SOFR and supply and demand conditions in collateral markets

(Extract from page 39 of BIS Quarterly Review, March 2019)

The secured overnight financing rate (SOFR) is based on secured overnight (O/N) transactions that reflect funding conditions in Treasury repo markets. To recall, a repo is a form of collateralised short-term loan, in which the cash borrower pledges a security as collateral while agreeing to repurchase it at a (typically) higher price at a future date. Historically, Treasury repos have served as an important source of funding for dealers in government securities, allowing them to raise cash in exchange for Treasuries pledged as collateral.

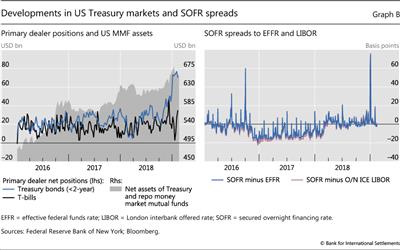

In normal times, repo rates tend to respond to the "cash" leg, ie the demand for, and supply of, funds against the collateral. However, this need not always be the case. For example, in flight-to-safety episodes when US Treasury collateral is in high demand, the collateral leg influences the cash leg, causing repo rates to fall. As a result, benchmarks based on repo rates, such as SOFR or the Swiss average overnight rate, will reflect the supply/demand conditions not only in funding markets, but also in markets for securities that serve as collateral. At times, this can cause the rates to diverge significantly and persistently from benchmarks based on unsecured rates. For example, SOFR was particularly compressed relative to the effective federal funds rate and O/N USD LIBOR from late 2016 to early 2018, in large part because of increased demand for Treasuries as balances shifted to government-only money market funds (MMFs) on the back of US MMF reform (Graph B). The spread then turned positive in Q1 2018 as the supply of Treasuries was boosted by higher securities issuance by the US government. The dynamics of SOFR spreads illustrate SOFR's sensitivity to supply/demand conditions in US Treasury markets.

The spread then turned positive in Q1 2018 as the supply of Treasuries was boosted by higher securities issuance by the US government. The dynamics of SOFR spreads illustrate SOFR's sensitivity to supply/demand conditions in US Treasury markets.

The pressure on the cash leg could also go in the opposite direction if there is a glut of collateral, rather than a scarcity. The spikes that SOFR exhibits around quarter-ends illustrate the point. These spikes reflect banks' balance sheet management around reporting dates for their exposures under the Basel III leverage ratio and surcharges for global systemically important banks. The spike at end- December 2018 is especially noteworthy (Graph B, right-hand panel). The magnitude was amplified because the US Treasury held additional auctions at year-end, a time when dealer balance sheets were particularly inelastic due to regulatory reporting, being already loaded with Treasury securities. Repo rates jumped as a result, reflecting the emergence of a premium for cash (discount for collateral) in secured funding markets, thus causing SOFR to jump.

The spike at end- December 2018 is especially noteworthy (Graph B, right-hand panel). The magnitude was amplified because the US Treasury held additional auctions at year-end, a time when dealer balance sheets were particularly inelastic due to regulatory reporting, being already loaded with Treasury securities. Repo rates jumped as a result, reflecting the emergence of a premium for cash (discount for collateral) in secured funding markets, thus causing SOFR to jump.

See Chen et al (2017) for a detailed quantitative assessment.

See Chen et al (2017) for a detailed quantitative assessment.  See eg CGFS (2017).

See eg CGFS (2017).