Green bond finance and certification

Financing of investments through green bonds has grown rapidly in recent years. But definitions of what makes a bond "green" vary. Various certification mechanisms have evolved to allow more granularity as well as continuity in assessment. Green bonds have been priced at issuance at a premium on average relative to conventional bonds, but their performance in the secondary market over time has been similar. A relatively large share of green bonds are in sectors subject to environmentally related credit risks. More consistent green bond standards across jurisdictions could help to further develop the market.1

JEL classification: G24, O16, Q50.

Green bonds are fixed income securities which finance investments with environmental or climate-related benefits. Green bonds are an integral component of "green finance" more generally, which aims to "internalize environmental externalities and adjust risk perceptions" for the sake of increasing environmentally friendly investments (G20 GFSG (2016)). Economic theory teaches that a first-best solution for closing the gap between the private and social costs of pollution would be a mix of lump sum taxes and subsidies, with regulations to impose implicit prices following closely behind. Green finance can also help to alleviate these externalities, through market-based means. It acts by increasing the flow of funds to environmentally beneficial projects, essentially reducing their costs, as well as by heightening awareness of the financial risks related to environmental change.2

How can investors be sure that the proceeds of green bonds are invested in an environmentally friendly way, and not merely "green-washed" to give the appearance thereof? While there is no single global definition of what precisely constitutes an "environmentally beneficial" use of proceeds, different standards have gained acceptance among market participants. Various organisations have started to provide green label certifications that indicate adherence to particular definitions of green, including "shades" of green. In so doing, they align the incentives of those who want to invest in these bonds, and make it easier for asset managers to satisfy those preferences. Green bonds could also conceivably serve as a hedge against environmentally related financial risks,3 though in this case additional information is needed about the sensitivity of various bonds to such risks, beyond just the quality of "greenness" itself.

In this feature we provide an overview of the state of the green bond market. We show that, a decade into the development of the market, there still are numerous labels for green bonds. We highlight how the various certification mechanisms for greenness have been evolving so as to allow more granularity as well as continuity in assessment. Consistent with other research, we document that green bonds at issuance have been priced at a premium on average relative to conventional bonds, while their performance in the secondary market has been similar to other bonds if currency risks are hedged. Finally, we document that green bonds are exposed to environmentally related financial risks to a relatively high degree.

The rest of this feature proceeds as follows. After providing a definition of green bonds, we briefly review the growth and composition of labelled green bond issuance from two different sources. The third section examines and classifies the various green labels provided by the private sector to certify green bond issuance. The fourth section focuses on the market pricing, financial performance and risks of green bonds. The conclusion summarises the policy implications.

The market for green bonds

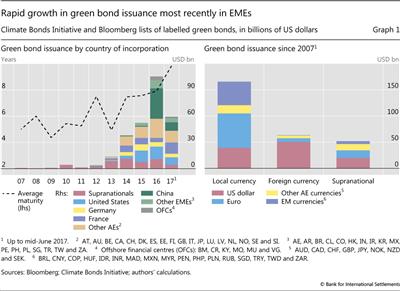

The market for bonds with a green label4 has grown rapidly in recent years. It started with the European Investment Bank's "climate awareness bond" issued in 2007, which is widely seen as the first bond with a green label. A key catalyst for subsequent market development was the introduction in January 2014 by the International Capital Market Association (ICMA) of the Green Bond Principles, which are the basis for many of the existing green labels (ICMA (2014)). Since then, the market for labelled green bonds has expanded dramatically: in 2016, aggregate issuance surpassed the $100 billion mark, and the first half of 2017 has already seen a total issuance of around $60 billion (Graph 1). The market for green bonds is nevertheless still very small compared with the wider global bond market, with a share of less than 1.6% of global debt issuance in 2016.5

The composition of green bond issuance has evolved considerably over time (Graph 1, left-hand panel). Through 2013, issuance predominantly came from supranationals (ie international organisations such as the European Investment Bank). Issuers from advanced economies in Europe and the United States dominated in 2014 and 2015. Since 2016, issuers from emerging market economies (EMEs), particularly corporates in China, have provided a large share of global issuance. The maturity of green bonds is typically medium-term, averaging between seven and eight years in 2014-16, but lengthened in the first half of 2017.

