Sovereign ratings of advanced and emerging economies after the crisis

The three major credit rating agencies have reassessed sovereign credit risks in the light of the Great Financial Crisis, increasing the transparency of their methodologies. This has resulted in material shifts in the rank-ordering of risks. Simple statistical models explain the lion's share of ratings differentials and capture some, but not all, of the methodological changes. Support is not found for the hypothesis of bias against emerging market economies (EMEs). Some rating agencies other than the big three offer alternative risk rankings that are more favourable to EMEs. However, these tend to be less closely aligned with the rankings provided by market prices and institutional investors.1

JEL classification: F34, G24, H63.

In recent years, the sovereign credit ratings of advanced economies (AEs) and emerging market economies (EMEs) have followed different paths. Years of reforms and strengthened macroeconomic frameworks have improved the sovereign credit ratings of most EMEs. During the Great Financial Crisis (GFC) of 2007-09 and the subsequent euro area debt crisis, the sovereign risk profile of many AEs deteriorated markedly. Since mid-2007, the average of the foreign currency sovereign ratings assigned by Moody's Investors Service, Standard & Poor's (S&P) and Fitch Ratings to 28 AEs has declined from AA+ to AA-, or by two full rating notches, while the average of the similar ratings assigned to 68 EMEs has been mostly stable. That said, there is still a considerable difference in credit ratings between the two sets of countries, some convergence notwithstanding (Table 1).

Among the various regions, Europe has borne the brunt of the decline in country risk measures since the crisis, at least according to the major rating agencies. The average rating of advanced European economies has declined by three notches, from AA+ to A+, although this hides significant variation between countries. For instance, Greece was downgraded from A to CCC and Italy from AA- to BBB. European EMEs have not gone unscathed, with mean ratings falling by one notch over the same time period, from BBB to BBB-. By contrast, the average rating of EMEs in Asia-Pacific rose by half a notch over the period, while the average rating of AEs in that region was down by just a fifth of a notch. In the Americas too, average ratings were up slightly for EMEs, and down by a fifth of a notch for AEs.

While these rating adjustments largely reflect fiscal and macroeconomic developments, credit ratings have also changed because of evolving methodologies and approaches to the measurement of sovereign credit risk. The rating agencies now rely more on quantitative inputs than before. At the same time, they now place more emphasis on the implications for sovereign risk of monetary policy regimes, currency internationalisation, event risk and economic growth.

Our article is, to our knowledge, the first to examine whether the post-crisis revisions to sovereign rating methodologies are reflected in estimated rating models. We find that some variables have gained in significance, as might be expected, but we also find that a simple linear model fits less well than before, which may echo the increased dispersion of ratings following the crisis. At the same time, we find no quantitative support for the view that EME sovereigns are rated more severely than AE sovereigns by the major agencies, once other determinants of country risk are taken into account.

In the first section of this special feature, we review the post-crisis changes in sovereign rating methodologies. In the second, we report the results of linear regression models for ratings before and after the crisis. The third section compares major agency ratings with other metrics for sovereign risk, including the ratings of other agencies and market spreads. The fourth section concludes.

Rating methodologies and their post-crisis changes

What are sovereign ratings?

Sovereign ratings are opinions about the creditworthiness of sovereign borrowers that indicate the relative likelihood of default on their outstanding debt obligations.2 Specifically, the major agencies often highlight that their ratings reflect the creditworthiness of a rated entity relative to that of other rated entities rather than vis-à-vis an absolute level of default risk. That said, the major agencies also document the (evolving) correspondence of their ratings to default probabilities.

The major rating agencies commonly limit their time horizon to between two and three years. Ratings are intended to reflect creditworthiness "through the cycle": perceived vulnerability to cyclical downturns, but not the current position in the cycle, should influence a rating (Kiff et al (2012)).

