Structured finance then and now: a comparison of CDOs and CLOs

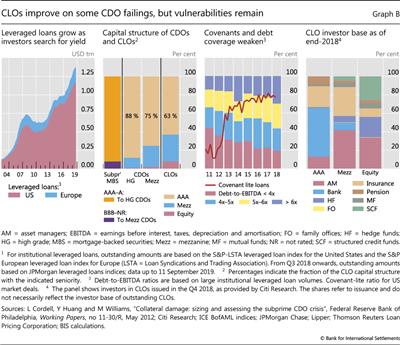

Collateralised debt obligations (CDOs) that invested in subprime mortgage-backed securities (MBS) were at the centre of the Great Financial Crisis (GFC). The issuance of subprime CDOs ceased after the GFC, but other forms of securitisation have grown substantially - in particular, collateralised loan obligations (CLOs). CLOs invest mainly in leveraged loans, ie bank loans to firms that are highly indebted, have high debt service costs relative to earnings and are typically rated below investment grade. The leveraged loan market has surged in recent years to roughly $1.4 trillion outstanding, of which about $200 billion is denominated in euros and the rest in US dollars (Graph B, first panel). This rapid expansion has been accompanied by the securitisation of leveraged loans into CLOs. As of June 2019, over 50% of outstanding leveraged loans in US dollars and about 60% of those in euros had been securitised through CLOs.

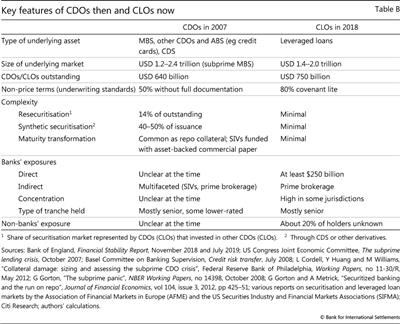

The rapid growth of leveraged finance and CLOs has parallels with developments in the US subprime mortgage market and CDOs during the run-up to the GFC. We examine the CLO market in light of that earlier experience. There are significant differences between the CLO market today and the CDO market prior to the GFC: CLOs are less complex, avoiding the use of credit default swaps (CDS) and resecuritisations; they are little used as collateral in repo transactions; and they are less commonly funded by short-term borrowing than was the case for CDOs. In addition, there is better information about the direct exposures of banks. That said, there are also similarities between the CLO market today and the CDO market then, including some that could give rise to financial distress. These include the deteriorating credit quality of CLOs' underlying assets; the opacity of indirect exposures; the high concentration of banks' direct holdings; and the uncertain resilience of senior tranches, which depend crucially on the correlation of losses among underlying loans. Table B contrasts the key features of the CDO and CLO markets, which are further elaborated below.

Complexity

CDOs and CLOs are asset-backed securities (ABS) that invest in pools of illiquid assets and convert them into marketable securities. They are structured in tranches, which have different priorities in terms of the cash flows from the underlying assets. The most junior or so-called equity tranche is often unrated and earns the highest yields, but is the first to absorb credit losses. The most senior tranche, which is often rated AAA, receives the lowest yields but is the last to absorb losses. In between are mezzanine tranches, usually rated from BB to AA, which start to absorb credit losses once the equity tranche is wiped out. The larger the share of junior tranches in the capital structure of the pool, the more protected the senior tranche (for a given level of portfolio credit risk).

CLOs are backed by simpler, more diversified pools of collateral than CDOs. CDOs issued in the run-up to the GFC consisted mainly of subprime MBS, and CDOs backed by other CDOs (so called CDO squared) were common. In 2006, almost 70% of the collateral of newly issued CDOs corresponded to subprime MBS, and a further 15% was backed by other CDOs. Furthermore, more than 40% of the collateral gathered by the CDOs issued that year was not cash MBS, but CDS written on such securities. When conditions in the housing market turned, the complexity and opacity of CDOs amplified financial stress. In contrast, CLOs are much less complex. Their collateral is diversified across firms and sectors, and the known incidence of synthetic collateral or resecuritisations is minimal.

When conditions in the housing market turned, the complexity and opacity of CDOs amplified financial stress. In contrast, CLOs are much less complex. Their collateral is diversified across firms and sectors, and the known incidence of synthetic collateral or resecuritisations is minimal.

Default risk and loss correlation risk

Senior CLO tranches currently appear to benefit from larger loss-absorbing cushions than existed for CDOs. Equity and, in particular, mezzanine tranches make up larger shares of the capital structure of CLOs than they did for pre-crisis subprime CDOs (Graph B, second panel). However, the actual protection afforded to senior tranches depends crucially on their sensitivity to default risk and, importantly, loss correlation risk.

Default risk and losses-given-default depend on the quality of the underlying assets. For both CDOs and CLOs, strong investor demand led to a deterioration in underwriting standards. For example, US subprime mortgages without full documentation of borrowers' income increased from about 28% in 2001 to more than 50% in 2006. Likewise, leveraged loans without maintenance covenants increased from 20% in 2012 to 80% in 2018 (Graph B, third panel). In recent years, the share of low-rated (B-) leveraged loans in CLOs has nearly doubled to 18%, and the debt- to-earnings ratio of leveraged borrowers has risen steadily. Weak underwriting standards reduce the likelihood of defaults in the short run but increase the potential credit losses when a default eventually occurs.

