The rise and financialisation of the renminbi

(Extract from page 43 of BIS Quarterly Review, December 2016)

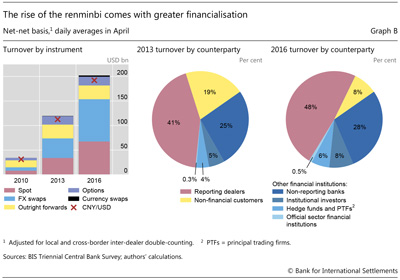

Renminbi turnover has approximately doubled every three years over the past decade and a half (Graph B, left-hand panel). Total daily turnover has reached over $200 million or 4% of global FX turnover. This makes the Chinese currency the eighth most traded currency in the world, overtaking the Mexican peso and only slightly behind the Swiss franc and Canadian dollar.

Along with the rise in the overall trading of the renminbi, its use as a financial instrument and to back financial rather than trade transactions has also increased. In the past, most of the limited turnover was in spot transactions. The Triennial reveals that spot now amounts to less than half of total turnover, while the share of FX swap trading has reached 40%. Associated with this, trading among financial institutions is now much more prevalent, while the share of renminbi trading with non-financial customers has declined steeply, from 19% in 2013 to 8% in 2016 (Graph B, centre and right-hand panels). However, the prominent role of the CNY/USD pair has not changed: 95% of renminbi trading is against the US dollar, and there is no serious liquidity in any other CNY pairs.

Renminbi trading volumes are growing rapidly, and the currency is becoming more financialised. The share of derivative compared with spot trading, and of financial compared with non-financial counterparties, are approaching that of well established and liquid currencies. Also, according to McCauley and Shu (2016), in line with RMB internationalisation, trading in offshore deliverable RMB forwards increased significantly, while that in non-deliverable forwards declined since the last survey. However, there are still impediments to the renminbi becoming a truly international currency. In addition to the low liquidity outside the CNY/USD pair, these include capital controls, the wedge between the offshore and onshore exchange rates, and ineligibility for CLS settlement. At the same time, the rapid growth of renminbi trading and the development of the associated financial markets (Ehlers et al (2016)) suggest that these hurdles may be cleared faster than might be expected.