Sovereign ratings, like the ratings on other credits, involve the assessment of both the ability and the willingness to pay. As a result, qualitative factors related to institutional strength and the rule of law assume greater importance than they otherwise might. There can also be path dependence in willingness to pay: countries may be wary of the reputational cost of default (Eaton and Gersovitz (1981)).

Thus, it comes as little surprise that rating agencies look at a very large number of indicators when assessing a sovereign's credit quality. These include measures of fiscal strength (such as public debt and interest cost burdens), economic strength (per capita GDP, output growth and inflation), institutional strength (governance, the rule of law and corruption), the monetary regime (exchange rate flexibility, reserve currency status) and other factors such as foreign exchange reserves, monetary aggregates and credit to GDP.

Changes in methodologies since the crisis

In the wake of the GFC and the European sovereign debt crisis, the major rating agencies have independently revisited their sovereign risk methodologies. These rating methodologies detail and rationalise the factors that drive the final assessments of the likelihood of default.3

A common theme is that the rating agencies have sought to move towards systems that rely more on quantitative inputs, in part to make ratings more transparent and replicable. The methodologies mostly take the form of a scoring system that lists all considered factors along with limits to their lowest and highest weights. In 2008, Moody's introduced a methodology that puts more weight on quantifiable factors, which it further refined in 2010. In 2011, S&P added several quantifiable factors to the ratings process. Fitch now uses a sovereign ratings model for foreign currency ratings based on 19 economic and financial variables that provide a benchmark for rating discussions. Even so, the methodologies still leave considerable room for qualitative adjustments and judgment.

At least four risk factors appear to have gained in importance in the methodologies, while one has lost ground.

To start with, differences in monetary policy regimes have come into sharper focus. Some sovereigns inside a currency union are now viewed as having less flexibility than those with an independent monetary policy. One agency may cut a sovereign rating by up to two notches if it views the union's monetary policy as inappropriate for the country concerned (Standard & Poor's (2014a)). Another agency assigns a lower rating to countries with inflexible exchange rate regimes.

Post-crisis, a number of AEs have relied on large-scale government bond purchases as part of their monetary policy toolkit. The three major agencies have generally taken the view that, over the relevant rating horizon, the corresponding potential for public debt monetisation does not call for downgrades. This reflects their judgment that somewhat higher inflation is not an adverse credit factor, and that the threshold beyond which such policies would pose a risk of much higher inflation - hence eroding economic or institutional strength - has not yet been reached.

Second, the degree of currency internationalisation, seen as a measure of the external liquidity available to a sovereign, has also gained in importance for some agencies. S&P has clarified the measures of internationalisation that can boost ratings, including the shares of the currency in global foreign exchange reserves and in global foreign exchange turnover. Sovereigns that can issue debt globally in their own currency are likely to be less vulnerable to a depreciation of the domestic exchange rate or shifts in sentiment on the part of foreign investors. Fitch argues for the importance of reserve currency status as a source of financing flexibility (Fitch Ratings (2013)), and also places weight on the openness and depth of domestic bond markets in both local and foreign currency.

Third, event risk - related to a sudden, extreme event that may severely strain public finances - has gained in importance. Related, contingent liabilities due to implicit guarantees in the event of distress of financial institutions and non-financial public sector enterprises have received more attention. S&P has revised its calculation of contingent liabilities, resulting in much higher estimates for total financial system liabilities.4

In addition, financial cycles are now given greater consideration. Credit booms can lower Moody's assessment of a sovereign's "economic strength" (and thus potentially its rating) by up to two rating notches. S&P will also reduce a rating if GDP growth has been fuelled by excessive credit growth and asset price increases. Fitch incorporates a Macroprudential Indicator (MPI) based on trends in credit growth and asset prices.

At the same time, the reliance on certain positive country attributes has been reduced. Most importantly, some agencies now place somewhat less emphasis on per capita GDP and greater emphasis than previously on growth performance and potential, taking into account multi-year averages to smooth cyclical effects as well as the outlook. In particular, Moody's changed its methodology in 2013 to recognise that potential growth can be just as important as per capita GDP when accounting for economic strength.

