Capital inflows enable domestic credit growth in a boom

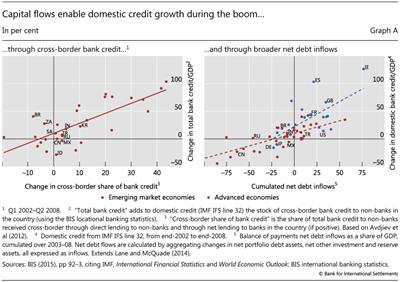

Credit booms and capital inflows tend to reinforce one another (Aliber and Kindleberger (2015)). Inflows of foreign capital to banks free them from the constraint of the domestic funding base and thereby enable domestic credit booms. In a sample of 31 emerging market economies between early 2002 and 2008, Avdjiev et al (2012) found that a rise in the share of cross-border bank funding, extended either directly to domestic non-banks or indirectly through banks, helped boost the ratio of bank credit to GDP, a measure of credit booms (Graph A, left-hand panel). Banks found non-core liabilities abroad to fund credit at home (Hahm et al (2013)).

Lane and McQuade (2014), using a broader sample of 62 countries and a more inclusive measure of international capital flows, found a similar dynamic. Here, the larger the net debt inflows, including both portfolio and bank flows, the larger the increase in a given economy's ratio of bank credit to GDP (Graph A, right-hand panel). The inclusion of Ireland, Spain and the United Kingdom shows that a domestic credit boom's reliance on external financing is not a symptom of financial underdevelopment. In fact, in the subsample of 23 advanced economies the response to capital inflows is greater than among EMEs, as the steeper trend line suggests.