For CDOs, losses were exacerbated by the sensitivity of the structures to correlation risk. The underlying collateral was poorly diversified, disproportionally consisting of low-rated tranches of subprime MBS (BBB and lower). Such strong demand for low-rated MBS led to a growing reliance on synthetic exposures through CDS and resecuritisation through CDO-squared vehicles, as discussed above. As a result, a large share of CDO payoffs were driven by a relatively small outstanding supply of low-quality securities. When housing prices fell and defaults on subprime mortgages mounted, returns on CDO mezzanine and senior tranches proved to be more highly correlated with the losses on equity tranches than many investors had expected.

Uncertainty about loss correlations is less acute for CLOs, yet remains a risk. Given the relative simplicity of these vehicles and the long history of defaults on high-yield corporate debt, loss correlations for leveraged loans (and thus CLOs) can in principle be estimated with more confidence than for subprime mortgages. However, the unusually high share of deals with low investor protection could materially affect the timing and clustering of defaults, compromising the reliability of these estimations.

Banks' exposure

When CDOs experienced losses, the eventual distress was worsened by opacity about banks' total exposures. Pre-crisis, banks retained mostly senior exposures, either directly or through structured investment vehicles (SIVs), off-balance sheet entities where banks collected exposure to CDOs, and other securitised products. Sometimes, as investor demand for CDO mezzanine tranches swelled, banks ended up holding the senior tranches for which there was less demand. In other cases, banks became exposed to subprime BBB risk, as they "warehoused" the securities while the portfolio of MBS tranches was gathered by CDO managers. The SIVs, purportedly separate from their sponsoring banks, engaged in maturity transformation by funding themselves mainly in the short-term wholesale markets, making themselves susceptible to liquidity runs. Banks' indirect exposure through SIVs was underestimated by investors at the time, and banks' total exposure to CDOs before the GFC was hard to gauge accurately.

Currently, banks' exposure to CLOs is less opaque. Banks still hold mostly AAA tranches (Graph B, fourth panel), but these are recognised on their balance sheets and there is no indirect exposure through SIVs. That said, banks may have other indirect exposures (see below). Moreover, among banks the concentration of CLO holdings is high. US and Japanese banks are among the largest investors. Relatively few institutions account for the majority of banks' holdings, and in some cases holdings are large relative to capital.

Relatively few institutions account for the majority of banks' holdings, and in some cases holdings are large relative to capital.

Spillover risks

Non-bank investors, such as hedge funds and insurance companies, are also major investors in CLOs, as they were in CDOs before the GFC. Ownership is more difficult to trace for non-bank investors than for banks. If non-bank investors were to experience losses on their CLO holdings, banks might be indirectly exposed. In particular, banks might be connected to those investors through legal and reputational ties, credit facilities or prime brokerage services. "Synthetic" prime brokerage, where hedge funds obtain leverage through derivatives with banks as counterparties, has grown rapidly in recent years. It also entails lower regulatory capital charges. Like banks' off-balance sheet exposure to CDOs, which was a source of instability in 2007, banks' prime brokerage exposure to CLO holders could result in larger losses than implied by direct exposures, creating heightened financial stress.

It also entails lower regulatory capital charges. Like banks' off-balance sheet exposure to CDOs, which was a source of instability in 2007, banks' prime brokerage exposure to CLO holders could result in larger losses than implied by direct exposures, creating heightened financial stress.

Additional spillovers could arise from disruptions in market liquidity. Since the GFC, assets managed by fixed income mutual funds, including bank loan funds, have increased substantially. Investment funds offering daily redemption of shares hold as much as 3% of their assets in CLOs. At times of market distress, investors may rush to redeem their shares, quickly depleting the liquidity buffers held by such funds. This rush could result in fire sales and large price volatility, imposing mark-to-market losses on other intermediaries. Price volatility could also disrupt short-term funding collateralised by CLOs, similarly to the "run on repo" in 2007. However, the use of CLOs as repo collateral appears minimal today, in contrast to the more widespread use of CDOs or MBS in the past.

See L Cordell, Y Huang and M Williams, "Collateral damage: sizing and assessing the subprime CDO crisis", Federal Reserve Bank of Philadelphia, Working Papers, no 11-30/R, May 2012. CDOs sold CDS to investors in exchange for a payment replicating the return on the insured MBS.

See L Cordell, Y Huang and M Williams, "Collateral damage: sizing and assessing the subprime CDO crisis", Federal Reserve Bank of Philadelphia, Working Papers, no 11-30/R, May 2012. CDOs sold CDS to investors in exchange for a payment replicating the return on the insured MBS.  Fitch Ratings, "Leveraged loans & CLOs in financial institutions", August 2019.

Fitch Ratings, "Leveraged loans & CLOs in financial institutions", August 2019.  Essentially, prime brokers swap with a hedge fund the return on some reference financial asset in exchange for a financing rate.

Essentially, prime brokers swap with a hedge fund the return on some reference financial asset in exchange for a financing rate.