Split ratings

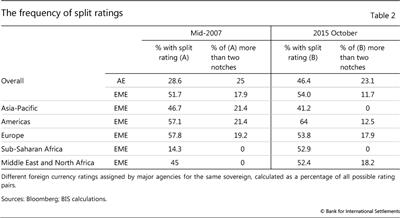

Differences in methodology contribute to differences in sovereign ratings across agencies (so-called "split ratings"). The frequency of split ratings for foreign currency sovereign debt in our sample is slightly above 50%. This is roughly the same as for corporates but well below that of the 70 largest international banks, which can be up to 90%. The frequency of split ratings has increased post-crisis, particularly for AEs (Table 2). Split ratings for AE sovereigns are now almost as common as for EME sovereigns, in sharp contrast to the pre-crisis situation. Greater disagreement is particularly evident for advanced European sovereigns, where the percentage of split ratings has soared from 22% to 48%.

Modelling sovereign ratings

This section explores how far changes in methodologies have been reflected in changes to the estimated determinants of ratings. We also ask whether there is evidence of bias against EMEs.5 While we focus on the factors that have been prominent in the recent changes to agency methodologies, we also include others commonly cited in the literature. Since the role of public debt has gained particular attention, we first assess the bivariate relationship of debt and ratings for both AEs and EMEs, before developing a parsimonious multivariate model that controls for other key factors.

Sovereign ratings and public debt

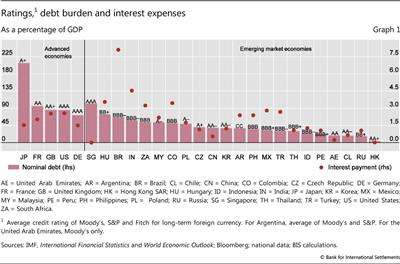

EMEs tend to have lower ratings than AEs, despite generally lower ratios of outstanding government debt to GDP (bars in Graph 1). This difference in EME and AE debt burdens has diminished over time but has not disappeared.6 Because interest rates tend to be higher in EMEs, the interest expenses of EMEs are roughly similar to those of AEs (dots in Graph 1). The stark difference between the two measures is shown by the examples of Japan and Turkey, rated AA- and BBB-, respectively. Japan's gross debt is well above 200% of GDP, while net interest expenses account for only 1.5% of GDP. Turkey's gross debt-to-GDP ratio is just above 30%, yet it pays net interest equivalent to over 3% of GDP, twice what Japan does. That said, some EMEs with very low debt levels, such as Hong Kong SAR and Saudi Arabia, are rated very highly.7

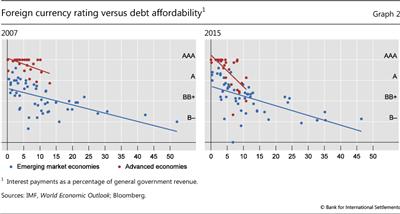

An alternative measure of debt load is debt affordability: higher interest-to-revenue ratios tend to translate into lower ratings for both AEs and EMEs (Graph 2).8 Using debt affordability (instead of debt burdens) considerably reduces the difference in the treatment of AE and EME debt ratios (Table 3). A simple regression of sovereign ratings on the debt burden (columns 1 and 2) and the EME designation indicates that EME status reduces a country's rating by about eight notches in both 2007 and 2015. But if debt affordability is used instead of debt burden (columns 3 and 4), the difference declines from around seven and a half notches in 2007 to five notches in 2015.

The importance of debt affordability shows that actual financing costs matter. The long post-crisis period of extremely low policy rates and unconventional monetary policy has lowered both long- and short-term interest rates, making debt more affordable. These factors, whether temporary or permanent, have indirectly supported the ratings of major AEs.9

Back-of-the-envelope calculations indicate that the interest rate burden in the major AEs would roughly double if the average interest rate on their debt reverted to its 2007 level, while that of most EMEs would increase by less. The speed with which higher interest rates feed into debt service burdens would, of course, also depend on the debt's maturity profile, which is typically longer in AEs.

