The rise of regional banking in Asia and the Pacific

Cross-border banking activity within the Asia-Pacific region has intensified since the Great Financial Crisis of 2007−09. In the years leading up to the crisis, much of the cross-border activity in the region had been driven by dollar credit intermediated largely by European banks. In the wake of the crisis, this global intermediation lost much of its European leg. Banks from within the region stepped in and soon came to dominate cross-border activity. Adding impetus to the intraregional trend, the ASEAN member governments have adopted a regional banking integration framework. Mindful of the lessons of European banking integration, the banking authorities in the region are seeking to balance the efficiency gains of regional integration against the risks of financial instability.1

JEL classification: F34, F36, G21.

Cross-border banking in Asia and the Pacific has steadily increased over the last dozen years, interrupted only by the Great Financial Crisis of 2007−09. This steady increase, however, masked a major change in the pattern of financial intermediation. In the global cross-border banking boom of 2001−07, most of the activity had taken the form of a flow of dollars from the United States to Europe and then to Asia- Pacific as well as back to the United States, with European banks serving as the major intermediaries (Avdjiev et al (2015)). Since the crisis, however, European banks have held back and banks from Asia-Pacific have stepped in, so that the bulk of the intermediation is now conducted within the region.

The intraregional trend seems likely to be sustained. Reinforcing this trend, member governments of the Association of Southeast Asian Nations (ASEAN) have recently adopted a regional banking integration framework. This will soon allow banks qualified in one member jurisdiction to operate freely in others. A rise of large regional banks could bring efficiency gains but could also enlarge channels of regional contagion.

In this article, we first characterise the regional dimensions of cross-border banking activity in Asia and the Pacific. We then analyse the proliferation of regional bank branches and subsidiaries in the region, how these units fund themselves, and what the implications are for their lending behaviour. Finally, we raise some specific financial stability issues: the potential for common and concentrated creditors as well as for systemic risks involving foreign branches; liquidity risks in foreign currency funding; and the increasing share of short-term foreign currency loans in Asia-Pacific banks' intraregional lending.

Trends in regional banking activity

Shifting patterns in global banking, especially the cross-border provision of dollar credit, have had an important bearing on banking flows in the Asia-Pacific region. In the period before the Great Financial Crisis, as Shin (2013) has shown, global banks increased leverage to provide cross-border dollar funding, and European banks played a prominent role in cross-border dollar intermediation. After the crisis, a prolonged period of low global long-term interest rates, new bank regulations and efforts to repair balance sheets led to a major shift in the pattern of cross-border financial intermediation. Global banks increasingly gave way to asset managers investing in long-term debt securities. This shift also opened up opportunities for Asia-Pacific banks to expand their activity within the region.

Strong growth and changing players

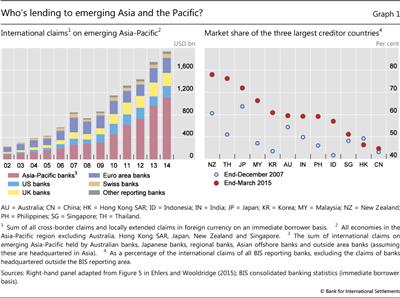

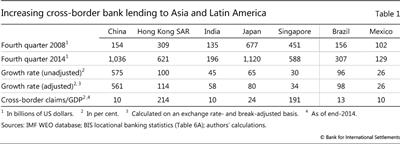

The last dozen years have seen a strong increase in cross-border banking in the Asia-Pacific region. Between 2002 and 2007, international bank claims on emerging Asia-Pacific almost quadrupled to $844 billion (Graph 1, left-hand panel). In 2007, euro area banks accounted for about a third of these claims, Asia-Pacific banks for a similar share, and Swiss, UK and US banks for roughly the other third. Over the same period, international bank claims on Latin America and the Caribbean grew more slowly, while those on emerging economies in Europe almost quintupled, albeit from a smaller base.2

The Great Financial Crisis was a watershed in international banking, and the Asia-Pacific region was no exception. Between 2007 and 2008, international lending in the region fell by $120 billion.3 But this halt was only temporary: international lending in Asia rebounded from 2009. International claims on the region more than doubled in five years (Graph 1, left-hand panel). China stands out, with cross-border claims on the country growing almost sixfold from 2008 to 2014 (Table 1). Hong Kong SAR and Singapore played an important role as regional banking centres, by intermediating a large amount of cross-border funds relative to GDP (Box 1).

The strong growth in international claims on emerging Asia- Pacific between 2009 and 2014 stands in contrast to developments elsewhere. During the same period, international claims on Latin America and the Caribbean grew by 48%, while those on emerging economies in Europe shrank by 11%. By March 2015, international bank claims on the emerging Asia- Pacific region totalled $1.9 trillion, while those on Latin America and the Caribbean and emerging economies in Europe stood at $624 billion and $597 billion, respectively.