Issuance tends to cover a wide range of currency denominations. While supranationals have tended to issue in euros and dollars, some EME entities have made use of local currencies (Graph 1, right-hand panel).

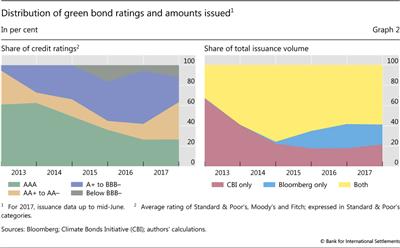

Issuers of green bonds tend to be highly rated, with only a small fraction rated below investment grade (Graph 2, left-hand panel). More bonds with earmarked claims on the cash flows of an individual project (ie project bonds) could help diversify issuers and credit risks (Standard & Poor's (2017a), Caldecott (2012); Ehlers et al (2014)). Project bonds naturally entail higher credit risks, given the high initial uncertainties of new investment projects (Ehlers (2014)). These could cater to investors looking for higher yields.

The above numbers aggregate figures from two widely used and broad-based lists of green bonds: those of the Climate Bonds Initiative (CBI) and Bloomberg. The CBI is an international non-profit organisation, funded by grants from non-profit and government sources as well as revenue from public sector contracts. Bloomberg is a widely used financial data and service provider. Both lists selectively include bonds with different types of green labels.

The two lists, and hence the corresponding volumes of issuance, do not coincide. The aggregate issuance of labelled green bonds from 2007 through the second quarter of 2017 in the CBI list equals $234 billion (comprising 1,092 individual issues). By contrast, Bloomberg counted $216 billion in green bond issuance (comprising 779 individual issues). Only $169 billion (624 individual issues) worth of bonds are present on both lists. The Bloomberg list of green bonds was less extensive prior to 2014, but since then the overlap has been greater (Graph 2, right-hand panel).

Forms of green bond certification

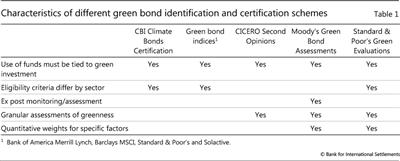

For investment in green bonds to take off, it is important for both asset managers and their principals to be able to identify the bonds that actually have environmental or climate-related benefits. Asset managers may have the resources to make an informed judgment on their own. Indeed, global initiatives such as the Financial Stability Board's (FSB) Task Force on Climate-Related Financial Disclosures aim to make better environmental information readily available (FSB TCFD (2016)). Still, external certification allows asset managers to show beneficiaries that they are indeed investing in green bonds when requested to do so, and may be more cost-effective. A variety of forms of green bond certification have emerged, which all aim at ensuring that the use of funds and subsequent revenue is tied to green investment (Table 1).

The ICMA Green Bond Principles are so-called "voluntary process guidelines" that outline general criteria that most certification schemes follow. They were put together by major private financial institutions under the aegis of the ICMA (ICMA (2015)). The Principles provide prospective issuers with guidance on the key components of green bond issuance, namely: (i) the use of proceeds for environmentally sustainable activities; (ii) a process for determining project eligibility; (iii) management of the proceeds in a transparent fashion that can be tracked and verified; and (iv) annual reporting on the use of proceeds.

Though this section reviews international certification mechanisms available to any issuer, many jurisdictions have developed their own national taxonomies of what constitutes eligibility as a green bond. Most notably, China's Green Bond Finance Committee has issued a Green Bond Endorsed Project Catalogue (People's Bank of China (2015)). For large domestic markets, this is a sensible option, but to the extent that international harmonisation is an issue, domestic guidelines run the risk of limiting the value of any particular green certification scheme to the domestic investor base. The ongoing initiative to improve the consistency of definitions and methodologies for determining the eligibility of green projects across the jurisdictions of China and the European Union represents perhaps the most significant effort to address this issue (European Investment Bank (2017)).

