Costs and benefits of switching to central clearing

Why did trading in some derivatives migrate to central clearing, while staying with bilateral clearing for others? Among derivatives not subject to mandatory clearing, the rate of voluntary clearing differed substantially. In particular, the clearing rate for non-deliverable forwards (NDFs) was much lower than that for non-mandated credit default swaps (CDS). Such divergence can be explained, in part, by structural differences across the two products.

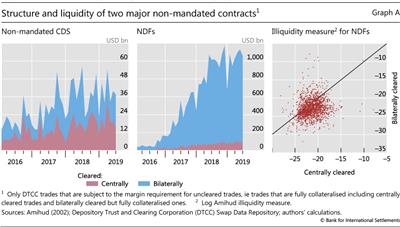

A substantial share of CDS trading has moved to central clearing over time, even in the absence of an official requirement. In June 2019, the monthly volume of centrally cleared CDS was, at $15 billion, comparable with the $23 billion of CDS that was cleared bilaterally each month (Graph A, left-hand panel). In comparison, the monthly volume of bilaterally cleared NDFs stood at $975 billion in June 2019, dwarfing that of centrally cleared NDFs (centre panel).

The decision to switch from bilateral to central clearing depends on a cost-benefit analysis that takes account of several elements. Among the potential benefits, lower capital or margin requirements certainly play a role, but so does the comparative ease of trade, or trading liquidity, in the bilaterally cleared and centrally cleared venues. These benefits vary across products, meaning that migration to central clearing might be cost-effective for some but not for others.

First, gains from margin netting in central clearing are higher if similar products are subject to clearing mandates. The reason is that CCPs generally allow for netting within the same asset class and initial margin is calculated at the portfolio level. Unlike NDFs, standardised CDS contracts are subject to the central clearing mandate, and non-mandated CDS can benefit from margin netting under central clearing.

Second, CDS generally have longer maturities than NDFs. Maturity is a key determinant of margin requirements for uncleared products. It is often less than one year for NDFs and typically five years for CDS. All else equal, the longer the maturity, the higher the margin requirement. Given the multilateral netting benefits of central clearing, the potential for margin reduction is greater for CDS than for NDFs.

Third, significantly lower liquidity in centrally cleared markets can reduce the incentive to switch away from bilaterally cleared venues. Coordination among traders plays an important role in this instance, because liquidity in centrally cleared markets could improve rapidly if enough traders opted out of bilateral clearing at the same time. Such coordination can be difficult to achieve when other advantages from switching, such as gains from netting, are small. For NDFs, the relatively small margin netting benefits provided little incentive for enough traders to migrate, and liquidity remained concentrated in bilaterally cleared markets, further discouraging migration to centrally cleared venues (Graph A, right-hand panel).

For a discussion of the effect of counterparty credit risk on traders' decisions to clear through CCPs rather than bilaterally, see P Fiedor, "Clearinghouse-Five: determinants of voluntary clearing in European derivatives markets", European Systemic Risk Board, ESRB Working Paper Series, no 72, March 2018; M Bellia, R Panzica, L Pelizzon and T Peltonen, "The demand for central clearing: to clear or not to clear, that is the question", European Systemic Risk Board, ESRB Working Paper Series, no 62, December 2017.

For a discussion of the effect of counterparty credit risk on traders' decisions to clear through CCPs rather than bilaterally, see P Fiedor, "Clearinghouse-Five: determinants of voluntary clearing in European derivatives markets", European Systemic Risk Board, ESRB Working Paper Series, no 72, March 2018; M Bellia, R Panzica, L Pelizzon and T Peltonen, "The demand for central clearing: to clear or not to clear, that is the question", European Systemic Risk Board, ESRB Working Paper Series, no 62, December 2017.