With the resurgence of cross-border lending, the set of leading players changed. In the wake of the crisis and amid sovereign debt problems in Europe, the cross-border activity of euro area banks fell off. As a result, they failed to keep up with the Asia-Pacific region's growing demand for dollar funding. By 2014, the share of these banks in international claims on emerging Asia-Pacific was down to 14%, less than half its 2007 level, although in absolute terms their claims were essentially unchanged. The banks that stepped in were largely from Asia and the Pacific: their share went up from 31% in 2007 to 57% in 2014 (Graph 1, left- hand panel).4 As discussed below, the greater role of banks from within the region led to an even greater use of short-term lending than before.

Box 1

The importance of Hong Kong SAR and Singapore

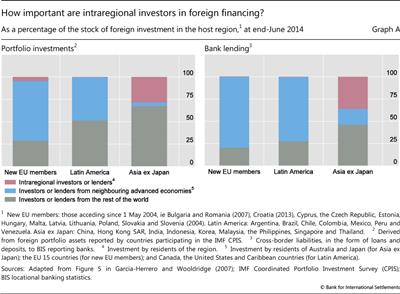

When we examine cross-border lending data based on the location of the creditor bank ("residence basis" rather than "consolidated basis"), cross-border banking in Asia excluding Japan looks much more intraregional than that in emerging economies in Europe and Latin America. This is largely because of the special intermediary role played by two banking centres: Hong Kong SAR and Singapore.

looks much more intraregional than that in emerging economies in Europe and Latin America. This is largely because of the special intermediary role played by two banking centres: Hong Kong SAR and Singapore.

Asian economies excluding Japan obtain a larger share of their financing from other economies within the region than do emerging economies in Europe and Latin America (red bars in Graph A). The larger share could be partly due to funds that originate elsewhere but are channelled to borrowers in Asia excluding Japan through domestic and foreign banks located in Hong Kong SAR and Singapore. This is also the case for portfolio investment, but it is more pronounced for bank lending.

Financial centres located in neighbouring advanced economies play a crucial role in channelling funds to emerging economies in Europe and Latin America. In particular, a substantial part of portfolio investment and cross-border loans comes from investors and lenders located in the United Kingdom for new European Union (EU) members and in the United States for Latin America (blue bars in Graph A). By contrast, Asian economies excluding Japan obtain a relatively small part of their foreign financing from the neighbouring advanced economies of Australia and Japan.

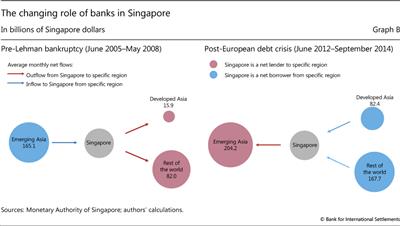

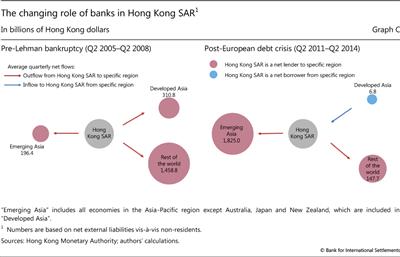

The role of banks in Hong Kong SAR and Singapore has shifted since the Great Financial Crisis. During the three years prior to 2008, banks in Singapore borrowed an average net amount of SGD 165 billion (USD 107 billion) a month from emerging economies in Asia and lent most of the funds either domestically or to borrowers outside Asia (Graph B). The crisis turned this pattern around. From June 2012 to September 2014, banks in Singapore were net borrowers from advanced economies and lent most of these funds to emerging economies in Asia, lending an average of SGD 204 billion (USD 163 billion) a month. Banks located in Hong Kong SAR also became bigger net lenders in the emerging Asia-Pacific region (including Singapore) over this period, while reducing their net lending outside the region (Graph C).

We compare three different emerging market regions: Asia, Europe and Latin America. For Asia-Pacific, we therefore focus on nine major emerging economies and exclude Australia, Japan and New Zealand, as described in footnote 1 to Graph A.

We compare three different emerging market regions: Asia, Europe and Latin America. For Asia-Pacific, we therefore focus on nine major emerging economies and exclude Australia, Japan and New Zealand, as described in footnote 1 to Graph A.  McCauley et al (2002) analyse bonds underwritten and loans syndicated for borrowers in Asia excluding Japan between 1999 and 2002, and find that Asian bond investors and banks on average committed half of the funds involved.