Climate Bond Certification

As discussed above, the CBI maintains a list and database of green bonds issued since 2009. The bonds in its database have green labels, but inclusion in the database does not constitute an opinion by CBI as to the correctness of the label.

The CBI also provides standards and a certification procedure. While the Green Bond Principles are very general, the CBI's Climate Bonds Standard establishes sector-specific eligibility criteria to judge an asset's low carbon value and suitability for issuance as a green bond. Assets that meet the CBI standard are then eligible for Climate Bond Certification, after an approved external verification that the bond meets environmental standards and that the issuer has the proper controls and processes in place.

A limitation of the CBI standard is that it does not necessarily mandate monitoring and verification on an ongoing basis (Table 1, first column). It is highly useful for investors to have an entity regularly renew its certification, particularly if they intend to maintain the investment over a multi-year horizon.

Green bond indices

Green bond indices identify specific bonds as green via a stated methodology, and allow investors to invest in a portfolio of green bonds to diversify risks (Table 1, second column). To this extent, the green bond index providers also effectively act as institutions of certification. At present, global green bond indices are compiled by Bank of America Merrill Lynch, Barclays MSCI, Standard & Poor's and Solactive.6 Each has its own methodology for choosing the components of the index. While advertising consistency with the Green Bond Principles, each index also specifies additional factors such as size and liquidity, as well as the specific industry sectors for which the proceeds are used.

Index providers can arguably serve an ongoing monitoring function, since they can discard entities from an index as well as include them. However, since many inclusion criteria for green bond indices are much less concrete than those for conventional bonds (such as minimum levels of market liquidity and credit ratings), it remains to be seen whether the index providers can monitor such environmental criteria on a continuous basis.

External reviews

Though it is not a part of the four main Green Bond Principles, it was recommended in the 2015 edition of the Principles that green bond issuers "use external assurance to confirm alignment with the key features of Green Bonds". This can include second opinions and verifications. From 2016, the Principles referred to "external reviews" rather than "external assurance", while the list of recommended external reviews was expanded to include those provided by rating agencies (ICMA (2016)).

A limitation of the CBI standard and inclusion in the green bond indices is their binary nature: a bond is either green or not. More granular assessments could contain valuable information for investors, such as the degree of environmental benefits, or whether environmental benefits are likely to persist. Indeed, the following providers of green certification make more granular assessments.

CICERO is a climate research institute based in Oslo (Table 1, third column) and the leading provider of second opinions. It evaluates the issuer's framework for both project selection and investment (CICERO (2016)). CICERO provides three different degrees of positive assessment ("shades of green"), reflecting the bond's adherence to a long-term vision for a low-carbon, "environmentally resilient" society. However, CICERO reviews the green bond framework at the time of issuance. Ex post changes in the framework or environmental impact are not monitored, unless the issuer specifically requests it.7

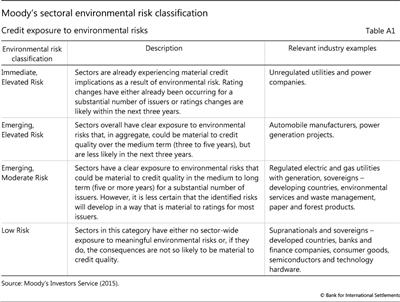

Moody's Green Bond Assessments. The first public methodology for the assessment of green bonds by a ratings agency was published by Moody's Investors Service in March 2016 (Table 2, second column). Green Bond Assessments (GBAs) are intended to "assess the relative likelihood that bond proceeds will be invested to support environmentally friendly projects", in line with the Green Bond Principles (Table 2, first column). As with their credit rating products, Moody's employs numerous quantifiable factors in determining the GBAs, with the explicit aim of increasing their transparency and replicability. Regular review is anticipated, similar to the way regular credit ratings are refreshed over a multi-year horizon.8

Standard & Poor's Green Evaluations. Standard & Poor's introduced Green Evaluations in 2017 (Table 2, third column). The focus of these ratings is broader than that of GBAs, as they include a technical environmental impact assessment component, along with governance and transparency components. A score between zero and 100 is intended to evaluate the relative ranking of the overall expected lifetime environmental impact relative to maintaining the status quo - after discounting for qualities of the governance and transparency of the bond's use of proceeds.

