Measuring reliance on foreign bank credit

(Extract from pages 18-20 of BIS Quarterly Review, March 2019)

Foreign banks (ie those with headquarters outside the borrower's country of residence) have been prominent players in EMEs. Nevertheless, lack of comparable, complete data makes it difficult to measure how important a role they may play. This box discusses how the BIS banking and total credit data can be used to construct measures of foreign bank reliance, and what these measures capture.

Foreign bank participation rates

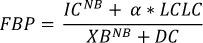

A first pass at a measure of foreign bank reliance, the foreign bank participation (FBP) rate, looks at the share of total credit from bank creditors provided by foreign banks (Ehlers and McGuire (2017), McGuire and Tarashev (2005)):

XBNB is cross-border bank credit to non-bank borrowers (from the BIS locational banking statistics). DC is domestic bank credit to non-bank borrowers (from the IMF International Financial Statistics). Thus, the denominator captures all credit provided by bank creditors, extended either locally or cross-border. The numerator is total foreign bank credit provided to non-banks in the economy (derived from the BIS consolidated banking statistics (CBS)), which comprises cross-border lending by foreign banks and local lending by the local affiliates of foreign banks. IC indicates international claims, which comprise cross-border credit and local credit extended in foreign currencies. LCLC is local credit extended in the local currency. The IC data are broken down by borrowing sector, allowing one to focus on, for instance, the non-bank sector, but LCLC does not include this sectoral counterparty breakdown in the time series. That breakdown is estimated by multiplying LCLC by α, the share of credit to non-banks in IC (Ehlers and McGuire (2017)).

Thus, the denominator captures all credit provided by bank creditors, extended either locally or cross-border. The numerator is total foreign bank credit provided to non-banks in the economy (derived from the BIS consolidated banking statistics (CBS)), which comprises cross-border lending by foreign banks and local lending by the local affiliates of foreign banks. IC indicates international claims, which comprise cross-border credit and local credit extended in foreign currencies. LCLC is local credit extended in the local currency. The IC data are broken down by borrowing sector, allowing one to focus on, for instance, the non-bank sector, but LCLC does not include this sectoral counterparty breakdown in the time series. That breakdown is estimated by multiplying LCLC by α, the share of credit to non-banks in IC (Ehlers and McGuire (2017)).

Foreign bank reliance

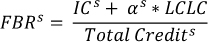

The FBP measure misses the important increase in bond financing and financing by non-bank creditors to emerging market borrowers in recent years (Aldasoro and Ehlers (2018), Avdjiev, Gambacorta, Goldberg and Schiaffi (2017)). Thus, a more comprehensive measure of credit in the denominator can more accurately capture the role of foreign banks in total credit provision. In 2013, the BIS began publishing series on total credit to the non-financial sector for individual countries (data extending to before 2013). These series capture credit extended in the form of currency and deposits, loans and debt securities from all lenders over a long time horizon (Dembiermont et al (2013), Dembiermont et al (2015)). These series allow us to estimate foreign bank reliance (FBR) as:

The s superscript indicates the borrowing sector, as both the CBS and total credit data permit decompositions by the borrowing sector (eg private non-financial sector or official sector). To estimate the sector split of LCLC, the ultimate risk (UR) data from the CBS are used, which break down total claims (IC + LCLC) by the borrowing sector. This may provide a more accurate estimate than applying the shares from IC, especially if LCLC is large relative to IC.

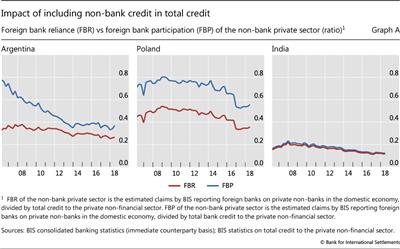

The inclusion of non-bank credit in the denominator makes a large difference for many EMEs (Graph A, left-hand and centre panels), but some still rely very little on bonds and other non-bank credit (Graph A, right-hand panel).