McCauley et al (2002) analyse bonds underwritten and loans syndicated for borrowers in Asia excluding Japan between 1999 and 2002, and find that Asian bond investors and banks on average committed half of the funds involved.

The shift coincided with greater concentration in the creditor banking systems. Between the fourth quarter of 2007 and the first quarter of 2015, the combined market share of the three largest creditor countries rose for most of the major economies in the region (Graph 1, right-hand panel). The increase in concentration was pronounced for Indonesia, Korea, Malaysia, New Zealand, the Philippines and Thailand. For these six borrowing countries as a group, the five largest creditors in the first quarter of 2015 included three economies from the region - Australia, Japan and Singapore - besides the United Kingdom and the United States. In 2007, the list of the five largest creditors had included France and Germany instead of Australia and Singapore. As of the first quarter of 2015, Australia was the most important creditor for New Zealand, Japan for Indonesia and Thailand, and Singapore for Malaysia.

Regional banks' foreign affiliates and business models

Foreign branches and subsidiaries

Cross-border banking involves either a bank in one country lending directly to borrowers in another, or a foreign bank lending through local branches or subsidiaries. To the extent that intraregional cross-border banking activity in Asia and the Pacific continues to intensify, the regional expansion of Asia-Pacific banks is likely to take the form of increased activity by branches and subsidiaries, as banks seek to establish a more permanent institutional presence in their target markets. Within the narrower ASEAN region, a recent banking integration initiative is likely to quicken the process (Box 2).

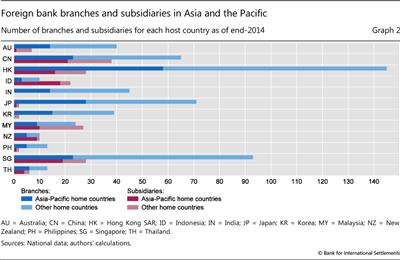

Almost all of the major economies in Asia- Pacific have banks with foreign branches or subsidiaries elsewhere in the region. As of the end of 2014, together the banks of Australia, China, India, Japan, Korea and Singapore counted 30 or more foreign branches and subsidiaries in the 12 major economies in the region. Most of them are also hosts to regional banks: China, Hong Kong SAR, Japan and Singapore each had 30 or more foreign branches and subsidiaries from elsewhere in the region (Graph 2).

In establishing a presence elsewhere in the region, Asia-Pacific banks tend to do so in the form of branches rather than subsidiaries: the former outnumber the latter by two to one. Foreign banks from outside the Asia-Pacific region also set up their local affiliates in the region predominantly in the form of branches: their Asia-Pacific branches outnumber their subsidiaries by five to one. However, banks headquartered in ASEAN countries generally have more subsidiaries than branches within the ASEAN region.

Funding models

Banks operating outside their home markets make use of a range of different funding sources to support their lending business.

Retail funding tends to be viewed as more "sticky" than wholesale or market funding. During the Great Financial Crisis, foreign banks' local affiliates that had a strong local retail funding base, such as those in many Latin American countries, weathered funding market stresses better than those relying mainly on wholesale funding.5

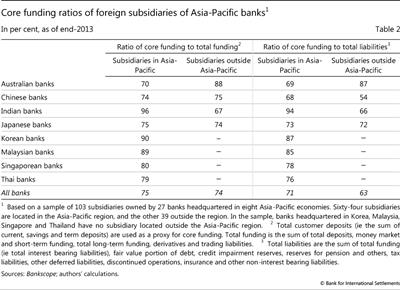

When we look at the degree of reliance on wholesale and retail funding regardless of currency, Asia-Pacific banks' foreign subsidiaries located in Asia and the Pacific show relatively strong core funding ratios, defined here as the ratio of customer deposits to funding from all sources (Table 2). In particular, the average share of their core funding in total funding stands at 75%, while that of core funding in total liabilities is slightly lower, at 71%. Moreover, the core funding ratios of intraregional subsidiaries of Asia-Pacific banks are higher than those of their subsidiaries located outside the Asia-Pacific region.

Another key aspect of business models is the funding currency. For foreign bank subsidiaries, local currency funding is generally more stable than funding in other currencies such as the US dollar. This is partly because local currency deposits mainly consist of relatively stable customer deposits for domestic use, while foreign currency deposits are made mainly by corporations or financial institutions that are sensitive to exchange rate and other developments. Lending by international banks' foreign affiliates that are funded in local currency is considerably less volatile than cross-border lending (see Ehlers and Wooldridge (2015) and references therein).

