Households' cross-border deposits

During the last few years, households' cross-border assets have received increased attention. Most of the research and discussion has revolved around the hidden wealth in offshore financial centres (Alstadsæter et al (2018), Zucman (2013)). The newly available data on cross-border bank positions vis-à- vis households in the locational banking statistics (LBS) offer additional insight into the nature of households' cross-border deposits. They can be combined with immigration statistics to help identify cross-border deposits linked to non-resident nationals making deposits with banks back home.

Households (including non-profit institutions serving households) have a limited presence in banks' international operations. At end-March 2019, they accounted for only 4% of BIS reporting banks' cross-border claims on non-banks and 14% of banks' cross-border liabilities to non-banks. Banks in Switzerland are an exception: foreign households accounted for 20% of their cross-border claims on non-banks and 51% of their cross-border liabilities to non-banks. Banks in Switzerland were the largest recipients of cross-border household deposits ($227 billion as of end-March 2019), accounting for 30% of the reported total (LBS).

Banks in Switzerland are an exception: foreign households accounted for 20% of their cross-border claims on non-banks and 51% of their cross-border liabilities to non-banks. Banks in Switzerland were the largest recipients of cross-border household deposits ($227 billion as of end-March 2019), accounting for 30% of the reported total (LBS).

A significant share of households' cross-border deposits are placed in banks located in emerging market economies (EMEs), largely denominated in the domestic currency of the respective EME. Foreign households also have deposits in countries with relatively high tax rates (eg Austria, Denmark, France, Sweden). With the newly available statistics (including unpublished bilateral data), we examine how the location of non-resident nationals can explain the geographical distribution of households' cross-border deposits with banks.

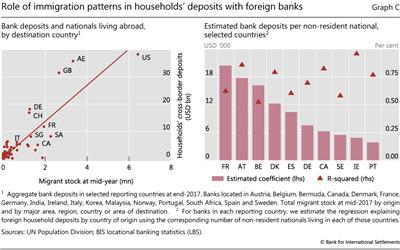

Deposits from households are strongly correlated with migrant numbers (Graph C, left-hand panel). For each bank location, we estimate the relationship between the number of non-resident nationals in a given destination country and the corresponding stock of cross-border household deposits from that country (right-hand panel). Results show that, for most countries, immigration patterns can explain the geographical distribution of cross-border deposits from households. The estimated coefficients are highly significant, and can be interpreted as the amount of deposits per non-resident national living abroad deposited with banks back home. Estimates range from around $4,000 for Portuguese nationals living abroad to around $20,000 for non-resident French nationals.

Figure computed for the sample of 31 countries that report the encouraged non-financial sector breakdowns for banks' domestic positions in the LBS.

Figure computed for the sample of 31 countries that report the encouraged non-financial sector breakdowns for banks' domestic positions in the LBS.