Notwithstanding its broader focus, the S&P methodology can also be viewed as mostly in line with the Green Bond Principles, while providing transparency with regard to the quantitative importance of various factors, and considerable granularity in the final assessment. That said, each score is a point-in-time evaluation, and is removed from the S&P website after at most 18 months. In this sense, ex post assessment is not provided unless requested as part of a separate evaluation.

The pricing of green bonds, financial performance and risks

For the green bond market to channel a significant amount of funds into environmentally friendly projects, green bonds should also fulfil the needs of both issuers and investors. Looking at the same issuer, the risk characteristics of a green bond are essentially identical to those of a conventional bond: while the proceeds from the issuance of a green bond are earmarked for environmentally friendly projects, green bonds are serviced from the cash flows of the entire operations of the issuer - not just the green project.

These characteristics have implications for the pricing of green bonds and their attractiveness for investors. A premium at issuance over comparable bonds without a green label would indicate that a significant number of investors value the label, enough to give issuers an extra incentive to issue bonds that have it. At the same time, these investors will still be interested in an acceptable financial performance of green bonds over time. Another consideration is the exposure to credit risks related to environmental change. That green bonds support environmentally beneficial projects does not necessarily imply lower exposure to such risks. The rest of this section discusses these issues further.

The green bond premium

Does the green label influence the price that issuers are willing to pay (in other words, the yield spread over risk-free rates that they are willing to accept) for a bond? A large body of literature documents that factors unrelated to credit risks can significantly influence bond yield spreads, such as specific demand and supply factors (eg Collin-Dufresne et al (2001), Greenwood and Vayanos (2014)) or liquidity premia (eg Longstaff (2004), Amihud et al (2006)). If a sizeable population of investors is willing to pay a premium (accept a lower spread) for green bonds, this should show up in the pricing of the bonds at issuance.

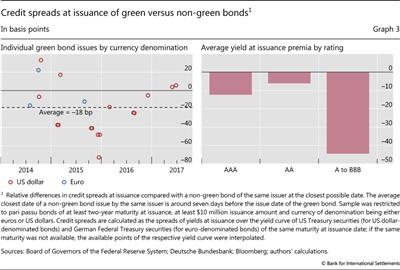

To analyse the price effect of the green label, we compare the credit spreads at issuance of a cross-section of 21 green bonds issued between 2014 and 2017 with the credit spreads at issuance of conventional bonds of the same issuers at the closest possible issue date (Graph 3). As most issuers of green bonds also regularly issue conventional bonds, this comparison allows us to control for issuer-specific idiosyncratic factors, including credit risk. We do not include any project bonds, as claims on cash flows could possibly be on different projects with different risk characteristics. We further restrict the sample to pari passu fixed rate bonds, to avoid the influence that debt seniority or the uncertainty of floating rates could have on the pricing at issuance. We look for conventional bonds of roughly the same maturity, and restrict our matched pairs to US dollar- and euro-denominated green bonds, as spreads over local benchmark rates tend not to be as stable for bonds issued in EME currencies.