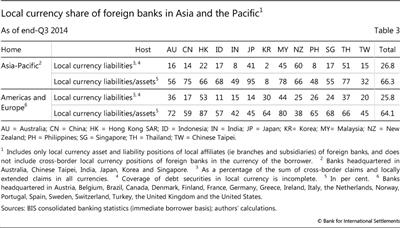

In aggregate, banks headquartered in six Asia-Pacific economies rely on local currency funding for their lending to the region to almost the same degree as those headquartered elsewhere (Table 3). Local currency liabilities represented 27% of the intraregional assets of Asia-Pacific banks, compared with 26% for banks headquartered elsewhere. However, in many host countries, banks headquartered in Asia and the Pacific have a lower share of local currency liabilities than those headquartered elsewhere. In particular, Asia-Pacific banks in Australia, China, Chinese Taipei, Hong Kong SAR, India, Korea, the Philippines and Singapore all have a lower share of local currency liabilities than non-Asia-Pacific banks in the respective economies. By contrast, Asia-Pacific banks that lend to Indonesia, Japan, Malaysia, New Zealand and Thailand maintain higher levels of local currency funding than those headquartered in the Americas and Europe.

Another way to look at the funding model is in terms of the local currency funding gap, defined as the difference between local currency assets and local currency liabilities.6 In aggregate, the funding gaps of banks headquartered in six Asia-Pacific economies and that lend to the region are about the same size as those of banks headquartered elsewhere (Table 3). Local currency liabilities are 66% of local currency assets in the region for Asia-Pacific banks, compared with 64% for those based in the Americas and Europe. As regards individual host countries, Asia-Pacific banks' lending to Chinese Taipei, India, Korea and the Philippines tends to have relatively large funding gaps, with the ratio of their local currency liabilities to local currency assets smaller than 50%, while their lending to Japan has a relatively small gap, with a ratio of 95%.

The maturity of foreign currency lending

A lesson of the 1997 Asian financial crisis is that mismatches between the maturity structures of foreign currency borrowing and lending can be an important source of risk. These days, Asia-Pacific banks typically borrow in US dollars and other international currencies, mostly from US and European banks, and lend in the same currencies to banks and non-banks in the region. Given their funding, do Asia-Pacific banks lend more at short-term maturities than do banks of other nationalities?

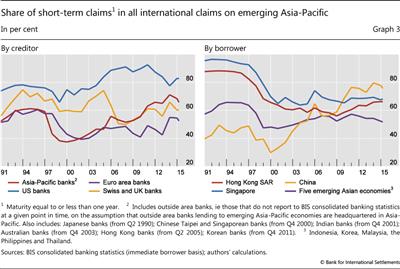

We can look at the issue of loan maturity from the perspectives of both creditors and borrowers. From the creditor perspective, before 1997 Swiss, UK and US banks tended to make the most use of short-term loans in providing financing to the emerging Asia-Pacific region (Graph 3, left-hand panel). In 1998, in the wake of the Asian financial crisis, banks from all regions cut back their short-term foreign currency loans to the region, although they eventually started lending at short term again.7 In the wake of the Great Financial Crisis, Asia-Pacific banks increased their share of short-term loans, which reached about 70% in 2014. This contrasts with the declining share of US banks.

Box 2

ASEAN banking integration and lessons from Europe

The ASEAN Banking Integration Framework

The ASEAN Banking Integration Framework (ABIF) aims to achieve a free flow of financial services within the ASEAN regional banking market by 2020. Under the ABIF, member countries have adopted the scheme of Qualified ASEAN Banks (QABs), in which a bank qualified in one jurisdiction will receive equal treatment in the others. To recognise the different levels of readiness among members, the ABIF process specifies two stages: a multilateral stage and a bilateral one. The multilateral stage will establish ASEAN-wide guidelines, while the bilateral stage will involve negotiations between countries on the admission of QABs. The framework will be implemented at two speeds: first among the five larger ASEAN economies, and later including the others.

The larger ASEAN economies are moving forward in negotiating bilateral agreements. On 31 December 2014, Bank Indonesia, the Financial Services Authority of Indonesia and the Central Bank of Malaysia signed a bilateral agreement that outlined the measures the two countries would implement under the ABIF, set out the definition of QABs and identified the market access and operational flexibilities that QABs would enjoy. As bilateral negotiations proceed among ASEAN governments, the negotiations have become catalysts for enhancing bank supervision and regulation in individual member jurisdictions in anticipation of an increasingly integrated banking system in the region.

Some lessons from banking integration in Europe

In many respects, the ASEAN members are following in Europe's footsteps. The member countries of the European Economic Area (EEA), consisting of the EU countries plus Iceland, Liechtenstein and Norway, agreed to mutual recognition of their supervisory frameworks in May 1992, and implemented in 1993 the "single passport" for banks, which ASEAN's QABs scheme resembles closely. The single passport fostered banking integration in Europe, although this proceeded only gradually.

