Corporate leverage and representation in a major bond index

(Extract from page 122 of BIS Quarterly Review, March 2018)

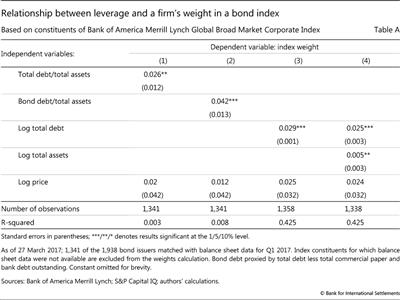

This box examines the relationship between a firm's leverage and its weight in a major corporate bond index, the Bank of America Merrill Lynch Global Broad Market Corporate Index. Data on corporate debt are matched with issuers in the index. A firm's weight in the index is then calculated as the sum of the market value of its individual bonds, divided by the market value for all issues where there is matching firm data.

Regression results confirm that there is a statistically significant positive relationship between a company's weight in the index and its leverage (based on either total debt or just bond debt; Table A, columns (1) and (2)), conditioned on the bond price. Although larger companies would be expected to have more outstanding debt, the coefficient on debt is about four times larger and more significant than the coefficient on total assets (column (4)). Specifically, a 1% increase in company debt is associated with a 0.025 percentage point increase in its weight in the index, compared with a 0.005 percentage point higher weight from a 1% increase in total assets.

Lack of data for some bond issuers could bias results if their leverage differs systematically from the average of the other issuers in the index.

Lack of data for some bond issuers could bias results if their leverage differs systematically from the average of the other issuers in the index.  Since firm index weights are not normally distributed, we also run regressions using the log of the weight: the results are essentially the same.

Since firm index weights are not normally distributed, we also run regressions using the log of the weight: the results are essentially the same.