Interpreting risk transfers in the BIS consolidated banking statistics

(Extract from pages 16-17 of BIS Quarterly Review, December 2017)

The BIS consolidated banking statistics (CBS) record net risk transfers, as well as gross inward and outward risk transfers. Inward risk transfers increase the credit risk exposures vis-à-vis a given counterparty country, whereas outward risk transfers reduce them, by passing them on to another counterparty country. Net risk transfers (NRTs) are defined as inward risk transfers minus outward risk transfers.

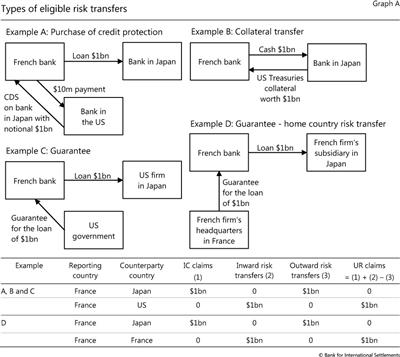

There are three types of eligible risk transfers for a creditor bank: parent and third-party guarantees, credit derivatives (protection purchased) and collateral transfers (see examples A-D in Graph A). A major share of risk transfers occurs either between internationally active banks or between a bank and a non-bank financial institution. For instance, in a collateralised borrowing transaction between banks, such as a repurchase agreement (example B), a creditor bank transacts with another bank to transfer the credit risk exposure vis-à-vis the counterparty country to the country of the collateral issuer (eg the United States in the case of US Treasury collateral).

Internationally active banks and other financial institutions also commonly buy and issue credit derivatives, such as credit default swaps (CDS, example A). If a creditor bank purchases a CDS from an entity located in country A to hedge an exposure to country B, the bank records an inward risk transfer vis-à-vis country A and an outward risk transfer vis-à-vis country B, both equal to the notional amount of protection purchased. Analogously, explicit guarantees transfer risk to the guarantor (example C). A special case in the CBS are credit exposures vis-à-vis foreign branches of banks. Consistent with standards set out by the Basel Committee on Banking Supervision, claims on bank branches are assumed to be guaranteed by the headquarters, even if no explicit guarantees are in place. In all other cases, guarantees need to be explicit.

In all of the above examples, credit exposures vis-à-vis a foreign counterparty may also be transferred to another institution in the home country (home country risk transfer). Home country risk transfers are typically driven by globally active firms in the home country (example D). Another example would be export or foreign direct investment credit guarantees provided by the government of the home country. Risk transfers vis-à-vis the home country therefore provide a measure of the share of foreign credit exposures that are ultimately against counterparties in the home country of the creditor bank. As risk transfers merely reallocate risks, but do not reduce or increase overall credit risk from the point of view of the creditor country, net risk transfers across all counterparty countries sum to zero. Risk transfers vis-à-vis foreign countries and home country risk transfers therefore mirror each other.

Risk transfers vis-à-vis foreign countries and home country risk transfers therefore mirror each other.

The treatment of collateral, however, varies across reporting countries. Risk transfers are likely to be underreported, as some countries do not report risk transfers related to repos or exchanges of collateral. On the other hand, inward and outward risk transfers may overstate cross-border transfers because some reporting countries include risk transfers between counterparties within the same country.

The treatment of collateral, however, varies across reporting countries. Risk transfers are likely to be underreported, as some countries do not report risk transfers related to repos or exchanges of collateral. On the other hand, inward and outward risk transfers may overstate cross-border transfers because some reporting countries include risk transfers between counterparties within the same country.  The sum of risk transfers vis-à-vis foreign countries and the home country can deviate from zero due to reporting errors and omissions.

The sum of risk transfers vis-à-vis foreign countries and the home country can deviate from zero due to reporting errors and omissions.