The member countries of the European Economic Area (EEA), consisting of the EU countries plus Iceland, Liechtenstein and Norway, agreed to mutual recognition of their supervisory frameworks in May 1992, and implemented in 1993 the "single passport" for banks, which ASEAN's QABs scheme resembles closely. The single passport fostered banking integration in Europe, although this proceeded only gradually.

One lesson from banking integration in the EEA is that the single passport should have been accompanied by effective area-wide banking supervision. Restoring confidence in the European banking system after the Great Financial Crisis of 2007−09 and the subsequent European sovereign debt crisis has required extraordinary efforts by the authorities. These have included the establishment of a single supervisory mechanism in the euro area, a comprehensive review of the quality of major banks' balance sheets, and macro stress tests to determine how much capital they would need to weather further adverse shocks. A related challenge currently being discussed is the setting of appropriate regulatory risk weights on credit to lower- rated EU sovereigns (Hannoun (2011)). Similar challenges are likely to arise as ASEAN financial authorities make progress in fully implementing QABs and seek to harmonise national regulations among the ASEAN members.

Another lesson is the importance of sound cross-border resolution frameworks. The resolution of troubled banks proved to be particularly difficult in the single banking market. For example, three Icelandic banks − Glitnir, Kaupthing Bank and Landsbanki − maintained large operations in the Netherlands and the United Kingdom under the EEA passport scheme. The collapse of these banks after 2008 sparked a cross-border dispute over who should pay for the bailout of their depositors. There was neither a region-wide resolution framework nor a bailout mechanism for dealing with failing cross-border banks. Progress has now been made with regard to resolving such issues in the future. A single rulebook for the resolution of banks and large investment firms in all EU member states came into force in January 2015. The new rules harmonised and improved the tools for dealing with failing banks across the European Union. At the same time, national resolution funds are being established. ASEAN members will be watching these steps closely as they work to develop their own resolution framework for regional banking integration.

ASEAN's 10 member countries can be divided into the larger "ASEAN-5" economies (Indonesia, Malaysia, the Philippines, Singapore and Thailand) and the smaller "BCLMV" economies (Brunei, Cambodia, Laos, Myanmar and Vietnam).

ASEAN's 10 member countries can be divided into the larger "ASEAN-5" economies (Indonesia, Malaysia, the Philippines, Singapore and Thailand) and the smaller "BCLMV" economies (Brunei, Cambodia, Laos, Myanmar and Vietnam).  For detailed accounts of the European lessons for ASEAN's banking integration, see Volz (2013) and Elliott (2014).

For detailed accounts of the European lessons for ASEAN's banking integration, see Volz (2013) and Elliott (2014).

Turning to the borrower perspective, there is some heterogeneity among Asian economies in terms of their reliance on short- term foreign currency liabilities (Graph 3, right-hand panel). Before the Asian financial crisis, international borrowing by Asian financial centres (Hong Kong SAR and Singapore) was almost entirely short-term, while that by China was largely long-term. Short-term borrowing fell sharply across all countries in the region immediately after the crisis. During the period between the Asian financial crisis and the Great Financial Crisis, the share of short-term loans in China's international borrowing increased steadily from 30% to 60%, while that of five emerging Asia-Pacific economies (Indonesia, Korea, Malaysia, the Philippines and Thailand) rose only slightly. After 2009, China's share grew sharply, approaching 80%. During the same period, the share of short-term borrowing of Hong Kong SAR grew somewhat more modestly, while that of the aforementioned five economies was broadly stable.

Two factors may explain the increasing share of short-term foreign currency borrowing: (i) the growing weight of interbank borrowing in total borrowing by all entities; and (ii) the rising share of short-term non-bank borrowing in all non-bank borrowing. Over the past two decades, the share of interbank borrowing has shown a similar trend to the share of short-term borrowing, with their correlation ranging around 0.5−0.6. Since we can expect banks to borrow from each other at short maturities in the normal course of business, the increasing share of interbank borrowing is likely to have contributed to the increasing share of short-term borrowing by the Asian economies.

A more important question is whether the share of short-term borrowing by non-banks has also increased. BIS data, however, do not provide a maturity breakdown separately for non-banks. Nonetheless, we can assume that all interbank foreign currency loans are short-term and subtract these loans from the amount of all short-term lending to each economy. This gives us a conservative estimate of the amount of short-term loans to non-banks in a country. We then find that, between the first quarter of 2009 and the first quarter of 2015, the share of short-term loans in all lending to non-banks increased by 21 percentage points for Hong Kong SAR, 20 percentage points for Singapore, 12 percentage points for China and 4 percentage points for the above-mentioned five emerging Asian economies. Such large increases in the share of short-term borrowing by non-banks are a cause for concern.

