Illusory AAA tranches: the case of resecuritisations

(Extract from pages 44-45 of BIS Quarterly Review, December 2014)

Instead of comprising individual bonds or loans, the pool underlying a securitisation may itself comprise other securitisations or tranches of securitisations. For instance, the run-up to the global financial crisis witnessed the rise of securitisations of mezzanine tranches, or mezzanine resecuritisations. From 2005 to 2007, the senior tranches of mezzanine resecuritisations could rely on a wide investor base thanks to perceptions that they were virtually risk-free. Such perceptions turned out to be wrong. This box argues that the poor performance of senior tranches of mezzanine resecuritisations during the crisis can be explained with an overlooked inherent feature of these resecuritisations: high correlation of the underlying assets.

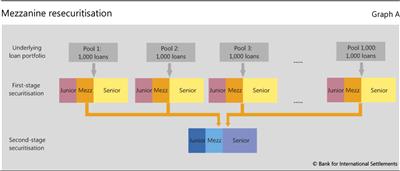

The box uses an illustrative example of a two-stage securitisation. In the first stage, 1 million homogeneous loans are split equally into 1,000 pools and then each pool is securitised. All first-stage securitisations are divided in the same way into junior, mezzanine and senior tranches. In the second stage, the 1,000 first-stage mezzanine tranches are all pooled together and securitised: this is a mezzanine resecuritisation (Graph A). The goal of the second-stage securitisation is to create a senior tranche that is subject to so little risk that it merits a AAA rating.

The risk characteristics of a first-stage mezzanine tranche would differ from those of an individual loan. Such a tranche is shielded by the corresponding junior tranche from the first losses on the underlying pool, ie from the losses triggered mainly by loan-specific, idiosyncratic shocks. Nevertheless, the mezzanine tranche is exposed to widespread, systematic shocks that are strong enough to completely wipe out the junior tranche. And the same systematic shocks would also dominate in mezzanine tranches from other first-stage securitisations. In turn, the greater relative role of systematic shocks in the mezzanine tranches than in the individual underlying loans implies that the losses on these tranches would be more strongly correlated than loan losses.

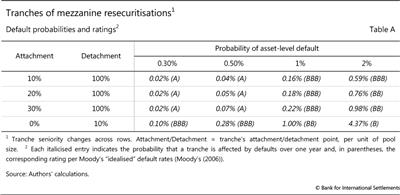

For a numerical illustration of this argument, let expression (A.1) in Annex 1 govern the credit risk of each securitised loan, and let the attachment and detachment points of each first-stage mezzanine tranche be equal to 3% and 7% of the respective pool. For a given homogeneous loan-level PD, the regulatory capital formula provides a common-factor loading that governs the correlation of defaults. Over a range of PDs from 0.3% to 2%, losses on first-stage mezzanine tranches are substantially more correlated than loan defaults. For any pair of loans, if there is at least one default, the likelihood of two defaults is lower than 3%. In the context of mezzanine tranches, the corresponding likelihood is 20 times larger. Namely, if at least one of two first-stage mezzanine tranches is subject to default losses, the other is as well with likelihood greater than 60%.

The strong correlation of losses on first-stage mezzanine tranches undermines the benefits of pooling these tranches together at the second securitisation stage. The higher this correlation, the smaller is the scope for diversification and the higher is the probability of large losses on the mezzanine resecuritisation. In fact, for the mezzanine resecuritisations implied by the stylised example in this box, the highest rating of a senior tranche with a realistic attachment point is A, several notches below the desired AAA rating (Table A). This is true even if the risk of the resecuritisation's junior tranche is quite low, corresponding to a BBB rating (last row in the table).

This can explain why senior tranches of mezzanine resecuritisations did not live up to their AAA ratings during the crisis. The admittedly stylised example above brings to the fore a key feature of first-stage mezzanine tranches that rating agencies underappreciated prior to the crisis: since these tranches are largely protected from idiosyncratic shocks, their losses are highly correlated. And it is thus unrealistic to expect that securitising such tranches could generate diversification benefits that give rise to low-risk securities.

For a study that reaches similar conclusions, see Hull and White (2010).

For a study that reaches similar conclusions, see Hull and White (2010).