International interbank activity in retreat

(Extract from pages 14-15 of BIS Quarterly Review, March 2014)

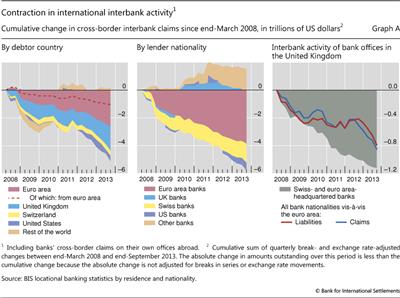

The 2007-09 global financial crisis and the subsequent euro area financial strains have left a profound imprint on international interbank funding. According to the BIS locational banking statistics by residence, cross-border interbank lending (including inter-office positions) fell from $22.7 trillion at end-March 2008 to $17.0 trillion at end-September 2013. While this contraction affected most countries worldwide, it was largest for borrowers in Europe, especially the euro area. Claims of BIS reporting banks on banking offices in the euro area fell by a cumulative $2.6 trillion (Graph A, left-hand panel), a reduction of 31%. Lending to banks in the United Kingdom dropped by $1.7 trillion, or 35%. Claims on banks in the United States and Switzerland fell sharply as well, by $415 billion (16%) and $346 billion (42%), respectively. This box considers which factors were at work, with an emphasis on developments in the euro area.

According to the BIS locational banking statistics by residence, cross-border interbank lending (including inter-office positions) fell from $22.7 trillion at end-March 2008 to $17.0 trillion at end-September 2013. While this contraction affected most countries worldwide, it was largest for borrowers in Europe, especially the euro area. Claims of BIS reporting banks on banking offices in the euro area fell by a cumulative $2.6 trillion (Graph A, left-hand panel), a reduction of 31%. Lending to banks in the United Kingdom dropped by $1.7 trillion, or 35%. Claims on banks in the United States and Switzerland fell sharply as well, by $415 billion (16%) and $346 billion (42%), respectively. This box considers which factors were at work, with an emphasis on developments in the euro area.

The BIS locational banking statistics by nationality show that banks headquartered in the euro area played a central role in the reduction in cross-border interbank lending, accounting for over two thirds of the total contraction (Graph A, centre panel). Swiss banks were responsible for most of the remainder. The large share of euro area and Swiss banks is partly related to the specific operation of their international interbank activities. These banks had traditionally routed a major part of their international operations through London. This practice was scaled down substantially during 2008-13. In fact, euro area and Swiss banks accounted almost entirely for the contraction in cross-border interbank activity registered by banks in the United Kingdom, reducing such activity by a cumulative $1.1 trillion since end-March 2008 (Graph A, right-hand panel, shaded area). The decline in cross-border interbank operations from the United Kingdom was concentrated on the euro area, in terms of both lending and borrowing (Graph A, right-hand panel, blue and red lines).

This practice was scaled down substantially during 2008-13. In fact, euro area and Swiss banks accounted almost entirely for the contraction in cross-border interbank activity registered by banks in the United Kingdom, reducing such activity by a cumulative $1.1 trillion since end-March 2008 (Graph A, right-hand panel, shaded area). The decline in cross-border interbank operations from the United Kingdom was concentrated on the euro area, in terms of both lending and borrowing (Graph A, right-hand panel, blue and red lines).

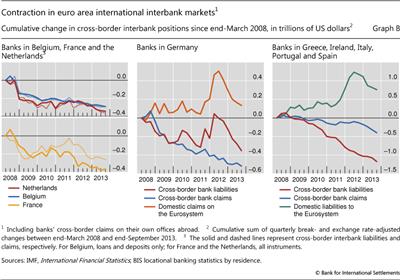

The sharp decline in international interbank activity on the euro area showed different patterns across countries, which can be categorised in three groups according to the differences in the evolution of banks' cross-border lending and borrowing. A first group, comprising Belgium, France and the Netherlands, experienced a significant reduction in cross-border funding during 2008-13 that was mirrored by a similar contraction in their cross-border interbank lending, resulting in largely unchanged net funding positions (Graph B, left-hand panel). Cross-border interbank borrowing and lending by banks in France initially fell rapidly during the global financial crisis, but recovered from mid-2009 to mid-2011. The intensification of the euro area financial crisis from the summer of 2011 triggered another sharp retreat in these banks' international interbank activity.

The second group comprises banks in Germany, which were large net recipients of international interbank funding, especially during 2010-13. These banks saw both cross-border interbank lending and borrowing decline for most of 2008-09 (Graph B, centre panel), but not subsequently. With the first tremors of the euro area financial crisis hitting financial markets in the first half of 2010, cross-border interbank liabilities of banks in Germany increased, offsetting part of the cumulative decline of the previous two years (red line). At the same time, these banks continued to reduce their cross-border interbank lending (blue line). The worsening of the euro area financial crisis from June 2011 to June 2012 led to a further sharp increase in the interbank liabilities of banks in Germany. This expansion was mirrored in an increase of the deposits maintained by banks in Germany with the Eurosystem (orange line).

In contrast, banks in the euro area periphery (the third group) experienced a large fall in their cross-border interbank funding, while their interbank lending declined more modestly (Graph B, right-hand panel). Cross-border interbank borrowing by banks in Greece, Ireland, Italy, Portugal and Spain fell by a cumulative $1.2 trillion during 2008-13 (red line). The resulting large international funding gap was covered by increased borrowing from the Eurosystem (green line). Hence, the Eurosystem replaced the international interbank market as a funding mechanism for these countries.

See J Caruana and A van Rixtel, "International financial markets and bank funding in the euro area: dynamics and participants", originally published in Economistas, December 2012.

See J Caruana and A van Rixtel, "International financial markets and bank funding in the euro area: dynamics and participants", originally published in Economistas, December 2012.  See G von Peter, "International banking centres: a network perspective", BIS Quarterly Review, December 2007.

See G von Peter, "International banking centres: a network perspective", BIS Quarterly Review, December 2007.  See A van Rixtel and G Gasperini, "Financial crises and bank funding: recent experience in the euro area", BIS Working Papers, no 406, March 2013.

See A van Rixtel and G Gasperini, "Financial crises and bank funding: recent experience in the euro area", BIS Working Papers, no 406, March 2013.