Multivariate regression analysis

As agencies use a variety of indicators, any attempt to explain ratings based only on fiscal strength can be misleading. The direct weight of fiscal strength (regardless of how it is measured) in final ratings generally accounts for at most one third. Thus, we now turn to a model that considers the broad set of factors covered by rating agencies. That said, we aim for a parsimonious model that covers only key categories of country risk based on a relatively small set of variables.

We examine a broad set of determinants covering fiscal, economic and institutional strength, the monetary regime, foreign reserves, credit exposure and EME designation. In line with the previous section, we consider both debt burden and debt affordability. We also consider default history in a broad as well as narrow definition. The cross-sectional samples comprise 82 countries (54 EMEs, 28 AEs) in 2007 and 81 countries (54 EMEs, 27 AEs) in 2015.10

We first estimate a base case model including the above-mentioned factors and the debt burden to represent fiscal strength (Table 3, columns 5 and 6). Further, we identify a history of default as a sovereign default on any debt obligation since 1975 (using a public database provided by the Bank of Canada). We test for the model's sensitivity to a narrower definition of default - namely, one whereby a sovereign has defaulted on its bonds since 1983, according to Moody's (Table 3, columns 7 and 8). We also control for the potential collinearity of default history with other variables by running the regression without it (not shown here but available from the authors).

We find that ratings can be largely explained by a relatively small set of fewer than 10 variables. This is in line with the results of previous studies, including Cantor and Packer (1996), Borio and Packer (2004), Hill et al (2010) and De Vries and De Haan (2015).11 Adding key variables to the EME designation and fiscal strength increases the adjusted R2 from 0.6 in 2007 and 0.5 in 2015 to almost 0.9 in 2007 and 0.8 in 2015. The generally lower R2 shown in Table 3 for 2015 may be related to the greater dispersion of ratings following the crisis, which may also be reflected in the growth of split ratings documented earlier.

Growth performance and potential, as proxied by the contemporaneous or three-year average (not shown) GDP growth rate, appear to have somewhat gained in importance, as suggested by some agencies' methodological revisions discussed above. The coefficient on GDP growth, which was insignificant and negative before the crisis, becomes positive across all specifications, and is statistically significant in one of the three reported specifications. At the same time, per capita GDP maintains its high statistical significance: a 10% increase in the level of per capita GDP adds 0.15 notches in 2015, slightly more than in 2007.

The regression results also reflect the new rating agency methodologies in that sovereigns with a flexible exchange rate regime and reserve currency status have higher ratings for a given level of debt. While in 2007 the nature of the monetary regime was mostly reflected in the reserve currency status variable, by 2015 the flexibility of the exchange rate regime, defined as a country having its own central bank and a free-floating currency, also had a significant positive effect. By 2015, exchange rate flexibility, other things equal, was associated with an increase in the sovereign rating of 2.5 notches in two of our specifications.

Fiscal strength appears to have increased in importance since the crisis. Every 10 percentage point increase in debt burden (public debt to GDP) lowers the rating by 0.2 notches pre-crisis and by 0.3 notches afterwards. And in the specifications with debt affordability, every 10 percentage point increase in interest-to-revenue lowers the rating by 0.7 notches pre-crisis and by 1.2 notches afterwards. Notably, the broader debt measure of external debt to GDP is either statistically insignificant, or significant but with a coefficient that is much smaller (one tenth) than that of the public debt-to-GDP variable.

Default history appears to have gained in importance since the crisis. Whereas pre-crisis the rating of a sovereign was lowered by close to two notches in countries with a history of default, this penalty increases to 2.5 notches in 2015. When default is defined more narrowly, this finding is even starker. A default on one of a country's bonds since 1983 is associated with a sovereign rating that is two notches lower in 2007 and nearly four notches lower in 2015.