Selected financial stability issues

Whether at the global or regional level, banking integration involves benefits and risks. The benefits include greater competition and enhanced efficiency, the availability of a wider range of banking services and greater risk-sharing, while the trends discussed in the previous sections suggest three potential sources of risks. The first is the growing systemic importance of foreign banks in host jurisdictions, both as common and concentrated lenders within the region, and through foreign branches and subsidiaries. The second is the liquidity risk in foreign currency funding associated with the funding models of Asia-Pacific banks. And the third is the shortening maturity of foreign currency loans. In this section, drawing on the analysis and results presented so far, we focus on these three areas of concern to regional financial authorities.

The systemic importance of foreign banks

As banks increase their activities across the region, their systemic importance is likely to grow. At one extreme, when a single regional bank dominates foreign lending, it becomes a "common creditor". It can create systemic risk through two channels: it can transmit shocks from its home country to many host countries simultaneously; and the losses it incurs in one host country can lead it to cut exposures elsewhere. Even if there are several foreign creditor banks for one host country, foreign lending to the country may be concentrated among a few creditors, raising similar issues. Furthermore, a foreign bank could be systemic in a small host market even if that market is not important to that bank's total global operations. All of these patterns create challenges for host supervisors and for home- host cooperation.

Foreign bank presence in the form of branches poses particular challenges. While often exposed to similar risks, branches tend to be less costly to set up and operate than subsidiaries because in many jurisdictions they are not subject to the same capital and liquidity requirements as domestic banks and foreign bank subsidiaries (Ehlers and Wooldridge (2015)). Instead, host countries typically rely heavily on the home jurisdiction in regulating foreign bank branches. In recent years, however, there has been concern that such regulation by the home jurisdiction may not adequately recognise issues of systemic risk in the host countries. The stability of the funding of branches in order to contain the risk of disruptions in domestic credit supply is one key issue in this regard.

The general policy direction for regulators in the region has been to put branches on an equal footing with domestic banks, subjecting them to the local, tighter regulatory requirements.8, 9 One example concerns the Hong Kong Monetary Authority (HKMA). In January 2014, the HKMA introduced a Stable Funding Requirement (SFR), under which both local banks (including subsidiaries of foreign- headquartered banks) and foreign bank branches whose loan growth in 2013 exceeded 20% must maintain longer-term stable funds, such as customer deposits and a capital base, to support their lending business.

Regulatory authorities in the region are well aware of the need to understand and monitor the sources and channels of systemic risk and to cooperate so as to prevent the failure of a regionally active bank and manage its fallout. Supervisory colleges for regionally active banks are an important mechanism for sharing information and discussing policy options (CGFS (2014a,b)). For example, the Central Bank of Malaysia and the Monetary Authority of Singapore (MAS) host supervisory college meetings for three Malaysian and three Singaporean banking groups, respectively, involving supervisors from jurisdictions where the banks have sizeable operations. However, certain types of sensitive information are difficult to share in a multilateral college format. Bilateral relations among supervisors and memoranda of understanding can be important complements. Another constraint on cooperation is asymmetries in regulatory powers between national authorities, which create a wedge between the willingness and the ability to cooperate.

Liquidity risks in foreign currency funding

The greater integration of the regional banking market in Asia and the Pacific can give rise to a special kind of liquidity risk to the banking system, namely that related to foreign currency funding. To support the rapid increase in the amount of their cross-border US dollar lending and overcome constraints on increasing their dollar deposits, regional banks have depended on dollar funding from global wholesale markets and derivatives markets (eg funding in their local currency swapped into foreign currency).10 As a result, the foreign currency loan-to-deposit ratio of many regional banks now stands well above 100%, although in some cases it has been on a downward trend recently. The risk of regional banks' facing difficulty in obtaining foreign currency wholesale funding at times of market stress may be an area for their central banks and regulators to monitor.11

Moreover, when foreign banks lend in a host jurisdiction in local currency, their local currency liabilities tend to fall short of their local currency assets. In principle, this local currency funding gap would be filled by foreign currency borrowing converted into the local currency. Banks that do not hedge exchange rate risk would suffer valuation losses were the local currency to depreciate. Even for banks that attempt to hedge their positions fully, accepting some costs, the foreign currency part of such transactions is subject to liquidity and basis risk.

