The importance of Hong Kong SAR and Singapore

(Extract from pages 122-123 of BIS Quarterly Review, September

When we examine cross-border lending data based on the location of the creditor bank ("residence basis" rather than "consolidated basis"), cross-border banking in Asia excluding Japan looks much more intraregional than that in emerging economies in Europe and Latin America. This is largely because of the special intermediary role played by two banking centres: Hong Kong SAR and Singapore.

looks much more intraregional than that in emerging economies in Europe and Latin America. This is largely because of the special intermediary role played by two banking centres: Hong Kong SAR and Singapore.

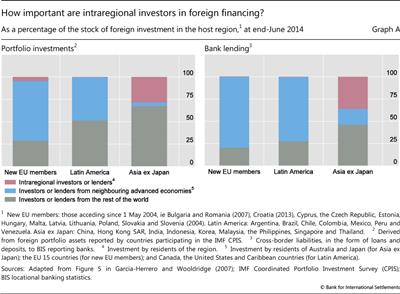

Asian economies excluding Japan obtain a larger share of their financing from other economies within the region than do emerging economies in Europe and Latin America (red bars in Graph A). The larger share could be partly due to funds that originate elsewhere but are channelled to borrowers in Asia excluding Japan through domestic and foreign banks located in Hong Kong SAR and Singapore. This is also the case for portfolio investment, but it is more pronounced for bank lending.

Financial centres located in neighbouring advanced economies play a crucial role in channelling funds to emerging economies in Europe and Latin America. In particular, a substantial part of portfolio investment and cross-border loans comes from investors and lenders located in the United Kingdom for new European Union (EU) members and in the United States for Latin America (blue bars in Graph A). By contrast, Asian economies excluding Japan obtain a relatively small part of their foreign financing from the neighbouring advanced economies of Australia and Japan.

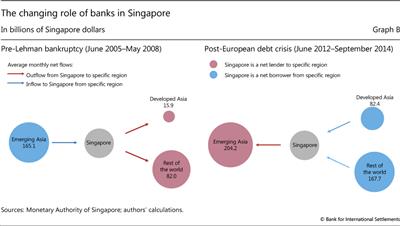

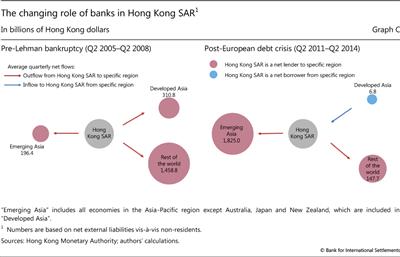

The role of banks in Hong Kong SAR and Singapore has shifted since the Great Financial Crisis. During the three years prior to 2008, banks in Singapore borrowed an average net amount of SGD 165 billion (USD 107 billion) a month from emerging economies in Asia and lent most of the funds either domestically or to borrowers outside Asia (Graph B). The crisis turned this pattern around. From June 2012 to September 2014, banks in Singapore were net borrowers from advanced economies and lent most of these funds to emerging economies in Asia, lending an average of SGD 204 billion (USD 163 billion) a month. Banks located in Hong Kong SAR also became bigger net lenders in the emerging Asia-Pacific region (including Singapore) over this period, while reducing their net lending outside the region (Graph C).

We compare three different emerging market regions: Asia, Europe and Latin America. For Asia-Pacific, we therefore focus on nine major emerging economies and exclude Australia, Japan and New Zealand, as described in footnote 1 to Graph A.

We compare three different emerging market regions: Asia, Europe and Latin America. For Asia-Pacific, we therefore focus on nine major emerging economies and exclude Australia, Japan and New Zealand, as described in footnote 1 to Graph A.  McCauley et al (2002) analyse bonds underwritten and loans syndicated for borrowers in Asia excluding Japan between 1999 and 2002, and find that Asian bond investors and banks on average committed half of the funds involved.

McCauley et al (2002) analyse bonds underwritten and loans syndicated for borrowers in Asia excluding Japan between 1999 and 2002, and find that Asian bond investors and banks on average committed half of the funds involved.