At the same time, the degree to which the sovereign's debt is in foreign currency appears to have lost its relevance. The decline of this factor may reflect the increased ability of EMEs to borrow in their own currency. Post-crisis, proxies for the exposure to debt in foreign currency have become statistically insignificant.

Other factors remain of similar importance before and after the crisis, such as indicators of institutional strength and foreign exchange reserves to GDP. A 10 percentage point increase in the ratio of foreign exchange reserves to GDP strengthens the rating by 0.4 notches. Institutional strength, as measured by the corruption perception index, is equally significant in both 2007 and 2015. By contrast, inflation is not statistically significant pre-crisis and remains generally insignificant afterwards.

A period in which credit grows faster than GDP, resulting in a higher credit-to-GDP ratio, is associated with a significant strengthening in ratings before the crisis for one specification. In 2015, the estimated coefficient sign changes to reflect the expected effect, whereby the risks of a potential credit boom lower ratings, but the coefficient is not statistically significant in any specification. Similar results hold when we use the size of the banking system to GDP. This may result from endogeneity: countries with financial systems that are strong for other (unobserved) reasons are able to support more rapid credit growth without it affecting their sovereign creditworthiness.12

Finally, the use of a multivariate estimation framework considerably reduces the "penalty" for the EME designation. In fact, when the variables discussed above are accounted for, the impact of the dummy for EME designation is much lower (less than one notch) both before and after the crisis, and statistically insignificant. This result holds even when per capita GDP, which is highly correlated with the EME designation, is dropped (not shown).

Do different sovereign risk metrics treat EMEs differently?

Assuming that our regressions adequately capture the rating agencies' methodologies, the previous results cast doubt on the hypothesis that ratings are lower for EME borrowers once a broad range of factors is considered. But the major agencies might still be emphasising other factors in a way that penalises EMEs. In the following, we compare the sovereign ratings of the big three rating agencies with alternative metrics for country risk - namely, ratings from other agencies, market measures of country risk and a survey of institutional investors.13

Non-major rating agencies

The major agencies dominate the global credit rating industry and rate the vast majority of internationally issued bonds. However, many other agencies exist. Fully 10 agencies are recognised by the Securities and Exchange Commission (SEC) in the United States, and 25 (not counting subsidiaries of the big three) are registered or certified by the European Securities and Market Authority (ESMA).

While these other agencies tend to cover borrowers in their home country, rather than providing rankings of global credits, some of them offer global ratings to international investors. We examine below the sovereign ratings of three such non-major agencies. Dagong Global Credit Ratings is China's largest rating agency; after rating its first sovereign borrower in 2010, it now rates over 90 such borrowers. Feri AG is a German asset manager which has been rating sovereigns for more than 20 years (Bartels and Weder di Mauro (2013)). The Japan Credit Rating Agency (JCR) was founded more than 40 years ago and is the only Japanese rating agency whose ratings are recognised by the SEC and ESMA.

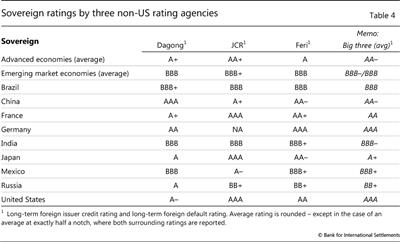

Comparing the sovereign ratings of the above three smaller rating agencies with those of the big three reveals some interesting patterns. Two of the three smaller agencies rate the United States significantly lower than the US-based major rating agencies. And all three give the sovereigns of their own headquartered countries the highest AAA rating, an opinion usually not shared by the other agencies.

On average, each of the three smaller rating agencies gives EME sovereigns higher ratings than the three major agencies (Table 4). Further, two of the three non-majors (Dagong and Feri) give AEs lower ratings on average. For these two, the gap between AE and EME ratings is four and two notches respectively, compared with five notches for the three majors and six for JCR.