Our results indicate that green bond issuers on average have borrowed at lower spreads than they have through conventional bonds. This confirms the results from other recent studies (eg Zerbib (2017), Barclays (2015)). The mean difference in spread in our sample is around 18 basis points.9 Overall, this is consistent with a high demand for green bonds (CBI (2017), OECD (2016)) relative to supply - in other words, enough investors have a preference for holding green bonds to influence the issue price. When we segment the sample by rating category, it appears that the green yield difference is greater for riskier borrowers (Graph 3, right-hand panel). Recall that we compare credit spreads at issuance of pari passu bonds from the same issuer, so this result does not reflect differences in credit risk (or other factors) across issuers within the same rating category. Again, this finding is consistent with previous work (Zerbib (2017)).

At the same time, we also document considerable variation across the individual green bond issues in our sample (Graph 3, left-hand panel). The standard deviation of the premium is 27 basis points. Not all issuers were able to take advantage of a yield discount at issuance: five out of the 21 green bond issues priced at spreads above the matched conventional bonds. We also could not document yield premia for higher levels of greenness as determined by the more granular assessments of the major rating agencies.10

Financial performance over time

Returns to investors from green bonds will reflect their performance over time, in particular when investors do not intend to simply hold them until maturity. The average premium at issuance will not necessarily translate into a noticeable underperformance in secondary market trading. Investors in the secondary market may well price in a different premium from primary market investors.11 Many investors will also be interested in the realised volatility of green bonds as a metric of financial performance.

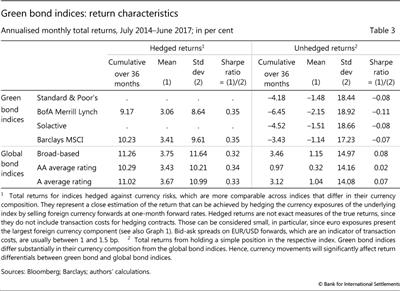

Green bond indices are a good starting point to analyse the secondary market performance of green bonds from an investor perspective. Green bond indices contain a diversified broader portfolio of bonds12 and thereby provide a good means of comparison with the performance of other bond indices that are suitable for a wide range of investors. We analyse so-called hedged returns, which measure returns in US dollars that can be achieved by hedging the currency exposures of the underlying index. As green bond indices differ notably from other global bond indices in their currency composition, currency movements alone can have an outsize impact on relative returns.

Overall, the performance of hedged green bond indices has been similar to that of global bond indices of comparable credit rating composition13 (Table 3, left-hand columns). Even though the available green bond indices by Bank of America Merrill Lynch, Barclays MSCI, Standard & Poor's and Solactive diverge slightly in their composition (CBI (2015)), their return characteristics hardly differ. The ratio of average monthly hedged returns to their standard deviation (Sharpe ratio), which is a standard measure for risk-adjusted performance, was in some cases even slightly higher for green bond indices than for global bond indices, though that difference was not statistically significant.

Total returns in US dollars on unhedged green bond indices, however, have exhibited higher volatility than those of broad-based bond indices (Table 3, right-hand columns). As the currency composition of the green bond indices is very diverse, and much less tilted towards the US dollar than is the case for global indices, movements in the currency of denomination of some green bonds in the indices increase the measured return volatility. This points to the importance of the availability of currency hedges for investors in green bonds.14

The green label and exposure to environmental risks

Carney (2015) describes the potentially severe impact of climate change on the economy as a "tragedy of the horizon": investors and other actors do not sufficiently take the risks into account as they materialise only over a long horizon. Indeed, a number of academic studies have documented a tendency for investors to inadequately price environmental risks (Hong et al (2016) and references therein). This is despite already strong evidence of severe financial impacts of both physical risks, due to climate-related events such as droughts and floods, and transition risks, such as the risk of a material change in environmental regulations (Caldecott et al (2014)). For instance, rating agencies now plan to take account of the financial risks related to the transition to stricter carbon emission rules implied by the Paris agreement when they analyse credit risks of bond issuers from polluting sectors (eg Moody's Investors Service (2016b)).

One question is whether green bonds can provide an instrument for investors to hedge against these environmentally related financial risks. If these risks materialise, bonds from issuers in polluting sectors may be subject to significant revaluations. To the extent that issuers of green bonds are better shielded against large revaluations, they could serve as an efficient risk management instrument.

