Central clearing predominates in OTC interest rate derivatives markets

(Extract from pages 22-24 of BIS Quarterly Review, December 2016)

New BIS data show that central clearing has made significant inroads into over-the-counter (OTC) interest rate derivatives markets but is less prevalent for other OTC derivatives. Central clearing is a key element in authorities' agenda for reforming OTC derivatives markets to reduce systemic risks. As of end-June 2016, 75% of dealers' outstanding OTC interest rate derivatives contracts were against central counterparties (CCPs), compared with 37% for credit derivatives and less than 2% for foreign exchange and equity derivatives. Overall, 62% of the $544 trillion in notional amounts outstanding reported by dealers was against CCPs, and 41% of the $21 trillion in gross market value.

In the BIS OTC derivatives statistics, data on CCPs were previously collected only for credit default swaps (CDS), whereas starting from end-June 2016 CCPs were separately identified for all types of OTC derivatives. Dealers report their outstanding positions in terms of notional amounts, which provide a measure of the aggregate amount of risk that they transfer from other counterparties to CCPs, as well as market values, which provide a measure of their counterparty exposure to CCPs. While outstanding positions against CCPs are not synonymous with the proportion of trades that are cleared through CCPs - known as the clearing rate - the former can be adjusted to approximate the latter. In the OTC derivatives statistics, a trade between two dealers that is subsequently novated to a CCP is captured twice: each dealer reports an outstanding position against the CCP. Therefore, under the extreme assumption that all positions with CCPs were initially inter-dealer contracts, a lower bound on the clearing rate can be estimated by halving outstanding positions against CCPs. Inter-dealer trades novated to CCPs would thereby be counted only once.

Dealers report their outstanding positions in terms of notional amounts, which provide a measure of the aggregate amount of risk that they transfer from other counterparties to CCPs, as well as market values, which provide a measure of their counterparty exposure to CCPs. While outstanding positions against CCPs are not synonymous with the proportion of trades that are cleared through CCPs - known as the clearing rate - the former can be adjusted to approximate the latter. In the OTC derivatives statistics, a trade between two dealers that is subsequently novated to a CCP is captured twice: each dealer reports an outstanding position against the CCP. Therefore, under the extreme assumption that all positions with CCPs were initially inter-dealer contracts, a lower bound on the clearing rate can be estimated by halving outstanding positions against CCPs. Inter-dealer trades novated to CCPs would thereby be counted only once. However, this underestimates the significance of clearing because an (unknown) portion of cleared trades are not between dealers and thus not double-counted in the BIS statistics. Moreover, CCPs' share of outstanding positions is lower than their share of trades because compression is more common for cleared trades.

However, this underestimates the significance of clearing because an (unknown) portion of cleared trades are not between dealers and thus not double-counted in the BIS statistics. Moreover, CCPs' share of outstanding positions is lower than their share of trades because compression is more common for cleared trades.

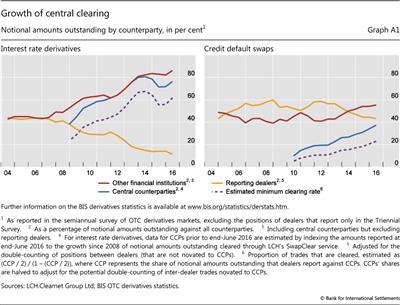

While comprehensive data on central clearing are available only from end-June 2016, the share of outstanding positions with other financial institutions - with which CCPs were previously grouped indistinguishably - can be used to approximate the pace of the shift in activity towards CCPs. For OTC interest rate derivatives, this share has been climbing steadily since 2007, from 44% of notional principal at end-June 2007 to 86% at end-June 2016 (Graph A1, left-hand panel). In contrast, the inter-dealer segment declined markedly in importance over this period, from 43% to 11%. These opposing trends were probably driven in part by the novation of inter-dealer contracts to CCPs. Using data from LCH to backdate the BIS statistics on CCPs, the clearing rate for OTC interest rate derivatives is estimated to have more than doubled between 2008 and 2016; it could plausibly have tripled (Graph A1, left-hand panel).