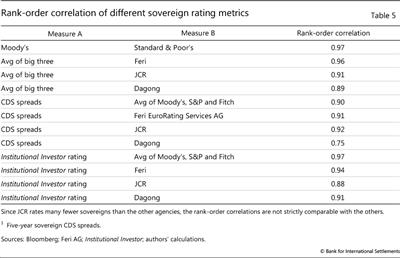

More generally, the ratings of non-major agencies tend to correspond less with those of the major agencies. This conclusion emerges if one considers the correlations of the sovereigns' rank-orderings (ie the highest rated one is rank 1, the second ranked 2 etc) with those of the major agencies (Table 5, rows 2-4). The rank-order correlations of each of the non-major agencies with the average ratings of the big three are much lower than, for example, the rank-order correlation between Moody's and S&P (Table 5, row 1).

Ratings and market credit spreads

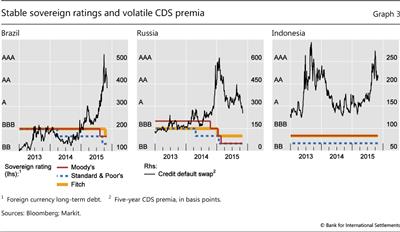

Market credit spreads provide another set of country risk rankings at any point in time. Graph 3 illustrates the movements of credit default swap (CDS) spreads and sovereign (foreign currency) ratings for Brazil, Indonesia and Russia, three countries for which CDS spreads have been particularly volatile in the past two years. Three observations are worth highlighting. First, CDS spreads are much more volatile than ratings. As a case in point, during the "taper tantrum" of 2013, many sovereigns saw sharp increases in CDS spreads while ratings were stable. Second, CDS spreads for different EMEs co-move more closely than ratings, pointing to swings in global risk appetite as drivers of CDS markets. Third, downgrades, at least recently, have tended to follow rises in spreads rather than vice versa.

The first two observations can be explained by the nature of risks captured by the two measures and by the horizon over which they measure risk. Ratings are intended to look "through the cycle" and are meant to capture the relative risk of default. Under normal conditions, this should make them slow-moving, although rapid adjustments have on occasion occurred in the midst of crises. CDS spreads, by contrast, reflect the market's perception of risk at a particular point in time. Moreover, they capture not only the absolute risk of default but also other components such as liquidity conditions and the time-varying price of default risk. Many of these factors can change quite rapidly in response to general market conditions and investors' risk appetite.

To the extent that swings in global risk appetite can increase overall market risk premia without changing the relative riskiness of sovereign borrowers, rank-orderings of spreads should remain somewhat more stable over time, more akin to credit ratings. In July 2015, CDS markets ranked EME credits on average as actually slightly higher-risk,14 and AE credits as correspondingly lower-risk, than did each of the big three rating agencies. At the same time, market rankings were significantly more correlated with ratings of the major agencies than with those of the non-major agency with the most sovereign ratings outstanding (Table 5, lines 5 and 8). Thus, credit markets do not appear to have shared the alternative vision of the balance of risks between EMEs and AEs offered by the smaller agencies in our sample.

Institutional Investor country risk rankings

Institutional Investor provides yet another metric against which to assess agency ratings. Every half-year, Institutional Investor surveys the top economists and analysts at global banks, securities and asset management firms. Those surveyed are asked to grade "each country from 0 to 100, with 100 representing the least likelihood of default". Responses are then weighted according to the global exposure of the participants' institutions.

Institutional Investor's rank-ordering of country credits is quite similar to that of the major rating agencies. In contrast to the non-major agencies, Institutional Investor's mean rank-orderings for EMEs (and AEs) are quite close to those of the major rating agencies. In addition, the ratings of Institutional Investor show much higher rank-order correlation with those of the major agencies than they do with those of any of the non-major agencies sampled in this paper (Table 5, last four rows). Once again, the alternative measure of country risk does not support the view that the major agencies are relatively harsh on the EMEs. More specifically, if a bias does exist, it is one shared with financial markets and asset managers more generally.

