The equity market turbulence of 5 February - the role of exchange-traded volatility products

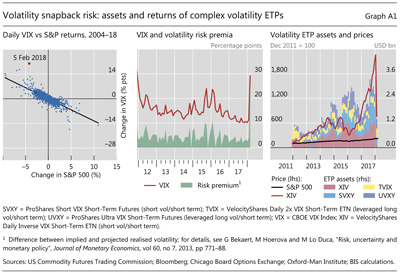

On Monday 5 February, the S&P 500 index fell 4% while the VIX - a measure of volatility implied by equity option prices - jumped 20 points. Historically, falls in equity prices tend to be associated with higher volatility and thus a rise in the VIX. But the increase in the VIX on that day significantly exceeded what would be expected based on the historical relationship (Graph A1, left-hand panel). In fact, it was the largest daily increase in the VIX since the 1987 stock market crash.

The VIX is an index of one-month implied volatility constructed from S&P 500 option prices across a range of strike prices. Market participants can use equity options or VIX futures to hedge their market positions, or to take risky exposures to volatility itself. Trading in both types of derivative instrument can affect the level of the VIX.

Because it is derived from option prices, theoretically the VIX is the sum of expected future volatility and the volatility risk premium. Model estimates indicate that the rise in the VIX on 5 February far exceeded the change in expectations about future volatility (Graph A1, centre panel). The magnitude of the risk premium (ie the model residual) suggests that the VIX spike was largely due to internal dynamics in equity options or VIX futures markets. Indeed, the considerable expansion in the VIX futures market - market size (ie total open interest) rose from a daily average of about 180,000 contracts in 2011 to 590,000 in 2017 - means such dynamics are likely to have had a growing impact on the level of the VIX.

Among the growing users of VIX futures are issuers of volatility exchange-traded products (ETPs). These products allow investors to trade volatility for hedging or speculative purposes. Issuers of leveraged volatility ETPs take long positions in VIX futures to magnify returns relative to the VIX - for example, a 2X VIX ETP with $200 million in assets would double the daily gains or losses for its investors by using leverage to build a $400 million notional position in VIX futures. Inverse volatility ETPs take short positions in VIX futures so as to allow investors to bet on lower volatility. To maintain target exposure, issuers of leveraged and inverse ETPs rebalance portfolios on a daily basis by trading VIX-related derivatives, usually in the last hour of the trading day.

The assets of select leveraged and inverse volatility ETPs have expanded sharply over recent years, reaching about $4 billion at end-2017 (Graph A1, right-hand panel). Although marketed as short-term hedging products to investors, many market participants use these products to make long-term bets on volatility remaining low or becoming lower. Given the historical tendency of volatility increases to be rather sharp, such strategies can amount to "collecting pennies in front of a steamroller".

Although marketed as short-term hedging products to investors, many market participants use these products to make long-term bets on volatility remaining low or becoming lower. Given the historical tendency of volatility increases to be rather sharp, such strategies can amount to "collecting pennies in front of a steamroller".

Even though the aggregate positions in these instruments are relatively small, systematic trading strategies of the issuers of leveraged and inverse volatility ETPs appear to have been a key factor behind the volatility spike that occurred on the afternoon of 5 February. Given the rise in the VIX earlier in the day, market participants could expect leveraged long volatility ETPs to rebalance their holdings by buying more VIX futures at the end of the day to maintain their target daily exposure (eg twice or three times their assets). They also knew that inverse volatility ETPs would have to buy VIX futures to cover the losses on their short position in VIX futures. So, both long and short volatility ETPs had to buy VIX futures. The rebalancing by both types of funds takes place right before 16:15, when they publish their daily net asset value. Hence, because the VIX had already been rising since the previous trading day, market participants knew that both types of ETP would be positioned on the same side of the VIX futures market right after New York equity market close. The scene was set.

Given the rise in the VIX earlier in the day, market participants could expect leveraged long volatility ETPs to rebalance their holdings by buying more VIX futures at the end of the day to maintain their target daily exposure (eg twice or three times their assets). They also knew that inverse volatility ETPs would have to buy VIX futures to cover the losses on their short position in VIX futures. So, both long and short volatility ETPs had to buy VIX futures. The rebalancing by both types of funds takes place right before 16:15, when they publish their daily net asset value. Hence, because the VIX had already been rising since the previous trading day, market participants knew that both types of ETP would be positioned on the same side of the VIX futures market right after New York equity market close. The scene was set.

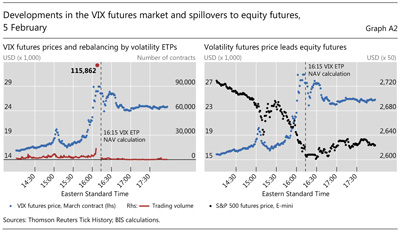

There were signs that other market participants began bidding up VIX futures prices at around 15:30 in anticipation of the end-of-day rebalancing by volatility ETPs (Graph A2, left-hand panel). Due to the mechanical nature of the rebalancing, a higher VIX futures price necessitated even greater VIX futures purchases by the ETPs, creating a feedback loop. Transaction data show a spike in trading volume to 115,862 VIX futures contracts, or roughly one quarter of the entire market, and at highly inflated prices, within one minute at 16:08. The value of one of the inverse volatility ETPs, XIV, fell 84% and the product was subsequently terminated.

Spillovers back to the equity market on that day were also evident. For example, peaks and troughs in VIX futures prices led those of S&P (E-mini) futures (Graph A2, right-hand panel). One transmission channel worked via VIX futures dealers that hedged their exposure from selling VIX futures to the ETPs by shorting E-mini futures, thus putting further downward pressure on equity prices. In addition, normal algorithmic arbitrage strategies between ETFs, futures and cash markets kept the related market dynamics tightly linked. For the day as a whole, the S&P 500 index fell 4.2%, a 3.8 standard deviation daily move.

Overall, market developments on 5 February were another illustration of how synthetic leveraged structures can create and amplify market jumps, even if the core players themselves are relatively small. For investors, this was also a stark reminder of the outsize risks involved in speculative strategies using complex derivatives.

The four products shown include exchange- traded funds (ETFs), which give investors exposure to market risk, and exchange-traded notes (ETNs), which are debt securities backed by the credit of the issuers and expose investors to both market and credit risk.

The four products shown include exchange- traded funds (ETFs), which give investors exposure to market risk, and exchange-traded notes (ETNs), which are debt securities backed by the credit of the issuers and expose investors to both market and credit risk.  Neither the size nor the complex strategies of leveraged and inverse volatility ETPs are representative of the broader ETP market; see V Sushko and G Turner, "What risks do exchange-traded funds pose?", Bank of France, Financial Stability Review, forthcoming.

Neither the size nor the complex strategies of leveraged and inverse volatility ETPs are representative of the broader ETP market; see V Sushko and G Turner, "What risks do exchange-traded funds pose?", Bank of France, Financial Stability Review, forthcoming.  As is common with debt securities, ETNs often come with an issuer call option to protect the issuer from losses. In the case of XIV, conditions of termination (called "acceleration" in the prospectus) include a loss of 80% or more from previous daily indicative closing value.

As is common with debt securities, ETNs often come with an issuer call option to protect the issuer from losses. In the case of XIV, conditions of termination (called "acceleration" in the prospectus) include a loss of 80% or more from previous daily indicative closing value.