But this need not be the case. Green bonds generally comprise investor claims on an entity's overall operations. A large and diversified energy company may invest a considerable amount in green projects, but other parts of its business (for instance coal power plants) may expose it to environmentally related credit risks, such as changes in carbon regulations. There may also be green bonds whose income stream is vulnerable to climate change quite apart from transition risk (for example, wind farms subject to flood risk). In the case of almost all green bonds, the exposure to environmentally related credit risks is a function of the entire company's business. Only a few green bonds are project bonds, where claims are on the cash flows of the financed green project itself.

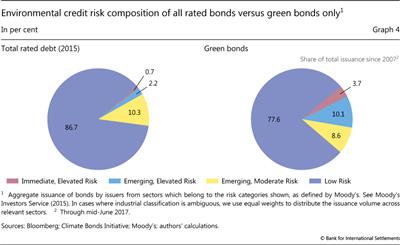

Indeed, the evidence suggests that green bonds are more, not less, exposed to environmentally related credit risks. Moody's provides a classification of credit exposures to environmental risks at the sectoral level (Moody's Investors Service (2015) and Annex Table A1).15 Within the universe of corporate debt rated by Moody's, 13.2% is issued by institutions in industries with moderate or greater exposure to environmental credit risk, and around 2.9% in industries classified as either immediate or emerging elevated risk (Graph 4, left-hand panel). By contrast, when we examine the industry composition of green bonds alone, we see that 22.4% of green bonds are issued in sectors with moderate or greater exposure to environmental credit risk, and nearly 14% in industries classified as elevated risk (right-hand panel). Thus, the percentage of green bonds in high-risk sectors exceeds that for overall rated debt by a factor of four.

Conclusion

Green bond principles and standards are an important step towards promoting green finance. Since the introduction of the Green Bond Principles by the ICMA in January 2014, the issuance of labelled green bonds has increased rapidly, with a growing number of issuers from the private sector and EMEs. Several green bond indices have also been introduced, allowing a broader group of investors to take a diversified position in green bonds. The evidence suggests that investors place value on the green label at issuance, even though the post-issuance financial performance of green bonds is comparable with that of conventional bonds. However, for this still relatively small market to grow more, several further developments need to take place.

First, the various existing definitions and labels for green bonds pose a challenge for investors, who may benefit from more consistent standards. The ongoing work to improve the consistency of standards in China and the European Union are promising in this regard. At the same time, more ongoing monitoring by "second opinion" providers, rating agencies or other forms of continuous third-party verification may be needed. Even if asset managers utilise the green label simply to signal to ultimate investors their fulfilment of green mandates, the information value of those labels can depreciate over time as technology evolves or policies of the issuer change.

A second informational aspect that is not covered by current green certification schemes is the environmentally related financial risks of green bonds. While the management of environmental risks extends far beyond green bonds, it is important to avoid the misperception that green bonds are insulated from such risks. In fact, among all rated bonds, those with a green label are more likely to be in sectors that are exposed to such risks. Green bond standards could be enhanced to highlight the degree of financial risks stemming from environmental factors so as to further encourage investors to manage these risks effectively.

References

Amihud, Y, H Mendelson and L Pedersen (2006): "Liquidity and asset prices", Foundations and Trends in Finance, vol 1, no 4, pp 269-364.

Andersson, M, P Bolton and F Samama (2016): "Hedging climate risk", Financial Analysts Journal, vol 72, no 3, pp 13-32.

Barclays (2015): "The cost of being green", US Credit Focus, September.

Caldecott, B (2012): "Green infrastructure bonds: accessing the scale of low cost capital required to tackle climate change", Climate Change Capital.

Caldecott, B, J Tilbury and C Carey (2014): "Stranded assets and scenarios", Smith School of Enterprise and the Environment, Discussion Paper, January.