Role of the domestic financial sector

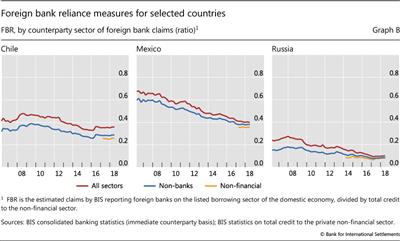

Foreign banks can provide credit directly to EME borrowers, either cross-border or via a local affiliate, or they can do so indirectly by lending to local banks or non-bank financials. Thus, examining credit from foreign banks directly to non-financial EME borrowers may underestimate the role of foreign banks in credit provision. However, including foreign bank claims on the domestic financial sector may also overstate the role of foreign banks if the financial sector in turn uses those funds to extend credit abroad. Alternative measures for the numerator shed light on the potential range of values for FBR: foreign bank claims on all sectors, foreign bank claims on the non-bank sector and foreign bank claims on the non-financial sector (Graph B). As it turns out, while including claims on banks in the numerator increases the FBR measure somewhat, non-bank financials do not contribute very much to the measure generally.

Besides the non-financial sector as a whole, it is useful to consider how reliant individual sectors of the economy (such as the private and official sectors) may be on foreign banks. Data to separate non-banks into financial and non-financial creditors are only available with recent enhancements to the BIS data. When disaggregating the borrower sector further, such as examining the private and official sectors, assumptions about the allocation of foreign bank credit lent indirectly through domestic banks become more tenuous. Thus, for those sectors it is safer to focus on a foreign bank reliance measure which is confined to direct credit provision.

DC corresponds to domestic claims or domestic credit to non-bank borrowers from monetary authorities and depository corporations (IMF International Financial Statistics). Some countries additionally provide domestic credit series including non-bank financial creditors. The DC series is no longer actively produced and maintained by the IMF across countries, and so cannot be used for recent data. For the construction of FBP in this box, total credit to the private non-financial sector from bank creditors is used, available from the BIS series on total credit.

DC corresponds to domestic claims or domestic credit to non-bank borrowers from monetary authorities and depository corporations (IMF International Financial Statistics). Some countries additionally provide domestic credit series including non-bank financial creditors. The DC series is no longer actively produced and maintained by the IMF across countries, and so cannot be used for recent data. For the construction of FBP in this box, total credit to the private non-financial sector from bank creditors is used, available from the BIS series on total credit.  Using the previous method with IC on an immediate counterparty basis results in a very similar estimate. Using the total claims series from the ultimate risk data in the numerator also results in a similar series, but the immediate counterparty data are used in order to show the breakdown between IC and LCLC. The ultimate risk data are available from Q4 2004.

Using the previous method with IC on an immediate counterparty basis results in a very similar estimate. Using the total claims series from the ultimate risk data in the numerator also results in a similar series, but the immediate counterparty data are used in order to show the breakdown between IC and LCLC. The ultimate risk data are available from Q4 2004.  Given data constraints, the sector definitions do not always line up perfectly. Since the data enhancements for foreign bank claims on the private non-financial sector have not been available until recently, claims on the private non-bank sector are used in the numerator for time series plots of FBR for the private non-financial sector. For the official sector, foreign bank claims include claims on both the government and the central bank, whereas the total credit series captures credit to the government only. For EMEs, central bank liabilities are small, but this measure may not be appropriate for countries whose central banks have employed quantitative easing measures.

Given data constraints, the sector definitions do not always line up perfectly. Since the data enhancements for foreign bank claims on the private non-financial sector have not been available until recently, claims on the private non-bank sector are used in the numerator for time series plots of FBR for the private non-financial sector. For the official sector, foreign bank claims include claims on both the government and the central bank, whereas the total credit series captures credit to the government only. For EMEs, central bank liabilities are small, but this measure may not be appropriate for countries whose central banks have employed quantitative easing measures.