In recent years, a number of national authorities have introduced policy measures aimed at limiting foreign currency liquidity risk. As guidance, the Basel Committee on Banking Supervision has recommended that a bank should identify, measure, monitor and control its liquidity needs in each currency and have sufficient liquidity resources to meet those needs in normal and stressed conditions. In 2014, MAS introduced a separate liquidity coverage ratio (LCR) for Singapore dollar exposures in addition to the standard LCR for all currencies.12 MAS also regularly stress-tests banks' liquidity positions as part of its annual industry-wide stress test. Finally, the Korean authorities introduced leverage caps on banks' FX derivative positions in October 2010 in order to limit short-term foreign currency exposures and thus reduce the potential impact of any disruption to the availability of foreign currency funding.13

Short-term foreign currency loans

International banks' decision to deleverage and thus not to roll over short-term foreign currency loans has often been a cause of sudden stops in capital inflows and financial crises in many Asia-Pacific economies.14 Even when banks perfectly match the maturities of their foreign currency assets and liabilities, non-bank customers who borrow at short term from these banks tend to face liquidity risks (and possibly currency risks too). The increasing share of short-term foreign currency loans in the quickly expanding intraregional activity of Asia-Pacific banks is therefore another area for policymakers to closely monitor.

To reduce the reliance on short-term foreign currency borrowing, many Asian countries have introduced prudential measures targeting such borrowing. For example, Korea introduced a macroprudential levy on domestic banks' foreign currency borrowing in August 2011. The assessment rate of the levy was set higher for short-term borrowing and lower for long-term borrowing, with the aim of promoting longer-term foreign currency funding by domestic banks. Similarly, the Chinese government introduced quotas on short-term external debt for foreign banks in China in June 2004, and reduced them gradually in 2007 and early 2008.15

Conclusion

In this article, we have shown that intraregional cross-border banking activity in Asia and the Pacific has steadily increased since the Great Financial Crisis of 2007−09, with regional financial centres such as Hong Kong SAR and Singapore playing important roles. The rise of intraregional banking activity could bring such benefits as greater competition and enhanced efficiency. At the same time, it could also give rise to some financial stability risks, such as financial contagion through common and concentrated creditors, liquidity risks in foreign currency funding, and the shortening maturity of foreign currency loans provided by Asia-Pacific banks.

The central banks and supervisory authorities in the Asia-Pacific region are aware of the challenges they face. Many jurisdictions have already implemented regulatory measures to mitigate the systemic risks potentially stemming from cross-border banking activity and from large foreign affiliates. They have also started to take measures to monitor regionally active banks more closely. However, achieving effective cooperation and coordination between home and host jurisdictions in dealing with internationally active banks has proved to be a difficult task. Continued efforts to enhance cooperation and coordination among regional financial authorities including data-sharing are strongly warranted.

References

Avdjiev, S, R McCauley and H S Shin (2015): "Breaking free of the triple coincidence in international finance", BIS Working Papers, forthcoming.

Bruno, V, I Shim and H S Shin (2015): "Comparative assessment of macroprudential policies", BIS Working Papers, no 502.

Chantapacdepong, P and I Shim (2015): "Correlations across Asia-Pacific bond markets and the impact of capital flow management measures", Pacific-Basin Finance Journal, vol 34, pp 71−101.

Committee on the Global Financial System (2014a): "EME banking systems and regional financial integration", report by a CGFS study group, CGFS Papers, no 51.

--- (2014b): "Workshops on EME banking systems and regional financial integration", summary of follow-up CGFS workshops, CGFS Papers, no 51a.

Craig, S and C Hua (2012): "Systemic risk in international dollar credit", Box 2.1 in Chapter 2 of IMF Global Financial Stability Report, October, pp 25−6.

Ehlers, T and P Wooldridge (2015): "Channels and determinants of foreign bank lending", BIS Papers volume from the RBNZ-BIS conference on cross-border financial linkages, forthcoming.

Elliott, D (2014): "Lessons for Asia from Europe's history with banking integration", ADBI Working Papers, no 461, February.

García- Herrero, A and P Wooldridge (2007): "Global and regional financial integration: progress in emerging markets", BIS Quarterly Review, September, pp 57−70.

Hannoun, H (2011): "Sovereign risk in bank regulation and supervision: where do we stand?", speech at the Financial Stability Institute High-Level Meeting, Abu Dhabi, United Arab Emirates, 26 October.

McCauley, R (2014): "De-internationalising global banking?", Comparative Economic Studies, symposium article, pp 1-14.

McCauley, R, S Fung and B Gadanecz (2002): "Integrating the finances of East Asia", BIS Quarterly Review, December, pp 83−95.

McGuire, P and A van Rixtel (2012): "Shifting credit patterns in emerging Asia", BIS Quarterly Review, December, pp 17−18.

McGuire, P and G von Peter (2009): "The US dollar shortage in global banking", BIS Quarterly Review, March, pp 47−63.