Carney, M (2015): "Breaking the tragedy of the horizon - climate change and financial stability", speech given at Lloyd's of London, 29 September.

CICERO (2016): Framework for CICERO's 'Second Opinions' on green bond investments, April.

Climate Bonds Initiative (2015): Bonds and climate change - the state of the market in 2015, July.

--- (2017): Green bond pricing in the primary market: Q4 2016 snapshot, March.

Collin-Dufresne, P, R Goldstein and J Spencer Martin (2001): "The determinants of credit spread changes", Journal of Finance, vol LVI, no 6, December, pp 2177-207.

Ehlers, T (2014): "Understanding the challenges for infrastructure financing", BIS Working Papers, no 454, August.

Ehlers, T, F Packer and E Remolona (2014): "Infrastructure and corporate bond markets in Asia", in Financial flows and infrastructure financing, Reserve Bank of Australia, conference volume, July.

European Investment Bank (2017): "New People's Bank of China and EIB initiative to strengthen green finance", press release, 22 March.

Fitch Ratings (2017): "Green bond funds face diversification challenge", special report, August.

FSB Task Force on Climate-Related Financial Disclosures (2017): Final report: recommendations of the task force on climate-related financial disclosures, June.

G20 Green Finance Study Group (2016): Green finance synthesis report 2016, September.

Greenwood, R and D Vayanos (2014): "Bond supply and excess bond returns", Review of Financial Studies, vol 27, no 3, pp 663-713.

Hong, H, F Li and J Xu (2016): "Climate risks and market efficiency", NBER Working Papers, no 22890.

International Capital Market Association (2014): Green Bond Principles, January.

--- (2015): The Green Bond Principles 2015, March.

--- (2016): The Green Bond Principles 2016, June.

Longstaff, F (2004): "The flight-to-liquidity premium in US treasury bond prices", The Journal of Business, vol 77, no 3, pp 511-26.

Moody's Investors Service (2015): "Environmental risks - heat map shows wide variations in credit impact across sectors", September.

--- (2016a): Green Bonds Assessment (GBA), March.

--- (2016b): "Moody's to analyse carbon transition risk based on emissions reduction scenario consistent with Paris agreement", June.

Organisation for Economic Co-operation and Development (2016): "Mobilising bond markets for a low-carbon transition", Green finance and investment, April.

People's Bank of China (2015): "Announcement No. 39," December.

Pereira da Silva, L (2017): "Green finance: can it help combat climate change?", remarks at the Global Public Investor Symposium on "Green bond issuance and other forms of low-carbon finance", Frankfurt am Main, 13 July, organised by the BIS, OMFIF, the Deutsche Bundesbank and the World Bank Group.

Standard & Poor's (2017a): "We won't solve for green finance unless we solve for infrastructure", S&P Global Market Intelligence, April.

--- (2017b): "Green evaluation analytical approach", S&P Global Market Intelligence, April.

Weidmann, J (2017): "Green bond issuance and other forms of low-carbon finance", speech at the Global Public Investor Symposium on "Green bond issuance and other forms of low-carbon finance", Frankfurt am Main, 13 July, organised by the BIS, OMFIF, the Deutsche Bundesbank and the World Bank Group.

White, L (2002): "The credit rating industry: an industrial organisation analysis", in R Levich, G Majnoni and C Reinhart (eds), Ratings, rating agencies and the global financial system.

Zerbib, O (2017): "The green bond premium", July.

1 The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS. We thank Claudio Borio, Stijn Claessens, Benjamin Cohen, Dietrich Domanski, Kumar Jegarasasingam, Luiz Pereira da Silva and Hyun Song Shin for their valuable comments, and Agne Subelyte for providing excellent research assistance. We also thank the Climate Bonds Initiative for providing us with their data.

2 See the proceedings of the conference co-organised by the Official Monetary and Financial Institutions Forum (OMFIF), the BIS and the World Bank Group in Frankfurt on 13 July 2017; see also Weidmann (2017) and Pereira da Silva (2017).