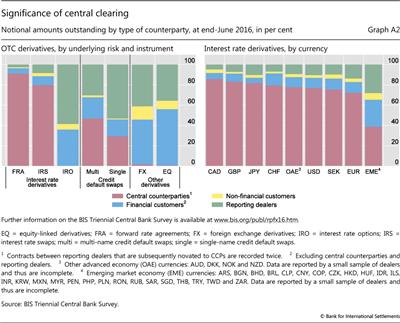

In the OTC interest rate derivatives market, the share of notional amounts booked against CCPs was highest for forward rate agreements, at 91% at end-June 2016 (Graph A2, left-hand panel). This is equivalent to a clearing rate of at least 84%, although this is probably an underestimate. For interest rate swaps, the share booked against CCPs was 80%, which is equivalent to an estimated minimum clearing rate of 66%. However, for interest rate options, central clearing was close to zero. Across major currencies, the importance of CCPs was uniformly high, ranging from 72% for interest rate derivatives denominated in euros to 86% for those in Canadian dollars, with US dollars in between at 77% (Graph A2, right-hand panel). Among EME currencies, it was significantly lower.

Central clearing has also gained in importance in credit derivatives markets. The proportion of outstanding CDS cleared through CCPs has increased steadily since these data were first reported, from 10% at end-June 2010 to 37% at end-June 2016. After adjusting for the potential double-counting of trades, this was equivalent to an increase in the estimated minimum clearing rate from 5% to 23% (Graph A1, right-hand panel). The share of CCPs is higher for multi-name than for single-name products: 47% versus 29% for notional amounts outstanding (Graph A2, left-hand panel). Multi-name products, which consist primarily of contracts on CDS indices, tend to be more standardised than single-name products and consequently more amenable to central clearing.

In other segments of OTC derivatives markets, central clearing was negligible. For FX derivatives, the share of outstanding notional amounts cleared through CCPs was 1.5% at end-June 2016, and for OTC equity derivatives 0.7% (Graph A2, left-hand panel). For commodity derivatives, CCPs' share is not known because a counterparty breakdown for this asset class is not collected in the BIS OTC derivatives statistics.

The relatively low shares for FX and equity derivatives are explained partly by differences in the regulations that apply to different derivatives. Regulators in most of the major derivatives markets require certain standardised OTC derivatives to be centrally cleared, particularly interest rate swaps, CDS and non-deliverable FX forwards; deliverable FX derivatives and equity derivatives are often not covered by these requirements. Also, some instruments, such as options, are currently not offered for clearing by CCPs. That said, regulators continue to expand clearing requirements, and many are also starting to require higher capital and margin for non-centrally cleared derivatives. This strengthens the incentive to move trades to CCPs. In the United States and other key markets, margining requirements began to be phased in starting in September 2016, so their impact on clearing will only become clear in future data.

This strengthens the incentive to move trades to CCPs. In the United States and other key markets, margining requirements began to be phased in starting in September 2016, so their impact on clearing will only become clear in future data.

See BIS, "OTC derivatives statistics at end-June 2016", statistical release, November 2016.

See BIS, "OTC derivatives statistics at end-June 2016", statistical release, November 2016.  Clearing rates published by other organisations typically refer to trading volumes, not outstanding positions, and count each trade only once. Volume-based statistics are influenced by the maturity of trades; contracts with very short maturities are captured each time the contract is rolled over during the period in which volumes are measured.

Clearing rates published by other organisations typically refer to trading volumes, not outstanding positions, and count each trade only once. Volume-based statistics are influenced by the maturity of trades; contracts with very short maturities are captured each time the contract is rolled over during the period in which volumes are measured.  For a discussion of compression, see T Ehlers and E Eren, "The changing shape of interest rate derivatives markets", BIS Quarterly Review, December 2016, pp 53-65.

For a discussion of compression, see T Ehlers and E Eren, "The changing shape of interest rate derivatives markets", BIS Quarterly Review, December 2016, pp 53-65.  See Financial Stability Board, OTC derivatives market reforms: eleventh progress report on implementation, August 2016.

See Financial Stability Board, OTC derivatives market reforms: eleventh progress report on implementation, August 2016.  See R McCauley and C Shu, "Non-deliverable forwards: impact of currency internationalisation and derivatives reform", BIS Quarterly Review, December 2016, pp 81-93.

See R McCauley and C Shu, "Non-deliverable forwards: impact of currency internationalisation and derivatives reform", BIS Quarterly Review, December 2016, pp 81-93.