emerging market economies in Latin America, again controlling for their co-movement with the global market, had been very muted and in line with that of the SARS epidemic (third panel). In early February, however, the performance of stock markets in Latin America deteriorated noticeably. This may be partly explained by investors' growing concerns that weak commodity prices are unlikely to recover soon, which would have a negative effect on those economies. Back in 2003, in contrast, commodity prices were in the early stages of a sustained rally that was interrupted only by the Great Financial Crisis of 2007-09.

Turning to advanced economies, the fallout on US and Japanese equities from the Covid-19 outbreak roughly paralleled that from SARS for the first 25 trading days following the news of the respective outbreaks (fourth and sixth panels). In contrast, the idiosyncratic performance of euro area stocks has thus far been slightly better than that registered during the comparable period of the SARS epidemic (fifth panel).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  The global risk factor should also reflect other features of the environment that were influencing stock market developments in different countries at different times. For example, the global economy during the SARS outbreak, which began in November 2002 and spread most rapidly between February and April 2003, was in a state of lingering weakness following the 2001 dotcom bust and the ensuing recession. The Covid-19 outbreak, by contrast, occurred during one of the longest economic expansions on record, with robust labour markets and solid consumer spending worldwide. The SARS epidemic also coincided with escalating political tensions that culminated in the Iraq war in mid-March 2003, a sequence of events that had its own effect on financial markets and the global economy. The Covid-19 outbreak, in contrast, is unfolding amid swings in trade-related tensions that have had a significant effect on stock markets throughout the world.

The global risk factor should also reflect other features of the environment that were influencing stock market developments in different countries at different times. For example, the global economy during the SARS outbreak, which began in November 2002 and spread most rapidly between February and April 2003, was in a state of lingering weakness following the 2001 dotcom bust and the ensuing recession. The Covid-19 outbreak, by contrast, occurred during one of the longest economic expansions on record, with robust labour markets and solid consumer spending worldwide. The SARS epidemic also coincided with escalating political tensions that culminated in the Iraq war in mid-March 2003, a sequence of events that had its own effect on financial markets and the global economy. The Covid-19 outbreak, in contrast, is unfolding amid swings in trade-related tensions that have had a significant effect on stock markets throughout the world.  The regression is based on the capital asset pricing model (CAPM).

The regression is based on the capital asset pricing model (CAPM).