Drivers of aggregate FX turnover

(Extract from pages 38-39 of BIS Quarterly Review, December 2016)

The macroeconomic backdrop has pointed to a moderation of the underlying demand for (spot) FX trading. Global trade (as a share of GDP) and global capital flows have fallen since 2013. Hence, global FX turnover has actually held up well relative to gross current, capital and financial account trading needs (Graph 1, right-hand panel). Trading with non-financial customers has dropped by about 20% (Table 1), another sign pointing to a decline in FX transactions associated with global trade.

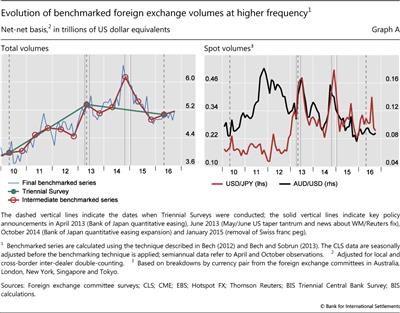

The overall fall in turnover conceals important nuances about the evolution of FX turnover between the 2013 and 2016 Triennials. To see this, we follow Bech (2012) and Bech and Sobrun (2013) and compute measures of benchmarked FX volumes using a combination of sources, including the more frequent FX surveys conducted by regional foreign exchange committees, information from major electronic trading platforms and CLS settlement volumes. The higher-frequency perspective reveals an even more pronounced drop in trading activity. FX activity actually peaked in September 2014, at $6.5 trillion per day (Graph A, left-hand panel). Volumes fell off steeply thereafter, to less than $5 trillion per day in November 2015, before recovering somewhat by April 2016.

Several factors, some due to central bank policy measures, seem to have led to this pattern. The previous Triennial took place amid heightened FX activity against the background of policy easing by the Bank of Japan in April 2013 (Rime and Schrimpf (2013)). FX trading then continued to rise until June 2013. This was the month when attention turned to the London 4 pm WM/Reuters fixing scandal. The same month coincided with the "taper tantrum", when expectations mounted that the US Federal Reserve would begin tapering its asset purchases. Trading volumes rebounded again in the second half of 2014, against the background of further easing by the ECB, including the introduction of negative policy rates, and an expansion of the Quantitative and Qualitative Monetary Easing (QQE) programme by the Bank of Japan that October. Indeed, major policy innovations by the Bank of Japan appeared to trigger heightened trading activity in the JPY/USD currency pair and related crosses, such as AUD/USD (Graph A, right-hand panel). This, in turn, contributed to spikes in total global FX market activity.

Aggregate volumes were also driven by the interaction of several macroeconomic developments with the micro drivers discussed in the text. The outsize price moves in the wake of the Swiss National Bank's abandonment of the Swiss franc's peg against the euro on 15 January 2015 sent shockwaves through the prime brokerage industry, causing prime brokers to raise fees and cut clients. This has further reduced participation by hedge funds and other leveraged players in FX markets, as they have already been experiencing low returns. Some banks also cut their business exposures to retail margin brokerage, which affected market access for retail aggregators. High-frequency trading (HFT) firms were also faced with tighter FX market access from the decline in prime brokerage as well as from various measures to curb HFT activity which were put in place by major FX trading venues beginning in mid-2013. All these developments had a disproportionate impact on spot trading, because the above-mentioned market participants seek returns by taking open currency positions or, in the case of HFT, focus on the most liquid instruments.

By contrast, trading in FX swaps rose because of the increase in currency hedging activity by long-term institutional investors, as they rebalanced their international portfolios on the back of central bank quantitative easing programmes. Similarly, FX liquidity management among dealer banks increased, as money market rates and lending spreads in major currencies diverged, which also contributed to the rise in FX swap turnover.