The importance of small cross-border banking links for emerging market economies

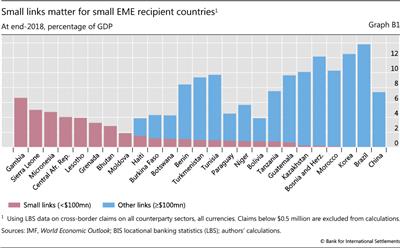

While small links - smaller than $100 million in size - account for a minor share of the total volume of cross-border credit, they account for a significant share of credit to borrowers in many emerging market economies (EMEs). For example, cross-border credit to borrowers in Gambia and Sierra Leone is entirely through small links (Graph B1). But small links are not equally important for all EMEs. For the largest, such as Brazil and China, small links are negligible.

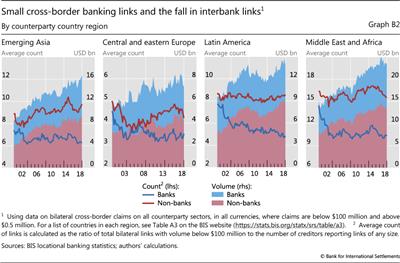

The volume of lending to EMEs associated with small cross-border relationships has increased steadily over the past two decades. This trend is evident for lending to both the non-bank and the bank sector (Graph B2). However, volumes disguise a fall in the average number of small bilateral links between banks and borrowers in EMEs. The only exception is non-bank borrowing in emerging Asia, which saw an increase in the average number of country-to-country links. Since 2014, the average number of interbank bilateral links has been declining for many EMEs, particularly in the Middle East and Africa and in emerging Asia. The decline in correspondent banking relationships in recent years may have contributed to the fall in the number of small bilateral links (CPMI (2019)).