Emerging markets and talk of tapering

(Extract from pages 16-17 of BIS Quarterly Review, December 2013)

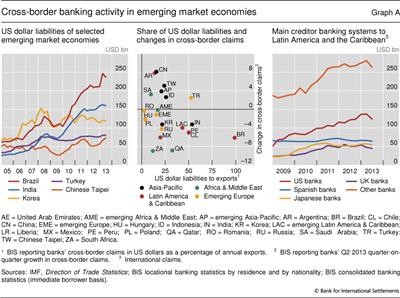

The accommodative monetary policy stance in advanced economies in the wake of the global financial crisis boosted capital flows to fast-growing emerging market economies and put upward pressure on their currencies. This contributed to a build-up of financial imbalances, reflected in surging credit and asset prices. International bank lending to these economies picked up markedly. The volume of foreign banks' US dollar-denominated credit to emerging market economies grew rapidly, especially during 2010-11. But this masked considerable variation across countries (Graph A, left-hand panel). US dollar-denominated liabilities of Brazil and India more than doubled from early 2009 to end-June 2013, to $237 billion and $160 billion, respectively. For Turkey and South-Korea, the growth of US dollar-denominated borrowing during the same period was more moderate.

A tightening of US monetary policy and higher US interest rates will raise the refinancing costs of US dollar-denominated debt. Moreover, possible related upward pressures on the US dollar will increase the value of this debt in local currencies. Emerging market economies with relatively low US dollar liabilities in terms of their exports, which generate foreign currency, may be affected less. These effects may also be relevant for liabilities denominated in other foreign currencies, as increases in US interest rates may be associated with higher rates in other advanced economies. At the same time, the channels are the most direct for liabilities denominated in US dollars. This box considers how cross-border credit to economies with relatively large US dollar liability exposures was affected by announcements of a "tapering" of large-scale asset purchases in May 2013.

The BIS locational banking statistics, which include inter-office activity, show that cross-border credit to a large number of emerging market economies with sizeable US dollar-denominated liabilities fell in the second quarter of 2013 (Graph A, centre panel). Those most affected were located predominantly in Latin America. The drop was largest for Brazil (with a ratio of US dollar liabilities to exports of 99%), but was also quite sharp for Chile (50%), Mexico (20%) and Peru (50%). In other regions, claims on India and Russia contracted as well. In contrast, cross-border credit to Turkey (52%) and several emerging Asian countries increased, most notably to Chinese Taipei and Indonesia.

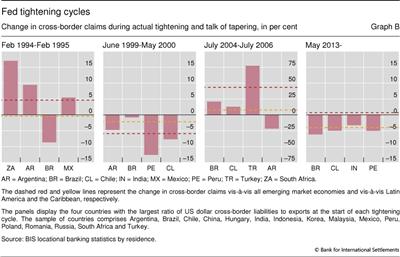

But the observation that countries with relatively large US dollar-denominated liabilities, especially those in Latin America, were strongly affected by talk about tapering is not new: something similar happened during previous Fed tightening cycles. Graph B shows the change in cross-border credit to the four emerging market economies with the largest ratio of US dollar-denominated liabilities to exports at the start of the four most recent cycles of US monetary policy tightening. These countries, which are drawn from a group of 16 main emerging market economies, are chiefly from Latin America. The growth of cross-border credit to the selected Latin American countries was considerably lower than that of claims on all emerging market economies during the 2004-06 cycle. In the second quarter of 2013 the difference was even more pronounced. Furthermore, during three of the four episodes, cross-border claims on Latin America and the Caribbean (Graph B, dashed yellow line) displayed a considerably lower growth than those on all emerging market economies (Graph B, dashed red line). The only exception was 1999-2000, when cross-border credit to emerging Asia continued to be severely affected by the Asian crisis.

The fact that sharp falls in credit to Latin American countries with relatively large US dollar exposures coincided with the talk of tapering may be related to the growing regional importance of US banks (Graph A, right-hand panel). These banks doubled their international claims on Latin America and the Caribbean from early 2009 to almost $140 billion in early 2013. The share of US banks in total international credit to Latin America is much higher than their share in claims on other emerging market regions. International claims of US banks on Latin America and the Caribbean fell by 10% in the second quarter of 2013, much more than those reported by other main creditor banking systems.