Analysing bilateral country links using the BIS international banking statistics

The BIS international banking statistics (IBS) are collected by national authorities at the bank level but reported to the BIS at the country level; all banks in a given reporting country are aggregated together. Therefore, the IBS measure country-to-country links but do not measure the much larger number of bilateral links between individual banks and borrowers. At end-2018, the locational banking statistics (LBS) captured the positions of more than 8,000 banks, reported as 47 country aggregates. Banks reported their positions against borrowers in more than 215 countries, resulting in 5,927 country-to-country links. Many of these links are for insignificant amounts of less than $0.5 million. Excluding these small links results in 4,822 links greater than $0.5 million.

The LBS include intragroup business and measure the geographical concentration of cross-border business. For example, a US bank might route its cross-border business via a financial centre such as London, resulting in two links: from the United States to the United Kingdom, and from the United Kingdom to the country where the final borrower resides. Therefore, the LBS potentially underestimate concentration of bank creditors because the same banking group may operate in different countries at the same time. The BIS consolidated banking statistics (CBS) take a nationality perspective and consolidate the worldwide claims of a given banking group to the country where it is headquartered.

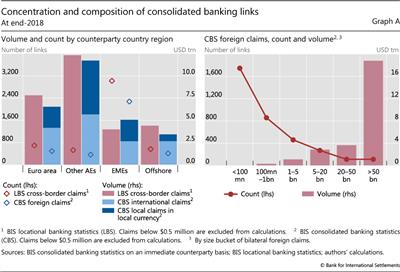

Not surprisingly, the number of links is much higher in the LBS than the CBS: 4,822 versus 3,550 at end-2018 (Graph A, left- hand panel). In part, this is due to differences in the number of reporting countries: 47 in the LBS, compared with 31 in the CBS. But the different reporting concepts of the LBS and the CBS mean that they cover different elements of international banking links. The CBS, by definition, do not contain claims between affiliates of the same banking group. The CBS, however, include credit extended locally by a foreign office of a given banking group. They distinguish between international claims (cross-border and local claims in foreign currency) and local claims in local currency. Internationally active banking groups tend to have large subsidiaries in advanced economies and in many major emerging market economies, reflected in a relatively high share of local claims in local currency.

In terms of how concentrated international banking is, the cross-border claims in the LBS and foreign claims in the CBS present a very similar picture (Graph A, right-hand panel; see also Graph 1, left-hand panel). The largest size group (>$50 billion) constitutes 3.1% of all consolidated links by number (versus 2.4% for LBS), which amount to 70% of all claims by volume (67% in the LBS). The smallest bilateral links (<$100 million) make up 49% of all consolidated links (50% for LBS) while they amount to only 0.1% of consolidated claims by volume (0.2% for LBS).