International credit to non-banks and the BIS Global Liquidity Indicators

International credit to non-banks - the measure used throughout this feature - builds on the various measures in the BIS global liquidity indicators (GLIs). A key measure of the GLIs is credit to non-residents (ie foreign currency credit), which measures credit to borrowers outside the jurisdiction where a currency is issued, for three major currencies (US dollar, euro and Japanese yen). For instance, US dollar credit to non-residents comprises all US dollar bank loans to and debt securities issued by residents outside the United States - be it cross-border or locally raised.

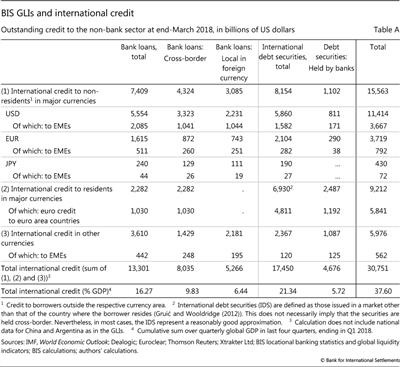

which measures credit to borrowers outside the jurisdiction where a currency is issued, for three major currencies (US dollar, euro and Japanese yen). For instance, US dollar credit to non-residents comprises all US dollar bank loans to and debt securities issued by residents outside the United States - be it cross-border or locally raised. International credit to non-banks encompasses credit to non-residents in the three major currencies (Table A, row 1) but adds cross-border credit to residents (ie cross-border local currency credit) in these currencies (row 2) as well as cross-border and locally extended foreign currency credit in all other currencies (row 3). A significant part of the amount in row 2 ($5.8 trillion or 63% at end-March 2018) consists of euro-denominated cross-border credit to euro area countries.

International credit to non-banks encompasses credit to non-residents in the three major currencies (Table A, row 1) but adds cross-border credit to residents (ie cross-border local currency credit) in these currencies (row 2) as well as cross-border and locally extended foreign currency credit in all other currencies (row 3). A significant part of the amount in row 2 ($5.8 trillion or 63% at end-March 2018) consists of euro-denominated cross-border credit to euro area countries.

Credit to non-residents in the GLIs can be broken down by instrument into bank loans and debt securities. However, banks do not just grant loans. They also can be significant holders of international debt securities (Table A, fifth column). As a result, it is misleading to identify securities issuance with capital market financing, as is often done. At end-March 2018, BIS reporting banks held about $4.7 trillion in international debt securities, more than a quarter of the total outstanding. Summing total bank loans (first column) and their debt securities holdings (fifth column) yields international bank claims on the non-bank sector - another key GLI.

The GLIs are residence-based and therefore do not include credit borrowed by offshore entities.

The GLIs are residence-based and therefore do not include credit borrowed by offshore entities.  See www.bis.org/statistics/e2_1.pdf.

See www.bis.org/statistics/e2_1.pdf.  See www.bis.org/statistics/e1.pdf.

See www.bis.org/statistics/e1.pdf.