Monetary Authority of Singapore (2014): Financial Stability Review 2014, 27 November, Macroeconomic Surveillance Department.

Shek, J, I Shim and H S Shin (2015): "Investor redemptions and fund manager sales of emerging market bonds: how are they related?", BIS Working Papers, no 509.

Shin, H S (2013): "Second phase of global liquidity and its impact on emerging economies", keynote address, Asia Economic Policy Conference, Federal Reserve Bank of San Francisco.

Volz, U (2013): "ASEAN financial integration in the light of recent European experiences", paper for a special issue of the Journal of Southeast Asian Economies.

1 We thank Stefan Avdjiev, Claudio Borio, Ben Cohen, Dietrich Domanski, Robert McCauley, Patrick McGuire, Hyun Song Shin, Chang Shu and Philip Wooldridge for helpful comments and suggestions. We also thank Jimmy Shek for excellent statistical assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS.

2 International bank claims on Latin America and the Caribbean grew by 52% to reach $346 billion, while those on emerging economies in Europe grew by 388% to reach $792 billion.

3 It should be noted that the fluctuations reported here are not on an exchange rate-adjusted basis. This is particularly relevant for the change between 2007 and 2008.

4 Among Asia-Pacific banks, lending by outside area banks (ie banks located in the BIS reporting area but headquartered outside) to emerging Asia-Pacific economies has increased sharply over the past decade, while Australian, Japanese and Singaporean banks have steadily increased lending to the region. McGuire and van Rixtel (2012) show that, even though the nationality of outside area banks is not known, data from BIS banking statistics and other sources indicate that the bulk of the increase in international claims extended by outside area banks is to borrowers in China, and is largely consistent with the increase in the total assets of Chinese banks' foreign offices in Asia.

5 The legal form of subsidiaries is often associated with a more stable retail funding base than that of branches. However, this is not always the case. The experience in central and eastern Europe testifies to this point. For example, in Hungary during the euro area debt crisis, the subsidiaries of western European banks that relied on wholesale funding from their parent banks were the ones vulnerable to deleveraging by the parents.

6 Banks fill this gap by borrowing foreign currency and converting it into local currency. They will choose either to keep open currency positions and expose themselves to exchange rate risks or to hedge their positions by entering into derivative contracts, such as currency swaps, at a cost. The gap is the maximum amount since it does not include local currency funding via the swap market.

7 The share of short-term loans in all foreign currency loans decreased sharply for a few years after the Asian financial crisis, partly because the stock of short-term loans adjusted much more than that of long-term loans, and partly also because trade activity requiring short-term credit fell significantly.

8 McCauley (2014) points out that recently a number of regulators have announced their intention to apply liquidity requirements to the subsidiaries and branches of foreign banks in their jurisdictions.

9 Also, the UK and US authorities have imposed tighter regulatory requirements on foreign affiliates. Specifically, in 2014 the UK authority strengthened the supervision of branches of international banks, particularly with respect to liquidity. The US authorities have stipulated that foreign banking organisations with US non-branch assets of $50 billion or more must hold their US subsidiaries under an intermediate holding company from July 2016. Such companies will be required to meet risk-based and leverage capital standards generally applicable to banking holding companies under US law, and to maintain a liquidity buffer in the United States in line with a 30-day liquidity stress test.

10 See McGuire and von Peter (2009) and Craig and Hua (2012) for discussions on systemic liquidity risks involving global dollar credit.

11 For example, MAS (2014) points out that rising foreign currency non-bank loan-to-deposit ratios of banks located in Singapore (including foreign bank branches and subsidiaries) could put pressure on the availability and cost of funding to support growth in cross-border lending (page 63), and that banks should continue to monitor and address risks arising from stresses to foreign currency funding and liquidity (page iii).

12 Similar steps have been taken outside the region. In 2013, the Swedish supervisory authority introduced separate LCR requirements on exposures denominated in euros and US dollars.

13 The maximum limits on banks' foreign exchange derivative contracts (including futures, FX swaps, currency swaps and non-deliverable forwards) were set at 50% (for domestic banks) and 250% (for foreign bank branches) of bank capital in the previous month. This measure was introduced in July 2010 with a three-month grace period.

14 In addition to sudden stops in banking inflows, policymakers have recently been paying attention to the possibility of sudden stops in bond inflows, including both international bonds purchased by foreign investors and domestic local currency bonds purchased by non-residents. Bruno et al (2015) consider banking inflows and bond inflows at the same time as foreign credit, and Shek et al (2015) discuss sudden stops in bond inflows intermediated by asset managers.

15 For detailed accounts of capital flow management measures taken by nine emerging Asian economies over 2004−13, see Appendix 1 of Chantapacdepong and Shim (2015).