Fixed income market liquidity in the wake of Brexit

(Extract from page 5 of BIS Quarterly Review, September 2016)

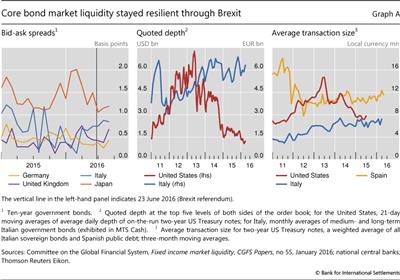

Before the UK referendum, many observers voiced concerns about whether markets would be resilient to an unexpected outcome. After the event, in core fixed income markets, and indeed most other markets, it was evident that the system was able to smoothly absorb the brief turbulence that followed (Graph A, left-hand panel). Markets went through the Brexit vote with little or no disruption to functioning. But questions about their underlying resilience remain.

Market liquidity can be defined as "the ability to rapidly execute large financial transactions at low cost with limited price impact". As market-based finance gains importance in financial systems worldwide, market liquidity has become increasingly relevant to financial stability. This is especially true in the case of core fixed income instruments, which perform critical roles as investments, collateral and pricing benchmarks.

As market-based finance gains importance in financial systems worldwide, market liquidity has become increasingly relevant to financial stability. This is especially true in the case of core fixed income instruments, which perform critical roles as investments, collateral and pricing benchmarks.

Taking a longer perspective, most indicators do not show a significant structural decline of liquidity in financial markets in recent years. For instance, bid-ask spreads have been stable and tight in major sovereign bond markets (Graph A, left-hand panel). While quoted depth and average transaction size have declined in some markets, in most cases they are not unusually low by historical standards (Graph A, centre and right-hand panels).

That said, financial markets have experienced a number of intense and short-lived episodes of stress in the last few years, such as the "flash rally" in US Treasury bonds on 15 October 2014 and the turbulence in the German bund market in May-June 2015. Although the explanations for these sudden changes in market conditions vary, the increased reliance of market participants on electronic trading platforms and the proliferation of trading algorithms in a number of key fixed income markets are likely to have been major factors. While the "electronification" of fixed income markets has contributed to reducing trading costs and improving liquidity in normal conditions, the spread of complex and often opaque trading strategies has raised concerns about potential implications for market stability in times of stress.

Committee on the Global Financial System, Fixed income market liquidity, CGFS Papers, no 55, January 2016.

Committee on the Global Financial System, Fixed income market liquidity, CGFS Papers, no 55, January 2016.