Conclusion

Since the financial crisis, the major global credit rating agencies have implemented significant changes to their methodologies for assessing sovereign credit risk. More attention is now given to monetary policy regimes, currency internationalisation, financial cycles, event risk and economic growth more generally.

We find that some of these methodological changes are reflected in estimated simple models of sovereign credit ratings. Ratings appear to be somewhat more sensitive to certain variables - such as the existence of a flexible exchange rate regime and GDP growth - than before, in line with the changes implemented by the major agencies. That said, other methodological revisions do not appear to be strongly confirmed by the regression model - perhaps testifying to the difficulty of capturing all the determinants of ratings in a parsimonious linear framework.

We also ask whether, as has been suggested by some financial market observers, agencies discriminate against EME sovereign borrowers relative to AE sovereign borrowers. True, for a given debt burden, the rating of an EME borrower will be tend to be lower than that of an AE borrower. However, expanding the set of explanatory variables eliminates the "penalty" on EMEs.

We then compare the sovereign ratings of the big three rating agencies with alternative metrics for country risk: namely, the ratings of some smaller non-US agencies, CDS spreads, and a survey of institutional investors. The three non-major agencies rate EMEs higher than do the US major agencies. However, the more generous view towards EMEs is shared neither by markets, as measured by CDS spreads, nor by the opinions of asset managers, as proxied by the Institutional Investor survey of credit risk. If biases exist, they are widely shared.

In closing, a few caveats are in order. The validity of our test of bias against EMEs depends on our models reflecting sufficiently well the agencies' methodologies, and on the methodologies accurately capturing the factors affecting relative creditworthiness. Both conditions are difficult to establish. Further, it may be that other characteristics of ratings which we have not been able to compare across agencies in this feature - such as their procyclicality and the timing of their announcements - are what cause the greatest concern among EME policymakers. The field of sovereign ratings remains a fruitful one for further research.

References

Amstad, M, E Remolona and J Shek (forthcoming): "How do global investors differentiate between sovereign risks? The new normal versus the old", Journal of International Money and Finance.

Bartels, B and B Weder di Mauro (2013): "A rating agency for Europe - a good idea?", CEPR Discussion Paper Series, no 9512.

Borio, C and F Packer (2004): "Assessing new perspectives on country risk", BIS Quarterly Review, December, pp 47-65.

Cantor, R and F Packer (1996): "Determinants and impact of sovereign credit ratings", Economic Policy Review, vol 2(2), pp 37-54.

Dembiermont, C, M Scatigna, R Szemere and B Tissot (2015): "A new database on general government debt", BIS Quarterly Review, September, pp 69-87.

De Vries, T and J De Haan (2015): "Credit ratings and bond spreads of the GIIPS", Applied Economics Letters, DOI: 10.1080/13504851.2015.1054063.

Eaton, J and M Gersovitz (1981): "Debt with potential repudiation", Review of Economic Studies.

Fitch Ratings (2013): 'AAA' sovereign characteristics and public debt ratios - Financing flexibility and reserve currency status; losing and re-gaining 'AAA' status.

--- (2014): Sovereign rating criteria.

Flandreau, M, N Gaillard and F Packer (2011): "To err is human: credit rating agencies and the interwar foreign government debt crisis", European Review of Economic History, vol 15(3), pp 495-538.

Gultekin-Karakaş, D, M Hisarcikhlar and H Öztürk (2011): "Sovereign risk ratings: biased toward developed countries?", Emerging Markets Finance & Trade, vol 47, May-June.

Hill, P, R Brooks and R Faff (2010): "Variations in sovereign credit quality assessments across rating agencies", Journal of Banking and Finance, vol 34(6), pp 1327-43.

Ilzetzki, E, C Reinhart and K Rogoff (2011): "The country chronologies and background material to exchange rate arrangements into the 21st century: Will the anchor currency hold?", mimeo.

