The Spanish and Irish cases: larger inflows from European banks, bigger booms

The Irish and Spanish cases resembled the US case in several salient respects. Both featured a large increase in private credit, big run-ups in house prices and, one way or another, a huge inflow of bank capital. The securitisation of mortgages in the United States should not obscure the role of banks as buyers of the bonds (Connor et al (2012)). And rather than just a heavy reliance on floating rate mortgages at the margin, these European economies relied entirely on floating rate mortgages.

The Spanish and Irish booms differed from the US boom in several important respects, however. For one thing, since both Spain and Ireland were part of the euro area, short-term interest rate setting looked to a broader economic domain than these two booming countries in the periphery (Regling and Watson (2010), p 24, Bank of Spain (2017), p 30).

Second, the investment of official reserves from Asia probably exerted less downward pressure on long-term yields in the euro area than such investment put on US Treasury yields. The dollar attracted about two thirds of reserves in the 2000s and the euro only 20-25%. Add the thoroughgoing reliance on floating rate mortgages in these European countries, rather than the long-term fixed rate debt favoured by official reserve managers, and it is hard to pin much of their booms on the Asian savings glut.

Third, the role of securitisation, the focus of many analyses of the US case, was much reduced in Spain and basically absent in Ireland. In Spain, the regional cajas depended heavily on so-called covered bonds to fund their mortgages, and 75% of these were held by foreign investors (Berges et al (2012)), notably German banks. These do not remove the risk of the mortgages from the originator, so they are better viewed as long-term secured funding rather than as securitisation proper. Other forms of securitisation did not qualify for removal of the assets from the balance sheet owing to limited risk transfer (Almazan et al (2015)).

With little risk transfer of real estate credit, the Irish and Spanish banks only shared their boom exposures to the extent that foreign banks participated in the credit booms directly. In Ireland's case, an RBS subsidiary, Ulster Bank, did manage to run up significant losses, for which the UK rather than the Irish taxpayers ended up paying. In Spain, however, the foreign bank role was limited. On the contrary, the international diversification of the two largest Spanish banks stood them in good stead as earnings abroad stabilised their profitability.

A further aspect that distinguishes the Irish and Spanish cases from the US one is the exposure of banks to property companies. They brought exposure not only to commercial real estate, but also to the construction of houses. On close inspection, the profitability of these in a boom frequently turns on speculation in raw land. This reinforced the banks' exposures to the feedback loop among capital inflows, credit growth and real estate prices.

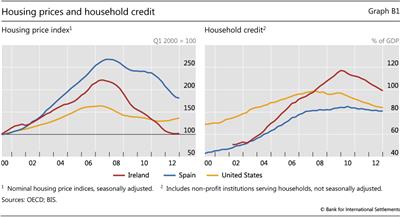

Fifth, house prices and household indebtedness traced more extreme trajectories in Ireland and Spain than in the United States. By the lights of the OECD, at least, house prices boomed more in Spain and Ireland than in the United States (Graph B1, left-hand panel). However, the US index conceals significant regional variation: the Case-Schiller 20-city index for the United States more than doubled between 2000 and the peak in mid-2006.

Ireland takes the prize for the largest run-up in household debt of the three as a share of GDP (Graph B1, right-hand panel). It rose by 50% of GDP through 2008, even before the ratio surged as the denominator fell. But Spain was not far behind. On this measure, the US experience was again relatively mild.

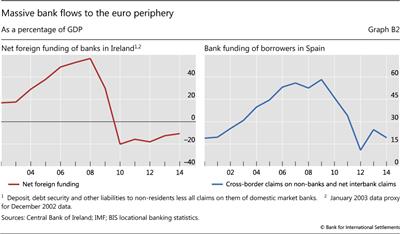

A final way in which the Irish and Spanish cases distinguish themselves from the US case is in the scale of the capital inflow. The left-hand panel of Graph B2 shows the net foreign liabilities of the banks in Ireland with local lending business. It shows a net inflow of over 50% of GDP (Everett (2017)). Recall that the inflow of official reserves into US Treasuries from end-2000 to mid-2007 amounted to 10% of 2007 GDP, and the change in European investors' holdings of US ABS in the same period amounted to about half that. In other words, even stripping out foreign banks' offshore activity in Ireland, and counting both the transpacific and transatlantic flows to the United States, the inflow of external funding into the Irish banking system was triple these capital flows into the United States.

It shows a net inflow of over 50% of GDP (Everett (2017)). Recall that the inflow of official reserves into US Treasuries from end-2000 to mid-2007 amounted to 10% of 2007 GDP, and the change in European investors' holdings of US ABS in the same period amounted to about half that. In other words, even stripping out foreign banks' offshore activity in Ireland, and counting both the transpacific and transatlantic flows to the United States, the inflow of external funding into the Irish banking system was triple these capital flows into the United States.

The inflow of bank credit to Spain also reached staggering proportions (Graph B2, right-hand panel). Since Spain does not have a large presence of offshore banking, we simply sum the stock of BIS reporting banks' cross-border claims on non-banks in Spain with their net cross-border claims on banks in Spain (see Avdjiev et al (2012) for further discussion). This aggregate rose from 15% of Spanish GDP to almost 60%.

Despite the differences, the key similarity stands out. European banks enabled credit booms in the United States, Ireland and Spain. The crises also cumulated: US losses crippled many European banks and sapped their defences against strains in Europe.

The US data include non-profits.

The US data include non-profits.  Excluding offshore banks; see Honohan (2006), Central Bank of Ireland (2010) and Lane (2015).

Excluding offshore banks; see Honohan (2006), Central Bank of Ireland (2010) and Lane (2015).