Sovereign and bank tensions in the euro area

During the second and third quarters of 2018, tensions originating in international trade, the political landscape, and spillovers from the current stress in EMEs weighed on asset valuations in the euro area. Among others, markets focused particularly on the political situation in Italy and the crisis in Turkey, as well as trade tensions with the United States.

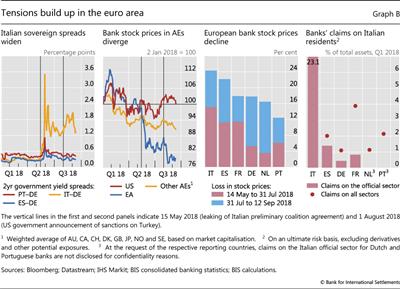

The Italian sovereign has recently gone through a series of idiosyncratic episodes of bond market stress. For instance, the spread of Italy's two-year yields vis-à-vis Germany's widened in the wake of the recent events in Turkey by much more than those of other euro area countries (Graph B, first panel). However, political events had already led to a significant widening in the Italian-German spread. The spread had begun to drift higher in mid-May with the leaking of a preliminary draft of the coalition's governing programme. And on 29 May, after the interim prime minister was appointed, it surged almost 200 basis points and reached levels not seen since August 2012. Although this spread increase surpassed any daily changes observed during the European sovereign debt crisis, the level of the Italian sovereign spread remained below those from the crisis period. Wider spreads seemed to reflect investors' concerns about future political uncertainty, especially over the potential fiscal policies of the new government.

The combination of stress in Italian sovereign bond markets and the currency crisis in Turkey put great pressure on euro area banks. Their stock prices vastly underperformed those of their peers from other advanced economies. An aggregate index tracking euro area banks' stock price performance dropped almost 20% from mid-May through mid-September (Graph B, second panel). In contrast, US banks traded sideways and other advanced economies' banks experienced much more moderate losses. The divergence between bank equity price performance in the euro area and the United States started in May, when political uncertainty in Italy increased. Euro area bank stocks traded sideways for several weeks afterwards, before the currency crisis in Turkey triggered another large step down.

Losses in bank stock prices varied significantly across countries. The losses from mid-May up to end-July were sharper for banks in France, Italy and Spain (Graph B, third panel, red bars). In part, this reflected banks' direct and indirect exposures to the Italian government and other Italian borrowers (fourth panel). The direct channel of transmission might work through large mark-to-market losses on government bond holdings and other assets, which would weaken banks' capital base. Potential indirect channels include tougher funding conditions as credit spreads rise for Italian banks and other large euro area banks.

Spillovers from the financial stress in Turkey deepened these concerns, as euro area banks were generally perceived as having large exposures to Turkish borrowers. To some extent, the correction triggered by the Turkish market turmoil had a greater impact on the banks that were most exposed to Turkish borrowers (Graph B, third panel, blue bars). But the losses were not necessarily proportionate to the size of the exposures. In fact, the underlying risk resulting from banks' country exposures is difficult to assess, as there are many factors that influence how banks might respond to adverse developments (Box C). Stock price losses may also have revealed investors' assessment about the prospective resilience of banks to future large shocks, as well as other country- and sector-specific developments. For example, German banks were hindered by their broader earning underperformance, and Italian banks were already perceived as relatively weaker.