Kiff, J, S Nowak and L Schumacher (2012): "Are rating agencies powerful? An investigation into the impact and accuracy of sovereign ratings", IMF Working Papers, no 12/23.

Moody's Investors Service (2013): Sovereign bond ratings: Rating Methodology.

Packer, F and N Tarashev (2011): "Rating methodologies for banks", BIS Quarterly Review, June, pp 39-52.

Standard & Poor's Rating Service (2014a): How S&P factors in monetary union membership in its sovereign ratings.

--- (2014b): Sovereign rating methodology.

Wigglesworth, R (2012): "Emerging markets in credit ratings call", Financial Times, 7 July.

1 The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS. We would like to thank Jimmy Shek for his invaluable research assistance.

2 Depending on the rating agency or type of rated entity, some ratings are intended to convey information about default probabilities while others refer to expected credit losses. But this distinction is unlikely to affect the rank-ordering of the sovereign credits examined in this feature.

3 The following discussion draws upon Fitch Ratings (2014), Moody's Investors Service (2013) and Standard & Poor's (2014b) as well as other cited publications of the rating agencies. Although the major rating agencies do not always agree on sovereign risk assessments, and there are distinctions to be made between their methodologies, the differences between the big three agencies are not the focus of this article.

4 For more on bank system rating assessments, see Packer and Tarashev (2011).

5 Policymakers in developing countries have been heard to complain of "prejudice in the models of Western-based agencies" (Wigglesworth (2012)). Gultekin-Karakaş et al (2011) find that high-income countries are more likely to get a strong rating, holding macroeconomic fundamentals constant. But these authors do not consider default history and some measures of institutional strength. Bartels and Weder di Mauro (2013) note that Moody's and S&P rate emerging market economies lower than does a European based agency (Feri), although they do not estimate a model for ratings and focus instead on evidence of herding behaviour in rating changes.

6 In 2007, for any given debt-to-GDP ratio, virtually all EMEs scored lower ratings than AEs, by eight to 12 notches. By 2015, this difference, while still significant, had diminished by around two notches.

7 The measurement of public debt stocks is also complicated by such matters as the obligations of subnational authorities and state-owned institutions (Dembiermont et al (2015)).

8 All results also hold if non-linear regressions are used to account for the kink in the relationship between EME ratings and debt affordability apparent in Graph 2.

9 The impact of ultra-low interest rates is reflected in the fact that the market values of government debt in the major AEs, as reported by the OECD, are well above the nominal values factored into ratings. For example, the value of the stock of outstanding French, Japanese, UK and US sovereign debt was around 25 percentage points higher than its nominal value. The use and interpretation of the concepts of market value and nominal amounts are discussed in Dembiermont et al (2015).

10 The regression results remain qualitatively the same when we run a regression for both periods on the same sample of 77 countries (50 EMEs, 27 AEs). Here we report the regressions from the two non-identical samples in order to make full use of the country information.

11 Cantor and Packer (1996) reach an adjusted R2 of 0.9 in a cross section for 1995 with eight variables. Borio and Packer (2004) use different models, with the most parsimonious one obtaining an adjusted R2 of 0.9 with seven variables covering 1996-2003. De Vries and De Haan (2015) examine the relationship between credit ratings and bond yield spreads of periphery countries in the euro area using a model that has an adjusted R2 of 0.6.

12 Alternatives have been tested, such as deviations of credit from country-specific trends and the average ratio of credit to GDP over three years. But the fit was worse and in some specifications the sign on the coefficients did not make sense.

13 Measuring the long-term default performance of EME and AE borrowers at similar rating levels would be the most direct way of checking the hypothesis of bias, but the scarcity of sovereign defaults would require a study using many decades of data. For an assessment of the performance of sovereign credit ratings in predicting defaults relative to bond prices in the interwar period, see Flandreau et al (2011).

14 For evidence that sovereign CDS markets price the EME designation, even after controlling for fundamentals, see Amstad et al (forthcoming).