3 Transition risks, ie the financial impact of changes in environmental regulation, are typically seen as the most significant risk bond investors face. Carney (2015) notes that "while a given physical manifestation of climate change - a flood or storm - may not directly affect a corporate bond's value, policy action to promote the transition towards a low-carbon economy could spark a fundamental reassessment".

4 The universe of bonds for which proceeds are used for environmentally beneficial projects, but which do not carry a green label, is still likely to be quite large (Climate Bonds Initiative (2015)). But as the green label becomes more commonly used, it becomes more and more likely that issuers will seek this label to distinguish themselves.

5 Based on an estimate of total global debt capital market issuance of $6.69 trillion in 2016 (see www.dealogic.com/insights/key-trends-shaped-markets-2016/).

6 In addition, there are several internationally listed green bond indices focusing on specific jurisdictions - in particular China. For instance, the Shanghai Green Bond Index Series (developed by the Shanghai Stock Exchange in collaboration with China Securities Index Co), or the CUFE-CNI Green Bond Index Series (developed by the Shenzhen Securities Information Co together with the International Institute of Green Finance) are indices based on green bonds issued in China which are also listed in Europe on the Luxembourg stock exchange.

7 More regular monitoring is now implicitly recommended by the Green Bond Principles though not necessarily delegated to third parties. In 2016, the Principles were updated to state that issuers should "- keep readily available up to date information on the use of proceeds to be renewed annually until full allocation and as necessary thereafter in the event of new developments".

8 ESG ratings, which assess a firm's performance across a weighted average of environmental, social and governance (ESG) issues, provide many of the same attributes. In June 2016, the Green Bond Principles statement by ICMA recognised that the "use of proceeds" bond concept might be applied to themes beyond the environment, such as bonds financing projects with social objectives, or with a combination of social and environmental objectives. However, the green bond label is still reserved for investment projects providing clear environmental benefits. Since ESG ratings are not specifically focused on environmental benefits, they are not considered in this feature.

9 An 18 basis point lower credit spread would be significant relative to the potential costs of a green label or rating. The certification fee for the green label of the Climate Bonds Initiative is a flat 0.1 basis points of the issue value (though the CBI also requires the external engagement of a party that verifies procedures and reports). As for the green assessments of the major rating agencies, even if they were to be as expensive as a normal credit rating (3-5 basis points of the issue volume (White (2002))), the costs would be far less than 18 basis points.

10 These new assessments have so far tended to be at one end of the spectrum: for instance, the 26 bond issues with Moody's GBAs as of end-July 2017 were all at the highest level (GB1). The 10 available bond issues with green rating evaluations by Standard & Poor's rank between 67 and 92 (out of 100), but the only four of these bonds for which we could find yields are from the same issuer and therefore have the same score. This does not allow us to make meaningful comparisons of the pricing of bonds across different green bond ratings. Likewise, because of a paucity of yield data, we cannot compare the impact of the rating agency assessments with those of the other green labels.

11 Buy and hold investors will have decided ex ante that the benefits of holding the individual issue to maturity equal or outweigh the premium.

12 Some analysts, however, have argued that green bond indices are less diversified than other much broader bond indices (Fitch Ratings (2017)). Nevertheless, the green bond indices we consider represent an accurate overall picture of the financial characteristics of the green bond market at its current stage of development.

13 The universe of labelled green bonds from Bloomberg and CBI has an average rating of slightly below AA. The average maturity and duration of the global bond indices and the different green bond indices are quite similar, but sectoral and currency compositions differ.

14 Importantly, some researchers (eg Andersson et al (2016)) have shown that it is possible to construct a portfolio of green instruments that has an identical performance to that of a broader market index. This would provide a product for a wide range of green investor that yields a financial performance equal to that of a diversified market portfolio, but with environmental benefits.

15 Credit risks from environmental exposures are defined as the risks to a borrower's ability to repay caused by physical climate events or changes in environmental regulations.