Private sector attempts to create credit-sensitive term benchmarks

(Extract from page 48 of BIS Quarterly Review, March 2019)

As part of its efforts to improve the LIBOR benchmark, and to bring it into line with IOSCO principles, the ICE Benchmark Administration (IBA) has set a list of objectives and introduced methodologies to produce a reformed LIBOR. In April 2018, the IBA announced that it intends to gradually shift the panel banks to the so-called waterfall methodology for computing LIBOR (ICE (2018a)). The key priorities are to: (i) base LIBOR on transactions to the greatest extent possible; (ii) expand the universe of eligible transactions to include wholesale funding from non-banks; and (iii) use techniques such as interpolation, plus expert judgment, to address gaps in eligible transactions. The IBA expects the transition to the new waterfall methodology to be completed by no later than the first quarter of 2019.

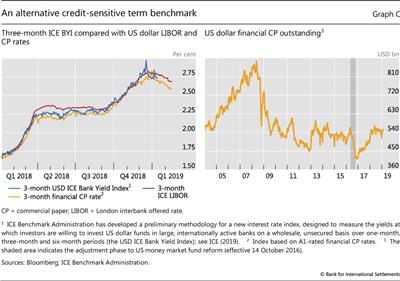

In January 2019, the IBA announced that it was exploring yet another credit-sensitive term benchmark particularly suitable for cash markets. Called the US Dollar ICE Bank Yield Index (BYI) (Graph C, left-hand panel), it seeks to measure the interest rates at which investors are willing to invest in the unsecured debt obligations of a broad set of large internationally active banks for a specified forward-looking tenor (ICE (2019)). The index is underpinned entirely by transaction data representing short-term, unsecured bank funding vehicles. The set of lenders that fund these instruments is broad, and includes central banks, governments, non- bank financials, sovereign wealth funds and non-financial corporates in order to maximise volumes. The instruments include unsecured term deposits, commercial paper (CP) and certificates of deposit (CDs).

This indicates that unsecured term funding still plays a pivotal role in bank balance sheets. It is mostly wholesale non-bank financials such as money market funds that invest in these short-term funding vehicles. For example, while the CP liabilities of US banks have declined from their pre-crisis peak, the long-term average hovers around $500 billion, which is comparable to the size of the market 15 years ago (Graph C, right-hand panel). More broadly, term deposits, CP and CDs still represent an important marginal source of term funding for banks.