Constructing the dollar positions of international banks with BIS statistics

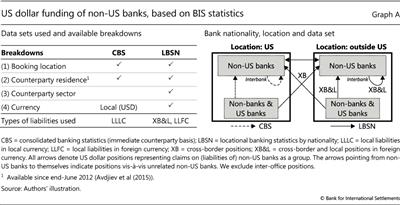

The analysis in this feature requires the estimation of US dollar liabilities by bank nationality (ie where the headquarters are located), broken down by the location of the booking office and the location of the counterparty. We follow the approach outlined in McGuire and von Peter (2009) and construct dollar positions by combining the BIS consolidated banking statistics on an immediate counterparty basis (CBS) with BIS locational banking statistics by nationality (LBSN). The summary of breakdowns available in the two data sets is given in the left-hand panel of Graph A. The CBS are organised on the principle of bank nationality and present reporting banks' consolidated foreign claims, broken down into international claims and local claims in local currencies (ie local currency positions booked by banks' foreign offices vis-à-vis residents of the host country). They have limited information about bank liabilities, but they do include their local liabilities in local currency. The LBSN are collected from the jurisdiction where the activity takes place, then broken down according to the nationality (headquarters) of the reporting banks. Each bank office (headquarters, branches, subsidiaries) in a BIS reporting country reports cross-border liabilities as well as foreign currency liabilities vis-à-vis residents in that reporting country. Along with the nationality breakdown, the LBSN also break down positions by currency, counterparty sector and, since end-June 2012, counterparty residence.

We follow the approach outlined in McGuire and von Peter (2009) and construct dollar positions by combining the BIS consolidated banking statistics on an immediate counterparty basis (CBS) with BIS locational banking statistics by nationality (LBSN). The summary of breakdowns available in the two data sets is given in the left-hand panel of Graph A. The CBS are organised on the principle of bank nationality and present reporting banks' consolidated foreign claims, broken down into international claims and local claims in local currencies (ie local currency positions booked by banks' foreign offices vis-à-vis residents of the host country). They have limited information about bank liabilities, but they do include their local liabilities in local currency. The LBSN are collected from the jurisdiction where the activity takes place, then broken down according to the nationality (headquarters) of the reporting banks. Each bank office (headquarters, branches, subsidiaries) in a BIS reporting country reports cross-border liabilities as well as foreign currency liabilities vis-à-vis residents in that reporting country. Along with the nationality breakdown, the LBSN also break down positions by currency, counterparty sector and, since end-June 2012, counterparty residence.

The right-hand panel of Graph A illustrates how we combine the two data sets to approximate the US dollar liabilities of non-US banks. Importantly, we exclude interbank positions vis-à-vis offices of the same banking group (ie inter-office liabilities). In the CBS these are excluded by construction by virtue of consolidation, whereas in the LBSN they can be excluded thanks to the counterparty sector breakdown.

As the CBS do not provide a currency breakdown, we only use these data to quantify the local liabilities in local currency booked by non-US banks in the US, where the currency is the dollar by definition (dashed arrows). As the CBS do not provide a counterparty sector breakdown for local positions in local currencies, we cannot distinguish between interbank liabilities (both to US banks and to non-US banks) and liabilities to non-banks. We use the LBSN for all the rest (solid arrows). In particular, we extract cross-border dollar liabilities to US banks and non-banks in the US (solid arrow connecting the stylised locations) as well as cross-border and local liabilities (vis-à-vis US banks, unrelated non-US banks and non-banks located outside the US (solid arrows inside the right-hand box)). These liabilities can be booked either in the home country of any particular non-US banking system (eg a Canadian bank booking US dollar liabilities in Canada) or in BIS reporting countries other than the US and the home country (eg a Canadian bank booking US dollar liabilities through a branch in France). Importantly, these liabilities can themselves be either local or cross-border. An example of the former would be a Canadian bank branch in France booking a US dollar liability vis-à-vis a resident of France; an example of the latter would be a Canadian bank branch in France booking a US dollar liability vis-à-vis a resident of Germany.

Most of the article focuses on US dollar liabilities. We therefore restrict the description in this box to dollar liabilities. The logic for building dollar asset positions is analogous.

Most of the article focuses on US dollar liabilities. We therefore restrict the description in this box to dollar liabilities. The logic for building dollar asset positions is analogous.  Positions are broken down by USD, EUR, JPY, GBP, CHF, the domestic currency of the country where the office is located, and all others. While we do not use the counterparty sector breakdown (other than for subtracting inter-office positions), we include it in the table to illustrate available breakdowns.

Positions are broken down by USD, EUR, JPY, GBP, CHF, the domestic currency of the country where the office is located, and all others. While we do not use the counterparty sector breakdown (other than for subtracting inter-office positions), we include it in the table to illustrate available breakdowns.