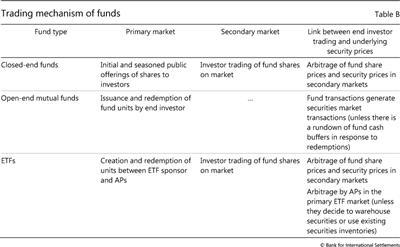

Trading mechanisms of ETFs compared with other fund types

(Extract from page 124 of BIS Quarterly Review, March 2018)

Like passive (index) mutual funds, exchange-traded funds (ETFs) seek to track the returns of a benchmark index. The key innovation of ETFs is a trading process that combines the characteristics of open-end mutual funds with those of closed-end funds. Variation in the number of ETF units arising from inflows or redemptions resembles the design of open-end mutual funds, while the ability to trade ETF shares throughout the day on a secondary market at a transparent price is a feature shared with closed-end funds. Trading of ETF shares on an exchange also allows market participants to place market, limit or stop orders, as well as to engage in short selling, which further boosts the ETFs' market liquidity.

ETFs' unique primary-secondary market trading mechanism is facilitated by registered intermediaries known as authorised participants (APs), typically broker-dealers or market-makers in the underlying securities. APs may trade the ETF shares on the secondary market like other investors, but they can also create and redeem ETF shares (known as "creation units") through direct transactions with the ETF sponsor at the current net asset value of the portfolio. The ability of APs to transact in both the primary and the secondary market incentivises profitable arbitrage of the ETF share price and the underlying assets. This, together with arbitrage by other market participants solely in the secondary market, underpins a key value proposition of ETFs for investors - near- immediate liquidity at a share price close to the value of assets underlying the price index. This can be contrasted with open-end mutual funds, where investors buy or redeem units directly at the fund's end-of-day net asset value.

This, together with arbitrage by other market participants solely in the secondary market, underpins a key value proposition of ETFs for investors - near- immediate liquidity at a share price close to the value of assets underlying the price index. This can be contrasted with open-end mutual funds, where investors buy or redeem units directly at the fund's end-of-day net asset value.

For example, in the case of a material decline in the price of ETF shares below the value of the underlying assets, APs could purchase ETF shares and redeem these with the ETF sponsor in exchange for the underlying securities, which they then may sell on the market.

For example, in the case of a material decline in the price of ETF shares below the value of the underlying assets, APs could purchase ETF shares and redeem these with the ETF sponsor in exchange for the underlying securities, which they then may sell on the market.