Global real housing prices

Global real residential property prices increased by 2% from end-2016 to end-2017, to stand 7% above their pre-Great Financial Crisis (GFC) level.

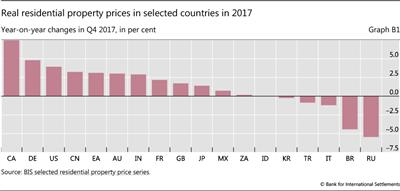

In advanced economies (AEs), prices grew by 5% on average in nominal terms and 3% in real terms - ie deflated by the CPI - from end-2016 to end-2017. The rise was particularly marked in Canada; prices rose more moderately in Australia, the United States and the euro area as a whole (Graph B1). Among the euro area countries, real property prices increased significantly in Germany, Ireland and Spain but fell slightly in Italy. Prices increased only slightly in Japan and the United Kingdom.

The rise was particularly marked in Canada; prices rose more moderately in Australia, the United States and the euro area as a whole (Graph B1). Among the euro area countries, real property prices increased significantly in Germany, Ireland and Spain but fell slightly in Italy. Prices increased only slightly in Japan and the United Kingdom.

Turning to emerging market economies (EMEs), prices increased by only 4% in nominal terms and 1% in real terms in 2017. Compared with 2016, real prices decelerated significantly in China and India and broadly stabilised in Indonesia, Korea, Mexico and South Africa. They continued to fall markedly in Brazil and Russia.

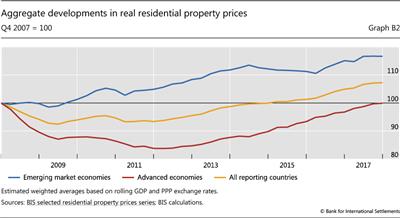

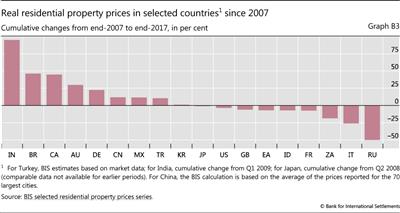

Taking a longer-term perspective, property prices continue to recover slowly worldwide. After a sharp decline in the aftermath of the GFC, average real residential property prices in AEs bottomed out in 2011-12 (Graph B2). Since 2012, they have increased continuously and are now back to their pre-GFC levels. But the situation varies across countries. Real prices are still significantly below their 2007 levels, by 3-7%, in the euro area, the United Kingdom and the United States (Graph B3). Within the euro area, however, there are major disparities. Post-GFC, real property prices have risen by 22% in Germany, fallen by 7% in France, and dropped quite sharply, by 24-33%, in Ireland, Italy and Spain. Regarding the AEs that were less affected by the GFC, real housing prices have almost returned to their pre-GFC levels in Japan, and are significantly above them in Australia and Canada (Graph B3).

Mainly as a result of their marked expansion in the early 2010s, real residential property prices in EMEs are 16% above the levels registered before the crisis (Graph B2). Prices have almost doubled since the crisis in India and are close to 50% higher in Brazil, despite the significant recent decline in that country. They are also above their pre-crisis levels in China, Mexico and Turkey, but below them in Indonesia and South Africa. In Russia, they have fallen by more than 50% compared with 2007 (Graph B3).

The data discussed here are CPI-deflated, unless otherwise stated. Residential property prices refer to the national average or its closest proxy for each country. Regional aggregates and global data are weighted using GDP numbers adjusted for PPP for the reporting countries. A statistical release focusing on the most recent developments is published on the BIS website every February, August and November.

The data discussed here are CPI-deflated, unless otherwise stated. Residential property prices refer to the national average or its closest proxy for each country. Regional aggregates and global data are weighted using GDP numbers adjusted for PPP for the reporting countries. A statistical release focusing on the most recent developments is published on the BIS website every February, August and November.  GDP-weighted averages using PPP exchange rates.

GDP-weighted averages using PPP exchange rates.

References:

Scatigna, M and R Szemere (2015): "BIS collection and publication of residential property prices", Irving Fisher Committee Bulletin, no 39, April.

Scatigna, M, R Szemere and K Tsatsaronis (2014): "Residential property price statistics across the globe", BIS Quarterly Review, September, pp 61-76.

Shim, I and K Kuttner (2013): "Can non-interest rate policies stabilise housing markets? Evidence from a panel of 57 economies", BIS Working Papers, no 433, November.

Tissot, B (2014): "Monitoring house prices from a financial stability perspective - the BIS experience", International Statistical Institute Regional Statistics Conference, November.