Financial conditions indices: the role of equity markets

Changes to financial conditions are often seen as an important channel for monetary policy transmission. Researchers and market analysts have accordingly constructed financial conditions indices (FCIs) for different economies, typically using the weighted average of several key variables, as a way to track and study these effects. This box examines recent FCI developments in selected economies and argues that FCIs are sensitive to volatile variables, even when these enter the index with a small weight. It illustrates this issue by considering how FCIs in the United States have responded to recent developments in US equity markets.*

This box examines recent FCI developments in selected economies and argues that FCIs are sensitive to volatile variables, even when these enter the index with a small weight. It illustrates this issue by considering how FCIs in the United States have responded to recent developments in US equity markets.*

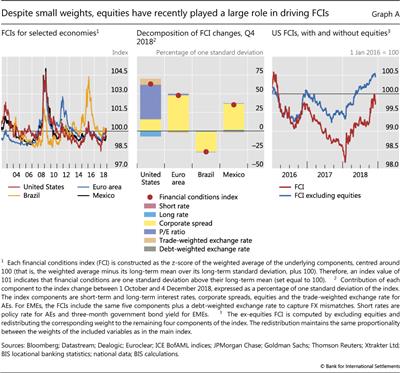

The left-hand panel of Graph A plots "synthetic" FCIs for the United States, the euro area, Brazil and Mexico. The FCIs were constructed using a similar approach to that employed by Goldman Sachs - including the choice of weights, which are selected using estimates of the relative impacts of changes in the components on GDP growth. The components comprise interest rates (short-term and long-term), corporate credit spreads, stock market valuations (ie price/earnings (P/E) ratios) and the exchange rate (trade- and debt-weighted). The weights of these variables reflect the structural characteristics of each economy. The variables enter the index in such a way that an increase in the component reflects a tightening of conditions (ie a contraction in funding availability).

The components comprise interest rates (short-term and long-term), corporate credit spreads, stock market valuations (ie price/earnings (P/E) ratios) and the exchange rate (trade- and debt-weighted). The weights of these variables reflect the structural characteristics of each economy. The variables enter the index in such a way that an increase in the component reflects a tightening of conditions (ie a contraction in funding availability).

These FCIs suggest that financial conditions in the United States, the euro area and Mexico have been broadly accommodative for a number of years, with the respective FCIs remaining largely below long-term averages in the period since 2013. The FCI has been more volatile in Brazil, which experienced a major recession in 2016-17. That said, financial conditions in the United States and the euro area have turned less accommodative in the past year.

The FCI has been more volatile in Brazil, which experienced a major recession in 2016-17. That said, financial conditions in the United States and the euro area have turned less accommodative in the past year.

In Q4 2018 in particular, the US FCI rose by almost three quarters of a standard deviation, while the FCIs for the euro area and Mexico point to a tightening of one hand and about one third of a standard deviation, respectively (Graph A, centre panel). By contrast, financial conditions loosened in Brazil. While recent changes in financial conditions were driven largely by corporate bond spreads in the euro area, Brazil and Mexico, the US FCI rose primarily on the back of a correction in equity valuations.

In fact, equity markets appear to have driven a large part of the loosening of US financial conditions as tracked by these indices in recent years, as well as the more recent tightening. An FCI computed excluding equities would have signalled significantly tighter financial conditions in the United States in the last two years (right-hand panel). The divergence occurs because, in spite of a relatively small weight (5% in the case of the US FCI), equities are relatively more volatile than the other index components.

The high sensitivity of FCIs to equity valuations under this methodology points to the importance of appropriately setting the corresponding weights. Some degree of reliance on market-based finance in funding economic activity, as well as the tendency of corporations to look to the equity market as a signal in their investment decisions, calls for equities to be included in FCIs. Against this, the short-term macroeconomic relevance of equity market developments could be overstated if distributional considerations do not inform the choice of weights. Equity holdings are concentrated among households at the top end of the income and wealth distributions, which tend to have a relatively low marginal propensity to consume. As a result, an index constructed without accounting for these differences may place too high a weight on equity valuations, thereby possibly overstating the boost in activity foreshadowed by a loosening of financial conditions.

* With many thanks to Nick Fawcett at Goldman Sachs and especially to Katie Craig, Marcus Petersen and Seth Searls at the Federal Reserve Bank of New York for several helpful exchanges.  Alternatively, a principal component approach may be used. See J Hatzius, P Hooper, F Mishkin, K Schoenholtz and M Watson, "Financial conditions indexes: a fresh look after the financial crisis", NBER Working Papers, no 16150, July 2010.

Alternatively, a principal component approach may be used. See J Hatzius, P Hooper, F Mishkin, K Schoenholtz and M Watson, "Financial conditions indexes: a fresh look after the financial crisis", NBER Working Papers, no 16150, July 2010.  The choice of weights is discussed in J Hatzius, S Stehn and N Fawcett, "Financial conditions: a unified approach", Global Economics Analyst, Goldman Sachs, September 2016; and in the follow-up Goldman Sachs FCI analysis published in the same outlet. The FCIs in Graph A are computed using the same weights underpinning the Goldman Sachs FCIs, with the exception of the FCI for the euro area. While Goldman's euro area FCI includes a "sovereign spreads" variable, this was not included in the euro area FCI in Graph A in order to improve consistency with the US indicator.

The choice of weights is discussed in J Hatzius, S Stehn and N Fawcett, "Financial conditions: a unified approach", Global Economics Analyst, Goldman Sachs, September 2016; and in the follow-up Goldman Sachs FCI analysis published in the same outlet. The FCIs in Graph A are computed using the same weights underpinning the Goldman Sachs FCIs, with the exception of the FCI for the euro area. While Goldman's euro area FCI includes a "sovereign spreads" variable, this was not included in the euro area FCI in Graph A in order to improve consistency with the US indicator.  For example, because higher P/E ratios are associated with a loosening of financial conditions and a boost to economic activity, they enter with a negative sign. Similarly, the dual effect of exchange rates on economic activity - an appreciation tends to dampen activity by depressing net exports, but it also boosts activity by reducing the real value of foreign-denominated debt held by households and corporates - is accounted for by including both trade-weighted and debt-weighted exchange rates in the FCIs for Brazil and Mexico. Only the trade-weighted exchange rate is included for the United States and the euro area, as households and corporates in those two economies do not have significant amounts of foreign-denominated debt.

For example, because higher P/E ratios are associated with a loosening of financial conditions and a boost to economic activity, they enter with a negative sign. Similarly, the dual effect of exchange rates on economic activity - an appreciation tends to dampen activity by depressing net exports, but it also boosts activity by reducing the real value of foreign-denominated debt held by households and corporates - is accounted for by including both trade-weighted and debt-weighted exchange rates in the FCIs for Brazil and Mexico. Only the trade-weighted exchange rate is included for the United States and the euro area, as households and corporates in those two economies do not have significant amounts of foreign-denominated debt.  Long-term averages were computed over periods starting 3 January 2000 for the United States, 31 January 2002 for the euro area, 28 November 2003 for Brazil and 2 January 2002 for Mexico; and ending 23 November 2018 in all four cases.

Long-term averages were computed over periods starting 3 January 2000 for the United States, 31 January 2002 for the euro area, 28 November 2003 for Brazil and 2 January 2002 for Mexico; and ending 23 November 2018 in all four cases.